What does “tax deferment” mean?

The legal norms governing the issue of granting a deferment for tax payment are given in Chapter 8 of the Tax Code of the Russian Federation.

You should be aware that deferment means a change in the deadline for fulfilling obligations to the budget. In this case, the maximum deferment period is 1 year. If there are compelling circumstances, you can obtain a deferment for either 3 years or all 5 years. In these circumstances, the necessary decision must be made at the level of the government and the head of the country's financial department.

Business entities have the opportunity to receive this kind of support from the state either for one or for a number of mandatory payments, including:

- personal income tax;

- property tax for individuals;

- transport tax;

- land tax.

As for legal entities, in their case the list is as follows:

- income tax;

- VAT;

- UTII.

It is important to understand that the amount of installment or deferment is limited by current legislation. Thus, guided by the provisions of Article 64 of the above-mentioned regulatory document, it is necessary to emphasize that organizations can receive a deferment in an amount that does not exceed the size of its net assets. If a Russian citizen applies for such a relaxation, then the amount of the installment plan will not exceed the value of his real estate, except in a situation where it is not possible to seize it for legal reasons.

Additional grounds for deferment or installment plan

A deferment or installment plan will be provided if at least one condition is met:

- decrease in income by more than 10%;

- decrease in income from the sale of goods, works, services by more than 10%;

- a decrease in income from the sale of goods, works, and services subject to VAT at a zero rate by more than 10%. This indicator is used if the volume of such sales is more than 50% of the total volume of sales of goods, works, services and property rights;

- receiving a loss on income tax for the reporting periods of 2020, if there was no loss for 2021. The fact of the loss will be established by the declaration for the reporting period preceding the quarter in which the application for deferment or installment plan is submitted.

How to calculate the decrease in income? It is necessary to compare the indicators of the quarter preceding the quarter in which the application for deferment or installment plan was submitted, and the indicators of the same period in 2021. If the taxpayer was registered only last year, then the indicators of the two quarters preceding the quarter in which the application is submitted are compared.

Applying for tax deferment

According to the provisions of clause 16 of the Procedure, according to which changes are made to the deadline for paying taxes and fees, ratified by order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated 12/16/2016. A similar right is granted to business entities and citizens by the tax service.

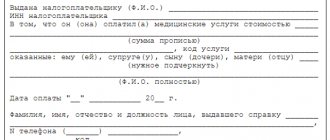

Citizens or business entities wishing to receive relief regarding the fulfillment of obligations to the budget should report to the tax service at the place of their registration, presenting the established list of documentation, including:

- application requesting a deferment;

- information from the bank on the volume of monthly turnover of financial resources for each of the 6 months that precede the date of submission of the application;

- certificates from financial institutions showing the balance of all accounts opened in the name of the applicant citizen or organization;

- a list of the applicant’s debtors indicating the prices of the agreements and the periods for fulfilling obligations under them, with copies of these agreements attached;

- the applicant’s obligation to fulfill the conditions for the duration of the deferment, according to which this decision is made, as well as the debt payment schedule;

- information that will confirm the presence of grounds for receiving relief from the fiscal service.

In addition to the papers indicated above, the applicant is required to submit a guarantee from the bank, surety or collateral.

Before submitting an application, a legal entity or citizen must make sure that there are no circumstances that would prevent them from obtaining such a right, including:

- the existence of an initiated criminal case related to offenses in the fiscal sphere;

- the tax authorities have facts that allow them to conclude that the applicant is in this way trying to hide funds or property that is subject to taxation;

- 3 years before filing such an appeal, the tax inspectorate made a decision to terminate the previously received deferment.

The applicant must receive a decision from the tax authorities on the received appeal within 30 days from the moment such an appeal was submitted.

If the tax office has made a positive decision, then it should contain information such as:

- the volume of obligations to the state treasury;

- a list of payments and contributions for which such a right was obtained;

- information about interest, if any, is paid in cases established by law;

- information about the property that acts as collateral, as well as about sureties or financial guarantees, if any.

If the tax inspectorate makes a negative verdict on the application received, then it must reflect the reasons for such a decision. It should also be remembered that the decision made can be challenged in accordance with the adopted procedure.

A copy of the rendered conclusion is sent to the applicant within 3 days.

Terms of tax deferments and installments due to coronavirus

The period for granting deferrals is limited to a period of 3 months to 1 year . The final duration depends on several factors.

to determine the installment for tax payments.

| Category/criteria | Maximum installment period |

| Strategic, systemically important, city-forming organizations and major taxpayers - with a decrease in income of more than 50% | 5 years |

| Strategic, systemically important, city-forming organizations and major taxpayers - with a decrease in income of more than 30% | 3 years |

All other companies if one of the criteria is met:

|

If the first deferment was given for a period less than the maximum , it can be extended .

You can ask for both a deferment and an installment plan. The procedure is as follows: before the end of the first deferment period, you need to submit another application - for installment payment.

IMPORTANT!

