Ensuring a high level of safety at an enterprise when performing labor functions is an important task. No matter how successfully it is solved, no one is immune from accidents. Therefore, the employer must provide guarantees to employees in such situations. We'll tell you how to pay insurance premiums for injuries in 2021, what changes have occurred and what an accountant should know about them. As for other types of insurance premiums, you may find the article “Changes in insurance premiums from 2021” useful.

What the law says

Contributions for injuries are funds sent through the Social Insurance Fund to an employee as compensation for harm to health caused in the performance of their work functions. The employer is obliged to accrue a certain amount monthly in relation to the labor income received by the subordinate. It is influenced by many factors, including:

- availability of benefits on insurance premiums for injuries;

- Kind of activity;

- approved tariffs for insurance premiums for injuries.

Despite the transfer of the bulk of contributions to tax authorities, in 2020 the FSS continues to oversee the contributions in question. Therefore, there are some changes.

Let us recall that the features and rules for deductions for injuries are regulated by Law of 1998 No. 125-FZ.

Key aspects

Let's start with the fact that all enterprises are required to insure their employees.

This insurance covers compensation payments due to workers in the event of injury or occupational disease. The amount of deductions directly depends on the likelihood of injury at work: the higher the risk, the higher the contribution. The basis of insurance for injuries is the employee’s monetary remuneration, which he receives based on the results of his work activity. It should be noted that contributions for injuries are made only if the legal relationship between the employee and the enterprise is formalized.

Important! Contributions for injuries are paid even from copyright agreements, if such a clause is provided for by the terms of the agreement.

General provisions

As mentioned above, the injury contribution is a certain amount that the employer transfers to the Social Insurance Fund in relation to each officially employed employee.

The need to deduct insurance premiums is regulated by labor legislation. However, in 2021, the procedure for transfers and reporting has changed somewhat. In particular, previously employers transferred health insurance contributions only to the Social Insurance Fund, which meant submitting a report only to this organization. Now you need to report to Social Insurance and the territorial branch of the Federal Tax Service.

Regulatory framework

The main provisions related to the transfer of insurance premiums are regulated by Law No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Additional regulations include:

- Government resolution defining types of work activities with an increased risk of injury and occupational diseases and special acts of the Federal Social Insurance Fund of the Russian Federation;

- Order of the Ministry of Labor No. 851n, establishing the classification of professional and economic activities by injury hazard class.

Download for viewing and printing:

Federal Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against industrial accidents and occupational diseases”

Order of the Ministry of Labor of Russia dated December 30, 2016 No. 851n “On approval of the Classification of types of economic activities by occupational risk classes”

Mandatory requirements

To pay injury fees, all enterprises must indicate and confirm their specialization. To do this, the following documents are submitted to the Social Insurance Fund:

- indicating the type of main activity of the enterprise;

- confirming the type of professional activity.

Large companies additionally submit an explanatory note on the enterprise’s balance sheet for the previous reporting year.

What object of taxation

The deductions under consideration are made provided that the employee has concluded:

- employment contract (always);

- civil contract (when such a condition is stipulated).

The employer deducts insurance premiums for injuries in 2021, regardless of whether or not subordinates have citizenship of our country.

Within the framework of the relationship under consideration, the insurer is the Social Insurance Fund, and the policyholder is:

- legal entities (regardless of the type of ownership);

- owner of his own business;

- an individual who has signed an employment agreement with another person.

Deductions to the Social Insurance Fund for injuries come from different types of income: salaries, allowances, bonuses, compensation for unclaimed leave, as well as when paying wages in products. Exceptions to taxation for injuries are:

- government benefits;

- payments due upon liquidation of an enterprise or reduction of personnel;

- funds received for work in particularly difficult or hazardous conditions;

- material assistance provided in the event of force majeure;

- fees for completing training or advanced training courses, etc.

Payers

Payers of contributions (or, as stated in the law, policyholders) are organizations and individuals who hire employees. It does not matter what type of activity is carried out by the organization and whether the individual is registered as an individual entrepreneur. Payment of contributions is mandatory for all employers. The size of the payment depends on the type of activity. We will talk about this below.

To register with the Social Insurance Fund, organizations do not have to take any action. After registering an organization, the tax authorities will transfer information about it to the Social Insurance Fund independently.

To register as an insurer, an individual must submit a corresponding application approved by Order of the Ministry of Labor dated October 25, 2013 No. 574n.

What are the rates for insurance premiums for injuries?

The rate for insurance of employees against accidents and occupational illnesses related to production activities is set in the range of 0.2 – 8.5%. It increases in proportion to the increase in the degree of risk to which the main activity of the enterprise is assigned. All these parameters are established by law.

