Definition

First, let's define the key features of the payment in question. State duty is a sum of money that is charged by specially authorized organizations and institutions for carrying out legally significant actions in favor of citizens or citizens. We are talking, in particular, about the issuance of documents, the provision of public services, certification of contracts, powers of attorney, wills, other expressions of will, state registration of transactions or enterprises, etc. The authorized institutions are: judicial, law enforcement, financial authorities, notary offices, civil registry offices and so on.

In Russia, the procedure for paying state duty is regulated by Chapter. 25.3 NK. The Code provides a more detailed definition of the payment we are interested in. According to the Tax Code, a state duty is a monetary fee that is levied on organizations and individuals when they apply to government agencies, local government structures or other institutions, as well as to officials authorized by federal, regional and local legislation to carry out legal actions established by the Tax Code , except for those carried out by consular offices of the Russian Federation. The issuance of documents and duplicates is recognized as legally significant actions, but the provision of copies will no longer be considered as such.

Payment procedure

When and how can I pay?

The state fee must be paid before going to court or other government agency. Individuals and individual entrepreneurs can pay it in cash through a cashier, operator or bank terminal, or by bank transfer from an account.

Legal entities usually pay state fees in cash. It can be paid in cash by the CEO acting on behalf of the organization (subject to restrictions on the size of cash transactions). Some government agencies do not accept payment from another representative of the organization by proxy. Although the legality of this remains in question, the safest way to pay the fee is by wire transfer from a bank account.

Payment via terminal

Not any payment terminal is suitable for payment, but only a bank terminal. The Tax Code of the Russian Federation does not provide for the possibility of paying state duties through payment terminals that belong to non-bank organizations and individual entrepreneurs (Letter of the Ministry of Finance of the Russian Federation dated November 28, 2014 No. 03-05-06-03/60831). Only a document issued by the bank’s payment terminal will serve as confirmation of payment of the state duty.

A little history

The term "toll" comes from the word "to go." At first, the concept meant “what came from goods.”

The history of the duty began a very long time ago. For example, in the Middle Ages this payment was used very often. A fee was then called a fee collected for the use of bridges and roads. Feudal lords were paid for performing judicial functions, maintaining order and implementing other important management tasks. However, the most popular were fees for entry and movement within the state, principality or individual city. Foreign merchants also paid for the right to sell their goods.

How did it happen that the duty became a state tax? By the 17th century State borders were clearly defined. Customs houses were created to control the movement of people from one country to another. It was from this time that duties began to be considered as one of the instruments of economic regulation.

In Ancient Rus', they collected the so-called myt - an analogue of customs duty. The gathering took place in places where carts and boats were parked. Already in the 12th century. Myt became an official state tax. But all this relates to the customs sphere. How were things going in other areas of public life?

In the 12th century. the system of state and local government was quite extensive. The ruler of Rus' was considered the Grand Duke, whose relatives sat in appanages, and therefore were called appanage princes. In addition, there were governors (in cities) and volosts (in volosts). They dealt with issues of territorial significance and received a kind of reward for their work - food. It could be either in monetary terms or in kind. At the same time, the population paid for almost everything: weddings, divorces, trials. The governors received payment even for arriving in the city. They lived, of course, very well.

Receipt and distribution of customs payments in the EurAsEC Customs Union

It is impossible not to dwell on possible violations that arise during the distribution of customs duties between the union states. These include, firstly, non-transfer or incomplete transfer of funds, and secondly, the presence of funds required for transfer in a single account, but providing information about the absence of these funds for transfer and, as a consequence, non-transfer. The resumption of the procedure for transferring funds is carried out based on the results of consultations held by the Secretariat of the Customs Union, a meeting of the Customs Union Commission, or a discussion at a meeting of the Interstate Council of the Eurasian Economic Community, after which these funds are transferred to a single account of the state that committed the violation.

Is a state fee a fee or a tax?

