Transaction code 22 in the purchase ledger

Organizations and individual entrepreneurs carrying out their financial and economic activities with the calculation of value added tax “VAT” and submitting tax reports on it are required to use the appropriate transaction codes and reflect these codes in registers, as well as in VAT returns.

Codes of types of transactions for tax accounting registers were approved by order of the Federal Tax Service dated March 14, 2016 No. ММВ-7-3/ [email protected] Their list is periodically updated with the introduction of new codes. To reflect codes in documents, special columns are provided: No. 2 in the sales/purchase books, No. 3 in the invoice journals. In 2021, the cipher registry has changed slightly, some of the codes used have been canceled, others have been added, and others have been detailed.

Correct indication of codes when documenting transactions is very important, since information from registers is transferred to the declaration and analyzed by tax authorities. The code details the type of operation and characterizes the algorithm for issuing an invoice and calculating VAT. For example, when deducting VAT on a transaction confirmed by documents, code 23 is indicated. When checking, the software resource of the Federal Tax Service recognizes that invoices are not registered using this code. An error in specifying the code will indicate a discrepancy, and the Federal Tax Service will request an explanation. True, the law does not provide for the imposition of penalties for such inaccuracies.

The transaction type code is used when entering an invoice into the purchase/sales ledger. The list of codes was approved by order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/136. This list is amended by law as necessary.

| Each individual code marks a specific operation or series of operations. From the table above we see that code “01” is used when purchasing or selling goods (work; it is applied to the operation of full or partial payment for deliveries in future periods, including under agency agreements, etc. The use of code “22” in the purchase book occurs in two groups of transactions. |

Special sections of the declaration

For exporters, the VAT declaration provides:

- section 4 – to reflect the tax in the case where the zero rate is confirmed;

- section 5 – to reflect tax deductions;

- Section 6 – to reflect tax when the zero rate is not confirmed.

In the same sections, report on exports to member states of the Customs Union. For the purposes of calculating VAT for Russian organizations, the following is equivalent to the export of goods:

- manufacturing of goods intended for export to countries participating in the Customs Union (clause 9 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- transfer of goods under a leasing agreement, which provides for the transfer of ownership to the lessee, as well as under trade credit or trade loan agreements (clause 11 of Appendix 18 to the Treaty on the Eurasian Economic Union).

Filling out the purchase book with code “22”.

Let's look at example 1:

entered into an agreement with OJSC Kosmos for the supply of equipment. The delivery amount is RUB 3,349,960. According to the terms of the agreement, Ram LLC supplies equipment only with an advance payment of 40%. Joint Stock Company OJSC Kosmos fully agrees with these conditions and transfers an advance payment in the amount of 1,339,984 rubles. (including the amount of VAT is RUB 204,404.34). Having received the advance payment, an invoice dated November 22, 2018 No. A411 is issued, with the code “02” reflected in the sales book.

December 3, 2021 ships a batch of equipment to OJSC Kosmos, and accordingly issues an invoice dated December 3, 2018 No. 465 in the amount of RUB 3,349,960. (including the amount of VAT is RUB 511,010.85). The operation of Ram LLC is reflected in the sales book with the code “01”. He filled out the purchase book with a previously issued invoice for advance payment.

The purchase book of Kosmos OJSC was filled out with the following details:

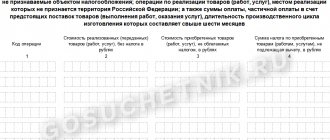

| Operation type code “22” is used to designate the following operations: ▪return of advance payments, when VAT, previously calculated for payment on an advance received, is accepted for deduction when returning such an advance in the event of termination of the contract or change in the terms of the contract (paragraph 2, clause 5, article 171 of the Tax Code of the Russian Federation); ▪when deducting advance VAT at the time of shipment, against which such an advance was previously received (clause 6 of Article 172 of the Tax Code of the Russian Federation). | ||

