Which regions are participating?

- Since 2011: Karachay-Cherkess Republic and Nizhny Novgorod region.

- Since 2012: Astrakhan, Novgorod, Novosibirsk, Tambov, Kurgan regions, Khabarovsk Territory.

- Since 2015: Republic of Crimea, Sevastopol, Republic of Tatarstan, Belgorod, Rostov, Samara regions.

- From 2021: Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions.

- From 2021: Republic of Adygea, Altai, Buryatia, Kalmykia, Altai and Primorsky Territories, Amur, Vologda, Omsk, Oryol, Magadan, Tomsk and Jewish Autonomous Regions.

- From 2021: Kabardino-Balkarian Republic, Republic of Karelia, North Ossetia, Tyva, Kostroma, Kursk regions.

- From January 1, 2021: Republic of Ingushetia, Mari El, Khakassia, Chechen, Chuvash Republics, Kamchatka Territory, Vladimir, Pskov, Smolensk regions, Nenets and Chukotka Autonomous Okrugs.

Legislation on the transition to direct payments

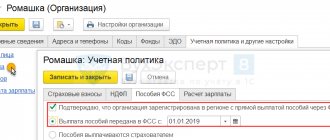

The transition to direct payment from the Social Insurance Fund for social payments made from funds transferred to the fund by employers in the form of insurance contributions has been planned for a long time. To implement it, a pilot project has been operating in Russia since 2011 (its rules were approved by Decree of the Government of the Russian Federation of April 21, 2011 No. 294), which at the beginning of 2021 was not joined by only 8 constituent entities of the Russian Federation:

- Krasnodar region;

- Perm region;

- Moscow region;

- Sverdlovsk region;

- Chelyabinsk region:

- Khanty-Mansiysk Autonomous Okrug;

- Moscow city;

- city of St. Petersburg.

With the onset of 2021, the payment of social benefits directly from the fund will begin in these regions. And, accordingly, the offset mechanism, which made it possible to reduce the amount of payments received by the Social Insurance Fund from employers by the amount of such benefits, will no longer be used. The termination date of this mechanism is set to 12/31/2020, since after its expiration, paragraphs. 2, 8, 9. 16 tbsp. 431 of the Tax Code of the Russian Federation, which describes the procedure for interaction between the employer, the Federal Tax Service and the Social Insurance Fund in terms of reducing the volume of contributions transferred by the employer for disability and maternity insurance (clause 3 of Article 5 of the Law of July 3, 2016 No. 243-FZ “On Amendments...”).

In addition, a law amending 2 laws containing rules for the payment of social benefits made to insured persons should come into force in 2021:

- dated 07.1998 No. 125-FZ “On Compulsory Social Insurance” - in relation to payments related to accidents;

- dated December 29, 2006 No. 255-FZ “On compulsory social insurance...” - in relation to payments for disability and maternity.

The transition to direct payments will allow the fund to organize personalized accounting of expenses for social payments.

Benefit payment procedure

In general, the direct payment system looks like this:

- An employee experiences an insured event and sends an application to the employer for payment of a certain benefit.

- The employee also provides the documents necessary to assign benefits, and the employer sends this package to the Social Insurance Fund.

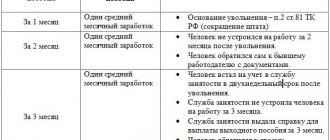

- With the direct payment system, the employer pays only 3 days of sick leave, and the remaining payments are made by the territorial branch of the Fund.

Why is an electronic sick leave better than a paper one?

Electronic sick leave is generated in a medical institution in a special program, which allows:

- minimize errors that a medical employee may make when filling out the paper version;

- ELN cannot be lost, falsified or damaged, no special place is required for its storage;

- information from the electronic tax record is automatically loaded into the 1C program - the accountant does not have to waste time filling out sick leave manually, and the percentage of errors, and therefore FSS refusals when reimbursement of expenses, is also reduced to a minimum;

- After formation, the ELN falls into the single FSS database; to confirm expenses at the expense of the FSS, the employer will not need to provide supporting documents.

Step-by-step instruction

Deadlines for submitting documents

Do I need to send a package of papers to the Social Insurance Fund in order to receive benefits not only from the employer for 3 days, but also the rest of the amount for sick leave? Yes, and the employer is required to submit documents for payment of benefits to the territorial body of the Social Insurance Fund . To do this, you must submit to your employer a certificate of incapacity for work and an application for benefits within 6 months. The organization prepares a certificate calculating benefits for the Social Insurance Fund and, together with a sick leave certificate and an application, submits it to the Fund within 5 days.

Who fills out the form and how?

The first part of the sick leave form is filled out by the doctor. The information in the second part is entered by the employer. According to Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n, when filling out the following basic rules should be followed:

- Do not use a ballpoint pen.

- If you need to make corrections, you should cross out the erroneous information and indicate the correct information on the back of the form.

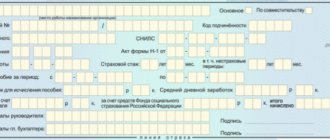

Since the Social Insurance Fund calculates the amount of compensation, the fields “At the expense of the Social Insurance Fund of the Russian Federation” and “Total accrued” must be filled in by a Fund employee.

