As always, we will try to answer the question “Travel allowances in RSV 2020”. You can also consult with lawyers for free online directly on the website without leaving your home.

Tax Code of the Russian Federation (taking into account the provisions of paragraph 7 of Article 81 of the Tax Code of the Russian Federation as amended by Federal Law dated July 3, 2016 N 243-F). At the same time, however, we note that in the circumstances we are considering, we are not talking about errors or distortions in the accrued insurance premiums. Federal Tax Service in a letter dated November 2021. Now, if the daily allowance, say 100 rubles, was not reflected in the calculation of contributions, you will have to submit updated calculations for insurance premiums.

General concept of daily expenses

Daily expenses are funds that are provided to an employee as additional expenses to pay for housing, as well as food outside the place of food.

When an employee is sent on a business trip, he must be paid a daily allowance for each day he spends on a business trip.

The amount of daily allowance is not regulated by law. But according to clause 11 of the Regulations approved by the Government of the Russian Federation dated October 13, 2008 No. 749, the enterprise must provide the posted employee with funds that he can spend on accommodation and transportation.

The daily allowance includes the following expenses:

- Fare;

- Living expenses;

- Food expenses

- Costs for business calls, Internet, banking or postal services, etc.

While on a business trip, an employee can spend daily funds for any purpose, and does not have to account for them.

Place of business travelers in RSV-1

1) daily allowance;

2) actually incurred and documented expenses:

- for travel to the destination and back (including fees for airport services, commission fees, costs of travel to the airport or train station (at the place of departure, destination, transfer), for baggage transportation);

- for renting residential premises;

- to pay for communication services;

- for payment of fees for issuing a service passport, fees for issuing visas;

- to exchange cash currency (or a bank check for cash foreign currency).

All other expenses compensated to the business traveler, as well as the mentioned expenses reimbursed to him without supporting documents, are included in the base for calculating insurance premiums. 1 tbsp. 8 of Law No. 212-FZ.

MORE: Sum insured and insured value

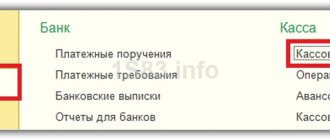

Travel expenses reimbursed to an employee reflect:

- in general for the organization in subsection 2.1 of section 2;

- separately in individual information for each employee who went on a business trip.

| Section 2. Calculation of insurance premiums by tariff and additional tariff |

2.1. Calculation of insurance premiums according to tariff

(rub. kop.)

In individual information for each employee, the amount of travel expenses reimbursed to him (daily allowance, travel costs, accommodation, etc.) is shown in subsection 6.4 of section 6 of the RSV-1 calculation in the total amount of payments that are subject to contributions to compulsory pension insurance.

When filling out information about the length of service of a posted worker in subsection 6.8 of Section 6, keep in mind that there is no special code entered in column 7 for the period of being on a business trip. This is a normal working period.

Section 6. Information on the amount of payments and other remuneration and the insurance period of the insured person

…

6.4. Information on the amount of payments and other remuneration accrued in favor of an individual

(rub. kop.)

Daily expenses

The amount of daily expenses is not established at the legislative level. The company independently establishes daily expenses in its internal regulations, for example this may be the Regulations on Business Travel.

At the legislative level, the maximum amount of daily payments is established and this is set out in paragraph. 12 clause 3 art. 217 of the Tax Code of the Russian Federation, from which income tax is not paid, namely:

- Business trip within the territory of the Russian Federation – 700 rubles;

- Business trip outside the Russian Federation – 2500 rubles.

If an enterprise sets the daily allowance in its internal regulations at 1,200 rubles, then it is necessary to pay income tax on the amount of 500 rubles.

How to calculate daily allowance during a business trip in Russia and abroad

The formula for calculating daily expenses is the same for both trips within Russia and for trips abroad. And she looks like this:

RS = SD × D,

Where

RS – estimated daily allowance;

SD – the amount of daily allowance for one day, which is established at the enterprise in internal regulatory documents;

D – Duration of a business trip, which is expressed in days, including days en route.

Important!!! If an employee has not spent all his daily allowances during a business trip, he is not obliged to return them to the company’s cash desk, much less account for them.

There are also cases when the provided daily allowance is not enough for an employee during a business trip. In this case, you can contact the head of the company to agree on additional daily allowances or spend your money during a business trip, which, after returning from a business trip, the company will compensate for the costs, only for this you need to save all supporting documents.

Calculation adjustment

Make an adjustment to the RSV if:

- in previous calculations the amount of contributions was incorrectly indicated;

- there are discrepancies between the total amount of contributions and the amounts accrued for each insured person;

- Incorrect personal information is provided for the employee. To avoid rejection of the report for this reason, it is necessary to regularly reconcile the personal data of employees.

The fact that the calculation is corrective must be indicated in the “Adjustment number” field on the title page. So, when submitting the initial report, the value “0—” is indicated in this field, and when submitting an adjustment, the value is indicated by the numbers “1—”, “2—” and so on in order.

If an adjustment report is filed within 30 days after the reporting period, that is, within the standard deadline for filing this report, the date of submission of the report is considered the date the adjustment was filed. If the tax inspectorate finds errors, then you have 5 working days after receiving the notification by email or 10 working days from the date the paper notification was sent to resubmit the report. The report is considered submitted if all changes and adjustments are made within the specified period.

