All individual entrepreneurs, regardless of the field of activity and the applied taxation system, pay contributions to the Pension Fund for themselves: one part of them is fixed, and the need to pay the other part of the contributions depends on the income received.

In this article we will cover:

- what is the amount of the fixed and variable part of the contributions paid by the individual entrepreneur to the Pension Fund;

- about the deadlines for paying contributions;

- about the key points in preparing a payment order and its details.

Together with you, we will make the payment and check mutual settlements with the budget.

Insurance premiums for individual entrepreneurs - what's new in the service?

Kontur.Accounting has accounts for accounting for insurance premiums of individual entrepreneurs:

- 69.pfip - insurance contributions of individual entrepreneurs for themselves for compulsory pension insurance, including 1% over 300,000 rubles;

- 69.omsip - insurance premiums of individual entrepreneurs for themselves for compulsory health insurance.

On the “Home” tab, a function has become available for paying a fixed portion of individual entrepreneurs’ contributions quarterly.

Also, import from 1C and bank statements is configured so that the amounts of individual entrepreneurs’ contributions for themselves are immediately displayed on the corresponding accounts 69.pfip and 69.omsip.

Fixed part of individual entrepreneur contributions - how to calculate and pay?

1. “Home” tab - open the task “Pay insurance premiums for individual entrepreneurs for ... quarter”:

2. Click on the “Create tax accrual” link.

3. An accounting certificate will open; you need to check the data filled in by the service. Edit if necessary.

4. Click "Save".

5. Open the task “Pay individual entrepreneur insurance premiums for... quarter” again on the “Home” tab.

6. Click on the “Create payment order” link.

7. Enter the information in the opened payment order.

Payment order for payment of a fixed contribution to the Pension Fund of Russia

General details

A payment order for the payment of insurance premiums to the Pension Fund of the Russian Federation in a fixed amount is generated using the Payment order in the Bank and cash desk section - Bank - Payment orders - Write-off button.

In this case, it is necessary to correctly indicate the type of operation - Payment of tax , then the form of the document takes the form for payment of payments to the budget system of the Russian Federation.

You can also quickly generate a payment order using the Tax Payment Assistant :

- through the section Main – Tasks – List of tasks;

- through the section Bank and cash desk – Payment orders using the Pay button – Accrued taxes and contributions.

Please pay attention to filling out the fields:

- Tax - Fixed contributions to the Pension Fund , selected from the Taxes and Contributions directory.

Fixed contributions to the Pension Fund are predefined in the Taxes and Contributions directory. The following parameters are specified for them:

- corresponding KBK code;

- text template inserted into the Payment purpose ;

- tax account.

If an element is predefined in the directory, then deleting it or changing its parameters is not recommended. If necessary, BukhExpert8 advises creating a new element in the Taxes and Contributions , to which you should specify your settings.

- Type of obligation - Contributions, constant part . The choice of the type of obligation affects the BCC, which will be indicated in the payment order.

- The order of payment is 5 Other payments (including taxes and contributions) , filled in automatically, as for all tax payments to the budget paid on time (clause 2 of Article 855 of the Civil Code of the Russian Federation).

Recipient details - Federal Tax Service

Since the recipient of the contributions is the tax office with which the individual entrepreneur is registered, it is its details that must be reflected in the Payment order document .

- The recipient , the Federal Tax Service, to which contributions are paid, is selected from the Counterparties directory.

- Recipient's account - bank details of the tax authority specified in the Recipient .

In the 1C program it is possible to use the 1C: Counterparty service, which allows you to automatically fill in and monitor the relevance of the details of government bodies. If the details are no longer relevant, the 1C:Counteragent will offer to update them in the Counterparties directly from the payment order form. PDF

- Recipient's details - TIN , KPP and Recipient's name , this is the data that is used to print the payment order. If necessary, the recipient's details can be edited in the form that opens via the link.

Payment details to the budget

The accountant needs to control the data that the program fills in using the link Payment details to the budget .

In this form, you need to check that the fields are filled in:

- KBK - 18210202140061110160 “Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions.” KBK is entered automatically from the Taxes and Contributions directory.

If the KBK is unknown for any payment to the budget, then you can use the KBK Designer by following the link to the right of the KBK .

- OKTMO code is the code of the territory of registration of the individual entrepreneur. The value is filled in automatically from the Organizations .

- Payer status - 09-taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - individual entrepreneur .

- UIN - 0 , because The UIN is contained only in tax notices or demands for payment of tax (penalties, fines).

- The basis of payment is TP payments of the current year , indicated when paying dues.

- The tax period is GY-annual payment , since contributions are paid for the tax period (year).

- The year is 2017 , i.e. year for which contributions are paid.

- Document Number — 0.

- Document date - 0-value not specified .

- Purpose of payment - filled in automatically using a template from the Taxes and Contributions directory. The field can be edited if necessary.

You can print a payment order by clicking the Payment order .

PDF

Variable part of individual entrepreneur’s contributions for himself - how to calculate and pay

The variable portion of contributions is 1% over income of 300,000 rubles. The calculation of the variable part is automated and is created based on the results of each quarter. This happens when the next payment is calculated from the constant part of the contributions.

