A new KND form 1151111 for the 4th quarter of 2021 has been introduced. What has changed in the document? Who and when should submit the DAM using the KND form 1151111? For reporting for which period should the new document form be used? Where can I download the new KND form 1151111 in excel for free? The answer to these questions, a sample of filling out the form with reduced rates, as well as download links are in this material.

The new form for KND 1151111 is a calculation of insurance premiums, which was approved by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] and is subject to submission to the tax office.

In addition to the calculation form, the order also contains the Procedure for filling it out, which describes in detail the procedure for filling out the calculation. Attached to the filling procedure are the necessary tables with codes for entering them into the calculation fields. The article provides the form KND 1151111 for the 4th quarter of 2021

.

The document is quite large, but it is clear and simple and contains sheets to reflect various information:

- information about the income of individuals;

- accrued contributions for compulsory pension insurance (OPS) at all tariffs;

- contributions for compulsory health insurance (CHI);

- accrued contributions for compulsory social insurance (OSS);

- paid benefits for sick leave, “children’s” benefits, benefits for some persons injured in various disasters and accidents;

- information where possible to apply reduced rates to contributions;

- data on payments to foreign citizens, stateless persons, students for work in student groups;

- heads of peasant farms (peasant farms) can use the report to reflect information about contributions for themselves to compulsory health insurance and compulsory health insurance;

- personalized data on the income of each employee.

New in the calculation

The main innovations of the new calculation of insurance premiums are as follows:

- New fields have appeared on the title page of the Calculation, which reflect information about the average number of employees. This information is determined in the manner established by Rosstat Order No. 711 dated November 27, 2019.

- New payer tariff codes have been introduced into the RSV: – code “20” for SMEs, which are allowed to pay contributions at a cumulative rate of 15%, and code “21” – for enterprises that were allowed not to pay insurance premiums for the 2nd quarter of 2021 in accordance with measures of government support in the situation with coronavirus. Now these codes are defined by Appendix No. 5 to the Procedure for filling out the DAM.

- It is provided for the indication of new codes of the category of the insured person by employers of the two specified categories - SMEs and those that were exempt from paying contributions for the 2nd quarter of 2021. “MS” is an individual from whose salary reduced insurance premiums are deducted. Used in conjunction with tariff code 20. “KV” – individuals working in small enterprises in the affected industries. Used in conjunction with tariff code 21.

- Starting from reporting for the 1st quarter of 2021, payers carrying out activities in the design and development of electronic component base products and electronic (radio-electronic) products will pay contributions at a cumulative rate of 7.6% (in accordance with the updated paragraph 1 of Article 427 of the Tax Code RF). For them, the Calculation provides a special tariff code - “22”, as well as a new category code of the insured person “EKB”.

- Barcodes on calculation sheets have been changed.

The method of submitting the document has not changed. From this year, insurance premium payers who employ more than 10 people provide calculations only in electronic format . If the number of employees is 10 or fewer, the employer can submit it both electronically and in paper format. Previously, the limit was 25 people.

How to correctly submit insurance premium calculations

Initially, it was necessary to report using the insurance premium calculation form KND 1151111 starting in 2021. The form was introduced by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] But, as we have already noted, from the beginning of 2021 a new form must be used.

Read more about the innovations in our review.

The calculations are submitted quarterly to the tax office at the place of registration of organizations and individual entrepreneurs making payments in favor of individuals. Separate divisions that themselves accrue and pay remuneration to individuals must submit reports at their location. The deadline for submission is the 30th of the month following the reporting period.

The calculation form for insurance premiums until 2021 inclusive was allowed to be submitted on paper only to those whose average number of individuals in whose favor the payments indicated in the calculation were made for the previous reporting period was 25 people or less.

Note! Since 2021, the conditions for submitting reports on paper have changed. Now only those insurers whose average number of employees in 2019 did not exceed 10 people can report on paper. See here for details.

If the payer of contributions discovers an error or inaccurate information in the completed and submitted form of a single calculation for insurance premiums, then:

- if, as a result of an error, the base for calculating insurance premiums is underestimated, the payer must submit an updated calculation;

- if the calculation has discrepancies (unreliability) in terms of personalized data, in the numerical indicators of section 3 or in the basic control ratios listed in clause 7 of Art. 431 of the Tax Code of the Russian Federation, then such a calculation will most likely not be accepted by the tax authority and will have to be redone and resubmitted; in this case, the newly submitted report will not be considered an adjustment, but will be treated as a primary one;

- if the report contains errors other than those listed above, then submitting an updated calculation is the right of the contribution payer.

