The basis of the legislative framework regarding insurance payments for 2017 is the following key legal acts:

- Tax Code of the Russian Federation, ch. 34 (on insurance fees in the Russian Federation), art. 431, clause 8 (calculation, payment, reimbursement of insurance premiums), art. 422 (amounts not subject to insurance contributions);

- Federal Law No. 243 of 07/03/2016 and No. 250, Art. 20 in the latest edition.

The reasons for the situation when insurance premiums need to be charged additionally can be different: omission of a period, mistakes made out of ignorance, violations, deliberate evasion of timely payment of premiums over several periods. For example, the tax base was erroneously understated or contributions subject to contributions were not taken into account in past periods.

Additional insurance accruals for past periods, if such a need arises, are required to be made by the following categories of employers and responsible persons:

- all legal entities (organizations with full-time employees, as well as those working under civil contracts);

- private entrepreneurs who have employees;

- PE on a patent or those who work privately (notaries, lawyers, jurists, etc.);

- individuals working with other individuals or contractors on the basis of an employment agreement.

The tax period for insurance payments to extra-budgetary funds is the calendar year. Reporting for 2017 is generated quarterly, half-yearly or 9 months. Often many operations simply cannot be performed on the current date. But in all the proposed situations, additional accrual will be an inevitable action that will sooner or later need to be performed.

Who checks?

So, the legislator gives the tax service and the Social Insurance Fund the right to carry out inspections. Inspections can be both desk-based and on-site.

Refusal to accept payment amounts for credit is not a reason for additional assessment of insurance premiums

Insurance premiums are verified:

- for compulsory pension insurance - Federal Tax Service;

- for compulsory health insurance - Federal Tax Service;

- in case of temporary disability and in connection with maternity (“sick leave”) - the Federal Tax Service;

- insurance against accidents at work and occupational diseases (contributions for injuries) - Social Insurance Fund.

On a note! The recipient and administrator of the contributions may not be the same. For example, the recipient of contributions under compulsory pension insurance is the Pension Fund, in case of temporary disability - the Social Insurance Fund. The Federal Tax Service monitors the completeness and urgency of payment of contributions.

IMPORTANT! A complaint to a higher authority against the tax authority’s decision to charge additional insurance premiums from ConsultantPlus is available at the link

Most often, scheduled inspections are carried out according to a schedule that complies with federal legislation. However, if a company undergoes reorganization, is liquidated, or a supervisory authority receives a complaint from an employee, an unscheduled inspection is carried out.

For periods up to 2021, inspections are carried out by the FSS and the Pension Fund.

Accounting for benefits not accepted for credit by the Social Insurance Fund: the employee returned the benefit

Accounting for social benefits not offset or reimbursed by social insurance depends on whether the employee returned the benefit, and whether it was initially subject to income tax.

For uncredited benefits - in accounting, the accountant reverses the entries for the accrual of the amounts of these payments. The accounting date will correspond to the date of the fund’s decision not to accept expenses. Then social expenses not confirmed by the fund can be withheld from the employee, but only in 2 cases:

- provision by the employee of knowingly incorrect information for calculating benefits (fake sick leave, certificate of earnings for the last 2 years with inflated amounts of the employee’s income);

- Accountant making a counting error.

According to Part 4 of Art. 137 Labor Code of the Russian Federation, Part 4, Art. 15 of Law 255-FZ, Part 1, Art. 138 of the Labor Code of the Russian Federation, such amounts can be withheld from the employee’s labor income, but not more than 20% of earnings for each month. In other situations, the return of excess social benefits is made by the employee voluntarily.

If an employee returns benefits voluntarily or social benefits are withheld from his salary, then the accounting records will be as follows:

| Debit | Credit | |

| Reversal of accrual of uncredited social benefits | ||

| 20, 23, 25, 26, 44 | Reversal of disability benefits for the first 3 days of illness | |

| Reversal of personal income tax from temporary disability benefits | ||

| 73, 76 | Social benefits are charged to the account of settlements with personnel for other operations. If the employee has already quit, but returns the overpayment, use account 76 | |

| 50, 51, 70 | 73, 76 | The employee voluntarily returned the amount of the wrongfully paid benefit or this amount was withheld from his salary |

| The uncredited allowance was paid in addition - since the VNIM contributions payable were previously reduced by its amount | ||

| Excessively withheld personal income tax was returned to the employee’s bank card |

Reasons for additional contributions

Additional assessment of contributions, as a rule, is a consequence of underestimating the base in calculations.

In practice, errors most often occur for the following reasons:

- Incorrect application of settlement rates. Thus, the current rate for compulsory health insurance is 22%, for compulsory medical insurance – 5.1%, for compulsory social insurance – 2.9%, and contributions “for injuries” depend on the type of activity of the company. Their value can range from 0.2 to 8.5%.

- Incorrect use of base limits for calculating insurance premiums for the current year. A similar situation may arise if the company is large, the wages of employees are quite high and at some point may exceed the limits established by government regulation in relation to one employee. In such cases, for pension contributions the basic tariff is set at 10%, and for contributions to the Social Insurance Fund, accrual occurs only within the limit (Article 425 of the Tax Code of the Russian Federation). Errors affect the OPS and OSS databases.

- Errors in including payments in the contribution base. In a general sense, this is the employee's income subject to contributions. The list of income is given in Art. 420 of the Tax Code of the Russian Federation, and in Art. 422 contains a similar list of amounts not included in the base. For example, financial assistance only in the amount of up to 4,000 rubles is not subject to contributions; compensation for unused vacation upon dismissal may be mistakenly not included in the base, etc.

The reason for additional accrual may also be calculation errors, incorrect transfer of data from previous periods, or even deliberate evasion of payment of contributions.

Based on the act, the company is obliged to calculate an additional amount to the funds, reflect it in accounting and make payment or resolve the issue in court.

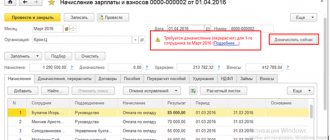

Accounting for additional accrual of insurance premiums in accordance with the inspection report

All transactions for additional insurance charges are recorded in accounting records. Incorrect display of additional charges will be considered an error, but not a violation. Accordingly, sanctions are not applied to the payer here. At the same time, the very fact of additional credits for contributions based on the instructions of the inspector is not recognized as an error in accounting.

| Postings for additional charges in accordance with the verification report | Characteristic |

| Debit 91-2 Credit 69-1 | Additional accrual of Social Insurance Fund |

| Debit 91-2 Credit 69-2 | Additional accrual of the Pension Fund |

| Debit 91-2 Credit 69-3 | Additional accrual of FFOMS |

The decision based on the results of the control carried out comes into force 10 days from the date of its presentation to the person being inspected. Accounting shows additional accrual transactions on the date when the decision took effect. Credited insurance premiums are included in other expenses, which, in turn, are included in the income and damage account (

How to reflect additional accrual in reporting?

Additional charges must be reflected:

- in the calculation of insurance premiums, which is submitted to the Federal Tax Service;

- in form 4-FSS, which is submitted to the Social Insurance Fund.

In both cases, adjustment reports are submitted, where the adjustment number is indicated in the appropriate field.

When paying additionally accrued contributions (respectively, “for injuries” - to the Social Insurance Fund, the rest - to the Federal Tax Service) and possible penalties for them, it is important to pay attention to the current payment details. As a rule, they are indicated in the inspection report. If an error occurs, the payment may be classified as unclear and the obligation to pay additional contributions will not be fulfilled. It is necessary to submit an application for clarification of payment.

Accounting for benefits not accepted for credit by the Social Insurance Fund: the employee did not return the benefit

The benefit cannot be recovered from the employee if the failure to offset social benefits arose due to an accountant’s incorrect interpretation of the law when calculating the amount of the benefit (Part 4, Article 15 of Law 255-FZ). In addition, the manager has the right to decide not to collect benefits regardless of the reason for the failure (Article 240 of the Labor Code of the Russian Federation).

