Tell me, what does “I’ll take the goods for sale” mean?

Many suppliers do even more for product distributors and allow them to pay in installments. The sales pact under discussion involves the release of funds upon sale. On the day of shipment, the supplier provides the buyer with a contract, delivery notes, invoices and other accompanying documents. A sample of the paper in question can be downloaded for free via a direct link.

Many counterparties enter into sales transactions upon the sale of goods. Payment is made in cash and by bank transfer. Such legal relationships are long-term. In this agreement between the two parties, there are many positive properties and almost no negative aspects. It is easier for a manufacturer or supplier to come to an agreement with counterparties, sellers of goods, rather than selling their own products to the end consumer. It is easier for consumers to buy any product nearby than to look for a wholesaler. Therefore, numerous entities benefit from this type of legal relationship.

Mandatory clauses of a contract for the sale of goods with payment upon sale

:

- Name, date, place of agreement, identification information;

- Subject, characteristics, rights, duties, responsibilities;

- Timing of implementation or sale, cost, payment procedure;

- Additions, comments, appendices;

- Final points;

- Signatures, transcript.

A pay-as-you-sell sales contract is easy to write. Almost any user of the Word editor can handle its execution. The pact is drawn up in at least two copies and signed by authorized representatives. If the trade has any special features, the parties may agree not to enter into such transactions in a certain territory. Typically, each cash-on-delivery arrangement is unique. Civil law allows subjects to include in documents all rules of conduct that are not prohibited by law.

Date: 2016-08-31

Compilation rules

All necessary information is placed on one A4 sheet. Both participants in the trade turnover relationship must be indicated here. They must be authorized to sign such documentation with internal organizational orders, notarized powers of attorney, etc. In general, the content and sequence of the information provided changes by agreement. But there are uniform standards for design. Such documents and contracts always begin with an explanation of their name, date and place of signing. The rest of the descriptive information goes further in the body of the text.

A simple example of a goods acceptance certificate form. What it contains:

- the name of the document is in the middle;

- when and where it is compiled;

- listing of parties;

- designation of the commodity unit itself, its quantity (with clarification of the measurement measure) and all amounts including VAT;

- number and date of the agreement on the basis of which all actions were carried out;

- signatures with seals in double-sided format.

The form is not unified at the state level and is compiled in free form. However, there are general principles for its compilation. It is recommended that the described information be specified as mandatory.

Transfer of goods for sale

⇐ Previous1234

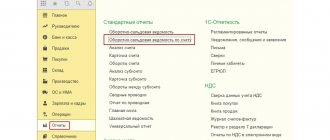

We hand over our goods for sale. You must first enter information about commission agents in the Counterparties directory. For such counterparties, check the Buyers box and draw up an agreement with the type of agreement “ With commission agent”

". The shipment of goods is processed in the same way as the sale of goods.

The fact of sale of our goods by a commission agent is documented in the document “Report of the commission agent on goods sold” (menu Documents – Sale). The document can be drawn up on the basis of the Sales of goods and services document.

- In the “Counterparty Documents” journal, select the required document Sales of goods and services.

- Menu Action - Based on - Commission agent's sales report. The document is filled out on the basis of the sales document; be sure to fill out the window for the method of settlement with the commission agent. If not all the goods are sold by the commission agent, then in the quantity column we put the quantity of goods sold and OK.

- Registration of payment from the commission agent. Based on the commission agent's report on sales, we draw up a document for receipt of funds.

Types and differences of intermediary agreements

There are three types of contracts that are concluded when working with intermediaries.

| Name | Agency (the concept is contained in Article 1005 of the Civil Code of the Russian Federation) | Instructions (the concept is contained in Article 971 of the Civil Code of the Russian Federation) | Commission (the concept is contained in Article 990 of the Civil Code of the Russian Federation) |

| Parties | Both the customer (agent) and the contractor (principal) must be legal entities or individual entrepreneurs | Represented by the customer and the contractor, who can be a legal entity or an individual | The executor (commission agent) and the person giving the order (committee). |

| The essence of relationships | The agent acts on behalf of the customer. A model is also possible when an agent acts on his own behalf, but in the interests of the other party. However, in both cases, the agent fulfills the terms of the contract at the expense of the principal and in his interests | Performing all or part of legal actions by an attorney on behalf of the principal and at his expense. At the same time, attracted clients and partners should know on whose behalf he acts. | On behalf of the customer, the commission agent undertakes to perform one or more actions with the participation of third parties on his own behalf, but in the interests of the principal. Basically, it is concluded in barter transactions, purchase and sale of goods or services, where the executive party undertakes to attract clients who meet the stated requirements of the customer |

| Remuneration | Paid. The parties determine the remuneration structure at their own discretion | The rules on remuneration follow from Art. 972 of the Civil Code of the Russian Federation. As a general rule, the contract is gratuitous, except in situations where the agreement provides otherwise | Paid. The parties determine the remuneration structure at their own discretion |

How to take goods for sale

To do this: select the document “Commission Agent's Sales Report” from the menu – Action – Based on and select Incoming cash order (if payment is in cash) or Incoming Payment order, and then bank statement (if payment is by bank transfer).

