Current laws provide for several options for changing the organizational and legal form of a legal entity. The most relevant for commercial organizations are two of them:

- Transformation of LLC into JSC, PC (according to Article 56 of the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ);

- Transformation of JSC into LLC, PC, NP (according to Article 20 of the Federal Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ).

When changing the legal form, it is worth taking into account the limitations that are inherent in the form of the newly registered company. For example, the minimum amount of authorized capital of an LLC or CJSC is 10,000 rubles; when such organizations are transformed into an OJSC, the minimum amount of authorized capital increases to 100,000 rubles. In addition, neither limited liability companies nor joint stock companies can have as their sole founder a legal entity that also consists of a single founder.

The decision to change the organizational and legal form can be made either voluntarily or compulsorily in order to comply with legal requirements. Thus, an LLC is obliged to transform into an OJSC/PC if the number of company participants exceeds 50.

Legal regulation of JSC reorganization. General provisions

Legislative regulation of the reorganization of joint stock companies is carried out by Art. 104 of the Civil Code in conjunction with a number of other norms of the code and the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ (hereinafter referred to as the Law). In accordance with paragraph 1 of Art. 104 Civil Code and paragraph 1 of Art. 15 of the Law, a corresponding decision can be made by the general meeting of shareholders. Moreover, as a general rule, such a decision is voluntary and depends on the will of the shareholders.

Ivan Klimov

Recently, on the website of the Federal Tax Service, it became possible to check data on TIN and other registration data presented by legal entities in certain documents. This service is necessary primarily in order to be able to verify the authenticity of the data provided by partners and make sure that this or that company is actually registered with the tax authority and actually carries out its work. When assigning a TIN to a foreign organization operating on the territory of the Russian Federation, a slightly different TIN encoding is used, in which the first four digits will always be 9909, which is an indication that the organization is registered in the territory of a foreign state.

Mandatory reorganization or prohibition of its voluntary implementation

At the same time, these norms separately stipulate that reorganization may have the nature of a mandatory procedure in cases that are expressly provided for by law. Thus, a JSC must be reorganized without fail (or cannot be reorganized based on a decision of shareholders) in the following cases:

- if there are cases of violation of antimonopoly legislation recorded in the established manner by enterprises occupying a dominant position in the market - Part 1 of Art. 38 of the Law “On Protection of Competition” dated July 26, 2006 No. 135-FZ;

- if the credit organization complies with the grounds established by law for the Bank of Russia's request for its reorganization (violation of liquidity standards, failure to satisfy creditors' claims within 7 days, etc.) - subclauses. 1–3 hours 1 tbsp. 189.26, art. 189.45 of the Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ;

- if the organization is a specialized financial company - Part 3 of Art. 15.2 of the Law “On the Securities Market” dated April 22, 1996 No. 39-FZ.

There are other situations in which voluntary reorganization cannot be carried out or in which it must be carried out without fail. In addition, the legislator establishes some exceptions from the general rules of the procedure. For example, in relation to the reorganization of a joint-stock investment fund (Article 9 of the Law “On Investment Funds” dated November 29, 2001 No. 156-FZ).

Regulation by law

The most important documents regulating the procedure are:

- Civil Code of the Russian Federation. The main types of reorganization, definitions, and features are established by Article 57 of the Civil Code of the Russian Federation.

- Federal Law No. 129-FZ of August 8, 2001 “On state registration of legal entities and individual entrepreneurs.” The procedure, necessary documents, nuances are indicated in Chapter V.

Other regulations establish some restrictions on the choice of legal form into which an existing enterprise can be transformed:

- LLC - into a partnership, a company of another type, a cooperative;

- private institution - to a foundation, non-profit organization, society;

- production cooperative - into a partnership, society;

- CJSC and OJSC - into LLC, non-profit partnership, cooperative.

When determining a new form, it is worth taking into account the requirements established by law for the amount of capital, the number of founders, etc.:

- A company cannot have one legal entity as its founder, which also has a single owner.

- The founder of a partnership must be registered as an individual entrepreneur if he is an individual.

- Minimum size of the capital: LLCs and CJSCs owe more than 10 thousand rubles;

- For OJSC this amount is equal to 100 thousand rubles.

