Which BCCs for individual entrepreneurs are valid in 2021? Have new BCCs for individual entrepreneurs been approved for 2021? Which BCCs should be used under the simplified tax system to pay insurance premiums in 2021? We provide tables for individual entrepreneurs for all tax regimes.

- Individual entrepreneur insurance premiums in 2021

- All new KBK in 2020

- Overview of changes since 2021

KBK: insurance premiums IP-2020

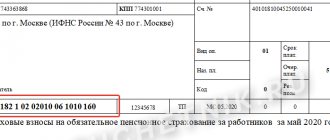

BCCs for insurance premiums represent the largest group of codes that are necessary for entrepreneurs of absolutely all taxation regimes. Individual entrepreneurs, when filling out payments for insurance premiums in 2021, must indicate the following BCC:

| Type of contribution | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for injuries | 393 1 0200 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| 182 1 0210 160 |

| 182 1 0220 160 |

| 182 1 0210 160 |

| 182 1 0220 160 |

What is KBK

When making a payment, it is important to indicate its purpose, that is, to which authority the money is transferred. It is for this purpose that the KBK is used. This code indicates exactly where the funds should be transferred and is a specific set of numbers.

Depending on the payments for which they are used, all existing BCCs are divided into four types:

- all tax payments made by ordinary citizens and entrepreneurs;

- transfer of funds intended to finance the budget deficit;

- payments for state duties, excise taxes, penalties and fines;

- monetary transactions carried out by government agencies.

What it is

The budget classification code is a specific set of numbers in which information is encoded. All 20 digits are divided into groups that have a specific name. There are four of them:

- the first block consists of the first three digits and is called “Administrator”. It indicates the organization to which the transferred funds are intended. For example, “182” is the Federal Tax Service, and “392” is the Pension Fund;

- the second group of numbers consists of the next 10 characters (from 4 to 13) and is called “Type of income”. This combination contains information about the group, subgroup and purpose of the payment. Numbers 6, 7 and 8 of this block specify income items, and the last two indicate the level of the budget into which funds should be received;

- the next four characters (14 to 17) serve to clarify what kind of payment is being made. The name of this block is “Program”. Using this combination, you can determine whether it is a tax, a fine or a penalty;

- the last three digits are the "Economic Classification". This contains information about the source of funds from the point of view of its economic type.

Decoding is not as complicated as it seems, and a certain pattern can be traced in it.

The KBK not only simplifies payments, but also helps the state correctly distribute funds and direct them to a particular budget. This combination of figures is also used by economic analysts to assess the dynamics of government expenditures and revenues.

The BCC is no less important for citizens who plan to engage in commercial activities and want to do it legally. It is also of great importance for individual entrepreneurs.

KBK for individual entrepreneurs in special modes in 2020

For each special regime tax, its own BCC has been approved:

| Tax | KBK |

| Tax under simplified tax system: | |

| 182 1 0500 110 |

| 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

Self-employed citizens participating in the experiment must transfer professional income tax to KBK 182 1 05 06000 01 1000 110. This code is provided for by Order of the Ministry of Finance dated November 30, 2018 No. 245n.

Read also

30.07.2020

Why does the individual entrepreneur need it?

After registering as an entrepreneur, each citizen assumes the responsibility to pay taxes and insurance premiums. When filling out payment slips, it is required to indicate the KBK for making such payments. Moreover, for each case there is a certain combination.

How to find out OKATO IP by TIN: what is it and why is it needed

Knowing all KBK IP codes for 2021 and following changes in them is very important. Without this information, funds will either not be transferred at all or will not be received as intended.

Note! If the payment order does not indicate the BCC, the bank will refuse to carry out the transaction.

What fees do you need to pay?

As stated in Art. 430 of the Code, an entrepreneur who does not have a hired workforce is required to pay 2 types of SV:

| for pension insurance | OPS |

| for medical | Compulsory medical insurance |

By virtue of Part 6 of Art. 430 of the Code, there is no need to pay SV to VNiM for an individual entrepreneur for himself (except for cases where the individual entrepreneur voluntarily entered into legal relations with the Social Insurance Fund in the manner prescribed by Article 4.5 of the Federal Law No. 255 of December 29, 2006 “On Mandatory...”).

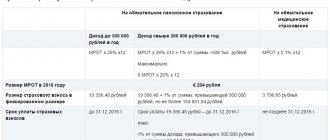

At the same time, if previously the size of the SV for individual entrepreneurs was determined depending on the current minimum wage, now the size of the SV is set at a fixed amount depending on the year for which the SV is paid.