| Column number and name of the “Purchase Book” | Information | |

| Column number | Name of the column | |

| 2 | Operation type code | «22» |

| 3 | Seller's invoice date and number | 11/22/2018 No. A411, |

| 9 | Salesman | Ram LLC |

| 10 | Seller's INN/KPP | 7702232022/77001001 |

| 15 | Advance payment amount (including VAT) | RUB 1,339,984 |

| 16 | VAT amount from advance payment | RUR 204,404.34 |

Summarizing the results, the transaction type code “22” is entered in the purchase book in the event of a return of advance payments referred to in paragraph 2 of clause 5 of Art. 171 of the Tax Code of the Russian Federation and for operations specified in clause 6 of Article 172 of the Tax Code of the Russian Federation.

When making a corresponding entry in the “purchase book” based on invoices, with code “22”, you must indicate the following details:

To consolidate the material, consider example 2:

The organization Fortura LLC (TIN/KPP 7816*****/780101001), under a contract for the supply of goods, received from Nadezhda LLC (TIN/KPP 7743******/997850001) an advance payment for upcoming deliveries of goods. Fortuna LLC issues invoice No. A100010331 dated June 17, 2018 to Nadezhda LLC for a total amount of 291,000.00 rubles, incl. VAT – 44,389.83 rubles, and is registered in the sales book with code “02”. LLC "Nadezhda" received from LLC "Fortuna" invoice No. A100010331 dated June 17, 2018 for an advance in the total amount of 291,000.00 rubles, incl. VAT – 44,389.83 rubles, reflected in the purchase book with code “02” (clause 12 of article 171, clause 9 of article 172 of the Code).

After shipment of goods to Nadezhda LLC, Nadezhda LLC issues an invoice for sales No. 10331 dated July 20, 2018 for a total amount of 177,000.00 rubles, incl. VAT – 27,000.00 rubles, and is registered in the sales book with code “01”. In the purchase book, Fortuna LLC registers previously issued invoice No. A100010331 dated June 17, 2018 to Nadezhda LLC for advance payment in the amount of 291,000.00 rubles, incl. VAT – 27,000.0 rubles with code “22”.

After receiving and registering the goods, Nadezhda LLC registers invoice No. 10331 dated July 20, 2018 in the purchase book for a total amount of 177,000.00 rubles, incl. VAT – 27,000.0 rubles with code “01”, and restores the amount of VAT previously accepted for deduction on the basis of an advance invoice, registering in the sales book invoice No. A100010331 dated June 17, 2018 for a total amount of 291,000.00 rubles , incl. VAT – 27,000.00 rubles with code “21”.

| √invoice number and date; √name and INN/KPP of the seller (indicate your own details); √cost of goods according to the invoice including VAT; √VAT amount. Reference information: when a seller indicates an entry with code “22” in the purchase book, a corresponding entry with code “02” is reflected in the sales book of this seller. | |||||||

| N p/p | Operation type code | Seller's invoice number and date | Seller's name | Seller's INN/KPP | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the invoice currency | The amount of VAT on the invoice, the difference in the amount of VAT on the adjustment invoice, accepted for deduction, in rubles and kopecks | |

| 1 | 2 | 3 | 9 | 10 | 15 | 16 | |

| 1 | 22 | No. A100010331 dated 06/17/2018 | Fortuna LLC | 7816*****/780101001 | 291 000,00 | 27 000,00 | |

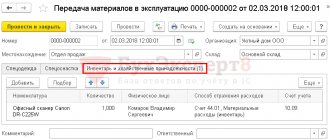

Receipt of final payment

Receipt of final payment for shipped goods (operation 5.1 “Receipt of final payment from buyer”) in the 1C: Accounting 8 version 3.0 program is reflected using the document Receipt to current account with the transaction type Payment from buyer, which is generated:

- based on the document Invoice for payment to the buyer (menu Sales -> Sales, document log -> Invoices for payment to the buyer);

- or by adding a new document to the Bank statements list (menu Bank and cash desk -> Bank, document journal -> Bank statements).

As a result of posting the document, the following accounting entry is entered into the accounting register:

Debit 51 Credit 62.01 - for the amount of final payment received, which is RUB 600,000.00.