This question arises for many people. It is quite reasonable. The fact is that state duty is a payment included by law in the country’s tax system. Accordingly, it can be considered as a special type of tax. The similarity lies in the mandatory contribution to the budget and the application of all general rules to payment. The difference lies in the targeted nature of the payment and remuneration. After all, in return for paying the state fee, the applicant receives a counter-provider - the required service. This does not happen with taxes.

From the above information comes the answer to another burning question - where does the state duty go? Amounts are transferred to the federal, regional or local budget depending on the level at which the body to which the payer applies is located. Each such structure issues a receipt indicating the details for paying the state duty. Today, you can make a deduction in a variety of ways. Recently, online payment has become a popular option. If for some reason the applicant was not issued a receipt, you can obtain details for paying the state fee from the office of the relevant authority. In this case, the applicant will have to enter them into the receipt form with his own hand.

State duty is a payment established by federal law. Consequently, it is obligatory for deduction throughout the entire territory of the state. Amounts, in accordance with Art. 50, 56, 61, 611, 612 BC are credited according to the standard of 100% to the budget of the corresponding level.

Program for maintaining the SRO register

3500 per season! This amount includes electricity, water, as well as current expenses (salary of the chairman, garbage removal, maintenance of networks and repair of the road surface inside the SNT). But contributions from each hundred square meters is not entirely correct, because each member of the partnership pays land tax based on the number of hundred square meters! Payment of contributions based on the number of acres is possible if this was decided by the general meeting and the corresponding entry is in the SNT charter! VAT is a tax for every citizen of the country in which he lives, this is so that the country does not fall to its knees from people - money-grubbers whose money is in a drawer under their clothes or the book “Where is my happiness”, this is not bad and not ok, that's the norm these days.

Payment functions

The object of state duty is legal actions, services of local, regional, state authorities, other authorized structures and officials. The list of such services is fixed by the Tax Code and is closed. In total, it provides more than 200 types of services. They can be divided into 4 groups and correlated with payment functions:

- Notary fee. It is established for all notarial actions established by law.

- Judicial state duty - for statements of claim, complaints, petitions, and other appeals filed in courts.

- Registration fee - for state registration of legal entities, individual entrepreneurs, transactions, computer programs, databases, civil status acts, etc.

- Administrative state fee. It is established for the issuance of documents upon acquisition/renunciation of citizenship, entry into the Russian Federation or exit from the country.

From December 29, 2010, no fee is charged when corrections are made to a document for errors made by the official or body that issued it when performing a legal action.

What is the state duty paid for?

The state duty is paid for the performance by state bodies of legally significant actions in relation to the citizen or organization that applied for their commission.

Legally significant actions for which a fee must be paid are listed in the Tax Code.

In Art. 333.17 – it is indicated for what the state duty is paid:

- when applying to courts - both arbitration and general jurisdiction, to magistrates;

- when applying to the Constitutional Court of the Russian Federation and constitutional (statutory) courts of the constituent entities of the Russian Federation;

- when contacting a notary to perform notarial acts (for example, drawing up a power of attorney);

- for state registration of acts of civil status (registration of marriages, births, deaths, divorces, etc.);

- upon receipt of passports of Russian citizens and foreign passports;

- when acquiring Russian citizenship;

- for state registration of computer programs, databases;

- for state registration of medicinal products;

- for state registration of legal entities, political parties, media, issues of securities, property rights, vehicles;

- for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of companies;

- for the right to export cultural property;

- for issuing permits for the export from the territory of Russia, for the import into its territory of species of animals and plants falling under the Convention on International Trade in Endangered Species of Wild Fauna and Flora;

- other legally significant actions.

The specifics of paying state duty depending on the type of legally significant actions performed, the category of payers or other circumstances are established by Articles 333.20, 333.22, 333.25, 333.27, 333.29, 333.32 and 333.34 of the Tax Code of the Russian Federation.

