Medical contributions under tax control

Let us remind you that from 2021, pension and medical contributions, as well as contributions for compulsory insurance in case of temporary disability and in connection with maternity, are administered by the Federal Tax Service of Russia. In this regard, you need to report and pay contributions, except for contributions “for injuries” to the Social Insurance Fund, through the Tax Service of Russia.

Since 2021, the BCC for payment of mandatory medical contributions has not changed. They are still supervised by the Federal Tax Service.

Calculation of penalties for insurance premiums in 2021 - 2021

Since 2021, the rules for determining the amount of penalties are regulated by clause 4 of Art. 75 of the Tax Code of the Russian Federation, containing 2 calculation formulas, in which the amount of debt is multiplied by the number of days of delay and by a rate equal to:

- 1/300 of the refinancing rate - applies to individuals and individual entrepreneurs (regardless of the number of days of delay in payment) and for legal entities that are late in payment by no more than 30 calendar days;

- 1/150 of the refinancing rate - valid only for legal entities and only for a period of delayed payment exceeding 30 calendar days, while for 30 days of delay a rate of 1/300 will be applied.

“Unfortunate” contributions, which continue to be supervised by the FSS, are subject to the procedure described in Art. 26.11 of the Law “On Social Insurance against Accidents and Occupational Injuries” dated July 24, 1998 No. 125-FZ, and are calculated using a formula similar to those described above using a rate of 1/300 of the refinancing rate.

The refinancing rate in each of the above calculations is taken in its actual values during the period of delay. That is, if it changed during the calculation period, then such a calculation will be divided into several formulas using their own refinancing rates.

penalty calculator will help you correctly calculate the amount of penalties .

Payment of contributions for medical insurance in 2021: BCC and other details

In terms of payment of insurance premiums for compulsory health insurance in 2021, the BCC has not changed. The recipient of these payments is the Federal Tax Service of Russia.

If we talk about filling out a payment order for the transfer of medical contributions within the framework of compulsory medical insurance, then:

- in the TIN and KPP field of the recipient of the funds - you need to indicate the TIN and KPP of the tax inspectorate, which administers the payment of contributions to compulsory medical insurance;

- in the “Recipient” field - indicate the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service, which oversees the payment of health insurance contributions;

- in the KBK field, the budget classification code current in 2021, consisting of 20 characters (digits), must be indicated. In this case, the first 3 characters indicating the code of the chief administrator of these budget revenues must have the value “182” - that is, denote the Federal Tax Service of Russia.

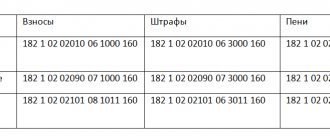

Tables with new KBK: decoding

Next, we present a table with new BCCs for insurance premiums for different types of insurance and compare the new codes with the previous ones.

| Insurance premiums | ||

| Purpose | KBK 2021 | KBK 2021 |

| Pension contributions | ||

| for insurance pension – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 | |

| for funded pension | 182 1 0200 160 | 392 1 0200 160 |

| for additional payment to pensions for flight crew members of civil aviation aircraft: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 | |

| for additional payment to pensions for employees of coal industry organizations: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 | |

| in a fixed amount for an insurance pension (from income not exceeding the limit): – for periods before January 1, 2017 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 | |

| in a fixed amount for an insurance pension (from incomes above the limit): – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 | |

| for the insurance part of the labor pension at an additional rate for employees on list 1: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160, if the tariff does not depend on the special assessment; 182 1 0220 160, if the tariff depends on the special estimate | |

| for the insurance part of the labor pension at an additional rate for employees on list 2: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160, if the tariff does not depend on the special assessment; 182 1 0220 160, if the tariff depends on the special estimate | |

| Contributions to compulsory social insurance | ||

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| in case of temporary disability and in connection with maternity: – for periods before January 1, 2021 | 182 1 0200 160 | 393 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 | |

| Contributions for compulsory health insurance | ||

| in FFOMS: – for the periods from 2012 to 2021 inclusive | 182 1 0211 160 | 392 1 0211 160 |

| – for periods after December 31, 2021 | 182 1 0213 160 | |

| in the Federal Compulsory Medical Insurance Fund in a fixed amount: – for the periods from 2012 to 2016 inclusive | 182 1 0211 160 | 392 1 0211 160 |

| – for periods after December 31, 2021 | 182 1 0213 160 | |

Read also

03.11.2016

BCC values for compulsory medical insurance contributions: table for 2021

Now we present a table that summarizes the current BCC for 2021 when paying medical contributions, which organizations and individual entrepreneurs transfer for their employees, and entrepreneurs also transfer for themselves in a fixed amount.

| Assignment of contributions for compulsory medical insurance | Basic payment | Penalty | Fines |

| Organizations and individual entrepreneurs for their employees | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| Individual entrepreneur in a fixed amount for himself | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

KBK table for payment of insurance premiums for employees and other individuals in 2021

| Payment | KBK payments | ||

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | for compulsory social insurance (OSI) | |

| Contributions | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

| Fines | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

If you made a mistake in the KBK: what to do

When indicating the BCC for insurance premiums for compulsory medical insurance in 2021, there is always a possibility that some accountants will transfer the payment for medical premiums for employees to an outdated budget classification code or make an inaccuracy when indicating the BCC that is current for 2021. And if the error only crept into the KBK, then nothing terrible happened. Payment of compulsory medical insurance contributions can be clarified.

To clarify the payment details for medical contributions for compulsory medical insurance, submit to the tax office an application in any form and documents that confirm the transfer of the payment to the budget. Based on this information, the Federal Tax Service will decide to clarify the payment.

Also see the article “Deadlines for payment of insurance premiums in 2021: table.”

SAMPLE OF SUCH APPLICATION FOR CLARIFICATION OF PAYMENT IN 2021

Read also

28.03.2018

Summing up the application of these BCCs

An entrepreneur who employs employees must make mandatory contributions for them to extra-budgetary funds. Which BCC should I indicate in the relevant payment orders? The amount of deductions, as well as coding, depend on the conditions in which employees work.

Contributions to employee pension insurance

The budget classification code does not depend on whether the employer’s income from the use of the labor of hired employees exceeds the maximum base value (300 thousand rubles). Deductions for employees with a base value both less and more than the maximum must be paid according to the following BCC: 392 1 0200 160. Separate codes for this type of payment have been cancelled. According to this BCC, the following types of contributions to the Pension Fund for the payment of an insurance pension are credited:

- main payment;

- outstanding principal payment;

- debt on canceled payment;

- the resulting arrears;

- recalculation payment.

Sanction payments for insurance contributions to the Pension Fund of Russia

- Fines - must be transferred according to KBK 392 1 02 02010 06 3000 160.

- Penalties are credited according to KBK 392 1 0200 160.

If employees work under special conditions

For employers who provide employees with harmful and/or dangerous working conditions, there is an additional rate of contributions to the Pension Fund, since the law will allow employees “for harmfulness” to retire earlier than the age prescribed. It is the deductions of these additional contributions that will help in the future to calculate the moment from which employees will be entitled to early retirement.

1. Hazardous work requires deductions for employees according to KBK 392 1 0200 160.

- Penalties for late payments are according to KBK 392 1 02 02131 06 2100 160.

- Fines for such contributions are according to BCC 392 1 0200 160.

2. For those employed in difficult working conditions, KBK 392 1 02 02132 06 1000 160.

- Peni – KBK 392 1 0200 160

- Fines – KBK 392 1 0200 160.

Contributions for hired employees to the Federal Compulsory Compulsory Medical Insurance Fund

Deductions for compulsory health insurance for employees are required by KBK 392 1 0211 160.

Penalties for this payment are according to KBK 392 1 0211 160.

Fines, if any, are assessed - according to KBK 392 1 0211 160.

Changes in the KBK in 2021 - 2020

In 2021, the list of KBK codes is determined by a new order of the Ministry of Finance dated November 29, 2019 No. 207n. Fortunately, he did not introduce any changes to the BCC regarding contributions.

Find out which BCCs have changed.

From 01/01/2019, the values of the BCC were determined by departmental order dated 06/08/2018 No. 132n. Immediately after its adoption, he made changes to the BCC on penalties for insurance premiums for compulsory health insurance paid at additional rates. Thus, from 01/01/2019 to 04/13/2019 there is no separate BCC for a tariff depending on the results of the SOUT. There are only two codes during this period, and not four, as there were in 2021. And they are:

- for list 1 - 182 1 0210 160;

- for list 2 - 182 1 0210 160.

But as of April 14, 2019, everything was returned back to the 2018 division.

The current BCCs for insurance premiums for 2019-2020, including those changed from April 14, 2019, can be seen by downloading our table.

You can double-check all KBK using a ready-made solution from ConsultantPlus. And the analytical material ConsultantPlus will help you fill out the payment form correctly for the transfer of penalties and fines on insurance premiums.

Filling out a payment form when paying a fine

The differences between paying the tax amount and the penalty amount lie in filling out several fields of the payment order:

- Field 106 “Basis of payment” when paying penalties acquires the value “ZD” in case of voluntary calculation and repayment of debts and penalties, “TR” - at the written request of the supervisory authority or “AP” - when accruing penalties according to the inspection report.

- Field 107 “Tax period” - you need to put a value other than 0 in it only when paying a penalty on a tax claim. In this case, the field is filled in according to the value specified in such a requirement.

- Fields 108 “Document number” and 109 “Document date” are filled in in accordance with the details of the inspection report or tax requirement.

As for the BCC (field 104), for penalties on contributions paid to the Federal Tax Service in 2019-2020, they are as follows:

| Insurance type | KBK |

| Pension | 182 1 0210 160 |

| Medical | 182 1 0213 160 |

| For disability and maternity | 182 1 0210 160 |

And for contributions for injuries, which remain under the jurisdiction of the FSS, the KBC for penalties is 393 1 0200 160.

How to meet the payment deadline for social contributions, read in this material.

KBK insurance premiums FSS

In 2021, the social insurance fund will continue to administer insurance premiums for industrial accidents and occupational diseases. You need to transfer contributions to the Social Insurance Fund and use a separate payment order for this. The BCC for insurance premiums to the Social Insurance Fund has not changed and is shown in the table below

| Payment type | KBK |

| Insurance premiums for injuries | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |