In addition to the introduction of a new form for calculating insurance premiums in 2021, the tax service has adjusted the control ratios (CRs), which are used for preliminary verification of the form. These changes were approved by letter of the Federal Tax Service No. BS-4-11/ [email protected] dated May 29, 2020.

The new CS will be useful to small and medium-sized businesses when checking the payment of payments, which, due to the COVID-19 pandemic, are subject to reduced insurance premiums from April 1, 2020.

For whom are the reduced rates developed?

Reduced tariffs were introduced for small and medium-sized enterprises. In accordance with Federal Law 102-FZ dated April 1, 2020, SME companies can use a reduced rate of 15% instead of the required 30% when calculating insurance premiums. Read more in the topic: “How to correctly calculate insurance premiums at a reduced rate?”

The possibility of applying a preferential tariff is determined by the amount of wages paid. Only those companies that pay their employees a salary exceeding the federal minimum wage - 12,130 rubles - can apply a reduced rate. If this indicator is not met, then the company must charge contributions at a rate of 30%. Also, only those companies that are included in the small business register can use the benefit.

The preferential tariff applies only to that part of the salary that exceeds the minimum wage. Payments within the minimum wage are taxed at the previous rate. There have been no changes to contributions for injuries, as they are calculated separately from pension, medical and social contributions.

Program for checking control ratios “Calculations for insurance premiums”

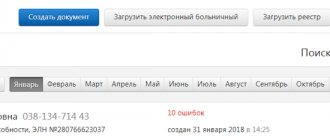

Changes in ratios are quite difficult to track when checking the DAM form manually. The best option is to check the completed “Calculation of Insurance Premiums” using special software that can be downloaded on the official ]]>Federal Tax Service website]]>:

- The program “]]>Taxpayer Legal Entity]]>” allows policyholders to fill out the Calculation of Insurance Premiums, automatically calculate indicators, check the correctness of formats, upload files for sending to the Federal Tax Service, etc. The program also integrates a function for checking the correctness of filling in accordance with control ratios.

- “]]>Tester]]>” is a program for checking reporting for compliance with formats and ratios.

Both programs are free and freely available for download.

In addition to programs developed by the Federal Tax Service, the preparation and verification of the DAM can be carried out using software used for accounting and tax accounting. Of course, provided they are updated in a timely manner.

Validity period of preferential tariffs and procedure for their application

These benefits have no restrictions on the period of use. Until December 31, 2021, this norm is regulated by 102-FZ, and from 2021, taxpayers must be guided by the amendments made to Art. 427 Tax Code of the Russian Federation.

Since the changes were made on April 1, the benefit must be applied from April accruals. The date of accrual of wages in accounting is the last day of the month, therefore the previous rate should be applied to March payments. At the same time, if the bonus for March is accrued in April, then such payments fall under preferential treatment (letter of the Ministry of Finance No. 03-15-06/38515 dated June 20, 2017).

Checking the DAM: how to apply control ratios in 2020

Let us remind you that in 2021, starting from the 1st quarter, policyholders fill out the Calculation using a new form, approved. By Order of the Federal Tax Service No. ММВ-7-11/470 dated September 18, 2019. To verify the correctness of the data entered into it, the corresponding control ratios were approved (letter of the Federal Tax Service No. BS-4-11/2002 dated 02/07/2020), used for the DAM for the 1st quarter of 2020.

Later, these ratios had to be adjusted - the Federal Tax Service provides new control ratios in the appendix to letter No. BS-4-11 / [email protected] dated 05.29.2020. Policyholders can use them for self-checking along with previously adopted ratios from letter No. BS-4-11/2002, starting with reporting for the half year 2021.

Next, let's look at how the list of previously approved test relations has changed.

New control ratios for DAM

The innovations affected the previously existing ratios, also by letter of the Federal Tax Service No. BS-4-11 / [email protected] dated May 29, 2020. new types of values were introduced: internal and interdocument .

Interdocument control ratios

The new CS are designed to verify the compliance of the application of the feed-in tariff. With their help, regulatory authorities determine whether the taxpayer is a small business.