If the employee does not return social benefits, then make the following entries:

| Debit | Credit |

| Reversal of accrual of uncredited social benefits | |

| Payments not credited by the fund are charged to other expenses | |

| 69 for subaccounts of settlements with funds or with the Federal Tax Service regarding the calculation of insurance premiums | Insurance premiums accrued on benefits not credited to the Social Insurance Fund |

| Personal income tax withheld from social benefits (except for temporary disability benefits) | |

| 69 s/account “Penies, fines on social contributions” | Penalties were accrued for late social contributions to the budget |

| 68 s/account “Penies, fines for personal income tax” | Penalties accrued for arrears on personal income tax |

| 69/68 for subaccounts of settlements with funds or with the Federal Tax Service regarding the calculation of insurance premiums/personal income tax, 69 s/account “Penies, fines on social contributions”, 68 s/account “Penies, fines on personal income tax” | Insurance premiums, personal income tax, penalties for insurance premiums and personal income tax are transferred to the budget |

Withhold personal income tax from the employee if he has not returned the amounts of incorrectly paid benefits, the tax was not withheld earlier and you decide that it is safer to withhold it. If the employee has already quit, inform the Federal Tax Service about the impossibility of withholding income tax.

In tax accounting, benefits not accepted by the Social Insurance Fund for credit are not included in the calculation of income tax, so a permanent difference arises and a permanent tax liability arises.

Read about fixing the differences between accounting and tax accounting.

Simplificationists also do not take into account benefits that are not included in social insurance in expenses.

What wiring needs to be done?

In accounting, the correction of errors is regulated by PBU 22/2010. The current year's error is corrected in the month in which it was detected (clause 5). If the error is related to the reporting period, it is corrected by posting Dt 20, 25, 44, etc. Kt 69 (according to the corresponding contribution subaccounts).

If we are talking about the previous reporting year, the reporting for which has already been signed, then Dt 91 Kt 69 - in case of a minor error (clause 14 of the PBU). If the error is significant, and the reporting for the year has already been signed, use posting Dt 84 Kt 69 (clause 9 of PBU).

At the same time, the right to determine the significance of an error remains with the organization (clause 3 of the PBU), and therefore many, especially small firms, use the entry Dt 91 Kt 69 (in terms of subaccounts reflecting the types of contributions) for additional accrual.

The issue of reflecting fines under the act has not been fully regulated. Many experts attribute the fine to the account. 91 as other expenses, and a penalty for 99. At the same time, instructions for using the chart of accounts (Order No. 94n 10/31/2000), as well as letters from the Ministry of Finance (see No. 03-03-06/1/42 dated 29/ 01/2007) allow us to say that account 99 reflects the amounts of tax penalties due throughout the year. In this regard, it seems possible to take into account penalties and fines by posting Dt 99 Kt 69.

For example, if, according to the inspection report for the previous period, additional contributions in the amount of 300 rubles were accrued (an insignificant error), a posting is made Dt 91/2 Kt 69 - 300 rubles. Fine the organization in the amount of 200 rubles. and a penalty of 150 rubles. will be taken into account Dt 99 Kt 69 - 350 rubles. Dt 69 Kt 51 – 650 rub. an additional payment was made according to the inspection report and the sanctions were paid off.

Interesting nuance! According to tax authorities, errors in calculations when calculating insurance premiums for compulsory medical insurance cannot serve as a refusal to accept the report. In doing so, they refer to Art. 431 of the Tax Code of the Russian Federation, paragraph 7 (Letter of the Federal Tax Service dated 02/19/18 No. GD-4-11/ [email protected] ). At the same time, when checking, on the basis of Art. 88 of the Tax Code of the Russian Federation, the tax authority will report the error, and it can be corrected with an updated calculation, which is submitted within 5 days. This rule does not apply to community pension contributions.

Briefly

- The administration of wage contributions is handled by the Federal Tax Service, with the exception of contributions for injuries, which are administered by the Social Insurance Fund. The reasons for additional assessment of contributions may be: incorrect interpretation of legislative norms, arithmetic errors, malicious negligence.