Product returns

To return a product from a supplier, you must:

- Menu Documents - Purchases - Receipt of goods and services, select the required receipt document.

- Menu Action – Based on – Return of goods to the supplier.

- A window will appear on the screen filled in based on the receipt document. If necessary, enter the quantity of the item being returned.

To process a product return from the buyer you must:

- Menu Documents – Sales – Sales of goods and services, select the desired sale.

- Menu Action – Based on – Return of goods from the buyer.

- A window will appear on the screen, filled in based on the implementation document. If necessary, enter the quantity of the item being returned.

Removal

Deleting objects (hereinafter, by objects we mean directory elements, groups, documents) occurs in 2 stages. At the first stage, the object is marked for deletion. To do this, you need to select the object and press the “Delete” key on the keyboard and confirm the request to mark it for deletion. The object will be marked for deletion and a deletion sign will appear on its icon – a blue cross.

To unmark for deletion, you must select an object marked for deletion, press the “Delete” button and confirm the request to unmark for deletion. The object will remain in the database until it is physically removed from the database. Only a user who has full rights can physically delete objects from the database. A window will appear on the screen, at the top of which all objects marked for deletion are listed. Click on the “ Control”

"and the program checks whether we can delete the marked objects.

Then click on the “ Delete

” button.

⇐ Previous1234

Date added: 2015-11-23; | Copyright infringement

Recommended content:

Related information:

Search on the site:

Accounting reflection of transactions for the purchase and sale of goods in retail when accounting for goods in purchase prices is carried out in the following sequence:

- receipt of products from the supplier, mutual settlements according to the agreement;

- displaying purchase prices in the accounting records of the enterprise, posting products to a retail warehouse or moving them from the main warehouse.

- sale of goods to a buyer purchasing it for personal use; mutual settlements with the customer, confirmation of payment;

- determining the financial results of the transaction, monitoring the results of the sale.

Retail trade refers to a type of trading activity that is associated with the purchase and subsequent sale of products to end consumers.

Note from the author! The main purpose of assets sold in retail trade is personal consumption. Sales of goods purchased for further resale are accounted for in wholesale trade.

In retail trade, the transaction is carried out on the basis of a purchase and sale agreement expressed orally. Payment is made in cash using cash registers in accordance with legislative changes in Federal Law 54-FZ of May 22, 2003, or by bank cards under an acquiring agreement if payment terminals are available in the store.

The accounting rules of a retail enterprise allow for the accounting of goods in both purchase and sales prices. The mechanism for accounting for goods in retail trade in purchase prices is identical to wholesale trade. The purchase of goods is displayed on the account. 41, an additional subaccount 41.2 is opened to account for retail goods.

Something to keep in mind! The procedure for accounting for products in the warehouse must be recorded in the company's accounting policy.

To summarize the results of entrepreneurial activity in retail trade, the financial result is determined, recorded in the company’s accounting records. 90. The basis document for monitoring is a retail sales report generated from cash register receipts at the end of a shift.

Basic transactions for retail trade when accounting for goods in purchase prices:

- Purchasing goods from a supplier

Operation Wiring Receipt of received products in the warehouse Dt41.2 Kt60 Accounting for input VAT Dt19.03 Kt60 Accounting for transportation and procurement costs Dt41 Kt60 – when transport costs are included in the purchase price Dt44 Kt60 – with separate accounting of transport costs Payment to the supplier for purchased products Dt60 Kt50.51 Transfer of previously purchased goods to the appropriate retail warehouse Dt41.2 Kt41.1 Note from the author! The method of accounting for transport costs is chosen by the company independently and must be reflected in the company’s accounting policies.

- Sales of goods to retail customers

Operation Wiring Transfer of products, write-off of costs Dt90.02 Kt41.2 Accounting for proceeds received from sales Dt62.R Kt90.01 (in addition to account 62, a subaccount 62.R is opened, recording retail revenue) Accounting for non-cash payments of acquiring transactions Dt57.03 Kt62R Receiving cash from customers Dt50 Kt62R Crediting income from acquiring transactions to the current account Dt51 Kt57.03 (Dt91.02 Kt57.03 – deduction of bank commission for payment processing). - Calculation of the financial result of the transaction

Dt90 Kt99 – profitDt99 Kt90 – loss

Standard form

Such a document confirms the accomplished fact of delivery of the purchased order. Or it is intended for storage if the buyer was dissatisfied and refused. An important aspect when signing is the inspection of the purchased products. After all, both participants can use this documentary evidence to their advantage. Especially when controversial issues arise. The receiving party in this situation actually signs for the fact that he has no dissatisfaction with the purchase. That the delivered goods and materials correspond to expectations (of a contractual nature).