Accounting is based on data on income and payments made on an accrual basis from the beginning of the year. If income for a quarter exceeds 300 thousand rubles, the service calculates a contribution of 1% of the excess amount for the previous quarter. This contribution is summed up with the next payment from the constant part, and a payment order is generated with the amount received. The contribution will appear in accounting after payment.

If you wish, the amounts of contributions payable calculated by the service can be edited. In this case, at the end of the year the service will generate the amount remaining to be paid.

Generate an accounting certificate (“Documents” → “Accounting certificate” → “Accounting certificate” button) and a payment order (“Documents” → “Bank” → “Tax payment” button → “Payment of taxes and contributions”) by analogy with fixed contributions according to the instructions above. The calculation method and payment details are the same.

Arrears and penalties: postings

Correspondence regarding identified arrears and penalties in relation to insurance premiums is as follows:

| The essence of the operation | Debit | Credit |

| Penalties accrued on insurance premiums | 99 or 91 (according to accounting policies) | 69.1.1, 69.1.2, 69.2, 69.3 |

| Payment of penalties by the policyholder | 69.1.1, 69.1.2, 69.2, 69.3 | 51 |

| Additional arrears on insurance premiums have been accrued | 20, 23, 25,26, 29, 44 - if the arrears were accrued for the current year 91.2 - if the arrears arose in previous periods | 69.1.1, 69.1.2, 69.2, 69.3 |

| Payment of arrears | 69.1.1, 69.1.2, 69.2, 69.3 | 51 |

2019, 2021 - what amounts of contributions must be paid?

In 2021, the fixed part of the individual entrepreneur’s contributions for himself is equal to 36,238 rubles, of which:

- RUB 29,354 — for compulsory pension insurance;

- RUB 6,884 - for compulsory health insurance.

In 2021, the fixed part is RUB 40,874, of which:

- RUB 32,448 — for compulsory pension insurance;

- RUB 8,426 - for compulsory health insurance.

Add to this amount 1% on income exceeding RUB 300,000.

Features of taxation

Back in 2021, the insurance coverage of citizens has undergone significant reforms.

Thus, the Federal Tax Service became the single administrator of revenues. Let us recall that previously payments for insurance coverage were credited directly to extra-budgetary funds (PFRF, FFOMS, Social Insurance Fund). Now the main regulatory act regulating the taxation procedure and tariffs for insurance premiums (IC) is Chapter 34 of the Tax Code of the Russian Federation. Generally established tariffs are the same for all economic entities:

- Mandatory pension insurance - 22%.

- Compulsory health insurance - 5.1%.

- Temporary disability and maternity insurance - 2.9%.

https://www.youtube.com/watch?v=https:QFPwT_j0i1Y

However, officials have provided benefits for some categories of taxpayers. These privileges are expressed in reduced tariffs for SV. Read more: “Who is entitled to reduced electricity tariffs in 2020.”

Please note that insurance against industrial accidents and occupational diseases (injuries) should also be transferred to the Social Insurance Fund. That is, contributions for injuries were not transferred to the jurisdiction of the Federal Tax Service. The amount of payments varies from 0.2 to 8.5% depending on the hazard class of the company’s main activity.

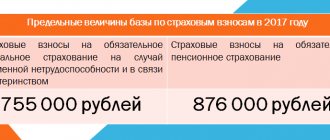

According to the SV, a limit has been set on the OPS (2020 - 1,115,000 rubles). If the amount of taxable income for an employee exceeds the specified limit, then the tariff is reduced to 10%. An acceptable limit has also been approved for VNiM (2020 - 865,000 rubles). However, if this limit is exceeded, the rate is reduced to 0%, that is, the SV for VNIM does not pay if the limit is exceeded.

Accounts

To reflect the transaction “insurance contributions for wages have been accrued,” the entry is drawn up using a special accounting account 69 “Calculations for social insurance and security” (Order of the Ministry of Finance No. 94n).

To detail the data for each type of insurance coverage, the chart of accounts provides special subaccounts:

- 69.1 - to reflect operations on social security of citizens (VNiM and NS and PZ).

IMPORTANT!

It is necessary to provide additional analytics for subaccount 69.1, for example:

- 69.1/1 - accruals in favor of VNiM;

- 69.1/2 - data on payments to the Social Insurance Fund in favor of insurance against accidents and occupational diseases.

- 69.2 - for calculating SV in terms of compulsory pension insurance;

- 69.3 - information on accrued SV under compulsory medical insurance.

The credit of these accounting accounts reflects the accrual of SV, and the debit reflects their payment.

It is worth noting that the employer accrues IC only to the payroll, that is, from the amount of taxable payments and remuneration for labor. No deductions are made from citizens' earnings when calculating SV.

Let us remind you that when creating a reserve for vacations in the budget, it is necessary to provide for similar deductions to the reserve fund, transactions and calculation features - in the article "How to calculate the vacation reserve in 2021."