- Additional assessment of contributions based on the inspection report entails the need to:

- reflect new data in accounting;

- submit updated calculations to the Federal Tax Service and Social Insurance Fund;

- pay contributions using the correct details, along with penalties and fines.

- In accounting, additional amounts of contributions for previous years are most often reflected in Dt 91. If the error is significant, Dt 84 is taken into account. The accounts correspond with the account. 69 in terms of subaccounts reflecting contributions.

- Sanctions reflect either Dt 91 or Dt 99 accounts. This issue needs to be regulated in the accounting policies.

How to reflect a contribution taxable benefit not credited to the Social Insurance Fund: tax agent reporting

If the fund refused to count or reimburse the benefit, then it is necessary to make adjustments to a number of reporting documentation of the tax agent:

| Reporting | The benefit was initially subject to personal income tax, the employee returned it | The benefit was initially subject to personal income tax, the employee did not return it | The benefit was initially not subject to personal income tax, the employee returned it | The benefit was initially not subject to personal income tax, the employee did not return it |

| 2-NDFL | Exclude the benefit amount from 2-NDFL and submit a corrective certificate | Submit corrective 2-NDFL for the employee, replace sick leave code 2300 with code 4800 | There is no need to correct anything in 2-NDFL | The employee has income that should be reflected in 2-NDFL under code 4800 and income tax withheld. If at the time of discovery of a benefit that has not been credited by the fund, the employee has already quit, then 2-NDFL should be submitted with sign 2 |

| 6-NDFL (if uncredited benefits are discovered in 2021 and later) | Submit the corrective 6-NDFL for the period of illegal payment of benefits, as well as for previous periods - since section 1 of the 6-NDFL form is filled out on an accrual basis from the beginning of the year | There is no need to correct anything in 6-NDFL | The employee now has income, submit the corrective 6-NDFL for the period of unlawful payment of benefits, as well as for previous periods | |

Read more about adjusting the quarterly personal income tax calculation.

How to pay additional taxes

Let's look at an example of paying additional taxes if they were assessed during an on-site audit. It is necessary to draw up a payment order for the transfer of taxes. It is filled out on the basis of Appendix No. 2 to Order of the Ministry of Finance No. 106n dated November 24, 2004. In particular, the payer needs to fill out the fields correctly:

- In field 104 you need to enter the budget classification code. The codes were approved by Order of the Ministry of Finance No. 150n dated December 30, 2009. If this is an order to pay taxes, you need to indicate code 182 1 01 01011 01 1000 110.

- In field 106 you need to indicate the basis for the payment.

- Field 107 indicates the frequency of tax payment.

- Fields 108 and 109 contain the details of the document on the basis of which the payment is made.

- Field 110 indicates the type of payment. If this is a tax transfer, you need to enter “TS”.

It must be remembered that the payer’s responsibility is not only to pay additionally assessed tax, but also to reflect transactions in accounting.

Deadline for additional taxes

The tax base is calculated in the organization based on the results of the tax period.

Federal Tax Service inspectors identify violations that constitute grounds for additional tax assessment in previous reporting periods. At the same time, recalculation of the tax base and additional tax assessment occurs for the period in which violations were detected.

However, the tax authorities are limited in the time frame for identifying the debt.

A tax audit, if on-site, can check periods no older than three years.

When can tax arrears be written off?

Current legislation provides for situations in which tax arrears may be written off. In this case, the debtor will still be considered to have a debt, but it may become uncollectible and, accordingly, no additional sanctions or restrictions will be applied to the debtor for its existence. In particular, tax arrears are considered uncollectible if the debtor:

- It is a liquidated organization.

- He was declared bankrupt in accordance with the procedure established by law.

- He was an individual and died.

- He received a court decision according to which the arrears could not be collected from him.

- He turned to the bailiffs with a request to close the proceedings on the basis that the amount of arrears was insufficient to begin bankruptcy proceedings or if the court refused to recognize bankruptcy due to lack of funds to pay legal costs.

