A so-called regressive tariff scale has been established for employee insurance contributions. Its essence is that when payments reach a certain value, the rates at which the amount of deductions are calculated are reduced. This amount of payments is called the maximum base amount. This value changes annually. Let's figure out what the maximum base for calculating insurance premiums is in 2021 and how to apply it in calculations.

New limits on insurance premiums for 2019

The maximum value of the base for calculating insurance premiums for 2019 was approved in accordance with paragraphs 3 and 6 of Article 421 of the Tax Code of the Russian Federation. New values are determined by a decree of the Government of the Russian Federation.

From January 1, 2021, the size of the maximum base values for calculating insurance premiums is as follows:

- 865,000 rubles is the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

- 1,150,000 rubles is the maximum base value for calculating insurance contributions for compulsory pension insurance.

Thus, if an employee’s income, calculated on an accrual basis from the beginning of 2021, exceeds 1,150,000 rubles, and the employer applies the basic (not reduced) rate of contributions to compulsory pension insurance, then from the amount of excess, contributions to compulsory pension insurance are charged at the rate of 10% (clause 1 Article 426 of the Tax Code of the Russian Federation).

The maximum base for contributions in case of temporary disability and in connection with maternity in 2021 is set at RUB 865,000. Employee income in excess of the established limit is not subject to contributions to VNIM (clause 3 of Article 421 of the Tax Code of the Russian Federation).

Please note: the maximum amount of the base for calculating “medical” contributions is not approved. These contributions, regardless of the amount of income of an individual in 2021, must be paid at a rate of 5.1%. There is also no maximum base for contributions “for injuries”.

It should also be noted that the reduced tariffs for companies and individual entrepreneurs on the simplified market, pharmacies on UTII and individual entrepreneurs with patents were not extended for 2021. Therefore, in 2021 they transfer contributions on a general basis.

See “Insurance premium rates in 2021: table.”

Tariffs for calculating contributions

Insurance premium rates for 2021 have been changed due to the situation surrounding the coronavirus pandemic. The government introduced preferential rates for all small and medium-sized businesses, which made it possible to slightly reduce the financial burden on them. Therefore, the tariff schedule for large businesses and SMEs should be considered separately. Note that contribution rates “for injuries” are not considered within the framework of this article, since they are individual and related to the risk class of the activity.

The current standard rates are presented in Table 2. They are applied by companies not included in the SME register, as well as small and medium-sized businesses for the first quarter of 2021.

To learn how a company or individual entrepreneur can confirm that they belong to a small business, read this article.

Table 2. Standard rates of contributions for employee insurance in 2021

| Type of contributions | Tariff within the base limit | Tariff over base limit |

| Pension | 22% | 10% |

| VNiM | 2,90% | 0% |

| Medical | 5% | |

Table 3 shows preferential tariffs - they are valid for small and medium-sized businesses from April 1 of this year.

Table 3. Insurance premium rates for SMEs, effective from 04/01/2020

| Type of deductions | Tariff before reaching the maximum base | Tariff above the maximum base |

| Pension | Within the minimum wage – 22%, over 10% | 10% |

| Medical | Within the minimum wage – 5.1%, above – 5% | |

| Disability/maternity | Within the minimum wage – 2.9%, above – 0% | 0% |

Increasing limits: table

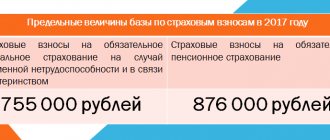

The maximum values of the base for insurance premiums are increased every year. Let's compare the values for recent years in the table.

| Year | Maximum base for pension contributions | Maximum base for social contributions |

| 2017 | 876,000 rub. | RUB 755,000 |

| 2018 | RUR 1,021,000 | RUB 815,000 |

| 2019 | RUB 1,150,000 | RUB 865,000 |

How to count

To calculate contributions, you need to use the calculation formula:

Contributions for the reporting month = Contribution base × Insurance rate

All insurance premiums must be calculated on the last day of the month for each employee and each type of contribution (clause 1 of Article 421, clause 1 of Article 431 of the Tax Code of the Russian Federation).

For the purposes of pension insurance, the calculation of pension contributions before and after reaching the limit established by the Government will look like this:

How to calculate contributions in 2021 taking into account the new limits

Next, we will explain how insurance premium payers in 2021 can use the new maximum values of the insurance premium base when calculating insurance premiums in 2021.

Pension contributions

In 2021, from taxable payments to RUB 1,150,000. inclusive of insurance premiums:

- at a rate of 22% – if general contribution rates are applied;

- at a reduced rate – if reduced rates apply.

