New rules for crediting and returning overpayments

From October 1, 2021, the provisions of Federal Law No. 325 of September 29, 2019 will come into force, which simplify the procedure for offset or refund of overpayments of taxes. Until October 1, tax authorities can redistribute overpaid taxes only within the budget of one type. Federal tax goes to the federal budget, regional tax goes to the regional budget, local tax goes to the local budget. For example, by overpaying VAT, a federal tax, you cannot pay off a debt on property tax, a local tax.

Starting from October, it will be possible to offset overpayments against future tax payments or pay off debts for another tax without reference to the budget level. For example, due to the income tax overpaid to the federal budget, it is possible to pay off arrears or a fine to the regional budget for transport tax or to the local budget for land tax.

If there is a tax debt to any budget - federal, regional or local - it is impossible to return the overpayment of taxes in money. The debtor, due to the overpayment, is obliged to first pay off his obligations for taxes, fines and penalties (Clause 6 of Article 78 of the Tax Code of the Russian Federation).

The rules for offset and refund of overpaid insurance premiums remain the same. For example, overpayment of pension insurance contributions cannot be “spread” onto social or health insurance contributions (clause 1.1 of Article 78 of the Tax Code).

How does overpayment of taxes occur?

Overpayment occurs due to errors either by the organization itself or by the tax authority.

Taxpayers themselves are wrong:

- when calculating tax. Accounting may make a mistake when calculating the tax base, applying the wrong tax rate, or not applying tax benefits and deductions;

- when filling out payment orders for the payment of taxes, penalties, and fines. Any error in the BCC or tax amount results in an overpayment for one tax and an underpayment for another.

Overpayment may arise due to advance payments.

For example, a company transferred advances for income tax during the year, but at the end of the year the tax turned out to be less than the amount of the transferred advances. So the company overpaid income taxes.

Tax inspectors may mistakenly collect taxes twice.

This occurs when a tax, fine or penalty is unilaterally written off from a current account. For example, the taxpayer has already transferred taxes, but the money has not yet reached the tax office. And the Federal Tax Service writes off the amounts without acceptance. Then there may be an overpayment.

Note!

Overpayment of taxes must be recorded on the organization’s front card with the Federal Tax Service. If, for example, a company transferred taxes through a problem bank, but they did not go to the budget, it will not be possible to offset or return them.

The courts believe that recognition of the obligation to pay a tax as fulfilled does not give rise to the taxpayer’s automatic right to return or offset the amount of such tax.

They confirmed that the taxpayer does not have the right to compensate for his losses at the expense of the budget (Determination of the Supreme Court of the Russian Federation No. 307-KG 18-10845 of August 8, 2021).

Interest on late transfer of refund

The Federal Tax Service and the Social Insurance Fund may be late with the return of insurance payments. In this case, the company can present the amount of interest determined depending on the size of the late payment and the duration of the delay itself. The amount of interest is determined by the standard formula used when establishing penalties:

Amount of overpayment * number of days of delay * 1/300 of the refinancing rate

The interest rate can be set only when the money has arrived in the company’s account. This is due to the fact that the amount of the penalty depends on the length of the delay. The corresponding calculation rules are established by Part 9 of Article 27 of Federal Law No. 212 dated July 24, 2009. The money is transferred by the Treasury of the Russian Federation on behalf of the funds.

IMPORTANT! Government agencies must return the money to the organization’s account. Funds accrued as late interest cannot be offset against future payments.

Example

The company overpaid contributions by 2,700 rubles. An application for a refund was sent. They were supposed to arrive on February 10th, but in fact they only arrive on February 20th. The company makes these calculations:

- Number of days of delay – 10.

- Percentage: 2,700 * 10 * 1/365 * 9%. = 6.66 rubles.

Interest will be accrued from the date that is the last day of transfer of the overpayment.