If an individual deferment (installment plan) is applied for a period of more than 6 months , security must be provided. This could be, for example, a pledge of real estate (the cadastral value of which exceeds the amount of payments for which the specified tax benefit is approved). A surety or bank guarantee is also acceptable.

How to write an application?

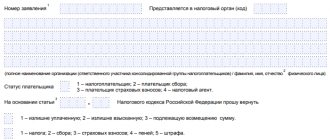

An application for the right to relief must be submitted in the appropriate form. When drawing up an application, you must provide the following information:

- name and details of the addressee;

- the name of the document itself;

- details and name of the legal entity or the full name of the applicant. In this case, you should indicate the TIN and KPP of the interested person;

- indicate the form for changing the payment period;

- determine the type of fee in respect of which it is necessary to change the payment period, as well as the amount of debt in words;

- identify existing grounds for obtaining relief;

- put the date of the application and the signature of the applicant.

Sample application for a tax deferment

letters (applications) to the tax office regarding deferment of payments due to the spread of coronavirus

Sample application for deferment of tax payments due to the spread of coronavirus

1 file(s) 23.52 KB

Download

SEE ALSO:

SAMPLE LETTER TO LANDLORD IN CONNECTION WITH CORONAVIRUS

SAMPLE APPLICATION FOR CREDIT HOLIDAYS DUE TO CORONAVIRUS

APPLICATION FOR CORONAVIRUS INDUSTRIAL SUBSIDY - FORM

LETTER AND AGREEMENT WITH SUPPLIERS ON DELAY OF PAYMENTS DUE TO CORONAVIRUS

TERMINATION OF THE AGREEMENT DUE TO CORONAVIRUS

DOCUMENTS AT THE ENTERPRISE

ORDERS AT THE ENTERPRISE

ORDER AT THE ENTERPRISE ON PREVENTING THE SPREAD OF CORONAVIRUS

ORDER ON HIGH READINESS AT THE ENTERPRISE IN CONNECTION WITH CORONAVIRUS

ORDER ON THE APPOINTMENT OF A RESPONSIBLE PERSON FOR CORONAVIRUS PREVENTION

ORDER ON TESTING WORKERS FOR CORONAVIRUS

ORDER ON CONDUCTING UNSCHEDULED INSTRUCTIONS ON CORONAVIRUS

ORDER ON THE ISSUANCE AND WEARING OF MEDICAL MASKS DURING THE SPREAD OF CORONAVIRUS

ORDER ON TRANSFER TO REMOTE (REMOTE) WORK DUE TO THE SPREAD OF CORONAVIRUS

ORDER ON THE ESTABLISHMENT OF PART-TIME WORKING DUE TO CORONAVIRUS

ORDER ON SUSPENSION FROM WORK DUE TO CORONAVIRUS

SAMPLE ORDER FOR CANCELLATION OF A BUSINESS TRIP DUE TO THE SPREAD OF CORONAVIRUS

ORDER ON DOWNTIME DUE TO CORONAVIRUS

ORDER ON PREMIUMS IN CONNECTION WITH CORONAVIRUS

SAMPLE ORDER: ON PREVENTING THE SPREAD OF CORONAVIRUS INFECTION IN AN EDUCATIONAL INSTITUTION

SAMPLE ORDER FOR A MEDICAL INSTITUTION TO PREVENT THE SPREAD OF CORONAVIRUS

FACTORY INSTRUCTIONS

INSTRUCTIONS OF ROSPOTREBNADZOR ON CORONAVIRUS PREVENTION

INSTRUCTIONS AT THE ENTERPRISE FOR EMPLOYEES ABOUT CORONAVIRUS

INSTRUCTIONS FOR PREVENTION OF CORONAVIRUS AT THE ENTERPRISE

INSTRUCTIONS: WHAT TO DO IF A CORONAVIRUS PATIENT IS IDENTIFIED

RULES OF PERSONAL HYGIENE FOR EMPLOYEES IN THE EVENT OF CORONAVIRUS FROM ROSPOTREBNADZOR

INSTRUCTIONS FOR MANAGERS OF COMPANIES WHOSE EMPLOYEES RETURNED FROM ABROAD

INSTRUCTIONS ABOUT THE PROCEDURE FOR INPUT CONTROL IN THE EVENT OF CORONAVIRUS

INSTRUCTIONS FOR DISINFECTION AGAINST COROVIRUS INFECTION

HAND WASHING INSTRUCTIONS TO PREVENT CORONAVIRUS

ACCOUNTING JOURNALS

SAMPLE JOURNAL FOR MEASURING THE TEMPERATURE OF EMPLOYEES IN CONNECTION WITH CORONAVIRUS

JOURNAL OF TESTING EMPLOYEES FOR CORONAVIRUS

JOURNAL OF WET CLEANING AND DISINFECTION OF PREMISES IN CONDITIONS OF CORONAVIRUS SPREAD

JOURNAL OF SURFACE TREATMENT FOR CORONAVIRUS

JOURNAL OF PREPARATION OF SOLUTION FOR DISINFECTION FOR CORONAVIRUS

JOURNAL OF INPUT CONTROL OF EMPLOYEES REGARDING CORONAVIRUS