Tax law norms

To calculate the taxable base, either the cost of the service provided to the applicant or the cost of the claim is taken into account. There is usually no tax period. This is due to the peculiarities of the payment deduction deadlines provided for by the Tax Code.

Typically, the state fee is transferred before the required legal action is performed. However, there are exceptions to this rule. In these cases, a tax period is established, and the duty is levied after the action is completed:

- Within 10 days after the court decision comes into force, if an individual or organization is the defendant, the decision is not made in their favor, and the plaintiff is exempted from paying the fee.

- Until March 31 of the year following the year of registration of the vessel in the register of the Russian Federation or (when applying for annual confirmation of registration) the last year of registration.

Receipt for payment of state duty tax

It's easier to find a legal entity. a company that will do all this. I am one of those who said that it is not difficult. This is really not difficult, but the cost of the services of a law firm is 3-7 thousand rubles, and they organize everything, the transfer of money and the contract and verification, so why torture yourself and then think that tomorrow your wife’s brother, a prisoner, will come and settle in one of the rooms in your apartment, if all you have to do is give these pennies. Although it's up to you

You know, you can, of course, try to shake up your license, or somehow come to a good agreement with the Fed so that they accept your receipt. There’s nothing wrong with it, in the grand scheme of things, that you paid in cash. So, for example, when registering an LLC or changes, the tax office only accepts receipts. Yes, and I once submitted documents to the Federal Reserve for registration of property rights - I constantly paid the state duty on my own behalf (from the representative) as an individual. So I think you have every right to pay from the director of the LLC. Another thing is that if your Fed gets into a pose, then it’s unlikely that anything can be done with it. And this happened to me. Only with the Federal Tax Service. I had to pay an extra thousand to the assholes.

We recommend reading: Presidential Payments to Large Children in 2020

Rates

The Tax Code provides for tariffs used in calculating state duties depending on the body performing the legal action, the nature of the document being drawn up or the specifics of the transaction being registered.

According to the Code, the rate can be expressed in a fixed amount, mixed - proportional or progressive.

The system for calculating the proportional rate on property documents depends on the degree of relationship. A progressive rate implies an increase in the payment amount as the tax base increases. The amounts of these tariffs may be additionally limited by maximum and minimum limits. In some cases, the rate takes into account the unit of document volume (for example, with a page-by-page certificate).

State duty is a tax payment or another - Business, laws, work

Any action that requires legal confirmation of legality is carried out in every country of the world only after paying a special type of tax, which is called a state duty.

Back in the Middle Ages, it was customary to collect tolls on roads and bridges located on the territory of individual states belonging to various cities, regions or feudal estates. Such fees were called duties. Payment of the state fee was required when filing claims in courts or to confirm the legality of ownership of lands or other property.

State duty in the Russian Federation

In Russia, payment of state duty is provided for by the tax code, and is described in detail in article No. 25.3 entitled “State duty”.

The definition of this type of tax states that the duty levied under the tax law is the collection of funds from individuals, legal organizations, private entrepreneurs or unincorporated organizations when they apply to various bodies authorized to carry out legal actions. These include:

- Local government officials.

- Local self-government organizations.

- State organizations.

In other words, these are the police, courts, registry offices, notary offices and other responsible financial organizations.

The state duty of the Russian Federation is charged:

- If necessary, apply to courts of general jurisdiction.

- When applying for a hearing by a magistrate.

- When filing a claim in the constitutional court.

- When preparing any notarial documents.

- When registering a civil status act.

- Upon receipt of the right to citizenship or removal of citizenship.

- When leaving or entering the country.

- When preparing documents and registering a legal entity.

- To enter into legal force of powers of attorney, wills, contracts.

The issuance of documents and their duplicates by authorized bodies is an action of legal significance; upon receipt, payment of a state fee is also required. The exception is the issuance of copies of such documents. There is no need to pay anything when ordering copies.

State duty, like other types of taxes provided for by Russian legislation, is a mandatory type of contribution of funds to the state budget. The state duty is subject to all general conditions that apply to other types of taxes. The only difference is the targeted nature of the transfers.