, KS 2.8-2.10 were introduced . code 20 in the calculation of insurance premiums , then at the beginning of each month, if there are accruals in columns 2, 3, 4 in subsection 1.1 of Appendix 1 of Section 1, the company must be in the SME register. Otherwise, the application of the reduced tariff will be unjustified.

There are situations when a taxpayer is excluded from the register in the middle of the last month of the quarter. In this case, the company has the right to apply a reduced tariff, since at the beginning of the month in question it was on the register.

Before filing a DAM with code 20 , it is recommended to check the status of a small enterprise. If a discrepancy is detected, the Federal Tax Service will require you to explain the reason for applying the preferential rate, after which you will have to make corrections and submit an updated calculation.

Internal control ratios

To check the correctness of filling out the calculation of insurance premiums of the Federal Tax Service, internal control ratios were introduced.

New reference ratios:

- 1.193 - there is no appendix 1 of section 1 SV with the value 01 in field 001 when there is appendix 1 of section 1 SV with the value 20 in field 001

- 1.194 - there is no subsection 3.2.1 of section 3 SV for the FL with a value in field 130 = NR if subsection 3.2.1 of section 3 SV for this FL is present with a value in field 130 = MS

- 1.195 - there is no subsection 3.2.1 of section 3 of the SV for the FL with a value in field 130 = VZHNR in the presence of subsection 3.2.1 of section 3 of the SV for this FL with a value in the field 130 = VZHMS

- 1.196 - there is no subsection 3.2.1 of section 3 of the SV for the FL with a value in field 130 = VPNR in the presence of subsection 3.2.1 of section 3 of the SV for this FL with a value in the field 130 = VPMS

- 1.197 - line 150 for each value of field 120 of subsection 3.2.1 of section 3 SV with a value in field 130 = NR < minimum wage in the presence of subsection 3.2.1 of section 3 SV for a given FL with a value in field 130 = MS

- 1.198 - line 150 for each value of field 120 of subsection 3.2.1 of section 3 SV with a value in field 130 = VZHNR < minimum wage in the presence of subsection 3.2.1 of section 3 SV for this FL with a value in field 130 = VZHM

- 1.199 - line 150 for each value of field 120 of subsection 3.2.1 of section 3 of the SV with a value in field 130 = VPNR < minimum wage in the presence of subsection 3.2.1 of section 3 of the SV for this FL with a value in field 130 = VPMS

Ratio 1.193 when the policyholder applies a reduced tariff determines the procedure for filling out Appendix 1, Section 1. The sequence of making charges will be as follows:

- the code 01 must be entered . The amounts of wage accruals must be within the minimum wage

- in the second Appendix 1, code 20 and charges are made that exceed the minimum wage

The ratios of group 1.197-1.199 are considered the most important for taxpayers . In addition, the list includes codes for the category of individuals. For example, MS are individuals who receive preferential accruals in excess of the minimum wage. If there is such a code, the HP code must be entered in field 130 in subsection 3.2.1 of section 3.

Using the example of the control ratio 1.197, the verification of accrued amounts in the DAM will be carried out as follows:

- if the MS code is present in subsection 3.2.1, then the base for calculating contributions should be equal to the minimum wage. If the tax base is less than 12,130 rubles, then the MS code cannot be used

- if the base is below the minimum wage and there are accruals at reduced rates, then in this case the calculation will have to be adjusted

Discrepancies between reports

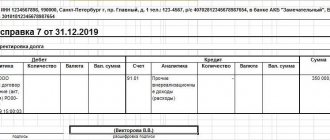

Now those who were not familiar have a little idea of the two calculations. It's time to move on to comparing indicators and emerging discrepancies in the two documents.

The taxable bases for personal income tax and contributions are different for individual types of payments. There are accruals that do not fall into one base in principle, since they do not even relate to the subject of taxation, but, on the contrary, are included in another.