Operation type code for VAT restoration

Codes of types of transactions for reflection in the book of purchases, sales and additional lists for them were approved by Order of the Federal Tax Service dated March 14, 2016 No. ММВ-7-3 / [email protected]

This order stipulates that VAT recovery operations specified in clause 8 of Art. 145, paragraph 3 of Art. 170 (except for paragraphs 1 and 4 of paragraph 3 of Article 170), Art. 171.1 of the Tax Code of the Russian Federation, as well as when performing transactions taxed at a 0% VAT rate, code 21 corresponds.

The above means that code 21 is indicated in all cases of VAT recovery, except:

- restoration of VAT when transferring property, intangible assets, property rights as a contribution to the authorized (share) capital of business companies and partnerships, contributions under an investment partnership agreement or share contributions to mutual funds of cooperatives, as well as transfer of real estate to replenish the endowment capital of a non-profit organization. In this case, the VAT recovery code 01 is indicated (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated September 20, 2016 No. SD-4-3/ [email protected] );

- restoration of VAT by the buyer when reducing the value of previously received goods (work performed, services rendered), property rights on the basis of an adjustment invoice received from the seller. In this case, the transaction type code will be 18 (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation).

Transaction type code in the sales book

- When receiving an advance from the buyer, code 02 must be indicated, which directly follows from the wording of the names of the transactions to which this code is assigned.

- When shipping, code 01 is indicated to the buyer. We believe that this code is indicated by the seller when shipping goods (work, services) regardless of the time of payment for these goods (work, services) - whether an advance was received from the buyer before shipment, or payment was made by the buyer after shipment .

- When restoring VAT on services paid in advance, from the amount of which VAT was accepted for deduction with the VAT amount reflected in the purchase book, code 21 is indicated.

Let me explain. According to clause 14 of the Rules for maintaining a sales book during restoration in the manner established by clause 3 of Art. 170 of the Tax Code of the Russian Federation, VAT amounts (previously accepted for deduction in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation), invoices on the basis of which VAT amounts are accepted for deduction are subject to registration in the sales book for the amount of tax to be restored.

In turn, in the name of the type of operation, which corresponds to code 21, indicated in Letter N GD-4-3/ [email protected] , clause 3 of Art. 170 Tax Code of the Russian Federation. And according to paragraphs. 3 of this norm, the amounts of VAT accepted by the buyer for deduction when paying (partial payment) for future supplies (work, services) are subject to restoration in the tax period in which the tax amounts on purchased goods (work, services) are subject to deduction in the manner established by the Tax Code of the Russian Federation. Tax amounts are subject to restoration in the amount previously accepted for deduction in relation to payment (partial payment) on account of upcoming supplies of goods (work, services).

That is, code 21 corresponds to the type of operation you specified in the question.

Section 6

Section 6 is intended to reflect transactions for which the deadline for submitting documents confirming the right to apply the zero VAT rate has expired.

The duration of this period is 180 calendar days. For exported goods, the 180-day period is counted:

- from the date of shipment (for deliveries to countries participating in the Customs Union) (clause 5 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- from the date of placing goods under the customs export procedure (for deliveries to other countries) (clause 9 of article 165 of the Tax Code of the Russian Federation).

In relation to work (services) related to the export of goods (import of goods into Russia), the procedure for determining the 180-day period depends on the type of work (service).

On line 010, enter the operation code. For each transaction code, fill in lines 020–040.

On line 020 reflect the tax base.

On line 030, indicate the amount of VAT calculated based on the tax base on line 020 and the VAT rate (10 or 18%).

Line 040 reflects the amounts of tax deductions:

- input VAT paid to the seller;

- VAT paid when importing goods into Russia;

- VAT paid by the tax agent when purchasing goods, works, services.

Fill in lines 050–060 only on the first page, and put dashes on the rest.

On line 050, reflect the total amount of VAT (the sum of all lines 030 for each transaction code).

For line 060, enter the summed indicator of lines 040 for each transaction code.