In total, there are 32 tariffs, formed taking into account different areas of activity (Article 1 of Law No. 179-FZ of 2005). They characterize different degrees of risk and the corresponding percentage of contributions. Tariffs for insurance premiums for injuries in force in 2020 are presented in the table below (in %).

The class to which the activity of an enterprise belongs can be determined using two regulatory documents:

- OKVED;

- Classification of activities by risk (approved by order of the Ministry of Labor No. 625-n).

This information is reflected in the registration documents received when applying to the FSS.

EXAMPLE

Let's consider using the table using the example of three companies:

| № | Name | Main occupation | Code |

| 1 | LLC "Inkom" | Wholesale of confectionery products, including chocolate and frozen desserts | OKVED 51.36.2 |

| 2 | ProfStroy LLC | Provides services in the field of construction of buildings and structures | OKVED 45.2 |

| 3 | LLC "Helios" | Mining of ores and precious metals | OKVED 13.20.41 |

As a result, for each of these organizations the rates for insurance premiums for injuries will be as follows:

| Company name | OKVED | Occupational risk class | Bid |

| "Inkom" | 51.36.2 | I | 0,2 |

| "ProfStroy" | 45.2 | VIII | 0,9 |

| "Helios" | 13.20.41 | XXIII | 3,7 |

In 2021, insurance premium rates for injuries will remain the same as they were in 2021 and 2021. This is provided for by Federal Law No. 419-FZ dated December 19, 2016. In particular, 32 basic tariffs will remain, calculated in the range from 0.2 to 8.5 percent of the amount of payments in favor of insured persons. Also in 2021, benefits for entrepreneurs who pay contributions for disabled people of groups I, II and III will remain unchanged. Such individual entrepreneurs pay contributions in the amount of 60% of generally established insurance rates

How to find out your tariff

To determine your insurance premium rate for injuries in 2020, you must confirm the type of economic activity for the past period. That is, 2017. The policyholder must no later than April 16, 2021 (April 15 falls on a Sunday) send to the Social Insurance Fund:

- statement confirming the main type of activity;

- confirmation certificate;

- an explanatory note to the balance sheet for the past year (representatives of small businesses are relieved of this obligation).

In case of failure to submit the listed documents, the fund does not charge fines, however, FSS specialists will set the tariff independently. This right is granted to them by Order of the Ministry of Health and Social Development of Russia No. 55 of 2006. Moreover, they will choose the highest risk class from the codes specified in the Unified State Register of Legal Entities for your enterprise. Such a decision is not always beneficial for the policyholder, so we recommend regularly and timely confirming the main type of activity.

Please pay special attention: it is impossible to challenge the maximum tariff assigned by the FSS (see Resolution of the Government of the Russian Federation No. 551). In this part, nothing has changed in 2021 regarding insurance premiums for injuries.

Also see “Confirming the main type of activity in the Social Insurance Fund in 2021: step-by-step instructions.”

The concept of “Disability”

A disabled person is a person who has serious health problems resulting from disorders of certain body functions and damage to systems. The reasons that became the basis for recognizing a citizen as disabled are not taken into account. They may consist of chronic pathologies, consequences after illness, injuries, or congenital abnormalities. Such a person needs protection and care from the state.

The established group must have confirmation in the form of a document confirming the assignment of a citizen to the category. The paper is issued by the medical and social commission. Limited ability to work is confirmed after certain periods of time.

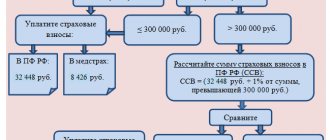

How much to transfer

Employers must calculate personal injury insurance premiums monthly for 2021 , taking into account accruals for the past 30 (31) days.

This can be done using the formula: CONTRIBUTIONS = B x TARIFF Where:

B is the base for contributions for injuries.

This is the amount of money received by the employee, on the basis of which the required value is calculated. The legislation does not provide for any restrictions on the amount. The calculation is made as follows: B = Paymentstd/gpd – Paytyn/o Where:

Paymentstd/gpd – funds paid to an individual according to an employment (civil law) contract.

Payments/o – non-contributory payments.

Note: when payments are made to a person in kind, contributions are calculated for the amount of money specified in the agreement. VAT and excise taxes are also taken into account.

EXAMPLE

The travel agency "Prestige" offers vacationers excursion tickets, as well as places to stay and vehicles. OKVED – 63.30.2. In February 2021, employees received a salary in the total amount of 3 million 500 thousand rubles, including financial assistance of 32 thousand rubles. Determine the amount of insurance contributions to the Social Insurance Fund.

Solution

- Let's calculate the base for calculating contributions:

B = 30 = 3,468,000 rub.