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Purpose of registration:

- To reflect the transfer of values from one person to another (legal and less often physical).

- To ensure that the accepted cargo is delivered in the appropriate form, quantity and with the required quality parameters. And also within the agreed time period. Failure to comply with these points will result in a full refund.

The template of the invoice and the act of acceptance and transfer of goods are two integral documents for commodity-monetary interactions between the parties to the transaction. Or in order to transfer property from one employee to another and between several departments. But then the name will be appropriate.

How to take goods for sale as an individual entrepreneur?

rubles (excluding VAT), transportation costs for delivery of goods amounted to 300 rubles. Accounting is carried out in purchase prices, transportation and procurement costs are included in the cost of production. The goods were put up for sale at 210 rubles per piece (100 pieces per batch). During the operating day, the store sold 30 units worth 6,300 rubles.

Accounting entries for the purchase of goods:

- Dt41.1 Kt60 – 15,000 rub. – the container has arrived at the main warehouse.

- Dt41.1 Kt60 – 300 rubles – delivery is included in the original price of the goods.

- Dt41.1 Kt41.2 – 10,000 rubles – part of the goods was moved for retail sale.

- Dt60 Kt51 – 15,300 rub. – full payment has been made to the supplier.

At the end of the working day, after closing the cash register shift, based on the retail sales report, the accountant of Sad LLC made the following accounting entries:

- Dt62R Kt90.01 – 6,300 rubles – display of the revenue received per day from the sale of containers.

- Dt90.02 Kt41 – 4,590 rubles – the cost of products sold is written off.

Note! Formation of the initial price = (batch cost + TKR) / number of pieces in the batch = (15,000 + 300) / 100 = 153 rubles per unit. - Dt50 Kt62R – 6,300 rubles – all goods were paid for in cash.

To calculate the financial result, an analysis of the account is carried out. 90 and determination of the balance on the debit or credit of the account:

| Balance beginning Dt | Balance beginning Kt |

| 4 590 | 6 300 |

| RPM 4,590 | RPM 6,300 |

| Balance | Balance 1 710 |

Since the store’s revenue exceeded the costs of purchasing containers, the limited liability company “Sad” made a profit from the sale of these products.

Display of financial result on account 99:

- Dt90 Kt99 – 1,710 rubles – profit.

Storage of primary documents

All such documentation should be stored for some time in a binder and transferred to the archive. The archiving system at each enterprise may vary, because it is internal accounting. Often, the entire documentary package for the purchase is stored together, and not separately, the contract and the act of acceptance of goods according to the acceptance and transfer form. Supervisory authorities have the right to request these papers during scheduled and unscheduled inspections (if facts of suspicious monetary manipulation are identified). Tax inspectors are dealing with this issue. This is also required for the needs of the organization itself. To raise information on expenses for a certain quarter, to sue an opponent (or to defend oneself in a debate), etc.

Rules:

- The chief accountant or financial director becomes responsible;

- when storing documentation for the current accounting period in the accounting department, special rooms or safes are used;

- packaging is carried out in chronological order and is accompanied by archival information.

Storage periods vary depending on the category of the document. On average, the figures vary from 1 year to 10 years. More specific details can be found in the list from the Main Archive of the USSR. It was formulated in '88 but updated in 2007.

Features when returning from customers

In retail trade, the buyer may return previously purchased products in the following cases:

- Failure to provide complete information about the properties of the product at the time of sale.

- Defect detected.

Something to keep in mind! Returns due to defects are possible even in the absence of a cash receipt or sales receipt. - Return of non-food quality goods that are not suitable for the buyer for one reason or another (providing a cash receipt is required).

In the accounting of the selling organization, settlements with customers for the return of products are recorded on account 76, data on previously received revenue and written-off costs are reversed.

Victor Stepanov, 2018-04-11

Responsibility for product safety

The intermediary is obliged to ensure the safety of the property entrusted to him (Article 891 of the Civil Code of the Russian Federation).

All conditions of this responsibility are fixed by law. However, when drawing up an agreement, the parties have the right to make some changes and introduce additional sanctions for violations. The most serious liability is for loss or damage to tangible goods accepted by the supplier. If such situations arise, the principal has the right to demand compensation for losses in full, unless otherwise stated in the contract.