How to find out about an overpayment

Both the taxpayer himself and tax inspectors can find overpayments of taxes. You can order a reconciliation report from the tax office or check your transfers in your personal account on the Federal Tax Service website. Within five working days after submitting the documents, tax officials must issue a reconciliation report and send it to the taxpayer.

If the tax authorities were the first to discover the overpayment, they are obliged to notify the organization - within 10 working days they must send a written message and indicate the date the overpayment was discovered (clause 3 of Article 78 of the Tax Code of the Russian Federation). The date of discovery of the overpayment is the day when the inspector discovered the excess for a particular tax. Regardless of whether the tax inspectorate informed the taxpayer about the fact of an overpayment or not, the overpayment can be disposed of within three years from the date of occurrence.

Taxes to the budget for the taxpayer can be transferred by any other person - an organization, an entrepreneur or a citizen without the status of an individual entrepreneur (paragraph 4, paragraph 1, article 45 of the Tax Code). But only the taxpayer himself has the right to return the excess or offset the payment. Third parties cannot do this (paragraph 5, paragraph 1, article 45 of the Tax Code).

Results

Now the return of insurance premiums (except for “accidents”) is subject to the rules established by the Tax Code of the Russian Federation and occurs through an appeal to the Federal Tax Service.

Rules similar in basic provisions were introduced into Law 125-FZ, dedicated to “unfortunate” contributions, which continue to be supervised by the Social Insurance Fund. Refunds of contributions overpaid before 2021 are made by the funds themselves that received these contributions. That is, in the period 2017–2021, there are 3 authorities capable of making a return, and to each of them the application for return will have to be drawn up in its own special form. Since 2021, there are two such authorities: the Federal Tax Service and the Social Insurance Fund (for contributions for injuries). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How can you manage your overpayment?

If an organization or individual entrepreneur has identified an overpayment of taxes, then the excess can be offset against the debt, left in a personal account with the Federal Tax Service for future payments, or the money returned to the current account. Let's consider each point separately.

Credit for arrears

If there is arrears on other taxes, fees, fines, penalties, inspectors will first pay off the arrears to the budget through overpayments. The inspectorate independently decides which tax debt can be closed and informs the organization. But they can only dispose of overpayments that are no more than three years old.

An organization can independently submit an application for credit indicating a specific tax. It is advisable to reconcile the calculations with the budget before doing this. If the amount indicated in the application does not coincide with the data of the tax office, the tax authorities will return the application.

The tax office makes a decision on offset or refusal to offset overpaid amounts against arrears within 10 working days:

-from the moment the overpayment is discovered, if the organization has not applied to the inspectorate with an application for credit against a specific tax;

-from the date of receipt of an organization’s application for credit against a specific tax, if the organization has submitted such an application;

- from the date of signing the act of reconciliation of settlements with the budget, if the inspection and the organization carried out a reconciliation;

-from the moment the court decision comes into force, if the organization has achieved offset through the court;

-from the day following the day of completion of the desk tax audit, which took place without additional assessments;

if a desk audit revealed violations - from the day following the day the decision entered into force.

Wiring used

Money received as a result of the return of an overpayment must be taken into account. They are recorded on account 69. In particular, these postings are used:

- DT69 KT51. The posting is recorded when the contribution is paid. Overpayments are reflected in debit.

- DT51 KT69. Return.

Overpayments that are not recorded as expenses when establishing the tax base are not considered non-operating income.

Credit towards future payments

If there is no arrears, you need to send an application to the inspectorate for crediting money using the approved KND form 1150057. Applications for crediting taxes overpaid to regional budgets at the location of separate divisions of the organization can be submitted both to the tax inspectorate at the location of the organization and to the tax inspectorates at location of separate units.

The application deadline is within three years from the date of payment of the excess tax or contribution. The application must be accompanied by documents confirming the overpayment - a payment order or an updated declaration. The tax office must make a decision on the offset within 10 working days from the date of receipt of the application from the organization.

Overpayments cannot be counted against future payments of taxes, fees, penalties and fines by other taxpayers. Such offset of Tax Code is not provided (letter of the Ministry of Finance dated March 6, 2017 No. 03-02-08/12572).