Let's take the most common cases:

- Financial assistance to former employees (for example, retired). Some organizations support employees who have worked for a long time at the enterprise, providing assistance on their birthday or for the purchase of medicines. Since the former employee is no longer an insured person in relation to the organization, financial assistance in any amount is not subject to contributions and is not included in the DAM at all. At the same time, this amount is not subject to personal income tax if it is less than 4,000 rubles. Everything above is included in the tax base.

- Child benefits. Monthly or for pregnancy and childbirth - both are not subject to personal income tax and contributions. At the same time, they are not indicated at all in 6-NDFL, but in the DAM form they are reflected in Appendix 1, subsections 1.1. and 1.2 in lines 030 and 040, even in the line titles, Article 422 of the Tax Code of the Russian Federation is directly mentioned.

- Gifts for employees . Similar to material assistance, they are subject to personal income tax in excess of four thousand rubles. At the same time, paragraph 4 of Article 420 of the Tax Code does not recognize gifts as subject to taxation of contributions in any amount (provided that a written gift agreement has been concluded). True, the Federal Tax Service may challenge some such operations. For example, when a gift is made as an incentive for exceeding the plan, in connection with achieving a certain length of service, etc., the tax office considers such a gift as a form of bonus and requires the calculation and payment of all due contributions, so it is better to avoid “working” wording in gift agreement or you will have to be prepared to defend the case in arbitration.

- Dividends. Here only personal income tax arises, because dividends, as well as material assistance to former employees, do not apply to income subject to contributions in principle. It is not indicated in the RSV, but in 6-NDFL it is included in the database and highlighted separately in the first section (line 025).

- Rent. It is not recognized as an object of taxation according to paragraph 4 of Article 420 of the Tax Code as a transfer of property for temporary use, which means that there is no need to charge contributions on these payments. At the same time, rent is subject to personal income tax and is reflected in 6-NDFL.

- Interest savings. When providing an employee with a preferential loan at a low interest rate (less than 2/3 of the refinancing rate) or interest-free, the organization as a tax agent is obliged to calculate the material benefit and withhold personal income tax from it. At the same time, since the loan agreement does not relate to a working relationship, work performed or services provided, there is no need to impose contributions and include the benefit received in the report.

- Compensation for late wages. It is calculated by the organization independently, and must be accrued without fail, but with minor delays of a couple of days, it is usually not counted. The employee can demand payment through the court, but given its penny size, this makes no sense.

Despite the usually ridiculous amounts, the Federal Tax Service insists that they should be subject to contributions, since they are not in the nature of compensation for the employee’s performance of his official duties (such as reimbursement of travel expenses, for example). At the same time, the judiciary takes the exact opposite position. The choice remains with the taxpayer - to follow the lead of the Federal Tax Service or to sue in the future.

And now pay attention, changes from 2021! Compensations were not subject to personal income tax in accordance with clause 3 of Article 217 of the Tax Code in 2021, but as of January 1, 2020, changes to the Tax Code came into force and clause 3 was declared invalid. I could not find a single suitable point in the article that would indicate that the norm has been preserved, so I believe that in 2021, compensation for delayed wages should be taxed.

Note! Income of participants upon leaving the organization - payment of the actual part of the share - is subject to personal income tax, unless the conditions for tax exemption are met: the share was acquired after January 1, 2011 and belonged to the participant continuously for more than 5 years. Contributions do not need to be calculated in any case.

All of the above payments may cause discrepancies in reports and violate the control ratios checked by the Federal Tax Service. In particular, it is noted whether the condition is met: the difference between line 020 and line 025 of the 6-NDFL calculation is equal to or greater than line 030 of subsection 1.1 of Appendix 1 of the DAM report. Moreover, even if everything is correct, but the same “more” is revealed, they will probably send a request.

The presence of a non-taxable amount may lead to an error

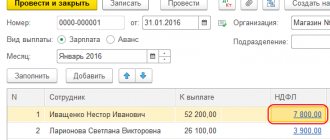

If there is a non-taxable amount in the accruals, a mistake can be made. For example, the amount of an employee’s salary consists of a basic accrual of 26,000 rubles. and sick leave payments – 4,000 rubles, which is not subject to taxation. If you divide the taxable amount (RUB 26,000) proportionally, an error will be generated when checking the control ratios.

