How the “Direct Payments” project works Algorithm for assigning and paying benefits Step 1. The employer receives documents from the employee If in the “pilot” region the LN is paper If in the “pilot” region the LN is electronic Step 2. The employer calculates the benefit and pays the amount for the first three days Step 3. The employer prepares and sends documents to the Social Insurance Fund Step 4. The Social Insurance Fund checks the documents and assigns benefits Step 5. The Social Insurance Fund pays benefits Reporting Calculation of 4-FSS contributions 2-NDFL certificates for employees How to prepare for the transition to the “Direct Payments” project How to reimburse from FSS amount of excess expenses How to reimburse from the FSS expenses for financial support of preventive measures

The Direct Payments project started in 2011. Now there are already 69 regions in it, and by the beginning of 2021 another 16 will join. The full list of participants is given in Decree of the Government of the Russian Federation dated April 21, 2011 No. 294.

How does the Direct Payments project work?

Now the FSS works with policyholders on an offset principle: the employer pays benefits, and he transfers the difference between the amounts of accrued insurance premiums and paid benefits to the Fund.

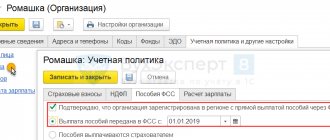

In the “Direct Payments” project, policyholders must pay compulsory social insurance contributions in full; they cannot be reduced by the amount of expenses incurred by the Social Insurance Fund.

The procedure for interaction between the Social Insurance Fund, employer and employee is also changing. The company receives an application and documents for payment of benefits from the employee, sends them to the FCC electronically, and the Fund directly pays benefits to the insured employee. At the same time, the calculation principle and the amount of benefits do not change.

The new rules apply to the payment of the following benefits:

- temporary disability benefits (including in connection with an industrial accident or occupational disease);

- maternity benefits;

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- payment of leave to a person injured at work (in addition to annual paid leave).

Julietta Anatolyevna Ustova, manager of the branch of the State Institution - the regional branch of the FSS of the Russian Federation for the Kabardino-Balkarian Republic, talks about the advantages of the pilot project:

“The new procedure allows citizens to receive the benefits due to them by law in a timely manner and in full, regardless of the financial situation of the employer. The policyholder does not need to withdraw funds from circulation to pay them. The calculation and transfer of benefits will now be carried out not by the enterprise’s accounting department, but by the regional branch of the Social Insurance Fund. This eliminates incorrect calculation of benefits, reduces labor costs and simplifies reporting. Insurance contributions for compulsory social insurance are not reduced by the amount of expenses incurred. Employers pay them to the Fund in full.”

Regulations

- Decree of the Government of the Russian Federation of April 21, 2011 No. 294, as amended. dated 11/13/2019;

- Art. 431 of the Tax Code of the Russian Federation (as amended by Article 9 of the Federal Law of November 30, 2016 No. 401-FZ), valid from January 1, 2020;

- Application form for the assignment of benefits - order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578;

- Form of the electronic register of information - order of the FSS of the Russian Federation dated November 24, 2017 No. 579;

- Order of the Ministry of Health of the Russian Federation dated September 1, 2020 No. 925N;

- Order of the Ministry of Health and Social Development dated July 11, 2011 No. 709n.

A Draft Decree of the Government of the Russian Federation No. 00110475 has also been developed. It approves the specifics of the appointment and payment by territorial bodies of the Social Insurance Fund of the Russian Federation of benefits for temporary disability, injuries, pregnancy and childbirth, one-time child benefits, as well as the procedure for reimbursement of expenses to policyholders for the payment of social benefits and for preventive measures to reduce industrial injuries and occupational diseases.

For example, when an insured event occurs, they plan to refuse to ask employees for an application for payment of benefits and a complete list of documents for assignment, as is done now. Instead, the employee will provide only those documents that the policyholder does not have. If the project is accepted, women on maternity leave will no longer have to apply for benefits.

Addition of the list of regions participating in the implementation of the pilot project

The full list of regions participating in the pilot project is given in Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. Decree of the Government of the Russian Federation No. 1459 provides for a gradual increase in the number of regions participating in the implementation of the Direct Payments project. So, the following are joining the project:

| Joining date | Regions |

| January 1, 2021 | Ingushetia, Mari El, Khakassia, Chechnya, Chuvashia, Kamchatka Territory, Vladimir, Pskov and Smolensk regions, Nenets and Chukotka Autonomous Okrugs |

| July 1, 2021 | Trans-Baikal Territory, Arkhangelsk, Voronezh, Ivanovo, Murmansk, Penza, Ryazan, Sakhalin and Tula regions |

| January 1, 2021 | Udmurtia, Komi, Sakha (Yakutia), Kirov, Kemerovo, Orenburg, Saratov, Tver regions and Yamalo-Nenets Autonomous Okrug |

| July 1, 2021 | Bashkortostan, Dagestan, Krasnoyarsk and Stavropol territories, Volgograd, Irkutsk, Leningrad, Tyumen and Yaroslavl regions |

In accordance with the Regulations on the assignment and payment of benefits during the implementation of a pilot project, with direct payment of benefits by the fund:

calculation and payment of benefits to employees are made not by the employer, but by the Social Insurance Fund. At his own expense, the employer pays for additional days off to care for a disabled child and the costs of taking measures

- for injury prevention, and also pays funeral benefits. These amounts are subsequently reimbursed by the territorial body of the Social Insurance Fund. At the same time, as in the general case, sick leave for the first three days of incapacity for work is paid at the expense of the employer;

- Payment of insurance premiums is made in the full amount in which they are accrued, without reduction by the amount of expenses for the payment of benefits. Data on benefits is not included in the 4FSS form and the calculation of insurance premiums.