Letter for refund of insurance premiums - form

Thus, in 2021 - 2021, the refund of overpayments on contributions is made through:

- The Federal Tax Service, in agreement with the fund, in terms of contributions paid since 2017;

- the fund itself - in relation to contributions paid before 2021 (in 2020 - 2021 this will have to be done through the court, since the three-year period for return will be missed);

- FSS - in terms of “unfortunate” contributions, regardless of the period of their payment.

To apply to any of the authorities, the payer of contributions must submit an application on his own special form, each of which can be downloaded on our website.

To draw up an application to the Federal Tax Service, you must use the document form contained in the order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] Now it is used as amended by the Federal Tax Service order dated November 30, 2018 No. ММВ-7-8/ [email protected] You can download it from the link below:

Is it possible to return overcharged insurance premiums, ConsultantPlus experts explained. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

To the Pension Fund of the Russian Federation (in relation to contributions for pension and health insurance paid before 2021), the appeal should be made in forms 23-PFR (if contributions were overpaid) or 24-PFR (if there was an excessive collection), approved by the resolution of the Board of the Pension Fund of the Russian Federation dated 22.12 .2015 No. 511p. Download it from the link below:

When applying for a refund to the FSS, Form 23-FSS will be used, approved by Order of the FSS of the Russian Federation dated November 17, 2016 No. 457.

Check whether you correctly post the return of overpayments on insurance premiums in accounting with the help of expert advice from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Refund of overpayment

To return money to the current account, the organization submits an application in the KND form 1150058 within three years from the date of the overpayment. To make a decision, inspectors have 10 working days from the moment they receive the application or sign the reconciliation report. After 5 working days, tax authorities are required to inform the organization or individual entrepreneur about the decision made (clause 9 of Article 78 of the Tax Code). After a month, return the overpayment to your bank account. If the taxpayer made a mistake and provided incorrect details, the refund will be processed after clarification.

Refund of overpaid taxes is a right, not an obligation, of the taxpayer. An organization or individual entrepreneur can waive their right, which does not contradict paragraph 6 of Art. 78 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia No. 03-07-11/63803 dated December 11, 2014).

Who should return the fee?

Contributions are divided into different types. The type of payment determines who should return it:

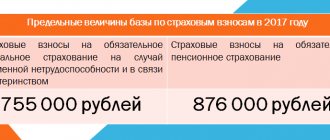

| Type of contribution | Until January 1, 2021 | From January 1, 2021 |

| OPS, compulsory medical insurance | Pension Fund | Inspectorate of the Federal Tax Service |

| FSS | FSS | Inspectorate of the Federal Tax Service |

There is also such a contribution as a contribution in case of injuries and accidents. The FSS was responsible for it until 2021 and is now responsible.

IMPORTANT! There is no refund of overpaid pension contributions.

If the overpayment is more than three years old

An organization can offset or return an overpayment within three years from the date of payment of the excess tax amount. The payment date is calculated differently. For example, for VAT, which is paid without advance payments, the three-year period will be counted from the date of transfer of the tax. And for income tax, which provides for advance payments, the period will be calculated from the moment of filing the declaration.

If the organization missed the deadline for filing an application, you can go to court. When considering a case in court, the limitation period of 3 years will be calculated according to the norms of civil, and not tax legislation. And the countdown of the period does not start from the moment of payment of the excess amount, but from the moment when the organization learned or should have known about it (clause 1 of Article 200 of the Civil Code). But you will have to prove that you learned about the overpayment later than it occurred. And it's not that simple.

Is it possible to collect interest from the Social Insurance Fund if contributions were collected illegally?

There was such a case in the judicial practice of the Ural District. An on-site inspection of the Social Insurance Fund discovered a shortage of payments for accidents at the enterprise and presented a demand for its payment. The organization complied with this requirement, but then decided to challenge it and filed a lawsuit demanding the return of the excessively collected amount, as well as interest accrued on it.

