The position of foreigners in the Russian Federation is regulated both on the basis of international agreements signed by the Russian side, as well as individual constitutional provisions and federal legislation.

In various circumstances, a foreign citizen can be recognized as a refugee, granted diplomatic status, and be given the opportunity to reside in the Russian Federation on a permanent basis. Persons with foreign citizenship can also become temporary residents and temporary stayers; the difference between these concepts, as well as their similarity, is determined by federal law.

Temporarily staying

Based on Art. 2 of the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation”, temporarily staying in Russia is a foreigner who has a visa (or in a manner that does not require a visa) and has received a migration card, but does not have a residence permit or temporary residence permit.

For temporarily staying foreign citizens, insurance premiums in 2019 are calculated in the following order (subclause 15, clause 1, article 422, article 426 of the Tax Code of the Russian Federation, clause 1, article 7 of Law No. 167-FZ, clause 1, article 20.1 of the Law No. 125-FZ, Part 1, Article 2 of Law No. 255-FZ):

- for compulsory pension insurance in the Pension Fund and injuries in the Social Insurance Fund - in the usual manner;

- for temporary disability and maternity - at a rate of 1.8%;

- for compulsory medical insurance - they are not charged.

Contributions are calculated according to special rules:

- employees who are citizens of EAEU countries (the same as Russians; with the exception of compulsory health insurance contributions for temporarily staying highly qualified specialists from the EAEU, they do not need to be accrued (letter of the Federal Tax Service dated November 22, 2017 No. GD-4-11/26208, dated February 14, 2017 No. BS-4-11/2686));

- for highly qualified specialists not from the EAEU (only contributions for injuries are calculated - letter of the Ministry of Finance dated January 29, 2019 No. 03-15-06/5081).

How is the temporary stay of a foreigner formalized?

The answer to this question is contained in the Decree of the Government of the Russian Federation “On the procedure for carrying out migration registration of foreign citizens and stateless persons in the Russian Federation” No. 9 of January 15, 2007.

As a general rule, foreign citizens temporarily staying in the Russian Federation are required to register with the Federal Migration Service of the Russian Federation at their place of stay.

Exceptions include certain categories of foreign citizens established by Russian legislation, for whom such registration is not mandatory.

Temporary residents

The status of a foreign citizen temporarily residing in the Russian Federation means that the person has received a temporary residence permit here.

In relation to permanently and temporarily residing foreigners, insurance premiums in 2021 are calculated as for Russians (letter of the Ministry of Labor dated 02/09/2016 No. 17-3/B-48). And this applies to all types of contributions.

Also see “Insured Person Category Codes for 2021: Table with Explanation.”

Why determine status

Point by point, how temporary stay differs from temporary residence in labor relations:

- basis - temporary residence permit or visa, migration card;

- the scope of employment rights (only in a specific subject of the Russian Federation - this is general, the difference is that those who have received a patent work only in the profession specified in it);

- registration of an employment contract (employers of migration card holders have an obligation to notify regulatory authorities). A particularly complex procedure is provided for those staying in the Russian Federation on a visa (invitation, permits).

The tariffs for contributions to compulsory medical insurance and compulsory social insurance from payments for such employees differ (pension contributions are the same).

The law does not indicate how to determine a temporary stayer or temporary resident; there is no single database with publicly available information. The status is determined only by the documentation the foreigner provides. The temporary residence permit looks like a mark, a stamp in the passport, a visa is pasted or inserted into an identity document, a migration card is a separate form. During the period of stay, the status may change, therefore, it is recommended that the employment contract provide for the person’s responsibility for failure to notify the employer about this.

If a foreigner has changed his status

In a letter dated 06.08.2019 No. SD-4-11/15529, the Federal Tax Service of Russia considered the calculation of insurance premiums in relation to payments and other remuneration in favor of a foreign citizen whose status during the billing period changed from temporarily staying to temporarily residing in Russia.

The Tax Code does not contain special rules governing the procedure for calculating insurance premiums in this situation. Therefore, the contribution base is determined on an accrual basis from the beginning of the billing period in the general manner.

Thus, from the moment a foreigner working under an employment contract acquires the status of a temporary resident, insurance premiums are calculated:

- for mandatory social insurance - at a rate of 2.9%;

- for compulsory medical insurance – at a rate of 5.1%.

Moreover, for the month of acquiring a new status, these contributions are calculated only from the portion of payments accrued from the day on which the status changed until the end of the month.

Read also

15.08.2019

How are they different from permanent residents?

Now let’s figure out what it means to permanently reside on the territory of the Russian Federation and what rights such status provides.