Since the state duty is a federal fee from citizens and organizations, its payment is mandatory in all regions of the Russian Federation.

The amount of state duty is determined in accordance with Articles No. 50; 56; 61; 611; 612 of the budget code.

All incoming funds from receiving state duty are transferred to the assets of local or federal budgets or the budget of federal entities.

Rules for paying state fees

All individuals or organizations are required to pay the state fee. Regardless of citizenship and nationality. Citizens and organizations of foreign countries are not exempt from paying this tax. Payment of the duty is made if:

- There is a need to fulfill the action of legal significance specified in Article 25.3 of the Tax Code.

- A person or organization is summoned to an arbitration court, a court of general jurisdiction, or to a magistrate as a defendant. If a decision is made in favor of the plaintiff, the latter is exempt from paying state duty, and the defendant is obliged to pay it in full.

If several payers simultaneously contact the responsible organization with a request to perform an action of legal significance, the total amount of the state duty is paid by them in equal shares.

If among the persons applying to the federal authorities there is a representative who has the right to benefits or is exempt from paying this tax, the amount of the state duty is reduced by the amount allocated for this representative.

The remaining part of the tax is paid by all payers who do not have benefits in paying the duty.

There is an exact list of objects for which state fees must be collected. It includes 230 types of actions that are legally significant. By nature they can be divided into four groups, these are:

1) Court fee.

It includes complaints, petitions, requests considered in the constitutional court. As well as statements of claim to arbitration courts - all claims and complaints considered by a court of general jurisdiction.

2) Notary fee.

Includes all types of notarial activities and actions assigned to notary offices.

3) Registration fee.

- Registration of state acts of civil status.

- Registration of business activities, legal entities, organizations without forming a legal entity.

- Registration of computer programs and databases.

4) Administrative fee.

Obtaining documents for leaving the country and revocation of citizenship or documents allowing entry into the country and obtaining citizenship.

According to the decision of the federal administration, payment of the state fee may be challenged if a mistake was made in the received document by the official who prepared this document.

The calculation of the state duty is based on the cost of the legal service itself or the price set for the claim. The period during which the duty must be paid is not specified in the tax code.

The accepted payment procedure is for this tax to be paid in full before the legal action is completed. The law provides several exceptions to this practice. In the first case, the possibility of payment is provided immediately after the completion of a legal action. In the second case, the exact deadlines within which the state duty tax must be paid are specified:

- Ten days from the date of entry into legal force of the adopted court decision. Such actions are practiced in the case of forced imposition of a duty on the defendant, when a decision is made in favor of the plaintiff.

- Until March 31 of the following year after the date of the decision and its entry into legal force. Such deadlines are set when applying for annual confirmation of registration by the judicial authorities.

State duty rates

The tax legislation provides for individual amounts for state duties in 2021. They depend on the status of the bodies performing the action of legal significance and the nature of the document or transaction. The following types of determining the size of the state duty rate are used:

- Fixed (solid).

- Ad valorem.

- Mixed.

Most often, fixed fixed duty rates are used. In case of assignment of ad valorem or mixed amounts of state duty, progressive or proportional rates are applied.

The proportional type of assignment of the amount of duty applies to documents on property, and depends on the degree of family ties. The progressive type of duty provides for an increase in the amount of tax, depending on the increase in the value of the base subject to taxation.

When assigning a progressive type of duty, the maximum and minimum amounts assigned are separately specified. The amount of the state duty may also depend on the volume of the document. In this case, the number of pages that make up the document is counted and each of them is certified.

Source: //novdmt.com/gosposhlina-eto-nalogovyy-platezh-ili-inoy/

How to pay the state fee at a discount?

In ch. 25.3 of the Tax Code provides for about 90 benefits provided to fee payers. Their types are established depending on the actions performed, the category of subjects, etc.