- According to the Classification of Activities by Risk, the travel agency "Prestige" is classified in class I of professional risk, which corresponds to a tariff of 0.2%. As a result, deductions for injuries are equal to:

CONTRIBUTIONS = 3,468,000 x 0.2 = 6936 rubles.

The Social Insurance Fund makes allowances or discounts for some enterprises. Therefore, the amount of final contributions may be further increased or decreased.

An example of how to calculate the payment amount

The FSS systematically monitors the accuracy and completeness of the calculation of insurance coverage for NS and PP. There are fines for violating the accrual and payment rules. Let's determine how to correctly calculate the amount of contributions.

Pion LLC made accruals in favor of its employees in October 2021 in the amount of 1,000,000 rubles. Including disability benefits - 150,000 rubles, non-taxable financial assistance - 20,000, benefits for the birth of a child, child care - 180,000 rubles.

The company has the right to apply a preferential tariff of 0.2%.

We calculate the base for October: 1,000,000 – (150,000 + 20,000 + 180,000) = 650,000 rubles.

Contribution amount = 650,000 × 0.2% = 1300.00 rubles.

In total, Pion LLC, for which the Social Insurance Fund tariff for accidents according to OKVED in 2021 is 0.2%, is obliged to transfer a contribution for October 2021 to the Social Insurance Fund in the amount of 1,300 rubles.

New data for discounts and allowances in 2020

Employers make “injury” contributions in accordance with insurance rates. However, a discount or surcharge may be applied to the tariff (clause 1, article 22 of the Federal Law of July 24, 1998 No. 125-FZ).

The size of the discount (surcharge) is determined by a formula that involves three indicators:

- The ratio of the Social Insurance Fund's expenses for the payment of benefits for all insured events for the policyholder and the total amount of accrued contributions;

- Number of insured events per thousand employees;

- The number of days of temporary disability for the policyholder per insured event (excluding cases of death).

The average values of these indicators by type of economic activity for 2021 were approved by Resolution of the Federal Tax Service of the Russian Federation dated May 31, 2017 No. 67. For example, for retail trade in food products, drinks and tobacco products in specialized stores, the indicated values are 0.07, 0.46 and 48.67, respectively .

Who can apply?

Let us remind you that small and medium-sized businesses include organizations and individual entrepreneurs classified in accordance with the terms of Law N 209-FZ, small enterprises, including micro-enterprises, and medium-sized enterprises, information about which is included in the unified register of small and medium-sized entities entrepreneurship (Clause 1, Article 3 of Law No. 209-FZ). Accordingly, preferential tariffs can only be applied by organizations or individual entrepreneurs included in the Register.

Information from the Register can be obtained on the website of the Federal Tax Service of the Russian Federation

What are the benefits for injury insurance premiums?

Organizations that pay contributions to the Social Insurance Fund on time and do not allow accidents or occupational illnesses to occur may qualify for a discount on contributions for injuries.

Please note that it is no longer possible to receive the benefit for 2020, since the application had to be submitted before November 1, 2021. But it will continue to operate in the future.

The size of the discount depends on various factors: the number of injuries per 1000 employees, days of incapacity for work in one case of injury, etc. Its maximum value is 40%.

When calculating contributions for disabled employees of groups I, II, III, the discount increases to 60%. The law does not require documentary evidence of rights to receive it.

EXAMPLE

Imperial-Stroy LLC offers services in the field of engineering and technical design (OKVED 74.20). The company was given a discount on contributions to the Social Insurance Fund - 25%. In March 2021, the company awarded employees a salary of 320,000 rubles, as well as disabled people of groups I and II - 73,000 rubles. Determine the amount of contributions.

Solution

The activity falls into class I professional risk, for which the tariff is set at 0.2%. Taking into account the 25% discount, the rate will drop to 0.15% (0.2 – 0.2 × 25%).

Accident insurance premiums will be:

- for the main employees of the LLC:

320,000 × 0.15% = 480 rubles.

- for disabled workers (0.2 – 0.2 × 60% = 0.08%):

73,000 × 0.08% = 58.4 rubles.

- total value:

480 + 58.4 = 538.4 rub.

The accountant must calculate contributions for insurance against accidents and occupational diseases in the amount of 538.4 rubles for March.

Payment procedure and reporting

Contributions for insurance against industrial accidents are transferred by payers monthly no later than the 15th day of the month following the billing month.

Contribution payers are required to report quarterly to the Social Insurance Fund. It is provided in form 4-FSS, approved by Order of the Fund dated September 26, 2016 No. 381. It is provided in electronic form if the average number of employees of the policyholder exceeds 25 people. If there are fewer employees, the report may be in paper form.

The deadline for submission depends on the form chosen for submitting the report:

- on paper - until the 20th day of the month following the reporting quarter;

- in electronic form - until the 25th day of the month following the reporting quarter.