If the buyer returned some of the goods to the exporter, fill in lines 080–100:

- on line 080 – the amount by which the tax base is reduced;

- on line 090 – VAT adjustment (the amount by which the calculated VAT is reduced);

- on line 100 – the amount of VAT that needs to be restored (previously accepted for deduction).

If you increase or decrease the price, fill in lines 110–150:

- on line 120 - the amount by which the tax base is increased;

- on line 130 – the amount by which VAT is increased;

- on line 140 – the amount by which the tax base is reduced;

- on line 150 – the amount by which VAT is reduced.

Calculate the amount of VAT payable to the budget for line 160 as follows:

| Line 160 = (line 050 + line 100 + line 130) – (line 060 + line 090 + line 150) |

Calculate the VAT refund amount for line 170 as follows:

| Line 170 = (line 060 + line 090 + line 150) – (line 050 + line 100 + line 130) |

Please take into account the amounts of VAT payable (reduced) reflected in sections 4–6 when filling out section 1 of the VAT return (clauses 34.3, 34.4 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558) .

Transaction type code in the purchase book

- When receiving materials and services, code 01 must be indicated, which directly follows from the wording of the name of the type of operation to which this code is assigned.

- The buyer's advance payment for shipped products has been taken into account.

According to the first paragraph of clause 22 of the Rules for maintaining the purchase book, invoices registered by sellers in the sales book upon receipt of the payment amount, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, including when the buyer uses a non-monetary payment forms are registered by them in the purchase book when shipping goods (performing work, providing services) on account of the received payment amount, partial payment indicating the corresponding amount of VAT.

Based on clause 8 of Art. 171 and paragraph 6 of Art. 172 of the Tax Code of the Russian Federation, tax amounts calculated by the taxpayer from amounts of payment, partial payment received on account of upcoming deliveries of goods are subject to deduction from the date of their shipment.

[email protected] provides for a separate code for operations to accept for deduction the amount of tax calculated from amounts of advance payment (partial payment)

We believe that code 02 can be used to reflect an advance invoice in this situation.

Indication in the sales book of the details of the document confirming payment

According to paragraphs. “o” clause 7 of the Rules for maintaining the sales book, column 11 indicates the number and date of the document confirming payment of the invoice, in cases established by the legislation of the Russian Federation.

In our opinion, from reading this norm it follows that column 11 of the sales book should be filled out only in cases where the tax legislation of the Russian Federation provides for the obligation to confirm the fact of tax payment.

The Ministry of Finance of Russia, in letter dated November 26, 2014 N 03-07-11/60221, also explains that column 11 of the sales book is filled out, in particular, upon receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services); when calculating the amount of tax in accordance with paragraphs. 1-3 tbsp. 161 of the Tax Code of the Russian Federation by tax agents specified in paragraphs 2 and 3 of Art. 161 Tax Code of the Russian Federation; upon receipt of funds that increase the tax base in accordance with paragraph 1 of Art. 162 of the Tax Code of the Russian Federation.

We believe that by doing so, the financial department also emphasizes that the obligation to fill out this column is directly related to the occurrence of the obligation to pay VAT to the budget.

According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, the object of taxation with value added tax is transactions involving the sale of goods (work, services) on the territory of the Russian Federation. That is, upon shipment, the obligation to calculate VAT arises regardless of payment for goods (work, services) sold.

Therefore, we believe that when recording the transaction of shipment (transfer) of goods, works, services, column 11 of the sales book is not filled out.

Please note that the position we have expressed on the issues considered is our expert opinion; we have not found any explanations from the authorized bodies.

>How to take into account VAT on an advance payment?>Answer

The buyer has the right to deduct VAT from the advance payment issued.

Why adjustments are needed

Any taxpayer on OSNO is obliged to submit reliable reports to controllers in a timely manner. If shortcomings and errors are discovered when calculating the tax base, the company is required to submit an adjustment. A correction report is submitted in the following cases:

- the cost of goods sold has changed due to established reasons;

- errors and shortcomings were found in the fiscal report that require correction;

- the company sold additional services and goods under new contracts;

- The declaration was submitted to the Federal Tax Service after the established deadline.

