Sick leave under the FSS pilot project in the regions participating in the experiment is paid according to a different scheme. The procedure for transition to new rules for the payment of hospital benefits is regulated by the norms of Government Decree No. 294 dated April 21, 2011 (as amended on December 1, 2018). The document provides for the introduction of a mechanism for direct payments from the Social Insurance Fund to insured individuals. The employer pays benefits only to the extent that is subject to repayment from the employer's funds; otherwise, the employer acts only as an intermediary between the employee and the Social Insurance Fund. Let us remind you that since 2021, several more regions of the country have joined the pilot project.

What is a pilot project

A pilot project is an experiment in which the Russian Social Insurance Fund directly pays social benefits without the participation of employers. Also, as part of the pilot project, the foundation, at its own expense, finances expenses for the prevention of injuries and occupational diseases. Contributions for “injuries” are not included in the financing.

For 2021, the experiment of the social insurance fund is being tested on itself (see table).

| Type of region of the Russian Federation | Participants in the FSS experiment |

| Republic | Crimea |

| Karachay-Cherkessia | |

| Tatarstan | |

| edge | Khabarovsk |

| Regions | Astrakhan |

| Belgorodskaya | |

| Kurganskaya | |

| Nizhny Novgorod | |

| Novgorodskaya | |

| Novosibirsk | |

| Rostov | |

| Samara | |

| Tambovskaya | |

| Sevastopol | |

| From July 1, 2021 | |

| Republic | Mordovia |

| Regions | Bryansk |

| Kaliningradskaya | |

| Kaluzhskaya | |

| Lipetskaya | |

| Ulyanovskaya | |

How sick leave is assigned as part of a pilot project

In order for an employee to receive the sick leave benefits due to him as part of the pilot project, he still submits all the necessary documents to his employer. If the employee’s disability is not related to an industrial accident, he submits to the employer:

- application for payment of benefits in the form approved by order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335;

- certificate of incapacity for work;

- certificates of earnings from previous places of work for the pay period, if they have not been submitted previously.

The employer must submit the received documents within five calendar days to the branch of the Federal Social Insurance Fund of Russia at the place of his registration. Attached to them is an inventory of the documents being transferred in accordance with the form from the order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335.

The FSS branch of Russia reviews the documents within 10 calendar days and makes a decision on payment of benefits or refusal. If the decision has a “plus” sign, then the money is sent to the employee’s bank account using the details that he noted in his application.

It is worth keeping in mind that the Social Insurance Fund pays disability benefits in the usual manner. That is, starting from the fourth day of sick leave, benefits are paid to the employee for the period of his temporary illness not by the employer, but directly by the Social Insurance Fund. In this case, the employer must pay the subordinate for the first three days at his own expense.

Also see “How sick leave is paid in 2021.”

If the FSS refuses

Keep in mind that if there is something wrong with the documents transferred to the FSS of Russia as part of the pilot project or they are not transferred at all, then the benefits paid to employees may be considered overpaid. The employer, in turn, may be required to reimburse the Social Insurance Fund for expenses incurred for sick leave benefits (clause 16 of the Regulations, approved by Decree of the Government of the Russian Federation of April 21, 2011 No. 294).

Currently, an experimental practice of paying employees directly from the fund has already been introduced in 20 regions of the country. From the beginning of the 2nd half of 2021, the number of regions connected to the pilot project will reach 33. More details about this can be found in Resolution 294 of the Government of the Russian Federation (approved on April 21, 2011).

Initially, the legislator’s plans were to maintain the transition period only until 2021. Such a norm was provided for by the provisions of 243-FZ in paragraph 3 of Art. 5 (approved on July 3, 2021), but later the government extended the project until 2021, approving the corresponding resolution No. 1427 on December 22, 2016, which came into effect at the beginning of 2021.

Karavaevo-Cherkessia and the Nizhny Novgorod region were the first to test the project. They entered the experiment on January 1, 2012, and six months later they were joined by Astrakhan, Kurgan, Novosibirsk, Novgorod, Tambov and Khabarovsk. 6 new territories were connected to the project during 2015 and 6 regions became participants in 2016.

Let's look at how participants in a pilot project need to report.

According to FSS Order No. 59, participants in the experiment must report in Form 4 to the FSS in the general manner. This rule was approved by document on February 26, 2015 and is still in effect. But there are a number of features for filling out the form, prescribed for some regions in accordance with the norms of FSS Order No. 267 (approved.

June 23, 2015). For example, the Karachay-Cherkess Republic does not fill out page 15 of table 1, the Nizhny Novgorod region does not provide tables 2 and 5, in Astrakhan it is not required to indicate data on line 15 of table 7 and fill out table 8. Samara, Tatarstan, Belgorod, Rostov must fill out the section 1 form 4 FSS in a special way:

- Line 15 of column “for the last 3 months of the reporting period” of table is not filled in. 1, data for 2 and 3 months is not indicated

- no need to fill out and submit tables 2 and 5 to regulatory authorities, starting with reporting for 2021

- Temporary disability expenses not included in 2015 are reflected by a decrease in expense indicators on line 15 gr. Tables 1 and 3 2 and 5

How to fill out sick leave for a pilot project

The organization whose employee received sick leave fills out only the continuation of the form - its second part. Registration of the first is the responsibility of the specialist of the medical institution that issued the document.