The benefit for paying state duty can be conditional or unconditional. To receive the first one, a certain condition must be met. For example, when preparing inheritance documents, an exemption on payment of state duty is provided for persons who lived with the testator until the moment of death. An unconditional benefit (for example, a discount on payment of a fee of 50%) is established for disabled people 1, 2 gr.

In addition, there is a complete exemption from transferring payments to the budget. This benefit, in particular, is provided to cultural institutions and other organizations and bodies receiving budget funding. Certain categories of citizens are also exempt from the obligation to pay state duty: disabled people and participants of the Second World War, Heroes of the USSR and the Russian Federation, full holders of the Order of Glory.

It should also be said about the benefits provided depending on specific legal actions. For example, plaintiffs may not pay the fee:

- on applications for recovery of wages, benefits and other claims arising from labor law;

- public organizations of disabled people acting as applicants and respondents.

Payment nuances: mortgage, patent

When paying state fees, in some cases there are certain subtleties that must be taken into account when issuing a receipt. This concerns the formation of the cost of a certain action.

- In one case, this may be a fixed contribution, which is determined by law and does not change regardless of who the payer is.

- In the second case, we are talking about the prices of lawsuits. The amount of the fee depends directly on how much you need to pay to file the application.

Registration of a mortgage

Since 2014, there is no fee for registering a mortgage. Just as this does not happen when repaying a loan. Before this, an agreement of this category was required to be registered in the state register.

It was considered officially concluded from that moment, but because of this, many delays often arose that prevented quick and trouble-free repayment.

Patent fee

A patent is a document whose main purpose is to certify ownership of a specific invention. Receipt of this paper requires payment of a state fee.

The procedure for payment and refund in case of overpayment is established in the relevant resolution. It determines all the important nuances, knowledge of which guarantees timely payment.

Two categories of citizens are exempt from paying the fee when obtaining a patent:

- An individual is disabled or a hero of the Second World War or other battles that took place on the territory of the former USSR. This is also true for citizens who are the sole author of a particular invention.

- Collective request for a patent, provided that each author of the invention is a WWII veteran.

Refund

The grounds for refund or offset of state duty are set out in Art. 333.40 Tax Code. The fee is refunded to the payer, in accordance with the norm, in whole or in part if:

- The applicant paid an amount exceeding the amount provided for in Chapter 25.3 of the Tax Code.

- The complaint, application or other appeal was returned, their acceptance was refused or the requested notarial actions were refused.

- The proceedings in the case were terminated or the application was left without consideration in the arbitration court or instance of general jurisdiction.

If the amount of the fee has not been returned to the payer, it will be counted towards the payment of the fee upon re-application, unless the three-year period from the date of the previous decision has expired and the applicant has presented the original receipt.

If a settlement agreement is concluded before the arbitration court makes a ruling, 50% of the paid state duty must be returned to the plaintiff. However, this rule does not apply to situations where the said agreement was drawn up at the stage of execution of the decision.

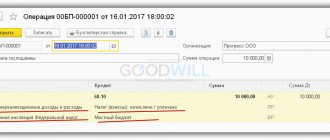

Reflection of state duty refunds in accounting entries

Duties from citizens and legal entities must be taken into account. Reimbursed funds for previously paid fees are taken into account in the subaccount “Other expenses”, since they are income for the institution (organization).

In this case, the accounting entries are reflected as follows:

- Return of the full amount of the state tax or a certain percentage (credit 68, debit 51).

- Contribution of funds to the state duty account (debit 68, credit 51).

- State tax, which is refundable, is included in other expenses (debit 68, credit 91).

Accounting entries allow you to quickly find any fee in favor of an enterprise and, if necessary, decide how to return the paid state duty to a citizen.

State fees are mandatory payments by individuals and organizations in favor of the state, which are paid for the provision of a certain type of legal services. But if the services were not required, or an excessively large amount was paid, you can always find a way out of the situation and get your money back.

