Normative base

Federal Law No. 27-FZ of 04/01/1996 “On individual (personalized) accounting in the compulsory pension insurance system”

Order of the Ministry of Labor No. 211n of 04/22/2020 “On approval of the Instructions on the procedure for maintaining individual (personalized) accounting of information about registered persons”

Resolution of the Board of the Pension Fund No. 507p dated December 6, 2018

Where to take the SZV-STAZH

The SZV-STAZH form is submitted to the territorial body of the Pension Fund of the Russian Federation at the place of registration of the policyholder - a legal entity or an individual (clause 1 of Article 11 of Law No. 27-FZ).

An organization that includes separate subdivisions (OPs) submits SZV-STAZH at the place of registration of each “separate unit”, which (clause 3, clause 1, article 11 of the Federal Law of December 15, 2001 No. 167-FZ (hereinafter referred to as Law No. 167-FZ)):

- has a separate bank account(s);

- accrues payments and rewards in favor of individuals.

Please note that the above “signs of independence” of the OP have been applied since 2021. At the same time, the company no longer needs to independently register with the Pension Fund of the Russian Federation at the location of the “responsible” divisions created in 2021. The Federal Tax Service will provide all the necessary information for this (clause 2 of Article 11 of Law No. 167-FZ).

Do not forget! Starting from 2021, all Russian organizations are required to inform the tax authorities at their location about vesting a separate division with the authority to accrue payments and remuneration in favor of individuals. A month is allotted for this from the date of issuance of the order to vest the “isolation” with the appropriate powers (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). Tax officials, in turn, will inform pensioners about this.

Why do we need to correct mistakes?

SZV-STAZH - a form of personalized reporting to the Pension Fund of the Russian Federation, containing information about the employee’s length of service, both general and preferential. This data directly affects the correctness and timeliness of calculating pensions to employees, so try to avoid any inaccuracies in them.

Errors made and discovered in the SZV-STAZH report must be corrected in order to:

- avoid claims from employees;

- protect yourself from fines from regulatory authorities.

How to quickly make clarifications? If inaccuracies are discovered by the policyholder himself, there is no specific deadline for correcting them, but we recommend doing this immediately upon discovery of the defects. If the Pension Fund notices the error and sends a corresponding notification, then the organization has 5 days to make changes.

ConsultantPlus experts discussed how to correctly fill out the SZV-KORR. Use these instructions for free.

Penalties for corrective forms

The policyholder will be fined if he does not provide the adjustment within the required five-day period. But see what fines the Pension Fund issues in the table (Article 17 27-FZ dated 04/01/1996).

| Sum | Type of fine |

| 500 rubles | For the absence of an employee in the report or for identified violations. Assigned for each insured person. |

| 1000 rubles | For violation of the procedure for providing SZV in the form of electronic documents. Assigned when the policyholder submits a paper report instead of an electronic one. |

How to correct information in a report

Before adjusting the SZV-STAZH report, it is worth carefully studying the technical data obtained when sending the original reports to the Pension Fund of Russia.

IMPORTANT!

Employers with more than 25 employees are required to submit information only electronically. If it is less, it is not prohibited to submit SZV-STAZH in paper form.

Sometimes the report is not accepted due to technical problems on the fund's side. Information about this is contained in the delivery protocol and is encoded as follows:

| Error code | Fact of acceptance of information | Error correction method |

| 50 | Information not accepted | Submit the SZV-STAZH form, type “Additional”. |

| 30-40 | Information partially accepted | Submit the SZV-STAZH form (supplementary), if the information is taken into account on the ILS, or SZV-KORR, if not taken into account. |

| 10-20 | Information accepted | Submit the SZV-KORR form. |

First, let's figure out how to correct the SZV-STAZH report if the information was not included in the fund. In order for the Pension Fund to see the necessary data, it is necessary to submit the supplementary form SZV-STAZH. It is filled out according to the same rules as the primary report.

Let us illustrate with examples how to submit a corrective report in this case.

Example 1. An employee was not included in the original reporting.

Example 2. SNILS or full name were indicated incorrectly.

For situations where data has been accepted by the Pension Fund of the Russian Federation and reflected on the employee’s ILS, but errors are found in them, the report for municipal employees and other categories of insured is adjusted using the SZV-KORR form specially created for this purpose. Her form looks like this:

There are several types of reports:

- OTM (cancelling) - to cancel information already taken into account;

- CORR (corrective) - to make changes to previously transmitted data;

- OSOB (special) - to enter information that is not in the original reporting.

IMPORTANT!

In accordance with clause IV adj. 5 to Resolution of the Board of the Pension Fund of the Russian Federation No. 507p, a special form SZV-KORR is not used to provide information in the SZV-STAZH form for “forgotten” employees. We recommend using the supplementary SZV-STAZH form.

We will show with examples how to make a canceling SZV-STAZH report, and how to make a corrective one.

