Income tax

Taking into account the provisions of sub. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, travel expenses are classified as other expenses. And the list of other expenses is not clearly defined (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). other economically justified expenses can be added to it

Tax legislation does not regulate the acceptance of taxi expenses on a business trip.

The employer independently determines the procedure and amount of reimbursement for travel allowances in accordance with Art. 168 Labor Code of the Russian Federation. According to the position of the Ministry of Finance, set out in letter No. 03-03-07/23568 dated March 25, 2020, expenses for taxi travel on a business trip can be taken into account when calculating income tax if you have correctly executed supporting documents.

An employer may prescribe in its local regulations the procedure for accepting taxi expenses. For example, in case of departure or return from a business trip, when public transport is no longer available. Or when the airport is in a remote area. In addition, the company may decide that an employee who goes on a business trip to the airport or train station during working hours takes a taxi to save time.

Taxi costs to and from work

Is it possible to take into account the cost of a taxi to take an employee to work and return him home? This issue causes a lot of controversy among accountants. And inspectors are sensitive to such expenses. On accounting for the costs of transporting employees to and from work, including using a taxi, the Ministry of Finance of the Russian Federation provided an explanation in letters dated March 16, 2017 No. 03-04-06/15198, dated November 27, 2015 No. 03-03-06/ 1/69181. Based on the letters, we draw conclusions: taxi costs for transporting an employee to work and back can be taken into account as tax-reducing expenses if one of two conditions is met:

- The use of a taxi is justified by the inconvenient geographical location of the place of work in relation to public transport stops or the production work schedule, which makes it difficult to travel by public transport. These grounds must be justified in the order of the manager, which establishes the procedure for using a taxi for official purposes.

- The delivery of an employee to and (or) from work using a taxi is provided for by the employment contract and (or) collective agreement as a remuneration system, and at the same time it is possible to determine the amount of income of each employee.

To accept expenses, they must be documented. The mandatory details on documents confirming the use of a taxi service have already been discussed.

Read more about the withholding of personal income tax from travel compensation in the article “Transport to work and back - a tax aspect.”

Personal income tax

- If an employee uses a taxi for production purposes - traveling by taxi to the destination on a business trip or back - such amounts are not subject to personal income tax.

In this case, the employer must have documents confirming payment for a taxi on a business trip. This opinion was voiced in the letter of the Federal Tax Service of Russia for Moscow dated January 28, 2019 No. 13-11/011687. Otherwise, in the absence of documents justifying production necessity or payment for a taxi, will be imposed .

Taxi expenses as entertainment expenses

It is rare that any organization in the course of its activities can do without organizing official receptions and negotiations. The costs of transporting officials of the taxpayer organization to the venue of the entertainment event and back are expressly mentioned as entertainment expenses in paragraph 2 of Art. 264 Tax Code of the Russian Federation. To accept them for accounting, they must be documented. To do this, the organization must have:

- order from the manager to carry out this event and incur related expenses;

- estimate of entertainment expenses;

- a report on entertainment expenses, which should include: the purpose and results of the event, date and location, program of the event, list of participants and amount of expenses confirmed by primary documents.

For more information about hospitality expenses and the peculiarities of their design, read the article “Representation expenses - what are these expenses?”

If the costs of delivery using a taxi are mentioned in the report and there are supporting documents, then such costs are taken into account in other costs associated with sales and production.

IMPORTANT! Representation expenses during the reporting (tax) period are included in other expenses in an amount not exceeding 4% of the taxpayer's expenses for wages for this reporting (tax) period.

Read more about rationing entertainment expenses in this article.

Documents for a taxi on a business trip

Confirmation of taxi expenses - an advance report for a business trip with supporting documents attached to it. Supporting documents for taxi services can be:

- act (in case of payment for a taxi by bank transfer by the employer under an agreement with the carrier);

- receipt (BSO);

- cash receipt (issued by the driver to the passenger).

Additional mandatory receipt details (BSO) for taxis are determined by Decree of the Government of the Russian Federation dated February 14, 2009 No. 112 in the Rules for the transportation of passengers and luggage by road and urban ground electric transport. Such documents must indicate:

- FULL NAME. employee (passenger);

- place of destination and departure;

- boarding and disembarking times.

What supporting documents are needed?

It is important for an organization to remember that if it is necessary to pay an employee the cost of hiring a taxi, the latter must correctly prepare supporting documents and submit an advance report.

In order to confirm the costs of using a taxi, the employee must provide a document for payment for services.

It is usually:

- Cash receipt that the taximeter prints;

- BSO receipt, which is issued by the driver himself (quite rare).

The Government Decree establishes a list of details that the receipt must contain - name, series and number, etc.

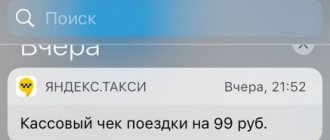

These rules are mandatory, and it is impossible to replace the receipt with any other document, since this possibility is not provided for by law. This is especially true for electronic taxi systems (Yandex.Taxi, GetTaxi or Uber).

If the company has entered into a direct agreement with the specified services and all transactions are paid non-cash from a bank account, then a printout from the electronic taxi system and an extract from the organization’s bank account will be sufficient to confirm expenses.