Incorrect section filling:

Incorrect completion of section 3 (code HP)

Incorrect completion of section 3 (MC code)

If the employee’s income contains non-taxable amounts, then according to the NR in block 150 it is necessary to indicate an amount equal to the minimum wage - 12,130 rubles, and in line 170 - the amount of the accrued contribution at a rate of 22%. According to the MR line, the accrued sick leave must be subtracted from the excess amount, and the resulting result is entered in block 150. Accordingly, contributions at a reduced rate (10%) will be calculated from this amount.

Correct filling of the section:

Correct completion of section 3 (code HP)

Correct completion of section 3 (MS code)

6-NDFL

The report consists of a title page and two sections. The title is standard, but pay attention to two fields: “period of presentation” and “at location (accounting).” Both are filled in with codes from the appendices to the instructions. The period is indicated differently depending on whether the organization (IP) is conducting normal activities or is undergoing a liquidation (reorganization) procedure. The first section follows, it shows generalized income, deductions and tax figures.

Important! In 6-NDFL, the first section is filled in with a cumulative total, and the information in the second section is indicated for the quarter.

The second section records transactions for the payment of income for the last three months of the reporting period, i.e. for a certain quarter. Each operation is entered in a block of 5 lines:

- Dates – actual receipt of income, personal income tax withholding and tax payment deadline.

- Amounts – actual income received and tax withheld.

This means that you need to indicate three dates at the same time, which will almost never converge. An example of three identical dates: payment of vacation pay, when it is made on the last day of the month (which is also a working day) and personal income tax is withheld from it.

Note! If any of the dates goes beyond the reporting period, then the entire operation will be reflected in the next calculation.

Let's get back to the amounts. The 6-NDFL report reflects income that is fully or partially subject to this tax, and sometimes it also indicates non-taxable payments. The indicators in section 2 and the data in section 1, as a rule, do not coincide.

Example: line 020 indicates accrued wages for the period January - March, and lines 130 indicate actual wages paid. Considering that employees will receive their salaries for March in April, and perhaps the December salary (received in January) will also be included in the report, the amounts will not match.

The report indicates income subject to tax in accordance with Article 209 of the Tax Code, but at different rates (a separate section 1 must be drawn up for each rate, lines 060 to 090 are filled out collectively). Let's say non-residents (not all) pay 30% instead of 13%.

What is not required to be included in the report:

- Financial assistance or gift up to 4,000 rubles.

- Daily allowance within non-taxable limits is 700 rubles in Russia and 2500 abroad.

- Reimbursement for accommodation and travel expenses on a business trip.

- Payment for travel to and from the place of rest for persons working in the Far North and equivalent areas.

- Other non-taxable income.

Please note that if you pay anything in excess of these amounts, you must tax the excess. What to do in this case with the non-taxable part? There are two options:

- We indicate in 6-NDFL only income that is subject to tax (for example, with financial assistance equal to 10,000 rubles, we include 6,000 in the report).

- We reflect the entire amount as income, and include the non-taxable part in the line with deductions (using the example with financial aid: 10,000 in line 020, and 4,000 in line 030).

The Federal Tax Service carries out a reconciliation of indicators according to control ratios, more details in Letter No. BS-4-11 / [email protected] dated March 10, 2016.

By the way! They check not only the internal consistency of the data, but also compare the average salary (according to annual personal income tax reports) with the minimum wage and the industry average for the constituent entity of the Russian Federation.

During a desk check of the calculation, the inspectorate checks the information with the DAM and, when it finds differences in the databases, sends a request. If you receive documents electronically, you must send a confirmation; once it is submitted, the deadline set for a response begins to run. If you are not ready to write explanations right away, leave time for maneuver - confirm on the last day. The main thing is not to miss the moment, otherwise you risk having your account blocked (clause 1.1, clause 3, Article 76 of the Tax Code).

6-NDFL has many nuances in filling out; we will return to them in the following materials and analyze the most difficult situations in more detail.