Also see “How to fill out sick leave for an employer: sample.”

So, first, the form contains information about the company - its name. Then they note whether this is the person’s main place of work or whether he is employed here part-time. Below on the form of the certificate of incapacity for work indicate the tax registration number and subordination code. After this comes information about the employee such as TIN and SNILS.

Next, you will need to indicate the person’s work experience. Below are the start and end dates of the employee’s period of disability. To calculate the amount of benefits, his average and daily earnings are also indicated.

After this, the amounts that should be accrued to the sick person by his employer and the Social Insurance Fund are given. Below they are summed up and the total amount of benefits that will be paid to the person for the period of his illness is displayed.

Be sure to indicate the surnames and initials of the head of the company, as well as the accountant or HR employee who filled out the sick leave. These persons put their signatures in the lower right corner.

Payment for additional days off to care for disabled children

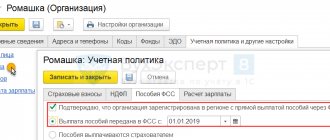

In setting up the organization's Accounting Policy, you need to indicate the date of entry into the pilot project (Fig. 1).

According to clause 4 of the regulation approved by Resolution No. 294, if the number of the enterprise exceeds 25 people, then information for assigning sick leave benefits can only be provided electronically in a strictly established form. Smaller legal entities may also use electronic means to transmit benefit information, but this is not their responsibility.

As of 2021, the Specification (version 1.7.3), approved on July 13, 2016, is in force for the exchange of electronic data on sick leave with the Social Insurance Fund. It contains two possible algorithms for creating a register of sick leave, a link to the program on the FSS website, as well as an address for sending the register.

Sick leave is entered into the Social Insurance Fund program according to a clear algorithm, so its use is quite convenient. But social insurance allows the use of other software tools for creating a register that meet the requirements of the Specification.

The register must be filled out and sent to the Social Insurance Fund within 5 days from the date the employer receives the sick leave. To avoid disagreements with the Social Insurance Fund, you should meet the five-day deadline, even if the sick leave contains an error made when filling out the fields by the medical institution, and the employee does not have time to receive a duplicate.

According to clause 16 of Regulation No. 294, the organization is liable for violation of the deadlines for sending information about sick leave to the Social Insurance Fund (as well as for concealing or unreliable information). An administrative fine may be imposed on an official in accordance with paragraph 4 of Art. 15.33 Code of Administrative Offenses in the amount of 300 to 500 rubles.

In addition, if, due to the fault of the organization, the amount of benefits paid to the Social Insurance Fund turned out to be more than necessary, then social insurance has the right to recover the amount of the overpayment from the enterprise. This is confirmed by arbitration practice (for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated October 26, 2016 No. 303-ES16-3905).

In connection with the implementation of the pilot project, the tab on which information about the amount of state benefits is placed has been modified in the form of accounting parameters settings. Now this tab is called “Government”. benefits" and on it, in addition to the list of benefits and their amounts, for each organization of the enterprise you can indicate the date of transfer of the functions of paying benefits to the FSS bodies.

This means that for all organizations participating in the FSS pilot project, the value of this field must be set to: “07/01/2011”.

Rice. 1

In the “Organizations” directory for policyholders participating in the pilot project, on the “Codes” tab of the element form, the fields of the section regarding the Social Insurance Fund must be filled in:

- No. in the FSS;

- Add. FSS code - for separate divisions;

- Subordination code;

- Name of the territorial body of the FSS.

Rice. 2

if the document date is greater than the date specified in the accounting settings, then additional sections will be visible and available for filling. According to the law, payment of benefits for insured events that occurred before the entry into force of the pilot project, but registered after 07/01/2011, is made in accordance with the new rules.

In most of the documents mentioned, a “Insured Data” tab has been added, the fields of which are automatically filled in according to the data in the “Organizations” directory. If all fields related to the Social Insurance Fund in the directory are filled out, no data needs to be filled out or adjusted on this page.

Previously in the program, one-time benefits from the Social Insurance Fund:

- in connection with death;

- when registering in the early stages of pregnancy;

- at the birth of a child;

- upon adoption of a child

were registered with a specialized document “Accrual of one-time benefits at the expense of the Social Insurance Fund”. According to the new rules for organizations participating in the pilot project, of the listed benefits, only social benefits for funerals are paid to the employee by the insurer, and then reimbursed by the Social Insurance Fund.

Therefore, the documents “Accrual of one-time benefits at the expense of the Social Insurance Fund” from July 1 are introduced only for registering benefits in connection with death.

Rice. 3

All other benefits at the expense of the Social Insurance Fund will be paid directly by the territorial body of the Fund and, therefore, there is no need to register their accrual in the program. The fact of transfer of a package of documents for the payment of other benefits from the list above is documented in other documents of the Program.

