What does Form 1-IP include?

Form 1-IP was approved in Appendix 11 to Rosstat Order No. 419 dated July 22, 2019. Detailed instructions for filling out are also given there.

Since January 1, 2021, changes have appeared in the order; take them into account when drawing up the report. Using this form, entrepreneurs report on their work during the year - revenue, types of activities, number of employees.

The form itself is small. It includes a title page and a short five-item questionnaire. Let's look at the filling rules.

Title page

The title page of form 1-IP is standard for all business reports.

It is necessary to indicate the detailed address of the individual entrepreneur: subject of the Russian Federation, street, house, apartment and zip code. It happens that the actual and registration addresses differ, then you need to enter the details of the actual address.

Next, indicate the full name of the entrepreneur and sign.

A standard part with codes is also provided. It must indicate the TIN from the certificate and OKPO based on the notification of assignment of statistics codes.

Section 2. Cargo transportation for the surveyed week of the quarter

Daily records of cargo transportation are kept for each trip with cargo in Section 2 FOR THE WEEK SURVEYED.

Only transportation of goods carried out during the survey week by truck on a commercial basis (for a fee) is subject to accounting.

Column 5. Cargo transported

Loads transported on vehicles with trailers are reflected in section 2 in column 5

.

Transportation performed without going onto a public road (within a construction site, quarry, between workshops and warehouses of an entrepreneur, etc.) is considered technological and is not taken into account.

Transportation of garbage and snow, mail and periodicals are also not taken into account.

Column 4. Transportation distance (mileage of a vehicle with cargo from the loading point to the unloading point)

In column 4

Section 2 shows the distance of cargo transportation for each trip based on shipping documents or odometer readings.

This column reflects only the mileage of the loaded vehicle; empty runs are not taken into account. If several trips are made along a standard route over a known distance, this distance should be repeated for each trip. If the transportation is carried out over a long distance and the car is on the road during the entire survey week, in column 4

you must indicate the approximate distance to the destination.

In column 5

Section 2 shows the weight of the transported cargo for each trip, taking into account the weight of the container or containers. If the weight of the cargo is not indicated in the shipping documents, it should be determined by calculation. The weight of bulk cargo (sand, lime, coal, etc.) can be determined by partial weighing. Determining the weight of a standard load (eg shoe boxes, boxes of groceries) is determined by weighing the load per unit and multiplying by the number of items. Determination of the weight of the cargo, counted in pieces (machines, refrigerators, furniture) is made by multiplying by the weight specified in the technical documentation, adding the tare weight.

In exceptional cases, the weight of the cargo can be determined by an expert, based on the carrying capacity of the vehicle and the degree of its loading.

If the vehicle is operating on a distribution route (with several unloading points), the weight of the cargo at the loading (departure) point is indicated. If the vehicle is operating on a collection route (with several loading points), the weight of the cargo at the unloading (arrival) point is indicated.

Point of loading, unloading of the vehicle - indicates the city or other locality where the goods were loaded (unloaded). If the loading (unloading) point is not located in Russia, then in addition to the city or other locality where the vehicle was loaded or unloaded, you must indicate the country, for example: Ukraine, Azerbaijan, Estonia, Mongolia, Germany, etc.

Survey part

The text portion of the form contains five questions and several subquestions that must be answered. Let's consider them sequentially.

Question 1. The answer must be “YES” or “NO”. The choice depends on whether you were engaged in business in the reporting year. If yes, then check the appropriate box and move on to the third question.

If you did not conduct business or worked for the entire year for hire from other individual entrepreneurs or organizations, then move on to the second question.

Note! If you are running a business and at the same time working under an employment contract in another company or individual entrepreneur, then you need to answer “YES” to the first question and completely fill out the form in accordance with your business activity.

Question 2. This question is relevant only for entrepreneurs who did not engage in business at all in the reporting year. Here you need to indicate whether you were employed or did not do anything during the entire reporting year.

Question 3. In the answer to this question you need to indicate all your earnings from the business during the year, which you received for the sale of goods, work or services. The amount must include taxes and other mandatory fees.

If you were settled not with money, but in the form of property or the provision of barter services, then the amount of proceeds is calculated based on the transaction price. If it is not determined, then calculate the revenue at the market value of the products received.

If you carried out activities but did not earn anything, put “0” in the line.

Question 4. In your answer, list in as much detail as possible all types of products, works and services that you sold in the reporting year. This needs to be done by type of activity. For example, shoe production and wholesale footwear trade.

Important! If an individual entrepreneur, through his own distribution network or other establishments, sells goods of his own production to the public, then the proceeds from their sale should be classified as production activities. Trade in this case does not stand out.

Subquestion 4.1 assumes that next to each type of activity you indicate the share of revenue that it generated. This must be done as a percentage, in whole numbers. The sum of all lines under clause 4.1 must be equal to 100%.

If you fill out the report electronically, additionally indicate the type of activity code according to OKVED2.

Question 5: This question requires you to indicate the average number of people who worked for your business in the reporting year.

The average number is calculated as follows:

number of persons working in each month (including sick and vacation pay) / number of months of activity in the reporting period.

Round the result to a whole number.

All employees are usually divided into partners, family members and employees.

Partners are those who have contributed to the assets of the business and do some of the work. Ordinary investors who gave money but are not involved in any way in the activity are not included here.

Helping family members include those who work as an assistant in a business owned by a relative or household member.

Employees include persons who work for remuneration under a written or oral contract. Individual entrepreneurs who pay taxes for themselves are not included here.

Form 1-IP Sample filling

Section 1. Availability of trucks on the start date of the survey

Data on the indicators contained in the form are provided for the surveyed week of the quarter at the direction of the territorial body of state statistics at the location of the individual entrepreneur.