Corrective information is submitted by both parties, since there are two parties involved in the transaction: the buyer and the seller.

Consultation

Dzhaarbekov Stanislav, tax expert, lawyer. Website: Taxd.ru

Advance payment

Advance payment (advance payment) is payment by the buyer (customer) for goods (work, services) before their delivery (fulfillment).

The buyer has the right to deduct VAT from the advance payment issued.

It should be noted that the buyer has the right to deduct VAT on advances issued. But you don't have to do this. Thus, the Ministry of Finance of the Russian Federation in its letters informs that the buyer has the right not to deduct such VAT (Letter of the Ministry of Finance of the Russian Federation dated May 20, 2016 N 03-07-08/28995, Letter of the Ministry of Finance of the Russian Federation dated November 22, 2011 N 03-07-11 /321). If you decide not to deduct VAT, then simply do not register the invoice received from the seller for the advance payment in the purchase book. Subsequently, upon receipt of the goods (works, services) for which an advance was issued, you will not need to restore VAT, since you did not deduct it.

VAT deduction on advances issued is regulated by:

clause 12 art. 171 Tax Code of the Russian Federation:

“Deductions from the taxpayer who transferred the amounts of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, are subject to tax amounts presented by the seller of these goods (work, services), property rights.”

clause 9 art. 172 of the Tax Code of the Russian Federation:

“Deductions of the tax amounts specified in paragraph 12 of Article 171 of this Code are made on the basis of invoices issued by sellers upon receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, documents confirming the actual transfer of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, if there is an agreement providing for the transfer of these amounts.”

To confirm the deduction of VAT on the advance payment issued, the buyer must have:

— Invoice (advance) from the seller;

— Agreement providing for the transfer of an advance;

- Payment documents.

Recovering VAT on an advance payment

Advance VAT is temporary. It is accepted as a deduction for the period before the acquisition of goods (works, services), and then restored.

The rules for recovering VAT on issued accounts are specified in paragraphs. 3 p. 3 art. 170 Tax Code of the Russian Federation.

“The restoration of tax amounts is carried out by the buyer in the tax period in which the tax amounts on purchased goods (works, services), property rights are subject to deduction in the manner established by this Code, or in the tax period in which there was a change in conditions or termination of the relevant agreement and return of the corresponding amounts of payment, partial payment received by the taxpayer on account of the upcoming supply of goods (performance of work, provision of services), transfer of property rights.

Amounts of tax accepted for deduction in relation to payment, partial payment for future deliveries of goods (performance of work, provision of services), transfer of property rights, are subject to restoration in the amount of tax accepted by the taxpayer for deduction on goods purchased by him (work performed, services rendered) , transferred property rights, in payment of which the amount of previously transferred payment, partial payment in accordance with the terms of the agreement (if such conditions exist) are subject to offset;”

That is, VAT should be restored in the tax period (quarter) when:

— accepted for deduction of VAT on goods (works, services) for which the advance was transferred;

— the seller returned the advance due to termination or modification of the contract;

According to the Ministry of Finance of the Russian Federation, VAT on the advance payment should be restored even if the seller’s receivables are written off as a bad debt, if the seller never fulfilled the obligation to supply the goods (Letter of the Ministry of Finance dated August 17, 2015 N 03-07-11/47347).

Example

The buyer issued an advance payment in the amount of 1000 rubles to pay for the goods, which are subject to VAT at a general tax rate of 18%1.

The buyer received an advance invoice from the seller, which indicated the amount of VAT of 152.54 rubles (1000 * 18/118). The buyer has the right to deduct this VAT.

Invoice

No later than 5 calendar days from the date of receipt of the advance payment, the seller must draw up an advance invoice in two copies (Articles 168, 169 of the Tax Code of the Russian Federation).

The seller must transfer one copy of the invoice to the buyer (clause 3 of Article 168 of the Tax Code of the Russian Federation).

The invoice issued when receiving advances has its own characteristics and is called an Advance invoice.