After paying the insured a funeral benefit and calculating insurance premiums for the billing period, the policyholder must submit an application to the Social Insurance Fund for reimbursement of funeral expenses. This is recorded in the Program by a document of the same name. The document is automatically filled in with the data of all accrued funeral benefits, which are reflected in the document “Calculation of Insurance Contributions” (the “Social Insurance Benefits” tab), which were not included in any of the previously submitted documents “Application to the Social Insurance Fund for reimbursement of funeral expenses.”

For each line of the document, you must indicate the status of the benefit recipient by selecting it from the drop-down list. In the header of the document, you must also manually indicate the number of pages in the transferred package of documents - the number of death certificates.

From the document, you can print the application form in accordance with Appendix No. 6 of the Order.

Rice. 4

In a similar way, documents are registered in the Program to reflect payment for additional days off to care for disabled children. They are accrued, as before, using the document “Payment based on average earnings.”

After the insurance premiums have been calculated, the document “Application to the Social Insurance Fund for reimbursement of payments to parents of disabled children” must be created. The document is automatically filled in with all accrued amounts of benefits, which are reflected in the document “Calculation of Insurance Contributions” (tab “Social Insurance Benefits”) and have not yet been reflected in the accounting by any other document submitted “Application to the Social Insurance Fund for reimbursement of payments to parents of disabled children.”

From the document, you can print out the application form in accordance with Appendix No. 7 of the Order.

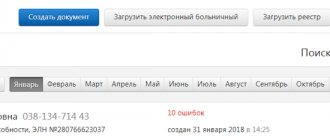

The register is formed to transmit information to the Social Insurance Fund in electronic form. When the document is automatically filled out, it includes all sick leave taken, except for sick leave for work-related injuries and occupational diseases, which were not previously registered in the registers.

Rice. 6

The register form consists of a table of certificates of incapacity for work and several tabs displaying data for a specific sick leave: when the cursor is positioned on a line in the employee table, the right side of the form is filled in with data on the corresponding sick leave.

Thus, the “Insured Person” tab is almost similar to the “Application” tabs on the sick leave sheet that we have already discussed and reflects information about the applicant and the method of transferring benefits. The tabs “Certificate of incapacity for work” and “Certificate of incapacity for work (continued)” are similar to the corresponding tabs of the document “Accrual on sick leave” and inherit the data from there.

The “Benefit Calculation” tab contains the data necessary to calculate the benefit amount: sick leave period, insurance period, earnings for two years or average daily earnings, etc.; These bookmarks are also inherited from the sick leave. The “Other” tab contains fields for filling in auxiliary data.

According to the new rules, not only the amounts of one-time benefits registered after the pilot project came into force will be paid, but also monthly benefits from the Social Insurance Fund, that is, child care benefits.

In the “Salary and Personnel Management” configuration, registration of parental leave is carried out using a document of the same name, and benefits are calculated monthly using the “Payroll” document.

In order for employees already on parental leave to receive benefits according to the new rules from July 1, 2011, they need to collect a package of documents for transfer to the Social Insurance Fund. One of such documents is the employee’s statement (Appendix No. 1 to the Order).

Rice. 7

The register of information in the Social Insurance Fund about benefits for the birth of a child is filled in automatically with data on all children of employees of the organization who were born within a year before the document was issued and are not indicated in other documents of this type that have already been completed.

Data about children must be indicated in the “Individuals” directory, on the “Personal Data” tab, in the “Family” table.

Rice. 8

To indicate the degree of relationship, data is selected from a directory of the same name, which, in turn, can be filled out according to the All-Russian Classifier of Population Information. Before creating the register for the first time, you should make sure that the codes of existing directory elements correspond to OKIN codes. Now it is important to establish this correspondence for at least four elements of the directory:

- Son - code "05"

- Daughter - code "06"

- Stepson - code "42"

- Stepdaughter - code "43"

Rice. 9

The fact is that when identifying children in a family, the program focuses specifically on the code of the directory element indicated as the degree of relationship, assuming that this is an OKIN code. If other codes are assigned to the mentioned elements in the directory, the program will not identify them as children and automatic filling of the register will be impossible.

Nuances of entering data

As has already become clear from the above, the pilot project does not affect the filling out of sick leave by the employer . However, it will be useful for employees who are delegated to issue temporary disability certificates in the organization to refresh their memory of some of the nuances associated with this professional task.

Pen and ink

According to paragraph 65 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia No. 624n, filling must be done exclusively with a gel, fountain or capillary pen. It is prohibited to use ballpoint pens for these purposes. Ink can only be black.

High tech

You are allowed to fill out the form using computer technology. At the same time, FSS letter No. 17-03-09/06-3841P states that partial filling out by hand if using a computer will not be an error.

Letters

Information about the organization and the employee is entered into the sick leave form exclusively in capital Russian letters. If the company name contains foreign elements, their combinations, as well as abbreviations, they should not be changed into Russian.

Cells

Filling should occur exclusively where the appropriate fields and cells are allocated for this. It is prohibited to go beyond their limits.

Seal

It is important to note that a seal is affixed to a sick leave certificate only if it is provided for in the company’s charter. There is a place on the right for her. You can go beyond its limits, but the print should not overlap part of the data in the cells.

Also see “How many stamps should there be on a sick leave certificate.”