Exceptions

The Tax Code stipulates cases when the state duty is not refundable. We are talking about the following situations:

- The defendant voluntarily satisfied the plaintiff’s demands after his claim was accepted for proceedings in the arbitration court.

- The settlement agreement was approved in a court of general jurisdiction.

In addition, the fee amount is not refunded for applications for registration/divorce, change of name or making other corrections to the record of the registry office if they were not satisfied, i.e. the authorized bodies did not perform these actions.

A similar rule applies if a person refuses state registration of a right, encumbrance (restriction) after contacting the relevant government agencies. Moreover, if the registration of rights, restrictions (encumbrances) on real estate was terminated, based on the application of the parties, 50% of the paid fee is returned.

Where does the state duty go to what budget?

Northwestern sector of the department of control and supervisory activities in the field of education of the Obrnadzor of the Republic of Belarus address: 452320, Dyurtyuli, M. Yakutova lane, 4 tel/fax: (34787) 3-05-89 E-mail: [email protected] , Specialists-experts Layakov Ildus Yurisovich, Khamidullina Gulchira Kiagapovna It depends on what state duty you mean. State duty for registration actions of tax authorities, arbitration courts - to the federal. State duty paid to courts of jurisdiction and magistrates for registration actions of traffic police, passport and visa services - to the local one.

Organizational matters

Refund of the overpaid/collected amount of duty is carried out at the request of the payer. It is submitted to the body or official who is authorized to perform the relevant legal actions for which payment was made. If the refund must be made in full, the original payment receipts should be attached to the application, and if partially, copies. The decision to grant the request is made by the relevant body or official.

Direct refund of the amount is made by the Federal Treasury department at the place of payment.

If a subject wants to return the state duty in a case being considered in court, including a magistrate’s court, he submits his application to the Federal Tax Service at the location of the relevant court.

You can send an appeal before the expiration of three years from the date of payment. Refunds are made within a month from the date of sending the application.

Enrollment

According to the Budget Code of the Russian Federation, which budget the state duty goes to depends on its purpose.

100% of the state duty is credited to the budget of the constituent entities of the Russian Federation:

- in cases considered by constitutional (statutory) courts;

- for performing notarial acts;

- for state registration of interregional, regional and local public associations, their branches, for state registration of changes to their constituent documents;

- for state registration of regional branches of political parties;

- for state registration of a vehicle pledge agreement, including the issuance of a certificate and its duplicate;

- for the issuance of a qualification certificate granting the right to carry out cadastral activities;

- for issuing a certificate of state accreditation of the regional sports federation;

- for registration of mass media, the products of which are intended for distribution primarily in the territory of a constituent entity of the Russian Federation, for issuing a duplicate certificate of such registration;

- for actions of authorized bodies related to licensing the use of subsoil plots of local significance;

- for the actions of authorized bodies related to licensing the procurement, processing and sale of non-ferrous and ferrous scrap metals;

- for the provision of licenses for the retail sale of alcoholic beverages issued by executive authorities of the constituent entities of the Russian Federation;

- for actions of executive authorities of constituent entities of the Russian Federation related to licensing and accreditation of educational institutions;

- for granting a license for the production, storage and supply of alcohol-containing non-food products, in part made from confiscated raw materials;

- for issuing accreditation certificates in order to recognize the organization’s competence in the relevant field of science, technology and economic activity to participate in control activities;

- for the actions of executive authorities of the constituent entities of the Russian Federation in affixing an apostille on documents on education, academic degrees and titles;

- for the issuance by the executive authority of a constituent entity of the Russian Federation of a special permit for the movement on roads of vehicles transporting dangerous, heavy and (or) large-sized cargo.

100% of the state duty is credited to the settlement budget:

- for the performance of notarial acts by officials of local government bodies of the settlement authorized to perform notarial acts, for the issuance by the local government body of the settlement of a special permit for the movement of a vehicle transporting dangerous, heavy and (or) large-sized cargo on a highway.