How much an individual entrepreneur who does not have a workforce will need to pay for 2021, 2021 and 2021 is already known:

| View SV | SV size in 2021, rubles | SV size in 2021, rubles | SV size in 2021, rubles |

| On OPS | 26545 | 29354 | 32448 |

| On compulsory medical insurance | 5840 | 6884 | 8426 |

At the same time, the size of the SV on the OPS depends on whether the amount of income of the individual entrepreneur for the billing period exceeded the mark of 300,000 rubles:

- if it has not exceeded, then the individual entrepreneur pays the above amount for this year;

- if it exceeds, then the individual entrepreneur, in addition to the above amount, pays 1% on the amount of profit that exceeded 300 thousand (for example, if income for 2021 was 350,000, then you will have to pay 26,545 rubles + 1% on 50,000, that is, additionally 500 rubles).

SV for compulsory medical insurance are paid in the amounts indicated in the table, regardless of what the income will be for the billing period.

Procedure for paying individual entrepreneur contributions

Payments can be made in installments throughout 2021 or in one lump sum . But the main thing is until December 31, 2021 . And pension contributions from income over 300,000 rubles. – until July 1, 2021 .

Contributions for compulsory medical insurance and compulsory medical insurance are transferred to the tax office in two separate payments.

ADVICE

You can fill out payment slips for contributions to the tax office on the website of the Federal Tax Service of Russia in a special service https://service.nalog.ru/payment/payment.html.

The correct example of filling out a payment order for an individual entrepreneur to pay insurance premiums for a compulsory insurance policy for himself can be found in the ConsultantPlus ready-made solution here.

Read also

18.12.2020

Calculation formula

In accordance with Part 1 of Art. 432 of the Code, the individual entrepreneur is required to independently calculate the amount of SV payable.

Fortunately, you don’t have to count a lot – the payments are fixed and known in advance. The only thing that will have to be calculated is whether the individual entrepreneur’s income exceeded 300 thousand rubles or not.

For information on what is considered income and what is not, see Part 9 of Art. 430 of the Code - it says that the procedure for determining income depends on the tax system used by the individual entrepreneur.

Next, the individual entrepreneur must determine whether he needs to pay the full amount of fixed payments? In particular, in Part 3 of Art. 430 of the Code states that when registering an individual entrepreneur during the year (for example, in May), the calculation of the SV is made in proportion to the number of months and days during which the activity was carried out.

For example, if a citizen registered as an individual entrepreneur on May 1, 2020, then for 2021 he will need to pay SV for compulsory health insurance and compulsory medical insurance at the rate of 8 months, that is, 26545 / 12 * 8 and 5840 / 12 * 8.

When registering within a month you will have to

Payment deadlines

The deadlines for paying SV for compulsory medical insurance and compulsory medical insurance paid by entrepreneurs who do not have hired labor are stated in Art. 432 of the Code.

Based on ab. 2 hours 2 tbsp. 432 of the Code, you must pay the SV for compulsory medical insurance, as well as the SV for compulsory pension insurance, calculated from the amount of income not exceeding 300 thousand rubles, before December 31 of the current period.

This means that the deadlines for paying SV in 2020-2020 are as follows:

| The period for which SV for compulsory health insurance and compulsory health insurance is calculated and paid | By what date and what year do you need to pay? |

| 2018 | Until December 31, 2021 |

| 2019 | Until December 31, 2021 |

| 2020 | Until December 31, 2021 |

But the SV for OPS from the excess amount can be paid a little later - before July 1 of the year that immediately follows the expired one. That is, for example, if an individual entrepreneur’s income for 2021 was 500,000 rubles, then until July 1, 2021, he needs to pay 1% on an amount greater than 300 thousand, that is, 1% on 200,000 rubles (2000 rubles). The main part of the SV (26545) must be paid by December 31, 2021.

If payment to the budget is not received by the specified dates (or is not received in full), the tax authority will independently calculate the amount of the tax due for payment and identify the arrears on the tax (clause 4, part 2, article 432 of the Code). In the future, the arrears will be collected in the manner established by Art. 46 and 47 of the Code.

What it is

KBK is a budget classification code, that is, a code designed to group income, expenses and sources of financing budget deficits (Part 1 of Article 18 of the Budget Code of the Russian Federation).

The application of codes is carried out in accordance with the Instructions on the procedure for application..., approved by Order of the Ministry of Finance of the Russian Federation No. 65n dated July 1, 2013 “On approval...”.

The assignment of the BCC is carried out in accordance with the principles of unity, stability and openness. CBs relate to budget revenues, so the corresponding code structure is used.