By the decision of the Arbitration Court in this case (No. A50-29761/2018 dated 06/06/2019), the FSS demand was declared invalid and illegal. Thus, the court satisfied the taxpayer's claim. The FSS tried to build its defense, referring to the provisions of Art. 26.12 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” and insisted that these payments were overpaid and not collected. This means that there is no basis for calculating interest.

Illegal assessment of taxes and fines. How to prove it in court?

The above law states that acts of bodies monitoring the payment of insurance premiums do not have the same signs of compulsoryness that acts of tax authorities have, therefore the positions of the Constitutional Court of the Russian Federation, set out in the ruling dated December 27, 2005 No. 503-O, and the position of of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 16551/11 dated April 24, 2012.

But the court, even after the appeal, did not change its statement that the fund’s requirement to pay the additional accrued amount of the fee, which was identified during the on-site inspection, is the basis for considering it excessively collected, and not excessively paid, thereby taking the side of the policyholder.

For your information. According to clauses 1, 2 of Art. 26.1 of Federal Law No. 125-FZ, if a fact of non-payment or incomplete payment of insurance premiums on time is revealed, then this arrears must be collected. The collection procedure is provided for in Art. 26.6 and 26.7 of Federal Law No. 125-FZ.

In which case is it not possible to return the money?

There are also situations when the Federal Tax Service refuses to refund the overpaid tax. Quite often this is due to the fact that taxpayers miss the statutory limitation periods of three years - if the overpayment of taxes arose due to the fault of the enterprise, one month - when the inspectorate itself is to blame.

Here, proof of the time of discovery of the fact of overpayment of tax is of great importance. If the taxpayer has the opportunity to submit them, and they do not exceed the established deadlines, then through court proceedings it is possible to obtain the return of overpaid tax.

Attention! A refusal to refund overpaid taxes can be obtained if the company has arrears to the budget. Indeed, in this case, the Federal Tax Service is given the right to carry out an offset without acceptance.

Refund or credit - which is better?

In addition to a tax refund, the taxpayer has the right to ask the Federal Tax Service to offset the amount of any overpayment of tax against the enterprise's existing obligations to the budget.

However, there is a limitation when crediting excess tax. It can only be done for taxes within one budget (federal, regional or local).

In most cases, the decision on a refund or offset is made only by the taxpayer (in the absence of tax debts). Therefore, what is better is a credit or a refund, each business entity decides independently, assessing the current situation in specific conditions, as well as the amount of overpaid tax.

Attention! Tax authorities always give preference to offsets, as this will allow them not to return money. Therefore, the offset procedure is much faster and requires fewer documents than a return. Taxpayers must also take this fact into account when making decisions about this.

In addition, it matters in what status the tax overpayment occurred. After all, if an excess payment was made by a tax agent, then he cannot take these amounts into account for obligations where he acts as a taxpayer. Only returns are possible here.

You might be interested in:

Patent taxation system for individual entrepreneurs in 2021: types of activities, how to switch

What to do if the tax was written off by mistake

The tax office has the right, without the approval of the taxpayer himself, to withdraw from him unpaid amounts of taxes, fines or penalties.

Sometimes such actions are carried out by mistake - for example, the authority did not receive a payment order, or the taxpayer himself made a mistake and indicated the wrong details, BCC number, etc.

If such an event does occur, then the tax office is obliged to return the unlawfully withheld amount. If the company has debts for any other taxes, then part of this payment can be used to pay them off, and the remaining funds will be returned.

To make a refund, you must submit a written application in free form to the Federal Tax Service. It must state the circumstances of the case, attach a supporting document (payment with tax transfer), and indicate bank details for the refund.

bukhproffi

Important! The application must be submitted within 1 month from the date of the unlawful write-off. If this period is missed, the amount can only be returned through legal proceedings. Three years are allotted for this.

It takes 10 days to process the submitted application. Next, the authority is given 1 month to return the amount to the bank account.