Reflection in the purchase book

VAT accepted for deduction on an advance invoice is reflected in the Purchase Book with the VAT transaction type code - 02 “Payment, partial payment (received or transferred) on account of upcoming supplies of goods (work, services), property rights, including transactions carried out on based on commission agreements, agency agreements providing for the sale and (or) acquisition of goods (work, services), property rights on behalf of the commission agent (agent) or on the basis of transport expedition agreements, with the exception of transactions listed under codes 06; 28".

Reflection in the sales book

1) If the buyer received goods (accepted work or services) on account of the advance payment:

VAT restored in connection with the purchase of goods (work, services) is reflected in the Sales Book with the VAT transaction type code - 21 “Operations for the restoration of tax amounts specified in paragraph 8 of Article 145, paragraph 3 of Article 170 (except for subparagraphs 1 and 4 of paragraph 3 of Article 170), Article 171.1 of the Tax Code of the Russian Federation, as well as when performing transactions taxed at a tax rate of 0 percent for value added tax"

2) If the contract is terminated and the seller returns the advance:

VAT restored in connection with the termination or change of the contract and the return of the advance is reflected in the Sales Book with the VAT transaction type code - 22 “Operations for the return of advance payments in the cases listed in paragraph two of paragraph 5 of Article 171, as well as the operations listed in paragraph 6 Article 172 of the Tax Code of the Russian Federation"

Reflection in the VAT return

The amount of VAT on the advance payment accepted for deduction is reflected on line 130 “13. The amount of tax presented to the taxpayer - the buyer when transferring the amount of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, subject to deduction from the buyer" Section 3 of the VAT return for that tax period (quarter), in which the advance was issued.

The amounts of restored VAT are reflected in line 090 “6.1. tax amounts subject to restoration in accordance with subparagraph 3 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation" section 3 of the VAT return for the tax period (quarter) in which the goods were received on account of the advance payment issued or when the advance was returned.

Reflection of advance VAT from the buyer in accounting

An advance was issued for the delivery of goods:

D 60 - K 51 - advance payment issued

D 68 - K 60-advance - VAT on the advance is accepted for deduction

Items received from seller:

D 41 - K 60 - Goods received

D 19 - K 60 - VAT on purchased goods (works, services) is reflected

D 68 - K 19 - VAT on purchased goods (works, services) is accepted for deduction

D 60-advance - K 68 - Restored VAT on advance

Example

The buyer and seller entered into a purchase and sale agreement for goods in the amount of 23,600 rubles (including VAT of 3,600 rubles at a rate of 18%). According to the contract, the buyer makes an advance payment in the amount of 11,800 rubles and after delivery of the goods the final payment is made.

20.02 The buyer paid the seller an advance in the amount of 11,800 rubles to pay for the goods (including VAT of 1,800 rubles).

The buyer deducts VAT in the amount of 1,800 rubles (based on the advance invoice received from the seller).

Buyer's accounting:

D 60 K 51 11 800 advance payment transferred

D 19 K 60 1,800 VAT calculated on advance payment

D 68 K 19 1,800 VAT accepted for deduction

10.03 The seller transfers the goods to the buyer in the amount of 23,600 rubles (including VAT 3,600 rubles).

The buyer calculates (restores) the VAT previously accepted for deduction on the advance payment (1,800 rubles) and accepts for deduction the VAT on the goods received (3,600 rubles).

Buyer's accounting:

D 41 K 60 20 000 goods registered

D 60 K 68 1,800 VAT previously accepted for deduction on the advance payment was restored

D 19 K 60 3,600 VAT in the cost of goods

D 68 K 19 3,600 VAT accepted for deduction

12.03 The buyer transfers 11,800 rubles to the seller.

The buyer does not take this amount into account either in the tax base or as a deduction.

Buyer's accounting:

D 60 K 51 11 800 payment for goods

Notes

1) from 2021 the basic VAT rate is 20% (until 2021 - 18%). The estimated VAT rate from 2021 is 20/120 (until 2021 - 18/118).