About doing business not from the beginning of the year

The Ministry of Finance recently provided clarifications on determining the amount of insurance premiums by a businessman in the event of the start and termination of business activities during the billing period. In Letter No. 03-08-02/49179 dated July 13, 2018, financiers indicated that fixed pension and health insurance contributions for themselves must be calculated and paid only for the period actually worked. The Department refers to paragraph 3 of Art. 430 of the Tax Code of the Russian Federation, according to which if individual entrepreneurs begin to carry out business activities during the billing period, then the fixed amount of insurance premiums payable by them for this billing period is determined in proportion to the number of calendar months, starting from the calendar month of the start of the activity.

For an incomplete month of activity, the fixed amount of insurance premiums is determined in proportion to the number of calendar days of this month. In order to implement the above norms, the calendar month of the start of a businessman’s activities is recognized as the calendar month in which his state registration as an individual entrepreneur was carried out.

Based on the foregoing, if an individual entrepreneur did not start operating from the beginning of the billing period, but was deregistered before the end of the billing period, he must calculate the amount of insurance premiums using the following formula (see Letter of the Federal Tax Service of Russia No. BS-3-11 / [email protected] ):

SV = SVfix / 12 x (M + DNDotr / DNDk + DPDotr / DPDk), where:

SV – the amount of insurance premiums to be paid;

SVfix – fixed payment;

M – the number of complete worked calendar months of the billing period;

DNDotr - the number of days worked in the month the activity began;

DNDk – the number of calendar days in the month in which the activity began;

DPDotr - the number of days worked in the month of termination of activity;

DPDk – the number of calendar days in the month of termination of activity.

Please note: you can also calculate the amount of insurance premiums for yourself using a calculator on the Federal Tax Service website (www.nalog.ru) in the “Electronic Services” section.

Example 4.

The date of registration of an individual as an individual entrepreneur with the tax authority is March 15, 2018. The date of deregistration of the merchant is October 20, 2018. How to calculate the amount of insurance premiums payable to the budget at the end of 2021?

In March 2021, an individual entrepreneur actually worked 17 days. (from 03/15/2018 to 03/31/2018), in October – 20 days. (from 10/01/2018 to 10/20/2018). The full calendar months of the billing period worked by the merchant are 6 (April – September).

Consequently, the amount of insurance premiums payable by an individual entrepreneur for the actually worked period in 2018 is:

As a result, an individual entrepreneur must pay the amount of insurance premiums for 2021 no later than November 05, 2018 - 19,431 rubles. (15,927 + 3,504).

Calculation rules

Insurance coverage is accrued on almost all types of income of workers that they receive as remuneration for their work. For example, deductions for social needs were made from the following types of payments:

- salary (official salary or tariff rate);

- incentive and compensation payments (bonuses, additional payments for overtime, night and holiday payments);

- regional and territorial surcharges and coefficients;

- payment for regular labor holidays, as well as educational and other holidays;

- other types of payments (for example, travel allowances, additional payments for part-time work, and others);

- payments under GPC agreements, author's orders, contracts.

But all types of state benefits (sickness, pregnancy and childbirth, one-time payments), financial assistance, unemployment benefits, preferential payments, pensions and similar types of income are completely exempt from SV taxation.

On termination of activities before the end of the billing period and calculation of contributions

According to the rules established by paragraph 5 of Art. 430 of the Tax Code of the Russian Federation, if a businessman who pays insurance premiums ceases to operate during the billing period, then the fixed amount of pension and medical insurance premiums payable for this billing period is determined in proportion to the number of calendar months up to the month in which the state registration of an individual in as an individual entrepreneur.

For an incomplete month of activity, the corresponding fixed amount of insurance premiums is determined in proportion to the number of calendar days of this month up to the date of state registration of termination of activity as an individual entrepreneur.

Accordingly, if an individual entrepreneur is deregistered before the end of the billing period, then he must calculate the amount of insurance premiums using the following formula (see Letter of the Federal Tax Service of Russia dated 02/07/2017 No. BS-3-11 / [email protected] ):

SV = SVfix / 12 x (M + Dotr / Dk), where:

SV – the amount of insurance premiums to be paid;

SVfix – fixed payment;

Мп – number of complete worked calendar months of the billing period;

Dotr – the number of days worked in the month of termination of activity;

Dk – the number of calendar days in the month of termination of activity.

Please note: you can also calculate the amount of insurance premiums for yourself using a calculator on the Federal Tax Service website (www.nalog.ru) in the “Electronic Services” section.

Payment of insurance premiums in this case is carried out no later than 15 calendar days from the date of deregistration with the tax authority (Article 432 of the Tax Code of the Russian Federation).

Example 1.

The individual entrepreneur was deregistered on October 20, 2018. How to calculate the amount of insurance premiums payable to the budget at the end of 2021? When is payment required?

The amount of insurance premiums payable by an individual entrepreneur for 9 months. and 20 days (in October) 2021 is:

As a result, no later than November 5, 2018, an individual entrepreneur must pay the amount of insurance premiums for 2021 - 26,043 rubles. (21,347 + 4,696).