From payments over 1,150,000 rubles. Contributions to compulsory pension insurance are charged at a rate of 10% if the company applies general tariffs. In the case where the company applies reduced tariffs, there is no need to pay fees at all.

Contributions for illness and maternity

In 2021, from payments to 865,000 rubles. inclusive, charge contributions at the following rates:

- 2.9% - if the company applies general tariffs;

- 1.8% - in relation to payments to temporarily staying foreigners (with the exception of highly qualified specialists, if the company applies general tariffs;

- at a reduced tariff - if the company applies reduced tariffs.

If the maximum base for calculating insurance premiums has been exceeded, do not accrue social contributions in case of temporary disability.

Pay medical contributions from payments to employees at a rate of 5.1%.

How to calculate contributions

To calculate contributions for a specific employee, it is necessary to determine the amount of income paid to him since the beginning of the year, which is subject to insurance premiums. If it is less than the maximum value, then standard rates apply. If payments exceed the established limits, then reduced tariffs must be applied to the amount of this excess. In this case, it is necessary to take into account benefits for SMEs.

An example of calculating contributions at standard rates

Let the employee’s salary be 150,000 rubles. No other payments were made to him in 2021. Let's calculate the premiums that need to be paid for its insurance for the period January-September. The base will be equal to 150,000 × 9 months = 1,350,000 rubles, that is, the amount exceeds the limits.

We will calculate pension contributions from the beginning of the year as follows:

- 1,292,000×22% = 284,240 rubles – the amount of deductions from income within the base limit;

- (1,350,000 – 1,292,000) x 10% = 5,800 rubles. The maximum base for calculating insurance premiums in force in 2020 has been exceeded, therefore we apply a reduced tariff to the difference;

- 284,240 + 5,800 = 290,040 rubles – the total amount of contributions for the period.

Contributions to VNiM will be calculated based on the maximum base value: 912,000 × 2.9% = 26,448 rubles. Once the income limit is reached, the employee's social security contributions are not made until the end of the year. If there were no regressive scale, then for January-September you would have to pay 1,350,000 × 2.9% = 39,150 rubles. The savings amounted to 12,702 rubles.

Contributions for medicine are calculated from the entire base at a rate of 5.1%: 1,350,000 × 5.1% = 68,850 rubles.

Calculation of contributions for SMEs

Let’s take the same amount of earnings – 150,000 rubles per month, but imagine that the company belongs to the category of small and medium-sized businesses. Calculating contributions will be more complex given that different rates apply and the base is exceeded.

Let's do the calculation using the example of pension contributions. It will consist of several stages:

- Calculation of contributions for January-March, when standard rates were applied. The base for this period will be: 150,000×3 = 450,000 rubles, which is less than the limit. Pension contributions are calculated at a rate of 22% and will amount to 99,000 rubles.

- Interim calculation of contributions to the PRF for each month from April to September. To do this, we divide the salary into 2 parts: the minimum wage (12,130 rubles) and the amount above this value (in our example, 150,000 - 12,130 = 137,870 rubles). From the first part, contributions are paid at a rate of 22% and amount to 2,668.6 rubles per month. From the second part of the salary, we calculate contributions at a preferential rate from Table 3: 137,870×10% = 13,870 rubles. The total monthly amount of contributions to the Pension Fund from April to September is 16,455.6 rubles.

- Calculation of contributions for April-September. This amount is equal to 16,455.6 × 6 months = 98,733.6 rubles.

- Calculation of the total amount of contributions to the employee’s pension insurance for January-September (point 1 + point 3): 99,000 + 98,733.6 = 197,733.6 rubles.

It is worth noting that in our example, the excess of the maximum base for calculating pension contributions occurred precisely in September. Starting from October, calculation of contributions to the Pension Fund will be made at a rate of 10%. That is, the amount of contributions for October will be 150,000 × 10% = 15,000 rubles. It is no longer necessary to allocate the minimum wage from the monthly payment, since the income exceeds the base limit.

The amount of other contributions is calculated using the same algorithm. However, it should be noted that the base limit for contributions to VNiM will be exceeded not in September, but in July. But when calculating medical contributions, you will have to divide your salary into two parts until the end of the year, since there is no income limit.

What payments should be included in the base for insurance premiums in 2021

In 2021, the tax base for contributions has not changed. To calculate the base, you must first add up all payments that relate to the object of taxation. The list of such payments is listed in paragraph 1 of Article 420 of the Tax Code of the Russian Federation. For example, salary and vacation pay. Then exclude non-taxable payments from the result. The list of such payments is contained in Article 422 of the Tax Code of the Russian Federation. For example, state benefits, financial assistance in the amount of up to 4,000 rubles. in year.