Please note that the updated calculation is submitted on the form that was current at the time the incorrect calculation was submitted.

The importance of meeting deadlines

In accordance with the requirements of paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, if the deadline for submitting calculations based on the results of reporting periods is violated, the entrepreneur or company will be subject to a fine of 200 rubles for each current calculation submitted on time.

Penalties for late reporting at the end of the year are calculated somewhat differently. In this case, the fine will increase to 5% of the amount of calculated insurance premiums for each month of delay. In this case, the fine should not exceed 30% of this amount, but should not be less than 1000 rubles. This norm is fixed in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

A pp. 1 clause 3 art. 76 of the Tax Code of the Russian Federation contains an addition: in some cases, tax authorities may even block the company’s bank accounts for late submission of calculations.

Contents of the calculation form

What is included in the insurance premium calculation form? As the name implies, the calculation includes information on accrued contributions for pension, health and social insurance.

Important! For insurance premiums for NS and PZ, which remained under the jurisdiction of the Social Insurance Fund, the reporting form 4-FSS remained, which is submitted to the Social Insurance Fund.

The new form for calculating insurance premiums in 2021 includes a general calculation for all individuals, as well as individual information for each person who received cash or other taxable income from an organization or individual entrepreneur.

In the unified calculation of insurance premiums for 2021 we find the following sections:

- the first section - it contains the amounts of accrued insurance premiums for the entire organization or individual entrepreneur as a whole;

- the second section is needed to reflect information about contributions from the heads of peasant (farm) households;

- the third section shows information about accruals in favor of each individual individually.

Some sections contain several applications and subsections. Please note that there is no need to submit all calculation sheets for insurance premiums KND 151111. It is necessary to submit only those sections and applications that are relevant to a specific payer of contributions, even if the data in them is zero. That is, if the payer of contributions does not apply reduced tariffs, then there is no need to include the corresponding sections in the reporting. However, when submitting a zero calculation, the calculation must include:

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

- title page;

- section 1 with subsections 1.1 and 1.2;

- appendix 2 to section 1;

- section 3.

New reporting form

As noted above, the new form was introduced in 2021. The report is a large document consisting of three sections on 24 sheets. Various online services have ready-made blank forms prepared in the form of zero reporting. The largest part falls on the first section, which includes the following calculations:

- general information about the payer's obligations;

- the amount of calculations of Pension Fund contributions;

- the amount of calculations of FSS contributions;

- the amount of calculations of FMS contributions;

- other special contributions - sick leave in case of temporary or total disability, as well as sick leave for pregnancy and childbirth;

- information regarding other payments financed from the federal budget.

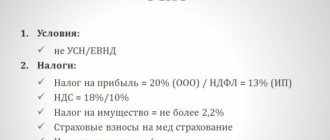

To correctly perform all calculations, you must have information about existing insurance rates:

- Pension Fund: 22%;

- Social Insurance Fund – 2.9%;

- FMS – 5.1%.

There are also 10 applications in the first section. Absolutely all entrepreneurs fall only under Appendices 1 and 2.

The second section of the report is mandatory only for farms or peasant households. Art. applies here. 105.3 of the Tax Code of the Russian Federation, according to which the price of natural products is calculated taking into account market prices. However, VAT also affects such goods.

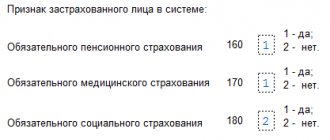

And finally, the third section contains data on each employee included in the insurance system, contributions for which are paid by the employer. This section includes 8 separate applications.

The title page must also be completed. From the title page to the end of the document, the TIN and KPP are affixed on each page. The title page indicates information about the company, the reporting period for which information is provided, and the number of pages.

A new type of report is submitted by all enterprises or individual entrepreneurs that have at least one employee on staff registered under a TD, or working on the basis of a GPA, receiving remuneration in the form of wages subject to insurance contributions.

How to enter data into the insurance premium calculation form

An important question that often raises questions even among experienced accountants is how to fill out the calculation in the technical sense, that is, how to enter words, numbers, addresses, last names and other data. And also in the case of submitting a calculation on paper - how exactly it should be printed and stapled.

Using the link below you can see a completed form for calculating insurance premiums and download it. Here, as an example, the title page of the calculation and section 1 are presented as mandatory for the formation of insurance premiums by all payers.

One cell is intended for one number, letter, space or syntactic character. Text, number, codes are written in the fields from left to right. If there are unfilled cells, a dash is placed in them. If the form for calculating insurance premiums in 2021 is filled out on a computer and not manually, you do not need to write a dash, leaving the fields blank.