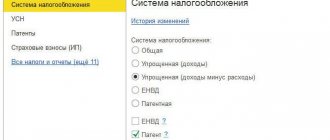

Changes in insurance premiums for daily expenses in 2017

In 2021, insurance premiums intended for the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund began to be controlled by the tax service. The rules for transferring these contributions are described in a separate section of the Tax Code of the Russian Federation.

The above contributions until 2021 had to be transferred in accordance with the federal law “On Insurance Contributions...” dated July 24, 2009 No. 212-FZ, which has already lost force. And in paragraph 2 of Article 9 it was said that daily allowances are in no way subject to insurance premiums, regardless of where the employee is sent, either within the territory of the Russian Federation or abroad. And the amount of daily allowance had no restrictions.

In the rules established by the new legal act (clause 2 of Article 422 of the Tax Code of the Russian Federation), a similar rule has been changed and contains a reference to restrictions within which daily allowance contributions may not be charged. Thus, exceeding the established limits automatically results in an obligation to charge insurance premiums for daily allowances in 2017-2021.

What daily allowances are considered to be issued in excess of the norm?

The new regulations on daily expenses state that daily allowances that are provided within the limits of the limit are not withheld from income tax and insurance premiums are deducted.

The amount limits are as follows:

- 700 rubles – business trip within the territory of the Russian Federation;

- 2500 rubles – business trip abroad.

Daily allowances that are issued for a business trip abroad can also be issued in foreign currency. Only in this case, on the day of issue, they must be converted at the ruble exchange rate. The question immediately arises, on what day is it necessary to convert the currency into rubles and from here the amount that is issued to the employee will be determined and is there an excess of the daily limit and is it necessary to pay tax and charge insurance premiums on them? According to letter No. 03-15-06/15230 of the Ministry of Finance of Russia dated March 16, 2017, recalculation must be carried out on the date when the advance report on the business trip is approved.

Thus, from 2021, not only the income tax of individuals should be withheld from the amount of excess daily allowance, but also insurance premiums for pension, medical and social insurance (OPS, compulsory medical insurance and compulsory social insurance (in terms of disability and maternity insurance)) should be charged.

The legislative framework

Within the framework of this issue, it makes sense to mention two codes at once - Labor and Tax. Both of them contain general or detailed information about excess daily allowance and how this payment is subject to insurance premiums. The following table will help to clearly consider this issue:

| Code | Information about excess daily allowances |

| Labor Code | 1. According to Art. 168, the employer is obliged to reimburse the employee’s expenses related to living outside his place of permanent residence. 2. The employer can independently determine the amount of daily allowance, fixing it in a local regulation or in a collective agreement. 3. A business trip is work carried out by an employee for a specified period outside the place of work and involving residence in a place remote from his permanent home. If the work officially involves traveling, then such a trip is not considered a business trip. At the same time, while on a business trip, an employee cannot lose the established salary or lose his job: his working conditions must remain the same throughout the entire period of the business trip. |

| tax code | 1. Daily allowances that exceed the norm established by the Government do not make the income tax base smaller (Article 264). 2. Article No. 217 limits the amount of daily allowance paid to an employee, which is not taxed. 3. Compensation payments established by local, regional, district, and federal legislation, the amount of which does not exceed the norms established by law, are completely exempt from taxation (Article 217). 4. Article No. 226 specifies the procedure for withholding personal income tax from daily allowances, which it is recommended that the accountant adhere to. |

In addition, it is important to refer to two decrees of the Government of the Russian Federation that address the issue of daily allowances. The first of them, No. 93, contains information about the rate of daily allowance paid and some of their features. Second, No. 729 includes the amount of reimbursement of travel expenses within budgetary organizations.

How to show daily allowances in a single calculation of insurance premiums

Reflect the entire amount of daily allowance in the calculation of insurance premiums on line 030 of subsection 1.1 of Appendix 1 to Section 1. The amount of daily allowance within the limits of the standard is not subject to insurance premiums. Therefore, reflect it on line 040 of subsection 1.1 of appendix 1 to section 1. Similarly, reflect it on lines 030 and 040 of subsection 1.2 and on lines 020 and 030 of appendix 2. Thus, only the taxable part of the daily allowance will be included in the taxable base on line 050 (letter from the Federal Tax Service from 08.08.2017 No. GD-4-11/15569)

In subsection 3.2.1 of section 3, reflect the amount of daily allowance:

- on line 210, indicate the entire amount of daily allowance (within the norms and above the norms);

- In line 220, include only the taxable amount, that is, in excess of the norms.

Features of reflecting travel allowances in RSV-1

Traditionally, a posted worker is given money on account to pay for travel, accommodation, other expenses and daily allowances authorized by the manager. 168 Labor Code of the Russian Federation; clause 10 of the Regulations, approved. Government Decree No. 749 dated October 13, 2008. The following situation is also possible: the business traveler pays all expenses from his own funds.

And then he turns to the employer for reimbursement of these expenses. In both cases, there is a payment of money to the employee to compensate for travel expenses, which is recognized as an object of taxation. Such amounts are reflected in the general manner in individual information for the posted employee and in subsection 2.1 of section 2 of the RSV-1 calculation.

But how to fill out pension statements when the tickets and hotel are not paid for by the employee himself?