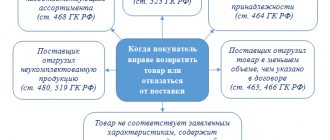

The procedure for purchasing food or industrial products between the seller and the buyer is regulated by the provisions of the Civil Code of the Russian Federation (Chapter 30).

The participants enter into an agreement under which one of the parties undertakes to supply a certain quantity of goods (services), and the other party undertakes to pay for it. Failure to comply with the provisions of the agreement serves as grounds for its termination and return of the goods, the grounds for which are defined by law.

Question: The buyer resells to the seller goods previously purchased from him and accepted for registration. In this case, the buyer, as a new seller, issues an invoice to the seller, as a new buyer. In this case, the former seller accepts VAT for deduction in the general manner as an ordinary buyer. How to reflect this option of returning goods in accounting? View answer

Return of goods in 2020-2021

So, from 2021, VAT when returning goods to the supplier is required to be processed according to the following rules:

- The seller prepares an adjustment invoice and records it in the purchase ledger.

- The buyer no longer draws up an invoice, but registers the seller’s adjustment invoice in the sales book (if he managed to accept VAT for deduction, if not, then he accepts the deduction in the non-refundable part).

It does not matter for what reason the return occurs. This is how the return of both defective and high-quality goods is processed if it does not comply with the contract. If you issue a return with an invoice from the buyer (as was done previously, until 2021), the seller will lose the VAT deduction. The same procedure applies if the buyer does not pay VAT due to the use of a special regime (USN, UTII).

ConsultantPlus experts spoke about VAT deductions from the seller when returning goods. Study the material by getting trial access to the K+ system for free.

Such clarifications are provided by the Ministry of Finance (you can view the details of the letters using the links above). But at the same time, he makes the following addition: if the goods are returned under a purchase and sale agreement, where the parties change places, invoices are issued as for sales (see, for example, letters of the Ministry of Finance dated May 15, 2019 No. 03-07-09/34582, No. 03-07-09/34591).

Read more about issuing return invoices in this article.

Registration of correct return of any low-quality goods to the supplier, important documents

The purchaser must notify the contractor immediately of any defective parts found in the lot. If you do not follow this rule established by Art. 483. Civil Code, the seller has the right not to accept the returned property.

For example, if an organization accepted a delivery without checking and did not report any defects, then even the court will not satisfy the requirements.

According to Art. 514, if everything is later sent back, the recipient is obliged to place the entire thing for safekeeping. His job will be to ensure the safety of the boxes until the shipper picks them up. If the manufacturer agrees with the existing defects and exports the batch, then the parties conclude:

- act of identifying inconsistencies (can be drawn up in the TORG-2 form);

- return invoice (TORG-12 is suitable as a basis).

If the purpose of sending products to the seller is to replace non-critical components or eliminate other minor defects, then everything must be done in writing. The days or weeks in which the shipper undertakes to replace defective parts, replenish or exchange parts should be agreed upon and specified in the documentation.

When the seller denies the possibility of violations, does not export and does not agree to change the defect, evidence is drawn up:

- claim;

- protocol according to which samples were taken for examination;

- a written or registered letter offer to participate in the inspection;

- expert opinion.

We must not forget that the statement of defects, written only by the recipient’s enterprise, only in a limited number of cases serves as an evidence base. This works if, when concluding the contract, both parties signed an agreement to apply such instructions. If it was not compiled, then it will not be evidence.

When the return will be a reverse implementation

As a rule, when returning goods, no one enters into a separate purchase and sale agreement, in which the buyer becomes the seller and the seller becomes the buyer. Therefore, it is not easy to immediately imagine the situation that the Ministry of Finance is talking about.

But even if there is no such agreement, reverse implementation may occur. Look carefully at the original contract. Does it contain a condition on the repurchase of goods by the seller? For example, if the buyer was unable to sell them before a certain time. This is the reverse implementation, in which the buyer must create an invoice.

The next point is important here. To avoid claims for deduction, the contract should clearly state that the return of the goods is carried out by return delivery, in which the buyer is the seller and the seller is the buyer. Then the inspectors will have no reason to find fault with the invoice (it will not be an adjustment, but a regular one). If there is no such specificity in the contract, claims are possible against any execution of the transaction:

- You made an adjustment invoice, and the tax office says: “You have a buyback, you need an invoice from the buyer” - and removes the deduction.

- Or, on the contrary, you have issued a return delivery, and the controllers tell you: “You don’t have anything written about return delivery, it says about a return” - and you also lose your deduction and are forced to go to court.

So review your contracts and make changes if necessary.

By the way, buyback is possible not only for unsold quality goods, but also for defective ones (letters from the Ministry of Finance dated May 15, 2019 No. 03-07-09/34582, No. 03-07-09/34591).

Registration procedure

There are two types of documents that must be properly prepared in order to make a return:

- claim;

- Act.

The first paper is drawn up on the organization’s letterhead. The signature of an accountant or other person authorized to sign the documentation is required.

Always indicated:

- legal and actual address;

- full title;

- information about the buyer - details, name, other information;

- information about the supply agreement that caused the claim, date, number;

- the reasons for creating the paper are described in full and in detail - discrepancies in quantity, quality, set;

- it is recommended to refer to the law;

- justification for the requirement - return, exchange, complete;

- time limits are established within which the supplying party must review and provide a written response;

- a census of everything invested.

Additionally, a return certificate is drawn up. This is a document that is drawn up by several authorized persons of the receiving company. It is confirmed by the results of the examination and is considered an official document sent from the buyer to the seller.