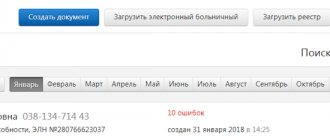

The photo shows a sample of filling out a sick leave certificate by an employer under the Social Insurance Fund pilot project

Filling out an application

The application form for payment of benefits is established by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 N 578. This application must be filled out by the employee, but as a rule, the employer does this independently in order to reduce the number of errors. The employee only has to check whether the bank details are correct and sign.

Minimum and maximum period

After you have provided your employer with your sick leave, he has 10 days to accrue sick leave for the first 3 days. And he is obliged to make the payment on the next day of salary transfer.

After receiving a certificate of incapacity for work from you, the employer is obliged to submit a package of documents to the Social Insurance Fund within 5 days. Over the next 10 days, the Social Insurance Fund is obliged to check all the information and pay you benefits.

Thus, the maximum period during which an employee will receive payment of disability benefits is 15 days from the moment he provides sick leave to the employer. The minimum payment period is not established by law.

How is personal income tax collected?

The employer withholds tax from the amount of compensation he makes. That is, during the first three days of illness. Personal income tax on the remaining amount is withheld by the Fund, because it is the Fund that pays this part of the benefit.

How to check traffic on a website?

An employee can find out the status of his sick leave on the Social Insurance Fund website. The Fund launched the “Insured Person’s Account” service, where the employee logs in through his account on the State Services Portal.

The account must be verified. When an employee logs into his account on the FSS website, he will be able to track his benefits.

Can they refuse and why?

The Social Insurance Fund may refuse to pay benefits in the following cases:

- The documents necessary for calculating compensation were not provided . In this case, the FSS sends the employer a notice of the need to transfer data within 5 working days from the date of receipt of the letter.

- The deadline for applying for benefits has been missed . If you do not have documents confirming that this deadline was missed for a good reason, the Fund will not transfer the money to you. To avoid these situations, the employer should submit a full package of documents on time, and the employee should not delay in applying for payment.

If you believe that the Social Insurance Fund illegally refused to pay you benefits, you need to go to court.

Positive and negative sides

The Social Insurance Fund project has certain advantages for both the employer and the employee. First of all, the responsibility for calculating the insurance payment lies with the Social Insurance Fund. The employer can transmit information about the insured person to the Social Insurance Fund in electronic form , which is more convenient.

Employees receive protection: they are spared from delayed payment of benefits or complete non-payment, as well as from controversial situations with the employer. However, the employer must now be more responsible about the deadlines for submitting the package of documents, as well as the correctness of filling out sick leave.

Reporting on insurance premiums

The peculiarity of filling out the Calculation of Insurance Premiums is that the amount of expenses in page 070 of Appendix 2 of Section 1 .

Appendix 3 and Appendix 4 of Section 1 must NOT be completed , even if the organization paid a funeral benefit and paid for additional days to care for a disabled child.

More details:

- Why in the RSV line 070 of Appendix 2 of Section 1 does not include the amount of payment for 4 days of care for disabled children?

- How to reflect the funeral benefit in the regions of the FSS pilot project?

If the organization switches to a pilot project from July 1, then the indicators on page 070 of Appendix 2 of Section 1 , as well as Appendix 3 and Appendix 4 of Section 1, are filled in with the amounts of benefits accrued before June 30 of the current year.

Possible questions and difficulties

- Can a company refuse to participate in a pilot project? No, if the company is located in a region that participates in the Direct Payments project.

- Is it possible to submit a single register to the Social Insurance Fund for several sick leaves at the same time? Yes, the employer has the right to submit one register for several certificates of incapacity for work. The form of the register and the rules for filling it out were approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 579.

- If the package of documents to the FSS turns out to be incomplete or with shortcomings, does the FSS notify? What is the deadline for providing the missing documents? In this case, the Social Insurance Fund sends a notification to the organization. After receiving the notice, the employer must provide the fund with the missing documents. 6 days after sending the notice, it is considered received.

- What to do if all the documents were submitted to the Social Insurance Fund in a timely manner, but the employee does not receive payments? In this case, it is necessary to check whether the information in the documents submitted to the Fund is correct. Particular attention should be paid to the employee’s full name and bank details. If all data is entered correctly, the benefit status can be checked in your personal account on the Social Insurance Fund website or directly at the territorial office of the Social Insurance Fund.

In modern economic realities, the old “credit” system of social payments is catastrophically outdated. The Social Insurance Fund project is designed to simplify work with insurance payments and optimize document flow , as well as protect citizens from non-compliance with the law by the employer.

There are no obvious disadvantages to the project yet. Nothing will change for insured persons, but for organizations the procedure for calculating and paying out funds is greatly simplified.

How to make changes to a certificate of incapacity for work

Features of correcting incorrect information are described in paragraph 72 of Order of the Ministry of Health No. 925n dated 09/01/2020 (replaced Order of the Ministry of Health and Social Development No. 624N dated 06/29/2011 and regulations supplementing (amending) it). It follows from this that erroneous information on the paper form is crossed out, and correct information is entered on the reverse side. Corrective agents cannot be used; corrections are prohibited! New data is confirmed by the seal of the organization, the entry “Corrected to believe” and the signature of the responsible person of the policyholder.

To correct an error in the electronic certificate of incapacity for work, you must again submit information to the Social Insurance Fund through your personal account.

We offer you to see a sample of how to fill out a sick leave certificate during a pilot project if an error is made on the paper form.