- for partnerships - 2 or more;

Division and spin-off of JSC

The division and separation of joint-stock companies are covered in Art. 18, 19 of the Law, respectively. These forms have a number of similar characteristics. Their main difference is that when a company is divided, new legal entities arise with the cessation of the existence of the divided one, while the legal entity from which the new company is separated continues to carry out its activities.

Within the meaning of paragraph 2 of Art. 19 of the Law, the spin-off can be made only in the form of a joint-stock company, i.e. the legislator does not intend to change the organizational and legal form of the spun-off organization. This is, in particular, evidenced by the mention in sub. 3 p. 3 art. 19 of the Law that when making a decision on spin-off, the issue of how to distribute shares of the spun-off company is decided. A similar conclusion follows from subsection. 3 p. 3 art. 18 of the Law regarding division of society.

Judicial practice also comes to the conclusion that it is impossible to change the form of a new legal entity separated from a joint-stock company, as well as newly formed organizations as a result of the division. Thus, summarizing the established practice of the courts and indicating its position, the Plenum of the Supreme Arbitration Court in paragraph 20 of the resolution “On some issues of application of the Federal Law “On Joint Stock Companies”” dated November 18, 2003 No. 19 (hereinafter referred to as the Resolution) indicated that the division or separation legal entities from a joint-stock company in a form other than a joint-stock company is impossible.

Reorganization for an individual entrepreneur

But changing an individual entrepreneur to an LLC is rather an illogicality. Of course, a businessman registered as an individual entrepreneur can become the sole founder of the organization being created. However, even if he decides to cancel his registration as an individual entrepreneur, the new company will not acquire any responsibilities because of this.

The fact is that the capital and obligations of an organization are separated from the property of its founder, while for an entrepreneur it is not possible to separate personal and work.

Accordingly, the company created by such a businessman will begin its activities with a clean slate, receiving as a bonus only such a non-monetary asset as the business reputation of its founder and, probably, director.

© www.one2start.ru

Reorganization of a joint stock company in the form of merger and acquisition

When merging joint stock companies in accordance with clause 1 of Art. 16 of the Law, a new legal entity arises with the cessation of existence of those participating in the merger. Subp. 3 clause 3 of this norm indicates that when concluding an agreement that is the basis for implementing the merger procedure, it must indicate a condition on the procedure for converting shares of the merged legal entities into shares of the newly created company as a result of the reorganization. The same requirement for the content of the accession agreement is established in sub-clause. 3 p. 3 art. 17 of the Law.

The SAC ruling in paragraph 20 voices a similar position, according to which changing the form during a merger and accession is not possible. The court proceeds from the fact that Art. 16, 17 of the Law do not provide for the possibility of a JSC to join or merge with an organization of another form. The only purpose of the forms of reorganization under consideration may be the creation of a joint-stock company, but only a larger one.

Algorithm of actions during reorganization

Preparatory stage: drawing up a plan and assessing assets

At the initial stage, you need to prepare for the process: draw up a plan to adhere to the deadlines provided for by law, notify the tax authorities in time about the decision to reorganize and create new legal entities, and also notify creditors.

It is important to evaluate property, assets and the extent of liabilities to various creditors. When taking inventory, you should rely on Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49, which provides methodological recommendations.

Confirmation of the decision on reorganization

Having made a decision on reorganization, the company must confirm it with a notarization. The decision of the sole participant of the company is confirmed by his signature certified by a notary (Part 3 of Article 17 of the Federal Law of 02/08/1998 No. 14-FZ).

A notification about the start of the reorganization procedure is sent to the registration authority at the location. The owners' decision is attached to it.

When entering information about the start of reorganization, the following may act as an applicant:

- the head of the permanent executive body of the reorganized legal entity or another person who has the right to act on behalf of this legal entity without a power of attorney;

- if there is a reorganization of two or more legal entities - the head of the permanent executive body of the legal entity that last made the decision on reorganization, or determined by the decision on reorganization, or another person who has the right to act on behalf of these legal entities without a power of attorney - another person acting on the basis of the authority provided for federal law.

The applicant's signature must be certified by a notary. However, this is not necessary if the documents are submitted to the registration authority by the applicant personally with a passport or sent in the form of electronic documents signed with an enhanced qualified electronic signature.

If two or more legal entities are involved in the reorganization process, then the notification is submitted to the registration authority at the location of the legal entity that last made the decision on reorganization, or to the registration authority that is determined in the decision on reorganization.