If during the surveyed week cargo was not transported on a commercial basis (for a fee), only section 1 is completed.

Section 1 provides information about vehicles intended for the transportation of goods available to an individual entrepreneur as of the beginning of the surveyed week. These are vehicles with universal bodies (for example, flatbeds) and with specialized bodies (for example, container carriers). The number of cargo carriers does not include special vehicles on a cargo chassis, such as truck cranes, cleaning vehicles, garbage trucks, auto repair shops, etc. Vehicles used exclusively for household maintenance (cleaning the area, garbage removal, etc.) are also not taken into account.

The number of trucks at the disposal of the entrepreneur should include both his own and those leased and purchased under a leasing agreement. Rented cars also include cars rented with a driver. You should also include trucks registered to another member of the entrepreneur's family, personal vehicles of drivers hired to work with their own vehicles, as well as vehicles used under other forms of ownership.

The general availability of cars should be shown regardless of where they are at the time of inspection (under repair, awaiting repair, on a business trip, for rent).

Grouping of vehicles according to their carrying capacity ( columns 4 - 9

section 1) is filled out on the basis of data from vehicle technical passports.

The carrying capacity of vehicles - tractors and timber trucks - is shown in accordance with the carrying capacity of the (semi)trailers assembled with them. If this data is not available (for example, in relation to rented cars), it is allowed to fill out the specified fields expertly (approximately). In any case, the sum of columns 4 - 9

of section 1 must be equal to the total number of trucks in the corresponding line.

Who submits Form 1-IP

Individual entrepreneurs report on their activities using Form 1-IP. It is taken by all businessmen who have duly registered and received individual entrepreneur status.

The exception is entrepreneurs in retail trade. Another form is provided for them - 1-IP (trade). But entrepreneurs who retail cars, motorcycles and other vehicles must also submit information using the usual 1-IP form.

Written research on the work of entrepreneurs is carried out selectively. Not all individual entrepreneurs are included in it, but only a part - that is, you do not have to report annually.

If you are included in the sample, the statistical authorities will send you a letter in which they will tell you about the need to report. But it happens that it is not sent. This circumstance does not exempt you from the obligation and penalties for late reports, so check the need to report yourself in the Rosstat service. Another option is to call your statistical office and ask if you are on the list.

Once every five years, Rosstat arranges a comprehensive survey and requires all individual entrepreneurs to report on the form. The last time it was held was in 2021. If nothing changes, the next full business study will begin in 2021.

Filling example

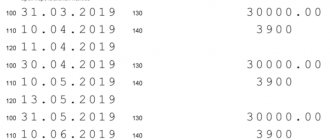

To understand how to fill out the 1-IP auto cargo form, let’s take the conditional data of a non-existent individual entrepreneur.

Individual entrepreneur: Anokhin Vladimir Nikolaevich.

Postal or legal address: Russia, Krasnodar region, Krasnodar, st. Proletarskaya, no. 86 of. 204, index 350004.

Occupation: freight transportation.

There are 9 trucks, of which the carrying capacity of 2 is up to 8 tons, 1 is up to 20 tons, 2 is up to 7 tons, 4 is up to 9 tons. They transport food products within the country.

Step-by-step preparation of the 1-IP form:

Enter OKPO code.

Complete Section 1.

Complete Section 2.

Indicate your phone number, email, and date of application in the bottom line.

Correct execution of the statistical questionnaire 1-IP for reporting to Rosstat will protect the entrepreneur from penalties and wasting time on correcting the document.

When and where to submit form 1-IP

Only those included in the sample will submit the 1-IP report for 2021 to Rosstat. This must be done once - before March 2, 2021. This day falls on Monday, so the deadline will not be postponed.

If by this time you have not appeared on the list of those required to submit a report, then you can relax. This year the examination will not affect you.

The form can be submitted in paper or electronic form. The place of delivery is the territorial body of Rosstat for the subject, which is attached to the address of the individual entrepreneur.

Statistical reporting

In this section, you enter all the information about the cars that one way or another belong to the entrepreneur.

In the lower fields, indicate your email address, contact phone number and the date of filling out the 1-IP auto cargo statistics report.

Penalties

Rosstat treats its reporting as strictly as tax reporting. For violation of the delivery procedure, late deadlines or provision of incorrect information, you will have to bear responsibility under the Code of Administrative Offenses of the Russian Federation.

Article 13.19 of the Code of Administrative Offenses provides for a fine for officials of 10-20 thousand rubles. If you commit a violation again, the fine will increase significantly and amount to 30-50 thousand rubles.

Law of the Russian Federation dated May 13, 1992 No. 2761-I provides that the violator is obliged to compensate the statistical authorities for the damage caused if he was late with the report or submitted incorrect data. In this case, Rosstat will have to make corrections to the final consolidated statements, and they will be required to compensate for this.

Zero report 1-IP

It happens that an entrepreneur has just registered and has not started working, but is already included in Rosstat’s sample. In this case, you will still have to report - fill out a zero report.

If you did not conduct business, you must fill out the title page and answer the question about conducting business in the reporting year.

Next, check the box that corresponds to the answer to the question “Did you work for hire?” If not, then the survey is completed - sign the form and submit it to Rosstat.

Entrepreneurs who do not work temporarily or have stopped working for a certain period of the reporting year report in accordance with the general procedure. Questions must be answered in accordance with the period in which the activity was carried out.

Results

Small enterprises that regularly (or intermittently) provide services for the transportation of goods by road on a commercial basis must submit special reports. Form PM-1 auto cargo, depending on the activity of the company's auto cargo activity, is submitted to the territorial office of Rosstat quarterly or monthly (if the activity is carried out irregularly).

For information on how to fill out a waybill for a truck, read our article “Truck waybill in accounting (form).”