What to do if a large amount of taxes has been assessed

Representatives of the government agency carry out additional assessments based on the results of establishing the correctness of pricing for transactions. Additional charges are made only when the transaction price deviates from market prices by more than 20%.

When increasing the amount of taxes, tax representatives must be guided by Article 40 of the Tax Code of the Russian Federation. This is an article that establishes the principles for determining the cost of goods and services. This regulatory provision specifies the grounds for additional charges. In particular, this is the percentage of deviation from market prices.

If an entrepreneur does not agree with the additional accrual, he can challenge the decision on the grounds that the representatives violated the provisions of Article 40 of the Tax Code of the Russian Federation. For example, paragraph 3 of Article 40 of the Tax Code of the Russian Federation is often violated. In this case, tax authorities do not set market prices. When recalculating the tax, the cost indicator is used. Such a decision is declared illegal (paragraph 4 of the Letter of the Presidium of the Supreme Arbitration Court No. 71).

What to write in an appeal

Do you have a VAT or profit check? — Here are the October 2017 clarifications of the Federal Tax Service on inspections (reality of operations, business purpose, schemes, distortions in reporting)

Tax lawyer Gordon A.E.

VAT deductions are taken only as part of a tax audit - desk or on-site, and this is documented with a whole set of documents.

Therefore, at a minimum, there must be a tax audit report that can be challenged, just like the audit decision made. Moreover, a challenge is possible both for violations of the taxation procedure and for violations of the procedure for considering and making a decision based on the results of a tax audit.

We recommend that already at the tax audit stage you receive legal support for tax audits from a lawyer or lawyer specializing in taxes.

They have the necessary experience and knowledge, and will advise the least unprofitable way to resolve a tax dispute in your situation.

When it is necessary

So, let’s denote cases of restoration of VAT previously accepted for deduction:

- The company ceases to be a VAT payer. Let us remind you that only companies and individual entrepreneurs using OSNO are recognized as VAT payers. Taxpayers under special and/or simplified taxation regimes can pay VAT, but do not have the right to claim it as a deduction. Consequently, the transition to simplified (special) tax regimes is the basis for the restoration of value added tax, previously taken into account as a tax deduction.

- Goods, work, services, property rights, property, intangible assets and other assets acquired for use in taxable activities began to be used in transactions exempt (Article 149 of the Tax Code of the Russian Federation) or non-taxable (Article 146 of the Tax Code of the Russian Federation). Or the place of sale of assets is outside the Russian Federation. In addition to the operations named in paragraphs. 2 p. 3 art. 170 Tax Code of the Russian Federation.

- An organization or individual entrepreneur has obtained the right to be exempt from paying value added tax. To use this privilege, special conditions must be met (revenue for the quarter - no more than 2 million rubles). Entities on the Unified Agricultural Tax do not have the right to apply the exemption.

- The cost of purchased goods, work, services, property or property rights, intangible assets and other things was reduced under the terms of the agreement with the counterparty.

- If the “Input Tax” was claimed by you for deduction in full, that is, from the entire cost of purchased goods, works, services, but for the advance payment you previously paid for future payment, you have already accepted VAT for deduction.

- For a previously paid advance against future supplies, you accepted tax as a deduction, but as a result of termination of the contract or a significant change in its terms, the advance was returned. You will also have to restore VAT when writing off receivables for advance payments for goods, work, services that you never received.

- Your company has received budget subsidies or investments that are aimed at compensating the costs of purchasing goods, works, services, or received to reimburse the costs of paying taxes when importing goods into the territory of the Russian Federation.

- When transferring a property asset (OS, MZ, NMA, property rights, etc.) as a contribution to the authorized capital of an organization (share contributions to mutual funds of cooperatives, contribution to the share capital of a partnership, contribution to an investment partnership) or when transferring real estate as a replenishment endowment capital of NPOs. There are exceptions (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation).