Deadlines for sending notice of reorganization

From the date of the decision, three working days are established for sending a notice of reorganization. The registration authority also enters the relevant information into the Unified State Register of Legal Entities within a certain period of time - within three working days.

Cancellation of the reorganization procedure is not provided for by current legislation.

After the date of sending the notice of the beginning of the reorganization procedure, the legal entity in the process of reorganization, within five working days, notifies in writing the creditors known to it about the current situation (Clause 2 of Article 13.1 of the Federal Law of 08.08.2001 No. 129-FZ).

Publications in the journal “Bulletin of State Registration”

When an entry about the beginning of the reorganization procedure has already been made in the Unified State Register of Legal Entities, the reorganized enterprise must publish a notice of reorganization twice, once a month, in the journal “Bulletin of State Registration”.

The period for the first publication is at least 30 days from the date of the decision on reorganization. There should be a time interval of a month between the first and second publications. Only after the second publication can a legal entity submit an application to the registration authority.

Violation of the deadline for submitting information about the start of the reorganization will result in a warning or a fine of 5,000 rubles. (clause 3 of article 14.25 of the Code of Administrative Offenses of the Russian Federation).

If two or more companies are involved in the reorganization, then the message is published on behalf of all companies participating in the reorganization.

Reconciliation of settlements with the tax office

Clause 3.3 of the Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01/ [email protected] states that at the beginning of the reorganization procedure, an official from the department for working with taxpayers carries out a reconciliation of the taxpayer’s accounts. The reconciliation report is submitted within 5 days from the date of receipt of the written request by the tax authority.

In accordance with paragraphs. 11th century 32 of the Tax Code of the Russian Federation, you can send a request for a reconciliation and receive a report within the next day after the day of drawing up such a report in the following ways:

- in electronic form via telecommunication channels;

- through the taxpayer’s personal account.

Preparation of documents

So, information about the reorganization was published twice in the journal “Bulletin of State Registration” with an interval of a month. Now is the time for the newly created legal entity to begin collecting all the necessary documents for submission to the registration authority.

Each form of reorganization has its own set of documents.

| Document | Conversion | Merger | Separation | Selection | Accession |

| Application for registration (form No. P12001) | + | + | + | + | — |

| Application for making an entry on the termination of the activities of an affiliated legal entity (Form No. P16003) | — | — | — | — | + |

| Constituent documents (2 original copies - if submitted in person or by mail, 1 copy - if submitted electronically) | + | + | + | + | — |

| Document confirming payment of state duty (RUB 4,000) | + | + | + | + | — |

| Evidence of notification of creditors (copies of publications in the “Bulletin of State Registration” and letters of a legal entity sent to its creditors) | + | + | + | + | — |

| Transfer deed | — | — | + | + | — |

| Merger Agreement (1 original copy) | — | + | — | — | — |

| Treaty of accession | — | — | — | — | + |

Please note that a document confirming the submission of information to the Pension Fund authorities is not required. The Federal Tax Service warns about this on the official website. The tax authority independently requests the necessary information from the territorial body of the Pension Fund.

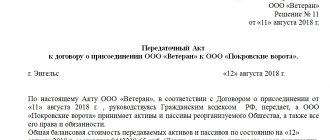

Contents of the accession agreement

During state registration of a legal entity created through reorganization in the form of merger, the applicant is the head of the permanent executive body of the acquired legal entity.

An affiliation agreement must be submitted to the registration authority. It must contain provisions on the procedure and timing of holding a joint general meeting of participants, as well as changes that are made to the company to which the merger is being carried out.

Changes to the charter may be required, in particular, to increase the authorized capital if the company does not have shares on its balance sheet for which the shares of the participants of the acquired company can be exchanged.

If a joint meeting will not be held, this is indicated in the agreement.

In addition to the mandatory provisions, the contract should include:

- name, information about the location of each company participating in the merger;

- procedure and conditions for merger: size of the authorized capital of the company to which the merger is taking place; a list of actions that need to be performed by each company participating in the reorganization, as well as the deadlines for their implementation; order of shares in the authorized capital of the acquired company.

When determining the procedure for exchanging shares, you must remember that a number of shares cannot be exchanged, since they are redeemed (Clause 3.1, Article 53 of Federal Law No. 14-FZ dated 02/08/98).