An example of calculating insurance premiums in 2021, taking into account new limits

Let's look at an example of how an employer can apply the new base limit for calculating insurance premiums in 2021.

Example:

Example. The company applies general insurance premium rates. Employee salary is 100,000 rubles. In this case, the limit on pension contributions (RUB 1,150,000) will be exhausted in November 2021. And for social (RUB 865,000) – in September.

The calculation of contributions is presented in the table.

| Month | Base for calculating insurance premiums on an accrual basis, rub. | Pension contributions, rub. | Contributions in case of illness and maternity, rub. | Medical contributions, rub. |

| January | 100 000 | 22 000 | 2900 | 5100 |

| February | 100 000 | 22 000 | 2900 | 5100 |

| March | 100 000 | 22 000 | 2900 | 5100 |

| April | 100 000 | 22 000 | 2900 | 5100 |

| May | 100 000 | 22 000 | 2900 | 5100 |

| June | 100 000 | 22 000 | 2900 | 5100 |

| July | 100 000 | 22 000 | 2900 | 5100 |

| August | 100 000 | 22 000 | 2900 | 5100 |

| September | 100 000 | 22 000 | 1885 | 5100 |

| October | 100 000 | 22 000 | 0 | 5100 |

| November | 100 000 | 22 000 | 0 | 5100 |

| December | 100 000 | 11 000 | 0 | 5100 |

Results

Income limits for calculating insurance premiums to the Social Insurance Fund and the Pension Fund of the Russian Federation are increasing annually.

The principle of calculation itself remains the same. Once the limit is reached, contributions to the Social Insurance Fund cease to be accrued, and to the Pension Fund they begin to be calculated at a different rate. There is no limit set for payments to the Compulsory Medical Insurance Fund, so they are calculated at the same rate for all income received. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

conclusions

| In 2021, consider the premium base cap when applying basic rates. Consider the amount as a cumulative total from the beginning of 2021 for each person. |

| Charge contributions for compulsory pension insurance at a rate of 22 percent from payments the amount of which does not exceed 1,150,000 rubles. If the amount of payments is greater, tax it on pension contributions at a rate of 10 percent. |

| Calculate contributions for compulsory social insurance in case of temporary disability and in connection with maternity from payments whose amount does not exceed 865,000 rubles. Do not impose contributions on payments greater than this amount. |

| The rate of contributions for compulsory health insurance does not depend on the amount of payments. Therefore, all payments without restrictions are subject to contributions at a rate of 5.1 percent. |

| Include in the base only those payments that are subject to insurance premiums |

Read also

13.12.2018

Where to submit reports

In 2021, contributions must be reported to the Federal Tax Service and Social Insurance Fund.

The calculation of insurance premiums is submitted to the Federal Tax Service quarterly before the 30th day of the month beginning immediately after the reporting period.

How to fill out a contribution calculation

In addition to this calculation, policyholders need to submit Form 4-FSS. Starting from 2021, the uniform is planned to change significantly. 4-FSS will no longer concern the costs of paying insurance coverage; tables with calculations for OSS from accidents at work and occupational diseases and expenses will be removed from its composition, but a table will be added with a breakdown of information about the taxable base and calculated contributions.

Special insurance cases

In addition to the main types of insurance, there are also special cases. In particular, for 2021 preferential rates for non-profit organizations and charitable organizations will remain. They must pay contributions to pension insurance at a rate of 20%; for the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund the rate is 0%.

For business entities using the simplified tax system, UTII or PSN, the period of application of reduced insurance rates ends in 2019 (the availability of benefits when calculating insurance premiums depended on the type of activity of the enterprise or individual entrepreneur). Starting from 2021, this category of companies and entrepreneurs will have to pay the following insurance premiums:

- Pension insurance contributions will be made at the usual rates of 22% and 10% (instead of 20%);

- Within the framework of social insurance, the rate will be 2.9%, instead of the zero rate;

- On the Compulsory Medical Insurance Fund - 5.1% instead of a zero tariff.

How much should you pay for yourself?

Many beginning entrepreneurs know that in addition to business taxes, they must also pay insurance premiums for themselves. But how much exactly should you pay? Every year these amounts change, and sometimes their sharp increase provoked a massive deregistration of individual entrepreneurs.

| ✏ This was the case in 2013, when the amount of mandatory payments immediately doubled. Because of this sharp increase, at least 500 thousand individual entrepreneurs have closed in Russia. Later, the contribution amounts were reduced, and the state no longer conducted such risky experiments. |

For a long time, insurance premium rates were tied to the minimum wage, so the mandatory payments of individual entrepreneurs grew along with the increase in the minimum wage. But starting from 2021, this procedure was abolished, and contributions were set at a fixed amount for three years at once.

Here is a table in which for each year the insurance premium rates of individual entrepreneurs for themselves are known in advance.

| Year | For pension insurance, rub. | For health insurance, rub. | Total |

| 2018 | 26 545 | 5 840 | 32 385 |

| 2019 | 29 354 | 6 884 | 36 238 |

| 2020 | 32 448 | 8 426 | 40 874 |

As we can see, mandatory payment rates continue to grow, but at a different pace - a little more than 10% per year.

But individual entrepreneurs’ contributions for themselves in 2021 in the amount of 36,238 rubles are provided only for those entrepreneurs who receive no more than 300,000 rubles of income per year. If the turnover is higher, then you must additionally transfer 1% of the amount above this limit to your pension insurance.

Thus, fixed payments of individual entrepreneurs in 2021 for themselves will amount to 36,238 rubles plus 1% of income over 300,000 rubles. For example, an entrepreneur who earns 50,000 rubles every month must pay 36,238 + (600,000 – 300,000) * 1%) = 39,238 rubles for the entire year.

| ✏ If you did not have the status of an entrepreneur for a full calendar year, then the total annual amount is reduced in proportion to the real period. A rough calculation gives us that the amount of contributions per month will be 36,238/12 months = 3,020 rubles. But not only full months are taken into account, but also the days of an incomplete month in which you had the status of an individual entrepreneur. So, the state does not take extra here. |

How does the earnings limit affect the amount of sick leave?

The situation with social insurance is more complicated. Sick leave is paid from the Social Insurance Fund, including in connection with pregnancy and childbirth. When income limits are raised, the maximum amount of maternity benefits for the standard 140 days of maternity leave also increases. In 2021 it is equal to 301,095.89 rubles.

In a similar way, the maximum amount of sick pay received due to illness is calculated. But instead of 140 days they put the number indicated on the certificate of incapacity for work.

If we consider the maximum amount of benefits for 1 day of sick leave, we will get 2434.2 rubles in 2021. More precise benefit amounts depend on the length of service and average earnings of the sick employee.

An example of calculating contributions when the limit is reached

Especially for the calculation example, we took employee A.S. Palkin, who receives a monthly salary of 104,242 rubles. From it we will calculate insurance premiums taking into account new legislative amendments established from April 1, 2021.

Table for calculating insurance premiums for an employee for the 1st quarter of 2021

| Period | Worker | Rate | Taxable base | OPS | VNiM | Compulsory medical insurance |

| October | Palkin | up to 12,792 rubles | 12 792,00 | 2 814,24 | 370,97 | 652,39 |

| Palkin | more than 12,792 rubles | 91 450,00 | 9 145,00 | 0,00 | 4 572,50 | |

| Palkin | Total | 104 242,00 | 11 959,24 | 370,97 | 5 224,89 | |

| November | Palkin | up to 12,792 rubles | 12 792,00 | 2 814,24 | 370,97 | 652,39 |

| Palkin | more than 12,792 rubles | 91 450,00 | 9 145,00 | 0,00 | 4 572,50 | |

| Palkin | Total | 104 242,00 | 11 959,24 | 370,97 | 5 224,89 | |

| December | Palkin | up to 12,792 rubles | 12 792,00 | 2 814,24 | 370,97 | 652,39 |

| Palkin | more than 12,792 rubles | 9 1450,00 | 9 145,00 | 0,00 | 4 572,50 | |

| Palkin | Total | 104 242,00 | 11 959,24 | 370,97 | 5 224,89 | |

| For the 1st quarter of 2021 | base | 38 376,00 | 8 442,72 | 1 112,91 | 1 957,17 | |

| reduced | 274 350,00 | 27 435,00 | 0,00 | 13 717,50 | ||

| Total | 312 726,00 | 35 877,72 | 1 112,91 | 15 674,67 | ||

Table for calculating insurance premiums for an employee for 2021

| Period | Worker | Rate | Taxable base | OPS | VNiM | Compulsory medical insurance |

| For 1 quarter | Palkin | up to 12,792 rubles | 38 376,00 | 8 442,72 | 1 112,91 | 1 957,17 |

| Palkin | more than 12,792 rubles | 274 350,00 | 27 435,00 | 0,00 | 13 717,50 | |

| Palkin | Total | 312 726,00 | 35 877,72 | 1 112,91 | 15 674,67 | |

| For the 2nd quarter | Palkin | up to 12,792 rubles | 38 376,00 | 8 442,72 | 1 112,91 | 1 957,17 |

| Palkin | more than 12792 rubles | 274 350,00 | 27 435,00 | 0,00 | 13 717,50 | |

| Palkin | Total | 312 726,00 | 35 877,72 | 1 112,91 | 15 674,67 | |

| For the 3rd quarter | Palkin | up to 12,792 rubles | 38 376,00 | 8 442,72 | 1 112,91 | 1 957,17 |

| Palkin | more than 12,792 rubles | 274 350,00 | 27 435,00 | 0,00 | 13 717,50 | |

| Palkin | Total | 312 726,00 | 35 877,72 | 1 112,91 | 15 674,67 | |

| For the 4th quarter | Palkin | up to 12,792 rubles | 38 376,00 | 8 442,72 | 1 112,91 | 1 957,17 |

| Palkin | more than 12,792 rubles | 274 350,00 | 27 435,00 | 0,00 | 13 717,50 | |

| Palkin | Total | 312 726,00 | 35 877,72 | 1 112,91 | 15 674,67 | |

| For 2021 | base | 153 504,00 | 33 770,88 | 4 451,64 | 7 828,68 | |

| reduced | 1 097 400,00 | 109 740,00 | 0,00 | 54 870,00 | ||

| Total | 1 250 904,00 | 143 510,88 | 4 451,64 | 62 698,68 | ||

How does the marginal base affect OPS?

Let's compare the approved insurance premium limits. In 2021, 22% of the employee’s income is taken from the employee’s income and paid to the Pension Fund. And so on until the person’s salary reaches the maximum. If your salary is less, then every month the employer contributes 22% of the paid earnings to your future pension. If the salary is higher, then as soon as you earn 1,292,000 rubles, the organization will transfer only 10% to the OPS. In 2021, this happens with monthly earnings of more than 107,667 rubles. But if it is lower, the employer will have to regularly pay 22% of your income to the Pension Fund.

Why were earnings limits introduced?

In Russian legislation, the maximum base for calculating insurance contributions in 2021 is needed to determine at what rates the employer pays mandatory amounts to social and pension insurance funds. The authorities increase these limits annually by the level of inflation. This is necessary so that employers can pay large salaries and not hide them from taxation.

Several years ago, there was also an income limit in the medical field. But then the authorities decided that the FFOMS budget was too small and decided to withhold all payments at regular rates from all salaries paid to employees.

In addition to the amounts for OSS and OPS that organizations and individual entrepreneurs pay for their employees, the base of excess insurance premiums affects the amount of accrued sick leave.

Which employees do not need to pay contributions for?

If you need to perform one-time work, you can use the services of self-employed citizens or enter into a civil contract with the right specialist. But, in this case, you need to approach the drafting of the contract very carefully, since often regulatory authorities reclassify these relations as labor relations.

For those with whom GPC agreements have been drawn up, you only need to pay contributions for compulsory health insurance and compulsory health insurance; contributions to the Social Insurance Fund are made only if this is specified in the agreement. Self-employed citizens (payers of professional income tax) and individual entrepreneurs do not need to pay contributions at all.

When an individual entrepreneur has the right not to pay insurance premiums

The obligation to pay contributions for yourself does not depend on whether the business generates income. An individual entrepreneur may not conduct any real activity at all, but must make mandatory payments for his insurance. The status of an employee, pensioner, disabled person, mother of many children and other preferential categories does not exempt from payment of contributions or reduce their size.

In 2021, the same grace periods that made it possible not to pay individual entrepreneur contributions in previous years were preserved:

- Caring for a child under one and a half years old, a disabled person of group 1, a disabled child, an elderly person over 80 years old.

- Military service upon conscription.

- Living with a diplomat spouse outside the Russian Federation or a military spouse under contract in an area where there is no opportunity to conduct business.

If one of these periods has come in your life, and you temporarily stop doing business, then you don’t have to pay contributions for yourself . To do this, you need to contact your inspectorate with an application using the form from the letter of the Federal Tax Service dated June 7, 2021 N BS-4-11 / [email protected] There are no other reasons not to pay individual entrepreneur contributions for yourself in 2021.

Limit base for contributions in 2018

In 2021, the following values were used for the maximum bases for contributions.

| Fund | Limit base, rub. | Bid |

| Pension Fund | Up to 1021000 inclusive | 22% |

| Pension Fund | Over 1021000 | 10% |

| Medical insurance | Limit base not defined | 5,1% |

| Social insurance | Up to 815000 inclusive | 2,9% |

| Social insurance | Over 815000 | 0% |