However, most often the company does not have a direct contract with the taxi service, and the employee is registered in the system in his own name and pays for services from a personal bank card.

In this case, a regular printout from the electronic system will not be enough, since it most likely will not contain all the required details, and first of all, the series and number of the receipt. However, there is an opinion of the Ministry of Finance, which is as follows.

Attention! Following the results of the trip, the citizen should receive a letter with trip data via email (if indicated in his personal account). If you provide a document confirming payment for services (bank card statement), as well as a printout of this letter, expenses can be taken into account

.

Let's sum it up

Taxi expenses incurred on a business trip can be taken into account for profit tax purposes, provided that the expenses are justified and documented.

If such expenses of a business traveler are included in income expenses, then they are not subject to personal income tax. If the employer compensates the employee for taxi expenses that are not sufficiently justified economically or are not supported by documents, then personal income tax should be withheld from such amounts.

Read also

15.05.2020

Taxi expenses for employees for business purposes

To expand the client base, in order to improve the quality of services and increase sales, organizations send employees to their clients (customers). A production necessity may be caused by an employee’s taxi ride to the counterparty with whom the company cooperates, which is not recognized as a business trip. Can these expenses be taken into account when taxing profits?

It is possible, if the employee used taxi rides specifically for official purposes, these trips are documented and their official purpose is justified in writing. The manager should issue an order indicating the employees who can use taxi services to perform their job duties. And employees must provide memos justifying the need for a taxi ride.

See also: “[INCOME TAX]: When is it permissible to write off taxi expenses?” .

If the employee’s job responsibilities, in principle, include regular travel, the organization must indicate the traveling nature of his work in the employment contract or local regulations. And documented taxi expenses should be taken into account for tax purposes.

If employees of an organization in the course of their work are forced to often resort to taxi services, in order to painlessly accept such expenses for tax accounting, it is advisable for the organization to enter into an agreement for the provision of taxi services with the appropriate company. Taxi payments should be made to the bank based on issued invoices or according to the terms of the agreement. In this case, to confirm expenses, the organization will have a bank statement with the amounts written off for payment of services, as well as primary documents provided by the taxi service confirming the implementation of these trips.

If you have access to ConsultantPlus, check whether you have correctly taken into account the cost of a taxi for a business trip employee. If you don't have access, get a free trial of online legal access.

Are taxi drivers required to give receipts?

If the carrier is ready to issue the required document, both he and the passenger must have an idea of what a sample taxi receipt looks like so that the paper fits the accounting department. The situation is complicated by the fact that the form of a travel ticket for taxis has not been approved at the legislative level, as is provided for regular transportation. Each carrier independently approves the form, which the taxi driver is then allowed to fill out by hand. Such BSO, printed in a typographical way, must have a series and number, since organizations and individual entrepreneurs are required to keep records of such documents.

Sample of filling out a receipt for payment for the use of a passenger taxi

The carrier may be deprived of its license if it violates the requirements not for the first time. But the threat of such punishment will have an effect if a legal carrier is operating. If you use private services, there is practically no chance of getting taxi receipts for your trip for your accounting department.

Many people know that from July 1, 2021, numerous amendments to CCP will apply. However, the changes are not limited to the installation of online cash registers and fiscal drives. One of the innovations is changes in the design of strict reporting forms (SRF). Let us explain what to now demand from employees who received money for business expenses or a business trip.

Document details

The details of documents confirming taxi trips play an important role, and in the case of litigation between the Federal Tax Service and the company, they often play a decisive role in the ability to recognize expenses of this kind.

Government Decree No. 112 of 02/14/09 (Appendix 5) defines the following details:

- series, number, name of the receipt (cash register receipt) for travel;

- name of the carrier company (TIN, address, telephone number and name itself);

- document date;

- cost of services;

- Full name and signature of the employee using the services.

Insurance premiums

According to paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, the object of taxation of insurance premiums is payments and other remuneration made in favor of individuals within the framework of labor relations and under civil contracts, the subject of which is the performance of work or the provision of services.

As stated above, payment for taxi services is made in favor of the organization, and not its employees, therefore the object of taxation with insurance premiums does not arise. The same approach is demonstrated in the Resolution of the FAS UO dated November 19, 2013 No. F09-10055/13 in case No. A76-25208/2012, the transfer of which to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused by the Resolution of the Supreme Arbitration Court of the Russian Federation dated March 19, 2014 No. VAS-2662/14.

Your region:

Altai region:

- Barnaul

- Biysk

- Yarovoe

- Gorno-Altaisk

Amur region:

- Blagoveshchensk

Arhangelsk region:

- Arkhangelsk

Astrakhan region:

- Astrakhan

Belgorod region:

- Belgorod

Bryansk region:

- Bryansk

advance report.online

Can an employee order a taxi to get to the airport or train station? Can a director travel to meetings with clients by taxi? Can employees order a taxi to get home if they stay at the office late? In what cases do taxi expenses reduce income tax, and in what cases do they not? What documents should an employee attach to the advance report so that taxi expenses do not raise questions for the tax office? All these questions quite often interest company managers, because many of them want, by creating comfortable conditions for their employees, not to miss out on benefits, reducing the amount of taxes that need to be paid. You will find answers to these questions in this article.