If similar cases occur in the activities of your company, then it is imperative to restore the amounts of VAT previously accepted for deduction. Otherwise, these circumstances will be revealed by the Federal Tax Service during desk or counter inspections. As a result, the Tax Inspectorate will issue the arrears for payment to the budget, and will also charge penalties and fines.

The second stage is consideration of the tax audit report and objections.

You must convey your arguments (objections) to the act to the tax authority. Consideration of the act and objections is carried out by the head of the tax authority that drew up the act. The examination is carried out at the tax authority, in person, in the presence of the person in respect of whom the tax audit report was drawn up. The person is notified in writing about the date, time and place of consideration of the act in advance.

At this stage, two tax mistakes are typical, which allow you to cancel the decision:

1) They do not notify the person about the date, time and place of consideration (they forget, the address is not correct, etc.)

2) The decision is not signed by the manager who reviewed the act and objections.

During the consideration, the arguments of the tax office and the taxpayer are heard.

Important:

The stage of consideration of the act and objections is the only stage when the taxpayer has the opportunity, and the tax office is obliged, to familiarize him with all the materials of the tax audit. Requests, responses to them, interrogation protocols, Premises Inspection Reports, Seizure Protocols and Expert Opinions, etc. are available. and so on. Including answers from law enforcement agencies.

This opportunity must be used to obtain the maximum amount of evidence, since at this stage it can be established that the evidence was obtained in violation of the law.

Sometimes, particularly zealous inspectors or deputy heads of the inspectorate prevent you from familiarizing yourself with or providing all tax audit materials. In this case, it is necessary to reflect such violations in the protocol, which must be drawn up when considering the act and objections.

Before consideration, you need to be prepared for public speaking, since orally in a short time you need to clearly and concisely state your position, be ready to present specific supporting documents, and object to the arguments and comments of the tax office.

In addition to the head of the inspection, at least 3-5 people from the tax office are present during the review.

The line of behavior of the person in respect of whom the act is drawn up during the consideration of the act and objections can be active, passive, provocative, depending on the chosen defense tactics.

In particular, the actions of a person may provoke the appointment of additional tax control measures (Part 6 of Article 101 of the Tax Code of the Russian Federation).

Formally, additional measures are appointed to obtain additional evidence to confirm the fact of violations of the legislation on taxes and fees or the absence thereof.

Additional measures may include requesting documents in accordance with Articles 93 and 93.1 of the Tax Code of the Russian Federation, questioning a witness, and conducting an examination.

The duration of additional activities is no more than 1 month.

Grounds for additional tax assessment

The tax office assesses additional taxes based on the results of on-site and desk audits for a number of reasons. Additional assessment is the procedure for the tax inspectorate to recalculate the tax base and the amount of tax for the period in which errors or distortions were discovered.

Thus, the reason for additional taxes is distortions in the calculation of the tax base.

At the same time, enterprises calculate the tax base for the purposes of paying different taxes, and the reasons for their additional assessment may be different.

In practice, there are the most common reasons that can be regarded by the tax authority as a distortion in calculating the tax base.

The tax base is distorted when the tax authorities have established and proven the following facts:

- receiving income that was not included in the declaration;

- “inflating” expenses;

- unjustified receipt of tax benefits.

All reasons are indicated in the letter of the Federal Tax Service No. BS-4-11/20019 “On Taxation” dated November 16, 2015.

Article 54.1 of the Tax Code defines distortion of the tax base as facts of reduction of the tax base by misrepresentation of the facts of economic life by:

- Conducting a transaction for the purpose of non-payment or incomplete payment of tax

- The obligation under the transaction is fulfilled by the proper party to the contract

Tax benefit is understood as receiving tax breaks on grounds that were created “artificially” by the organization - division of business, creation of affiliated organizations, transactions with affiliated organizations. Don’t forget about the accountant’s banal mistakes when calculating the amount of tax.

Attention: watch a video on the topic of tax audits and disputes with tax authorities, ask your question in the comments to the video and get free legal advice on the YouTube channel, just don’t forget to subscribe: