Inventory of goods in a warehouse is a check to clarify data about the inventory and material assets stored in it. The research results are compared with the information specified in accounting and financial documents. Such an audit allows you to timely identify surpluses and theft in production.

When is it necessary to conduct a warehouse inventory?

There are scheduled and unscheduled inspections. The first type of procedure is carried out once a year according to the approved schedule. The second type of audit is appointed by the company's management or regulatory authorities in the presence of special circumstances.

The list of special cases is prescribed in Federal Law No. 402 of 2011. Such situations include:

- change of management or transfer of ownership and management of the company;

- reduction of more than 50% of the workforce;

- transfer of the organization to another form of ownership;

- fact of theft, illegal use of property, damage;

- complete or partial destruction of stocks as a result of an emergency.

Emergency situations mean events related to force majeure. These include floods, fires, hurricanes and other disasters not related to human factors. Below we will look at how inventory is carried out correctly in a warehouse and what documents are drawn up at the end of the event.

Missing inventory items

The inventory of some goods and materials consists only of checking the validity of the amounts listed in the relevant accounting accounts. These are the following values:

- on the way;

- shipped;

- not paid on time by buyers;

- located in the warehouses of other organizations.

Only amounts confirmed by properly executed documents can remain on inventory accounts that are not under the control of financially responsible persons at the time of inventory (in transit, goods shipped, etc.).

| Inventory status | Supporting documents |

| On my way | Suppliers' settlement documents or other substitute documents |

| Shipped | Copies of documents presented to buyers (payment orders, bills, etc.) |

| Overdue payment | Documents with mandatory bank confirmation |

| In third party warehouses | Safety receipts reissued on a date close to the date of the inventory |

You must first reconcile these accounts with other corresponding accounts.

EXAMPLE

In the “Goods shipped” account, it should be established whether this account contains amounts whose payment for some reason is reflected on other accounts (“Settlements with various debtors and creditors”, etc.), or amounts for materials and goods, in fact paid and received, but listed as en route.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Documents for download.

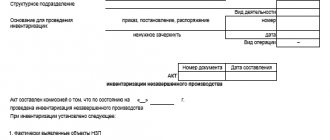

- – a decision by the manager about all the steps that need to be taken regarding the event. At large enterprises, several copies of the form are allowed for different types of warehouse inventory. Most often, a large number of orders are created when it is necessary to conduct an audit of several premises within one company.

- – required in 2 copies to record the total upon counting of products. The documents are kept by the employee being inspected and in the accounting department.

- previously issued (INV-4 form) - filled out for items received for which there is no payment. For such positions there are special conditions for the transfer of ownership rights. The form classifies them into two categories: revenue not received due to delays and due to non-arrival of the payment date.

- , which is kept by the employee responsible for savings (INV-5 form) - all inventories are taken into account. The receipt for the form indicates which items need to be capitalized or written off. Facts of disagreement with accounting data in the accounting department are recorded in the statement (form INV-19).

- not arrived at the warehouse (INV-6) - appropriate for accounting for products that were not delivered due to long-term transportation, are delivered, they are declared with the appropriate notes during the inventory of goods in the warehouse; we will consider in more detail below how to correctly carry out such a check.

Inventory of goods

Inventory of inventory items is the most labor-intensive process. This is due, first of all, to large volumes and a diverse range of material assets, as well as shortcomings in ensuring control over their safety.

Let's look at the procedure for taking inventory of inventory items using the example of taking inventory of goods. The availability of goods in warehouses and retail stores is periodically checked through inventory. It is important to remember that inventory is the main means of control during the acceptance and transfer of material assets.

When carrying out an inventory of goods, it is necessary, on the one hand, to compare their quantity in kind with the data of analytical and synthetic accounting for account 41 “Goods” and off-balance sheet accounts, and on the other hand, to confirm the correctness of the valuation of goods.