Advance report for a business trip in a personal car

If an employee goes on a business trip to another city or country, then most often he gets there by train or plane, and to the train station or airport by taxi. Can such expenses be reimbursed and accepted to reduce income tax? The company decides on its own whether the employee can be reimbursed for the cost of his taxi fare during a business trip, but the expenses incurred must be supported by properly executed documents. In order to accept expenses to reduce profits, they must be justified, for example, the airport is located far from the place of departure, the departure time of a train or plane is too late, the high value of the cargo carried in luggage, business customs require the use of a taxi, etc. Thus, after returning from a business trip , the employee must attach a correctly completed receipt for payment for taxi services to the expense report, and then the company will reimburse him for these expenses and accept them to reduce profits.

In many companies, the director and managers go to meetings with clients by taxi. Sometimes a company enters into an agreement with a carrier company (then the director issues an order that all employees use the services of this company for business purposes), sometimes employees order a taxi from any company and report through an advance report on the expenses incurred. In order to accept such expenses to reduce income tax, there must be an order from the director justifying such trips (for example, due to the fact that the company does not have its own or rented transport, employees are allowed to use taxi services to perform official duties), and in the job descriptions of employees who use taxis to travel to the tax office, for negotiations, etc., it is recommended to state that their work involves travel and maintaining the company’s image. There should also be travel reports; these could be acts that describe where the employee went and how much was spent. If there are a lot of trips, the employee will not always remember where he went or will not provide this information to the accounting department on time. The Advansovka application will help with this; with its help, you can immediately send your accountant a copy of the taxi payment document with a comment.

Documents required to confirm expenses

If the employment contract or collective agreement states that in certain situations an employee can use a taxi, then these expenses will be economically justified, which means they can be accepted to reduce income tax. In this case, the employee must attach a taxi receipt to the advance report.

Each trip must be supported by documents. According to Russian legislation, a taxi driver must issue a receipt that contains all the necessary details - details of the carrier company, information about the trip, the cost of the trip, about the client, have stamps and signatures, etc. But in reality, such receipts cannot be obtained. Depending on which receipt the employee attaches to the expense report, different options for reimbursing him are possible: if the receipt contains all the necessary information, then the money for the trip is reimbursed to the employee in full, but if the receipt does not comply with the law or is lost and the employee provided only an official note, in which he asks to reimburse taxi expenses, the accountant will withhold 13% (Personal Income Tax) from the amount specified in it. In order to avoid such situations, it is better for the company to enter into an agreement with the carrier company. Then the employee will attach a coupon to the advance report, which specifies the route, cost, etc., and the carrier will provide the accounting department with a monthly report and invoice, which will indicate all trips and the names of those who used the services and routes. But even in this case, in order to check the correctness of the acts, the accountant needs the employee to hand over these coupons with comments about which client or on what official business he went, and the correctness of filling out the coupon will not matter.

Documents required to confirm expenses.

Usually, if you have correctly executed expenditure and supporting documents, the tax inspectorate does not have any questions, and the Advance application will help you quickly provide all the necessary information for drawing up such documents to your accountant.

It's only fair to share…

You can read this German English

Briefly

- Taxi services can be recognized in income tax calculations if the economic justification of the expenses is proven and the relevant provisions contain an employment (collective) agreement and other legal regulations of the company.

- The traveling nature of the work of the company's employees using the simplified tax system and using taxis, according to officials, does not give the right to include such costs under the tax system.

- CCP checks (receipts) confirming the trip must contain a number of mandatory details (name of the carrier, receipt number, travel amount, etc.), without which it will be impossible to confirm expenses.

- Compensation to employees for taxi services for expenses incurred in the performance of their official duties is not subject to personal income tax and contributions to funds.

Introductory information

The variety of situations when workers turn to taxi services can be divided into three groups.

The first, perhaps the most traditional, is the use of taxis by business travelers. At the same time, a car is often taken not only for travel to the airport or train station and back, but also for trips directly to the place of business trip. The second group is the use of taxis as daily transport for employees’ business trips. For example, managers - to clients, executives - to negotiations and business meetings, accountants - to regulatory authorities, etc.

And finally, the third, rarest group, but also encountered in practice, is the use of a taxi to travel to the place of vacation and back by those workers who are entitled to pay for these expenses (i.e., workers who work in the Far North and similar areas). to their localities). Let's look at each of these groups in more detail.

Fill out waybills indicating the route and mandatory details in a special service

The market is deregulated

According to Ekaterina Stankevich, the arrival of aggregators such as Yandex, Uber and the like on the Belarusian market revealed many problems. Including the problems of local carriers. But systemic things also became obvious:

A complex game of checkers

— A couple of weeks ago we prepared an action plan, which includes separate articles to resolve these issues. They relate, among other things, to licensing and the creation of equal conditions for all business entities. These proposals have been submitted to the Government. If the plan is approved, the movement will begin. But let me make a reservation right away: the plan has not been agreed upon. We could not find a common position with the same Ministry of Economy.