A foreign citizen receives permanent resident status while he has a temporary residence permit. At this time, he has the opportunity to obtain a residence permit (residence permit), issued for 5 years and renewable multiple times. At the same time, he notifies annually of proof of his residence.

Permanent resident status effectively provides the same rights as citizenship, with the exception of the right to participate in government (political rights).

FOR EXAMPLE

Foreign citizens who arrived in the Russian Federation for a period of no more than seven days, with the exception of cases where these foreign citizens are in a hotel or in another organization providing hotel services, in a sanatorium, rest home, boarding house, etc. A complete list of such citizens is contained in paragraph 6 of Art. 20 Decree of the Government of the Russian Federation No. 9 of January 15, 2007

Registration of a foreign citizen with the Federal Migration Service of the Russian Federation is carried out on the basis of a notification of the foreign citizen’s arrival at the place of stay. The form of notification of the arrival of a foreign citizen at the place of stay is approved by Order of the Federal Migration Service of Russia dated September 23, 2010 No. 287. The state fee for migration registration is not charged.

The notification to the FMS of the Russian Federation is made by the receiving party.

Independent registration is allowed for a foreign citizen in exceptional cases when the receiving party, for good reason, cannot issue such a notification (clauses 20, 22 of Rules No. 9 of January 15, 2007).

The receiving party may be citizens of the Russian Federation permanently residing in the Russian Federation, foreign citizens and stateless persons, legal entities, their branches or representative offices where the foreign citizen actually lives or works (clause 7, clause 1, article 2 of Law No. 109-FZ dated July 18, 2006; clause 26 of Regulations No. 9 dated January 15, 2007).

If a foreign citizen is staying at a hotel, then the receiving party is the hotel administration. The hotel administration must, within one working day following the day of arrival of the foreigner, notify the territorial body of the Federal Migration Service of Russia of his arrival, as well as perform all necessary actions related to his registration at the place of stay (clause 20 of Rules No. 9 of January 15 2007).

The legislation establishes the deadline for registering a foreign citizen. Thus, notification of arrival is submitted to the territorial body of the Federal Migration Service of the Russian Federation no later than 7 working days.

This period is calculated from the date of arrival of the foreign citizen at the place of stay.

The notification can be delivered to the Federal Migration Service of the Russian Federation by an authorized representative of the receiving party in person or sent by mail.

If the notification is delivered to the office of the Federal Migration Service of Russia by an authorized representative of the receiving party in person, then the detachable part of the notification form with a mark from the migration registration authority is returned to this authorized representative (clause 33 of Rules No. 9 of January 15, 2007). If the notification is sent by mail, it must be completed in two copies. In this case, one copy will remain at the post office, and the other is sent to the Federal Migration Service of the Russian Federation (clause 27 of Rules No. 9 of January 15, 2007). When sending documents by mail, the postal operator issues the sender a tear-off notification coupon with a calendar stamp and signature. Along with the coupon, a receipt for sending the postal item and a copy of the list of attachments will be issued (clause 33 of Rules No. 9 of January 15, 2007).

If the notification is submitted to the Federal Migration Service of the Russian Federation by an authorized representative of the receiving party in person, the migration service puts a corresponding mark on its acceptance on the tear-off part of the notification.

The necessary documents are attached to the notification.

If the notification is issued by the receiving party, then a copy of the identity document of the foreign citizen and a copy of his migration card is attached to it.

If the notification is issued by a foreign citizen independently, then the following documents are attached to it:

- a copy of the identity document of the foreign citizen;

- documents confirming valid reasons preventing the receiving party from independently sending a notification of arrival;

- a copy of an identity document of a citizen of the Russian Federation (a foreign citizen or a responsible person of an organization) acting as the host;

- a copy of the migration card (for a foreign citizen temporarily staying in the Russian Federation).

Thus, the basis for registration at the place of stay is the receipt by the territorial body of the Federal Migration Service of the Russian Federation of a notification of arrival.

Registration at the place of residence of a foreign citizen temporarily staying in the Russian Federation is carried out for the period stated in the notification of arrival, but not more than for the period established by the Federal Law “On the Legal Status of Foreign Citizens in the Russian Federation”.

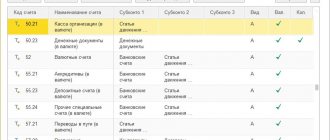

Payroll and taxes

To calculate wages and taxes, go to the “Salary” section, open the register of documents for calculating wages and contributions and create a new document.

We automatically fill out a new document using the “Fill” button. The system will calculate wages, as well as personal income tax and insurance contributions for each employee.

We check the correctness of the accrued contributions on the “Contributions” tab.

You can check accrued contributions using the reports that are located in the “Taxes and Contributions” section - “Reports on Taxes and Contributions”: analysis of contributions to funds, an insurance contribution card, checking the calculation of contributions, checks the tax base and accrued taxes, if a discrepancy is detected, the data are highlighted in red. Thus, the calculator can check the accruals and tax base.

First problem: the term of the fixed-term contract is two calendar years

In the described situation, the accountant needs to look at the duration of the contract in each year. So, if in each of them it is less than 6 months (for example, from September to May), then the person is not recognized as insured. If in any year the period is more than 6 months (for example, from September to July), then payments to the foreigner will need to be assessed to the Pension Fund. Moreover, from the first month of the employment contract, even if in the previous year the number of months was less than six (see letter of the Ministry of Labor of Russia dated August 29, 2013 No. 17-3/1436).

Fourth problem: the foreigner quit without working for 6 months

This situation will not bring any additional worries to the accountant. The dismissal of a foreigner in respect of whom contributions were calculated does not change his status, even if this occurred before the expiration of 6 months from the date of concluding an employment contract with him. After all, the wording of the law is such that it is not the actual period of work that matters, but the period for which the contract is concluded. So if an agreement was initially concluded for a period of more than 6 months, or for an indefinite period, then no recalculations need to be made in connection with early dismissal (see letter of the Ministry of Labor of Russia dated 08.29.13 No. 17-3/1436).

Insurance premiums for foreign workers who are citizens of EAEU countries

In May 2014, countries such as Russia, Kazakhstan and Belarus entered into an agreement with each other on the Eurasian Economic Union. The following year, these countries were joined by Armenia and Kyrgyzstan. In accordance with this agreement, citizens of the EAEU countries have the right to the same benefits as citizens of the Russian Federation.

Important! Thus, these employees should be charged insurance premiums for compulsory health insurance, compulsory medical insurance and social insurance at the rates that apply to employees who are citizens of the Russian Federation.

Recruitment

Go to the “Personnel” section, open the “Employees” directory, create a new employee. In the employee’s card, follow the “Insurance” link, where we indicate the status of the insured person, as well as the period from which information about the insurance status is valid, the month of registration of changes.

Next, in the employee’s card, follow the “Personal Data” link, indicate in the “Citizenship” section the country of the foreign employee or switch the attribute to “Stateless person”. This data will be included in the insurance premium report.

Please note: if an individual has already been registered in 1C, then when creating a new employee, the system will issue a warning that a similar person has been found and will offer to determine whether this is the same individual or a namesake.

After creating an employee and collecting documents for hiring the employee, go to the “Personnel” section, open the register of documents for admissions, transfers, dismissals and create a new document “Hiring”, where we enter the date of admission, employee, work schedule, position, information on wages, employment contract data.

For foreign employees, the “Additional” tab appears in the reception, in which we display the following data:

- Work permit.

- Residence permit.

- Conditions for providing medical care.

Thus, the employee is hired.

Features and differences of concepts

Legalization of residence of foreigners consists of several stages, each of which allows you to strengthen the rights of a migrant and subsequently become a full citizen of the Russian Federation. First, you need to understand what the difference is between a residence permit and a temporary residence permit, because these are completely different concepts.

RVP and residence permit are documents that allow you to live and work in Russia. Problems often arise with the difference between the concepts of “temporary stay” and “TRP”. The first does not allow you to stay in the Russian Federation for longer than 90 days (or the validity of the visa) and does not allow you to find a job without special permission. A temporary residence permit allows you to work and live in the country officially throughout the entire validity period of the document.

What is a temporary residence permit

The temporary residence permit is issued by the Main Directorate of Migration Affairs of the Ministry of Internal Affairs in the selected region. After receiving it, a citizen of another country can legally stay and work in the Russian Federation.

How does a temporary residence permit differ from a residence permit:

- valid for 3 years;

- there is no possibility of extension;

- you can engage in entrepreneurial activity;

- It is prohibited to live or find work in a region other than the one where the document was issued.

A temporary residence permit relieves a migrant from the difficult process of collecting and preparing documentation for running his own business or traveling abroad.

Resident card

A citizen of another country or a stateless person has the right to obtain a residence permit. Having received the document, you can fully live and work in the country for 5 years. At the end of the period, it is allowed to extend it for the same period.

Residence permit holders are granted the following rights:

- choosing any region to live in;

- medical service;

- searching for and applying for a job anywhere in the country;

- the opportunity to create your own enterprise with authorized capital, become an individual entrepreneur;

- extension of the document is possible.

What is a residence permit in Russia? This is the optimal and most profitable option for obtaining citizenship and, accordingly, a passport. The owner of the document has almost equal rights with other citizens of the Russian Federation.