Here you need to provide information:

- date and place;

- details of both organizations;

- the name of the service or thing that is the basis;

- expert opinion;

- signs how purchased products will be returned to the warehouse;

- indicate invoice details for reverse transfer for low-quality goods;

- if there is compensation - terms and amounts;

- signatures;

- print.

Both parties will sign, but only the manager or other authorized person on each side. His right must be confirmed by a special power of attorney, otherwise the document has no legal force.

Return of goods: difference in accounting

The differences between a return and a buyback are also important for reflecting the transaction in accounting.

Regular return

When returning goods that have been accepted for registration, the buyer will make the following entries:

- Dt 76 (not 62!) Kt 41 - for the cost of return;

- Dt 76 Kt 68 - for the amount of VAT on the adjustment invoice.

The seller must reverse:

- revenue: Dt 62 Kt 90;

- cost: Dt 90 Kt 41;

- VAT: Dt 90 Kt 68.

Buyback

The buyer reflects the sale of goods:

- Dt 62 Kt 90 - for the redemption amount including VAT;

- Dt 90 Kt 41 - for the cost of returned goods;

- Dt 90 Kt 68 - for the amount of VAT.

The seller, accordingly, enters these goods into his account:

- Dt 41 Kt 60 - for the cost of return (redemption);

- Dt 19 Kt 60 - for the amount of VAT;

- Dt 68 Kt 19 - VAT deductible.

How to return payment

In the event that the current buyer has already fully returned material assets to the seller, the supplier is obliged to transfer the agreed amount of money to the client’s account. The amount of compensation may be the same as for the original payment for services. It is also allowed to reduce/increase the cost of goods, but only by mutual agreement. Additionally, it must be taken into account that the seller has the right to retain a small part of the money in order to cover expenses incurred. The loss of possible benefits is not considered when calculating the cost of the product upon repurchase.

Also on the topic: In what cases and in what form can the authorized capital of an LLC be reduced

Additionally, the seller may retain part of the amount to cover the costs of repairs/purchase of damaged items. For example, this applies to vegetables and fruits, which have a very short shelf life.

Results

The procedure for processing the return of goods to the supplier has changed since 2019 and is now uniform: the supplier draws up an adjustment invoice, and the buyer only draws up an invoice marked “return of goods.” The buyer does not issue an invoice for the return. Based on the adjustment invoice, the seller accepts VAT for deduction during the period of return of goods, and the buyer recovers the VAT.

For a sample of filling out a correction invoice for returning goods to a supplier, see here.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

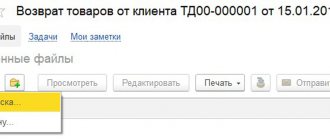

6.1. Return of goods due to the following reason: “Defects discovered after installation” will be accepted for consideration.

If:

— The return is created no later than 6 months. from the date of sale from the company’s warehouse; (The period may be extended depending on the requirements of the supplier Company.)

— The following scans are attached to the return; (The list may change depending on the brand of the item being returned):

• Claim report

• Order-Work Order

• Warranty card

• Copy of Station Certificate

• Photos: stickers (confirming the supplier), parts (general view), defect.

This return will be reviewed and a decision will be made on it within a period of 1 to 14 days, depending on the deadlines set by the supplier to the shipping company.

6.2. Return of goods due to: “Inadequate packaging, Mechanical damage, Part with traces of installation” will be accepted.

If:

— The return is created no later than 1 business day after the goods are transferred to the client, or is carried out at the time the goods are transferred from the company driver.* — The following scans of documents are attached to the return:

- Claim report

- Photos: stickers (confirming the supplier), packaging (general view), parts (general view), defect.

— if the return is made upon acceptance of the goods from the company’s driver, or upon receipt of the goods through “Pickup”, then in the case of this return none of the above documents are required;

This return will be reviewed and a decision will be made on it within 3 to 6 business days, depending on the client’s geographic distance from the company’s main office.

6.3. Return of goods for the reason: “Re-sorting of the article, Re-sorting of the brand” will be accepted for consideration.

If:

— The return is created no later than 1 business day after the goods are transferred to the client

— The following scanned documents are attached to the return:

- Claim report

- Photos: stickers (confirming the supplier), packaging (general view), details (general view).

— The article and/or brand indicated on the packaging corresponds to the customer’s order, but the attachment is mis-sorted; a link to the original website of the ordered brand is required, confirming the mis-sort.

This return will be reviewed and a decision will be made on it within 3 to 6 business days, depending on the client’s geographic distance from the company’s main office.

6.4. Return of goods for the reason: “Shortage of Goods-Place, Internal Shortage” will be accepted for consideration.

If:

— The return is created no later than 1 business day after the goods are transferred to the client, or is carried out at the time the goods are transferred from the company driver.*

This return will be reviewed and a decision will be made within 3 to 6 business days.

6.5. Return of goods for the reason: “Incomplete” will be accepted for consideration.

If:

— The return is created no later than 1 business day after the goods are transferred to the client, or is carried out at the time the goods are transferred from the company driver.*

— The return is accompanied by a link to the original website of the ordered brand, confirming the shortage. — When returning goods in transit due to shortage: 1 piece. instead of 2 pcs. and more, it is necessary to return the entire quantity of goods under this article from one delivery.

This return will be reviewed and a decision will be made on it within 3 to 6 business days, depending on the client’s geographic distance from the company’s main office.

6.6. Return of goods of good quality “Return with a discount” will be accepted for consideration no later than 10 days from the date of receipt of the goods from the Autosoyuz company.

6.7. Providing the client with a scan of the Service Station Certificate for consideration of the Return is a mandatory condition when requested by the Supplier.

*Refunds at the time of transfer of goods from the company driver apply only to goods of inadequate quality from the current delivery:

- mechanical damage;

— re-grading according to the applicability of the part;

— absence of goods specified in the delivery document;