The KBK of budget revenues always consists of 20 digits:

| Number | What does (D - income) mean? |

| 1st, 2nd and 3rd | Administrator code D (in this case, the administrator is recognized as the Federal Tax Service) |

| 4th | Group D |

| 5th and 6th | Subgroup D |

| 7th and 8th | Article D |

| 9th, 10th and 11th | Subarticle D |

| 12th and 13th | Element D |

| 14th, 15th, 16th and 17th | Subspecies group D |

| 18th, 19th and 20th | Analytical group of subtype D |

KBK for paying penalties on insurance premiums to the Pension Fund for individual entrepreneurs for themselves

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance in the Pension Fund of the Russian Federation for individual entrepreneurs for themselves (fixed amount, based on the minimum wage) | penalties | 182 1 02 02140 06 2110 160 |

| fines | 182 1 02 02140 06 3010 160 | |

| Penalties and fines on insurance contributions for pension insurance to the Pension Fund for individual entrepreneurs for themselves on income exceeding 300 thousand rubles. | penalties | 182 1 02 02140 06 2110 160 |

| fines | 182 1 02 02140 06 3010 160 | |

In FFOMS

Who is exempt from paying

Based on Part 7 of Art. 430 of the Code, entrepreneurs who do not have hired personnel do not need to pay SV for compulsory health insurance and compulsory medical insurance during the periods provided for in paragraphs 1, 3, 6-8 of Part 1 of Art. 12 Federal Law No. 400 of December 28, 2013 “On insurance…”, that is:

- during compulsory military service;

- when caring for a child until such child is 1.5 years old;

- when caring for a person over 80 years of age;

- when living together with a military spouse (s) in an area where there is no opportunity to find a job;

- when spouses of ambassadors, consuls, etc. live abroad.

At the same time, exemption from payment of SV during the above periods occurs only if the individual entrepreneur did not conduct business activities (Part 8 of Article 430 of the Code).

To confirm the absence of activity, you need to submit a tax application and documents, the list of which is stated in the Letter of the Federal Tax Service of the Russian Federation No. BS-4-11 / [email protected] dated April 26, 2021 “On the exemption...”.

So, entrepreneurs are required to pay self-employment insurance for compulsory medical insurance and compulsory medical insurance. The payment amount is fixed.

Additionally, you need to pay SV for OPS if the amount of income for the year is more than 300 thousand rubles. To pay, you need to fill out a payment order, indicate the BCC in it and submit it to the bank for execution.

What are the dangers of an error in the KBK?

If the fee is paid to the wrong BCC, it will be stuck in unclear payments. The tax office will not see it and may charge a penalty on the amount owed. However, this is illegal - after all, an error in the KBK is not a basis for recognizing the obligation to pay the contribution as unfulfilled (Letter of the Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7 / [email protected] ).

If you made a mistake with the KBK, fill out an application to search (clarify) the payment. In the application, indicate the type of insurance premium, the BCC for which it was paid and the tax period (the year for which it was paid). A document confirming payment of this fee must be attached to the application.

By the way, starting from 2021, a new procedure for clarifying payments for taxes and contributions has been in effect. Details about it can be found here.

You can learn about the deadlines for paying insurance premiums for individual entrepreneurs for yourself in 2021 from this article.

Budget classification code for special regimes

There are several taxation systems for individual entrepreneurs. The most common of them:

- STS (Simplified Taxation System);

- UTII (Unified tax on imputed income).

How to find out whether an individual entrepreneur is closed at the tax office and via the Internet

Each of these taxes has its own BCC.

simplified tax system

This taxation system provides two options for paying taxes.

- 6% of income is paid;

- 15% of the amount “Income minus expenses” is paid.

Codes for the first group.

| Tax | 182 10500 110 |

| Penya | 182 10500 110 |

| Fine | 182 10500 110 |

Combinations for the second group of payers.

| Tax | 182 10500 110 |

| Penya | 182 10500 110 |

| Fine | 182 10500 110 |

Important! If the minimum tax is paid (1% of income), then the BCC is the same as with the simplified “Income minutes expenses”.

UTII

Budget classification codes for UTII payers

| Tax | 182 105 020 1002 1000 110 |

| Penalty | 182 105 020 1002 2100 110 |

| Fines | 182 105 020 1002 3000 110 |

What is KBK and where is it indicated?

The Budget Classification Code (BCC) is a 20-digit code in which numbers are combined into groups. They contain information about the type, recipient and purpose of the payment.

Legal entities and individual entrepreneurs who work on the simplified tax system must correctly indicate the BCC in the payment order. This determines whether the Federal Tax Service will credit the amount paid.

In the payment order for KBK, field 104 is provided.