The date is written as follows: for the day of the month there are two cells, for the month - two cells, for the year - four cells. There is a dot between the fields.

Page numbering is continuous, starting from the title page, all presented pages are numbered consecutively as follows: 001, 002 and so on.

All amounts are indicated in rubles and kopecks. If there is no summary or quantitative indicator, zeros are entered in the fields intended for them.

For paper reports, corrections, printing on both sides of the sheet, and binding that leads to damage to the paper are not allowed.

Some nuances of filling out the calculation

Let us briefly outline the nuances of entering data into the form for calculating insurance premiums in 2021.

The title page is standard and includes information about the payer of insurance premiums, as well as the code for the billing period and the tax office where the calculation must be submitted.

The next sheet is filled out by individuals - not individual entrepreneurs who made payments subject to insurance in favor of individuals.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Section 1 includes general data on accrued contributions for the billing period in total, as well as for each of the last three months of this period. Here we also find fields for KBK. In addition, lines 120–123 reflect the excess of expenses incurred for the payment of insurance amounts over accrued social insurance contributions.

Please note that in all other cases, only the accrued amounts of contributions are included in the calculation. There are no fields for amounts actually paid.

Section 1 Disclosure

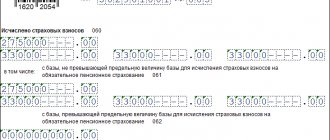

The appendices to Section 1 include the amounts of all payments to individuals in total from the beginning of the year and separately for each of the last three months of the billing period. There are separate lines for payments that are not subject to contribution.

The appendices to section 1 and their subsections disclose in detail the origin of the amounts of assessed contributions specified in section 1.

Subsection 1.2 is for medical contributions.

In subsections 1.1, 1.3 (1.3.1 and 1.3.2) data on pension contributions are entered - at regular rates and at additional tariffs.

Appendix 1.1 is intended to calculate the amounts of contributions for additional social security for certain categories of workers related to aviation and the coal industry.

Appendices 5–7 are used to summarize information on contributions at reduced rates.

Appendix 8 - for contributions from payments to foreign citizens, with the exception of highly qualified specialists.

Appendix 9 - payments and contributions to students.

Appendices 2–4 reflect payments and social insurance contributions in connection with illnesses and maternity.

Let's note column 002 in the appendix. 2, which discloses information on social insurance contributions. The attribute of payments, that is, belonging to the FSS pilot project, is indicated here:

- 1 - direct payments;

- 2 - credit system.

If the organization is participating in a pilot project of the Social Insurance Fund and disability benefits are paid directly from the Social Insurance Fund, then it is necessary to put 1. If the payer does not belong to the region where this project was launched, we put 2.

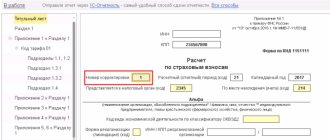

Sample of filling out the form according to KND 1151111

Below we present examples of filling out sheets for some sections. For more information on the procedure for filling out the calculation form for KND 1151111, read the article: “DAM for the 2nd quarter of 2021 (sample of completion).”

Title page

Section 1

Appendix 1 Section 1

Subsection 1.2

The video material provides information about the features of filling out the DAM in 2021:

Second and third sections

The unified calculation form for insurance premiums for 2021 contains two more sections.

Section 2 is filled out by the head of the peasant farm regarding the total amounts of accrued contributions for pension and health insurance and for each individual member of the peasant farm separately.

If there are no hired workers on the farm, the calculation is submitted once a year, before January 30 of the year following the reporting year. Otherwise, the calculation is carried out according to the general rules.

Section 3 is filled out for each individual who received payments in the reporting period from the payer of contributions and contains not only information about the amount of payments and accrued contributions, but also personal data: Full name, Taxpayer Identification Number, SNILS, date of birth and details of an identification document personality.

Codes in section 3

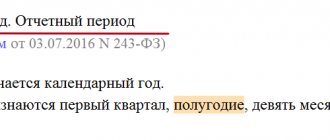

Section 3 is personalized information for each individual. In this section you also need to show the code for the billing (reporting) period:

- 21 – for the first quarter;

- 31 – for half a year;

- 33 – in nine months;

- 34 – per year.

If the calculation is generated during the reorganization or liquidation of an organization, the codes will be as follows:

- 51 – for the first quarter;

- 52 – for half a year;

- 53 – in nine months;

- 90 – per year.

The value of field 020 of section 3 must correspond to the value of the “Calculation (reporting period (code)” field of the calculation title page.

Read also

06.02.2017