Example 1. A person who was not an employee of the organization was incorrectly indicated in the report.

Example 2. The information provided about the length of service is incorrect.

Deadline for submitting the supplementary form SZV-STAZH

Having figured out in what cases the supplementary form SZV-STAZH is submitted, let’s move on to the deadlines. The document is sent to the Pension Fund of Russia before March 1 of the year following the reporting year.

If the Pension Fund finds discrepancies between SZV-STAZH, SZV-M and information from the calculation of insurance premiums, a notification is sent to the company with a request to clarify the discrepancy in the data or correct the errors. In this case, the organization receives 5 working days to send an addition to the original SZV-STAZH.

Structure of SZV-STAZH and procedure for filling out the form

The SZV-STAZH form includes five sections:

- section 1. “Information about the policyholder”;

- section 2. “Reporting period”;

- Section 3. “Information about the period of work of the insured persons”;

- Section 4. “Information on accrued (paid) insurance contributions for compulsory pension insurance”;

- Section 5. “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision.

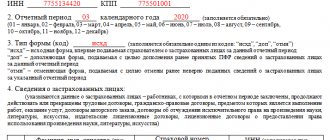

The procedure for filling out section 1 of the SZV-STAZH form

Section 1 of the SZV-STAZH form indicates the registration number in the Pension Fund of the Russian Federation, INN and KPP, as well as the short name of the policyholder in the fields of the same name.

In the “Information Type” block, an “X” indicates the type of form being presented:

- “initial” – if information is submitted for the first time;

- “supplementary” – if the original information contains errors that do not allow the data on the personal accounts of individuals to be taken into account;

- “appointment of pension” - if in order to assign a pension, an individual needs to take into account the period of work in the calendar year for which the SZV-STAZH form has not yet been submitted.

The procedure for filling out section 2 of the SZV-STAZH form

Section 2 of the SZV-STAGE form indicates the reporting period - the calendar year for which information about the insurance period is provided. For example, when submitting a report for 2021, the policyholder will enter the value “2017” in the “Reporting period” field.

The procedure for filling out section 3 of the SZV-STAZH form

In section 3 of the SZV-STAGE form, the following information is indicated for each insured person: full name (columns 2-4), SNILS (column 5), periods of work (columns 6 and 7), special codes regarding periods of work (column 11).

Remember the following rules:

- Last name, first name, patronymic “physicist” are indicated in the nominative case;

- Information regarding periods of work of an individual should not extend beyond the reporting period. For example, when reporting for 2017, dates can only be within the period from 01/01/2017 to 12/31/2017;

- When filling out SZV-STAZH with the “pension assignment” type, the period of work is filled in up to the date of expected retirement.

The table below presents some codes that the policyholder must use to explain the periods of work of the insured person. Let us recall that until 2021, section 6 of the RSV-1 form was filled out using a similar principle. Now this principle is used in SZV-STAZH.

| Code | Explanation |

| "AGREEMENT", "NEOPLDOG", "NEOPLAUT" | These codes are used to indicate periods of work under civil contracts. If payment to the contractor was made during the reporting period, then the code “AGREEMENT” is indicated. Otherwise, the code “NEOPLDOG” or “NEOPLAVT” is entered. |

| "CHILDREN" | This code is used to indicate the period of parental leave |

| "NEOPL" | This code is used to designate a period of unpaid leave, downtime due to the fault of the employee, an unpaid period of suspension from work (preclusion from work), etc. |

| "QUALIF" | This code is used to indicate a period of off-the-job training |

| "SOCIETY" | This code is used to indicate the period of performance of state or public duties |

| "SDKROV" | This code is used to indicate the days of donation of blood and its components and the days of rest provided in connection with this |

| "SUSPENDED" | This code is used to indicate a period of suspension from work (non-admission to work) through no fault of the employee |

| "UCHOTVUSK" | This code is used to indicate the period of additional leave for employees combining work and study |

| "DLCHILDREN" | This code is used to indicate the period of parental leave from 1.5 to 3 years |

| "Chernobyl Nuclear Power Plant" | This code is used to indicate the period of additional leave for citizens exposed to radiation due to the Chernobyl disaster |

| "DOPVIKH" | This code is used to indicate additional days off for carers of disabled children |

Columns 8 and 9 indicate the codes of territorial and special working conditions, respectively, according to the Classifier of parameters used when filling out information for maintaining individual (personalized) records (Appendix to the Procedure for filling out SZV-STAZH, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p (Appendix No. 5, section II)).

The procedure for filling out sections 4 and 5 of the SZV-STAZH form

Sections 4 and 5 of the SZV-STAZH form are filled out only when generating a report with the type of information “appointment of pension”.

If for the periods listed in section 3, pension insurance contributions have been accrued (paid), then in section 4 the sign “X” o. Otherwise, the sign is placed opposite the word “no”.

Section 5 is completed in a similar manner in relation to paid pension contributions under early non-state pension agreements, if they have been concluded.