ROOMS VENTILATION SCHEDULE IN CONDITIONS OF CORONAVIRUS SPREAD

CLEANING SCHEDULE TO PREVENT THE SPREAD OF CORONAVIRUS INFECTION COVID-19

SCHEDULE FOR QUARTZING ROOMS TO PREVENT THE SPREAD OF CORONAVIRUS

JOURNAL OF QUARTZING ROOMS FOR THE PURPOSES OF CORONAVIRUS PREVENTION

JOURNAL OF INSTRUCTIONS TO EMPLOYEES ON CORONAVIRUS

JOURNAL FOR THE ISSUANCE OF MASKS TO EMPLOYEES IN THE EVENT OF CORONAVIRUS

RECORDING LOG FOR ISSUANCE OF PASSES IN THE EVENT OF CORONAVIRUS

STATEMENTS, EXPLANATORY NOTES

EMPLOYEE'S STATEMENT ABOUT REMOTE WORK

STATEMENT: REFUSE TO TEST FOR CORONAVIRUS

EMPLOYEE CONSENT TO WORK DURING CORONAVIRUS

APPLICATION FOR CORONAVIRUS INDUSTRIAL SUBSIDY - FORM

RECEIPT FOR NO CONTACT WITH CORONAVIRUS PATIENTS

ADDITIONAL INFORMATION

ACTION PLAN AT THE ENTERPRISE FOR CORONAVIRUS PREVENTION

ADDITIONAL AGREEMENT TO THE EMPLOYMENT CONTRACT IN CONNECTION WITH THE TRANSITION TO REMOTE WORK

CERTIFICATES FORM FROM PLACE OF WORK DURING THE SPREAD OF CORONAVIRUS

CERTIFICATES FOR KINDERGARTEN DURING CORONAVIRUS

CERTIFICATE OF NO CONTACT WITH INFECTIOUS PATIENTS WITH CORONAVIRUS

ANNOUNCEMENT IN THE STORE IN CONNECTION WITH CORONAVIRUS: MASK MODE AND DISTANCE BETWEEN BUYERS

CHECK LIST FOR EMPLOYEES DURING THE SPREAD OF CORONAVIRUS

ORGANIZATIONAL SAFETY STANDARD IN THE CORONAVIRUS

SAMPLE LETTER TO LANDLORD IN CONNECTION WITH CORONAVIRUS

LETTER AND AGREEMENT WITH SUPPLIERS ON DELAY OF PAYMENTS DUE TO CORONAVIRUS

TERMINATION OF THE AGREEMENT DUE TO CORONAVIRUS

SAMPLE CLAIM FOR REFUND DUE TO CORONAVIRUS

CORONAVIRUS RESEARCH FORM WITH ANALYSIS RESULTS

SEE ALSO:

RECOMMENDATIONS TO THE MANAGER, ACCOUNTANT AND HR MANAGER ON CHANGING WORK PROCEDURES AND FILE ADDITIONAL DOCUMENTATION IN CONNECTION WITH THE SPREAD OF CORONAVIRUS

OCCUPATIONAL SAFETY INSTRUCTIONS FOR ACCOUNTANTS

OCCUPATIONAL SAFETY INSTRUCTIONS

PREVENTION OF NEW CHINA CORONAVIRUS - 2021, SYMPTOMS

REGULATORY DOCUMENTS (ORDERS) GOVERNING THE PREVENTION OF CORONAVIRUS

ADDITIONAL INFORMATION MATERIALS ON CORONAVIRUS: FLYERS, POSTERS, LECTURES, PRESENTATIONS, ETC.

CORONAVIRUS 2021 - INFORMATION FOR EMPLOYEES IN THE EDUCATION FIELD (PRECEDURE EDUCATIONAL INSTITUTIONS, SCHOOLS, UNIVERSITIES, INSTITUTIONS, UNIVERSITIES)

CORONAVIRUS INFECTION COVID-19 - INFORMATION FOR HEALTHCARE PROFESSIONALS

Reasons for receiving a deferment

From a legal point of view, valid reasons for obtaining such an opportunity are:

- receipt by a legal entity of damage due to force majeure circumstances;

- lack of budget funding, which was supposed to cover the debt;

- the presence of a threat of bankruptcy, which may be caused due to the payment of mandatory payments to the budget;

- production of goods or services on a seasonal basis;

- participation in legal relations that allow you to obtain a deferment in tax payment.

Federal tax breaks

In a situation where an interested person claims the right to receive installment payments for payments to the federal budget, such a decision is also made by the Federal Tax Service. However, such a decision requires coordination with other authorities.

When we talk about fulfilling obligations to the budget of the constituent entities of the Russian Federation, the Federal Tax Service must make a collegial decision, which will be made with the financial structures of those constituent entities of the federation to which such an obligation was formed.

When a decision is made to defer the unified social tax, the verdict is agreed upon with the relevant extra-budgetary funds. If the debt arose during the movement of goods across the customs border, then a joint decision is made with the Federal Customs Service.