How to save on paying state fees

From January 1, 2021, the state fee is 4,000 rubles. But it may not be paid if the legal entity sends documents to the registration authority in electronic format (clause 32, clause 3, article 333.35 of the Tax Code of the Russian Federation).

Need an electronic signature? Choose a certificate for your task

To learn more

Why do you need a transfer deed?

Order of the Ministry of Finance of the Russian Federation dated May 20, 2003 No. 44n provides methodological instructions for the preparation of financial statements during reorganization. For formation, the following are required: constituent documents of organizations that appeared as a result of reorganization, decisions of the founders or relevant bodies determined by the legislation of the Russian Federation, agreements on merger or accession in cases established by the legislation of the Russian Federation, a transfer act.

A transfer deed is a document that defines the rights and obligations of organizations during reorganization in the forms of separation and separation. For merger, accession and transformation, such an act, in accordance with Art. 58 of the Civil Code of the Russian Federation, not required.

Without a transfer deed, state registration of legal entities created as a result of reorganization is impossible. Therefore, it is submitted for registration along with the constituent documents.

Before drawing up the transfer deed, an inventory of the property is carried out, since the property and obligations are transferred to the legal successor on the basis of this document.

Participants in the reorganization process have the right to fix the method of assessing the property transferred or accepted in the procedure of legal succession in the decision on reorganization. Property valuation can be carried out:

- at residual value;

- at current market value;

- at a different cost (actual cost of inventories, initial cost of financial investments, etc.).

Who approves the transfer deed:

- founders (participants) of a legal entity;

- the body that made the decision on the reorganization.

What is important to consider when drawing up a transfer deed

Despite the fact that the form of the act is not fixed by law, it must contain some fundamentally important provisions. In particular, this applies to provisions on succession of all obligations of the reorganized legal entity in relation to all its creditors and debtors. The requirement also applies to obligations disputed by the parties - they are also prescribed.

In addition, the act specifies the procedure for determining succession in connection with a change in the type, composition, value of property, the emergence, change, termination of the rights and obligations of the reorganized legal entity, which may occur after the date on which the transfer act was drawn up (clause 1 of Article 59 of the Civil Code RF).

Contents of the transfer deed

The document may include:

- financial statements;

- acts (inventory) of inventory of property and liabilities of the reorganized organization;

- primary accounting documents for material assets subject to acceptance and transfer as a result of reorganization;

- decoding (inventory) of accounts payable and receivable.

Deadlines for drawing up and approving the transfer deed

It is better to draw up the document at the end of the reporting period or the date of preparation of interim financial statements.

Clause 5 of the Methodological Instructions clarifies that the date of approval of the act is determined by the founders within the period of reorganization provided for in the agreement (decision) of the founders on reorganization, taking into account the necessary procedures provided for by law (notification of creditors (shareholders, participants) about the decision on reorganization and presentation them requirements for termination or early fulfillment of obligations and compensation for losses, inventory of property and obligations, etc.).

Submission of documents to the registration authority

You can send documents in one of the following ways:

- by mail

- at the MFC

- notary (at the request of the applicant)

- in electronic format on the Federal Tax Service website (documents must be signed with an enhanced qualified electronic signature of the applicant)

If the package is generated electronically, then the documents must be scanned taking into account the technical requirements and certified with the electronic signature of the applicant or the signature of a notary. In this case, the signature key must be valid at the time of signing the electronic document and on the day the documents are sent to the tax authority.

When reorganizing in the form of merger, documents are submitted to the tax office at the location of the company to which the merger is taking place.

Documents receiving

After submitting documents for state registration, you will receive them on the 6th working day.

The applicant can do this personally or through a representative. The set of state registration documents includes:

- Unified State Register of Legal Entities sheet;

- constituent document with a mark of the registering authority (1 copy).

If documents were submitted to the inspection or by mail, then receipt is carried out by mail to the applicant’s address.

If the applicant applied to the MFC, he will receive them here. The same procedure applies in the case of sending documents through a notary - receipt from the notary.

If the documents were sent electronically via the Internet, then the finished set will be sent by email.

Succession

After the company has gone through all stages of reorganization, has completed and received the necessary documents, the obligations to pay taxes and fees pass to the legal successor, regardless of whether he was aware of the facts and circumstances of failure to fulfill obligations by the reorganized legal entity (Clause 2 of Article 50 of the Tax Code of the Russian Federation ).

The assignee will have to pay all penalties due on the duties transferred to him, as well as fines imposed before the reorganization.

Who becomes the legal successor for the payment of taxes and fees

- In case of a merger, a legal entity resulting from the merger of several legal entities.

- Upon merger, the legal entity that merged it becomes the legal successor of the merged legal entity.

- In the case of division - the legal entity that arose as a result of the division.

Rights and obligations, according to paragraph 3 of Art. 58 of the Civil Code of the Russian Federation, are transferred in accordance with the transfer act. If this document does not allow determining the share of the legal successor or excludes the possibility of fulfilling obligations in full, or the reorganization was aimed at non-fulfillment of the obligation to pay taxes and fees, then, by a court decision, the newly created legal entities can fulfill these obligations jointly and severally.

- When separated, there is no succession.

As in the previous case, if, as a result of the separation, the taxpayer is unable to fully fulfill the obligations to pay taxes and fees, and such reorganization was conceived and organized for the sake of failure to fulfill the obligation, then by a court decision the separated legal entities can fulfill the obligations jointly and severally.

- Upon transformation, the newly created legal entity becomes the legal successor.

Features of converting a JSC into an LLC

The transformation of a joint stock company into a limited liability company is subject to the rules of Art. 20 of the Law. Thus, the reorganization procedure in this form includes the following main stages:

- submission by the executive body of the company to the general meeting of shareholders of the issue of reorganizing the JSC into an LLC;

- adoption by the general meeting of a decision on reorganization (its content must comply with the requirements of paragraph 3 of Article 20 of the Law);

- drawing up and sending to the tax inspectorate an application for registration of the reorganization;

- exchange of company shares for shares in the authorized capital of a newly created LLC;

- completion of the procedure (receipt of documents from the tax office based on the results of consideration of the application for reorganization).

Practical difficulties are caused by the procedure for exchanging shares for shares in the authorized capital of an LLC. In accordance with sub. 3 p. 3 art. 20 of the Law, in the decision on transformation, shareholders must determine the procedure for such an exchange. With clear regulation, the procedure is implemented without serious problems, which is confirmed by the decision of the Arbitration Court of the Volga District dated April 12, 2016 in case No. A12-26775/2015.

Other nuances

Conversion is a rather complex procedure. There are a few more nuances, knowledge of which will allow you to carry it out without violations:

- The liquidated enterprise must draw up final financial statements as of the date preceding the day the reorganization was recorded.

- The new organization must provide introductory reports. It is compiled by transferring indicators from the final one.

- If an enterprise used a special tax regime, then after reorganization it can apply the simplified tax system or UTII only if it submits an application to the tax authorities.

- Small organizations wishing to switch to the simplified tax system or UTII can submit a corresponding application within five days from the date of creation.

- The duration of the procedure is approximately 2-3 months .

- To implement this, you can use the services of specialized companies.

Change from CJSC to JSC

With the entry into force of the innovations of the Civil Code introduced by Law No. 99-FZ dated 05/05/2014, such concepts as a closed or open joint-stock company ceased to exist. Instead, the concepts of non-public and public joint-stock companies were introduced.

In this regard, by virtue of Part 5 of Art. 3 of Law 99-FZ from 01.09.2014 the creation of organizations in the form of a closed joint stock company becomes impossible. When settling legal relations with the participation of closed joint stock companies and in relation to organizations of this form, the newly introduced rules on joint stock companies in the Civil Code are applied. That is, closed joint-stock companies are actually considered joint-stock companies, and changes in the organizational and legal form are not additionally required (Part 10 of the said law).

However, it is still necessary to make changes to the constituent documents of the former closed joint-stock company in order to bring them into compliance with the current norms of the Civil Code. But on the basis of Part 7 of Art. 3 of Law 99-FZ, this should be done the next time changes are made that are not related to the need to bring documents into compliance with new legislation.

When the OGRN of a legal entity changes

The date of deregistration of an organization and exclusion of information from the Unified State Register of Legal Entities is the date of entry into the Unified State Register of Legal Entities of an entry on the termination of the activities of a legal entity as a result of reorganization. The tax authority is obliged to send information about the deregistration of an organization in connection with the termination of the activities of a legal entity as a result of reorganization and an extract from the Unified State Register of Legal Entities via communication channels to the tax authorities where the organization is registered on the grounds established by the Tax Code of the Russian Federation, no later than the working day following the day the organization is deregistered (clause 3.5 of the Procedure). The TIN of an organization reorganized in the form of separation or merger does not change . An organization that has separated from the reorganized organization is assigned a new Taxpayer Identification Number (TIN). When deregistered due to termination of activities as a result of reorganization, the TIN of the merging organization is invalidated. If such data changes, the state registration tax authority issues a certificate of amendment to the unified state register of registration of legal entities. The registration number issued at the time of registration of a legal entity remains unchanged. Since only notes about changes are entered into the unified register, the main certificate received by the company on the day of its official establishment remains valid.

Results

In conclusion, let's summarize some results:

- when dividing a joint stock company or separating a legal entity from it, the organizational and legal form of the JSC must be preserved;

- mergers and acquisitions of joint stock companies are possible only with organizations that have the same organizational and legal form;

- the purpose of reorganization in the form of a merger or accession is the consolidation of a joint-stock company, the combination of assets of several joint-stock companies;

- the transformation of a joint-stock company, including into an LLC, is carried out according to the rules of Art. 20 of the Law;

- from 09/01/2014, an enterprise cannot be registered in the form of a closed joint-stock company, and previously created closed joint-stock companies are equated to a joint-stock company;

- bringing the constituent documents of previously created CJSCs into compliance with the norms of the Civil Code must be carried out together with the next amendments to these documents.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When does the tax identification number of a legal entity change?

As stated in the said Order of the Ministry of Taxes of the Russian Federation, the tax authority that deregistered the organization is obliged to send information about the deregistration of the organization in connection with the termination of the activities of the legal entity as a result of reorganization and an extract from the Unified State Register of Legal Entities via communication channels to the tax authorities in which the organization is a member. registered on the grounds established by the Tax Code of the Russian Federation, no later than the working day following the day the organization is deregistered. In accordance with clause 3.3 of this procedure, taxpayer identification numbers (TINs) may be invalidated if changes are made to the regulatory legal acts of the Russian Federation. A taxpayer identification number (TIN) that has been declared invalid cannot be assigned to another taxpayer. If an organization or individual has more than one taxpayer identification number (TIN), only one of them is recognized as valid, the rest are invalid. Taxpayer identification numbers (TINs) recognized as invalid are posted on the websites of the departments of the Ministry of Taxes and Taxes of Russia for the constituent entities of the Russian Federation.

In what cases is form P14001 filled out?

- Everything related to a share in an LLC: sales, donations, inheritance, withdrawal of a participant and distribution of his share.

- Change of director.

- Change of legal address, if it does not change in the Charter (the Charter indicates only the locality, without a detailed address, and the new address will be in the same locality).

- Changing OKVED codes, if this does not contradict information about the types of activities of the company specified in the Charter.

- Correcting errors in the Unified State Register of Legal Entities.

When making various changes (for example, a change of director and addition of OKVED codes), you can submit one application on form P14001, but you cannot indicate in one application a change in registration information and correction of errors in the Unified State Register of Legal Entities.

We make and change the TIN of the organization

A certificate of tax registration, or otherwise INN, is issued on a special form. If you try to find on the Internet an example of what a taxpayer identification number of a legal entity looks like, you will see a large variety of options for filling it out, and even more so for the appearance of the document.

- appear at the territorial tax office;

- draw up an application for a duplicate (ask tax officials to help you with this);

- provide documents confirming your registration, as well as a passport;

- pay a state fee of three hundred rubles;

- wait five working days and pick up the document.

Procedure for submitting an application in form P14001

Depending on the situation, the package of documents for reporting new registration information also includes:

- minutes of the general meeting of participants or the decision of the sole participant to change registration information;

- agreement on the sale of the share and a document confirming its payment;

- certificate of right to inherit a share;

- participant’s statement about leaving the LLC;

- documents confirming the right to use the premises at the new address (lease agreement, letter of guarantee from the owner or a copy of the certificate of ownership);

There is no state fee when submitting an application in form P14001.

The authenticity of the applicant's signature on form P14001 must be notarized. The notary mark is affixed on page 4 of sheet “P”. You must report changes in registration information using form P14001 to the registering tax office within three working days (Article 5 of the Law “On State Registration”).