Foreigners: insurance premiums for injuries in 2021

Employers are required to insure against injury or occupational illness not only Russian citizens, but also foreign employees, as well as those permanently or temporarily residing in the territory of the Russian Federation. In this situation it does not matter:

- residence status;

- length of stay;

- place of work – Russian office or foreign “separate” office.

Managers must adhere to the following rule: when concluding an employment contract with a foreign employee, the procedure for calculating contributions to the Social Insurance Fund is the same as for Russians. Contributions are made to wages, bonus payments and allowances, compensation for unused vacation, etc.

When a civil contract is concluded with a migrant worker, contributions for injuries are calculated if there is a condition in the signed agreement.

EXAMPLE

, engaged in the production of kitchen furniture (OKVED 36.1), signed an employment contract with foreign employee K.V. Grigoryan. What amount must be accrued to the Social Insurance Fund for injuries if the employer made the following payments to him for March 2021:

- salary – 28,900 rubles;

- bonus – 5000 rubles;

- financial assistance in connection with the birth of a son – 4,000 rubles.

Solution

- Let's determine the basis for calculating insurance premiums:

B = 28,900 + 5000-4000 = 29,900 rub.

- According to the Classification of Activities by Risk, the activity is classified as class VIII of professional risk, which corresponds to a tariff of 0.9.

- Insurance premiums for injuries for a foreign employee will be:

29,900 x 0.9% = 269.1 rub.

Employment of a disabled person

When applying for a job, the applicant must present a certificate and an individual rehabilitation program. The document indicates the group and level of disability.

Reception

A person with limited ability to work independently looks for a job or is referred by the employment service. If an applicant is hired, he is required to provide a number of documents:

- Russian passport;

- work record book, with the exception of the first drawing up of a contract or placement of a part-time employee;

- military ID;

- SNILS;

- diploma of completion of an educational institution or certificate;

- certificates of completion of training, advanced training;

- certificate of no criminal record.

After receiving the package of documentation, the applicant writes an application, an agreement is concluded with him, and the manager creates an order for employment. A disabled employee is introduced to the duties and other acts of the company. Then a T-2 card is drawn up and an entry is made in the book.

For disabled people of groups 1 and 2, a week of up to 35 hours of work is established, for

Category III restrictions are not provided.

Dismissal

If a person is diagnosed with group 1 disability, then he is fired after the sick leave is closed and a VTEK certificate is issued. Termination of labor activity occurs on the basis of Article 83 of the Labor Code of the Russian Federation unilaterally. The reason is medical indications.

Dismissal of a disabled employee of group 2 due to reduction occurs according to the general rule. The exception is an industrial accident in which an employee is injured. The employer must offer him a place suitable for his health.

If a disabled employee refuses, the manager carries out the dismissal procedure on the employee’s own initiative due to disability due to amendments to the employment contract.

The third group is equal to ordinary workers. The administration has the right to dismiss a person if he does not fulfill the duties specified in the contract.

What's new

What's new on personal injury insurance premiums in 2021? There are practically no changes. Legislators simply retained the insurance premium rates and introduced new data for calculating discounts and surcharges. More extensive changes have taken place in 2021. Let's remember what changed then:

| Change | Content |

| Expanding the rights of the Social Insurance Fund | Since 2021, the Social Insurance Fund has the following rights: • demand explanations from policyholders regarding contributions; • maintain control over the receipt of funds; • calculate the amount of insurance premiums, etc. |

| The collection procedure has been established | The Basic Law - 1998 No. 125-FZ - was supplemented with new articles that regulate methods of collecting arrears, deferments, accrual of penalties, etc. |

| The calculation procedure has been specified | Terms, as well as settlement and reporting periods, are determined at the legislative level |

| Control over payment of contributions has been tightened | Law No. 125-FZ has been supplemented with rules on conducting desk audits, recording audit results, etc. |

Also see: Reimbursement of Workwear Costs through Contributions: What Has Changed.

Read also

26.12.2017

Pension contributions

Transfers of funds to the Pension Fund in 2021 are made from the earnings of a disabled person. The total amount of payments adds up to the size of the future pension. The obligation to pay insurance premiums is defined by the Tax Code, therefore non-payment or incorrect calculation of the amount is equivalent to an offense. The employer faces fines.

The deduction of OPS contributions is carried out to the Federal Tax Service, since it regulates all payers. Rules for transferring funds:

- the last day of payment is the 15th of each month; if it falls on a weekend or holiday, the payment is postponed to the next business day;

- insurance premiums are paid in full;

- Individual entrepreneurs and self-employed people make transfers once a year according to the tax system.

Insurance premiums are calculated in rubles and kopecks. The amount of contributions to the Pension Fund is equal to 22% of earnings. The employer does not have any benefits or discounts for this payment item.