100% of the state duty is credited to municipal budgets:

- in cases considered by courts of general jurisdiction, justices of the peace (with the exception of the Supreme Court of the Russian Federation);

- for state registration of vehicles, including temporary registration at their place of residence, for issuing various certificates to car owners, etc.;

- for issuing permission to install an advertising structure;

- for the issuance by a local government body of a municipal district of a special permit for the movement of a vehicle transporting dangerous, heavy and (or) large-sized cargo on a highway;

- for the performance of notarial acts by officials of local government bodies of a municipal district, authorized in accordance with the legislative acts of the Russian Federation to perform notarial acts in a populated area that is located on an intersettlement territory and in which there is no notary.

The budgets of city districts and municipal districts, federal cities of Moscow, St. Petersburg and Sevastopol are subject to crediting the state duty for the provision of licenses for the retail sale of alcoholic beverages issued by local governments at a rate of 100%.

State duty offset

The possibility of its implementation is also provided for in the Tax Code. With offset, the excess amount previously paid for a specific legal action is offset against payment for a similar service.

To exercise his right, the payer must submit an application to the body or official to whom he previously applied. You can also send an appeal within three years from the date of the decision to return the excess amount or from the date of its transfer to the budget.

The offset is carried out in the manner prescribed in Chapter. 12 NK.

Differences

To determine whether a state duty is a tax or a fee, you need to consider their main characteristics. The first concept is more capacious, because a tax is the obligation of all payers to transfer part of their income or profit to the treasury. The collection is not mandatory. Such a contribution is necessary for the state to carry out any actions against the payer.

The main characteristics of the tax are:

- obligation;

- gratuitousness;

- coercion;

- the need for calculation;

- belonging to budgets of various levels.

To correctly calculate the payment amount, you need to decide on the object, know its base cost, tax rate and period. It is also necessary to understand what the tax collection procedure is, so as not to miss the established deadlines.

Different rules apply regarding collection. It is paid one-time and for a specific service by authorized bodies. This means that it is optional and cannot be forced. However, the main difference between a fee and a tax is that after payment, the implementation of legal actions to obtain certain rights is guaranteed.

When it becomes necessary to pay a state duty, whether it is a tax or a fee, the individual does not care. Having a receipt in hand, he deposits the amount established by law. It doesn’t matter to him at all what such an action is called.

For a legal entity, everything is more complicated. The form of payment order, with which it is possible to transfer funds, requires a precise definition of the purpose of the contribution and entering this information in the appropriate field. However, it is enough for the bank to know that a state fee has been paid. Whether it is a fee or a tax, you do not need to specify in the payment purpose field.

Additional guarantees

In accordance with the Tax Code, persons applying to authorized bodies may be provided with an installment plan or deferment of payment of state duty.

To take advantage of this opportunity, the interested person submits a request. Deferment/installment plan can be provided within the period specified in clause 1 of Art. 64 NK. At the same time, the Code provides another important guarantee. No interest is accrued on the amount of state duty for which a deferment/installment plan has been granted throughout its entire term.

Difference between fee and state duty

Personally, first of all, before getting married, I think it is appropriate to contact the executor with a request with approximately the following content: Economic court_________________ st. ___________________ To the bailiff ________________ On the provision of information _________ in accordance with the application submitted by our organization and on the basis of the court order of the Economic Court _________ No. ____________, enforcement proceedings No. _______ were initiated to recover from ______________ ________(____________) rubles. The period for voluntary fulfillment has expired; to date, the Debtor has not taken any actions indicating an intention to repay the debt. ____________. The Economic Court ______ has seized funds located or arriving at settlement accounts opened at CJSC JSCB Belrosbank and OJSC Belvnesheconombank, but forced collection is also not carried out, although it is known that the Debtor is carrying out activities. In connection with the above and on the basis of Art. 345 of the Economic Procedural Code of the Republic of Belarus, paragraph 19 of the Instructions for enforcement proceedings in the economic courts of the Republic of Belarus, approved by resolution of the Plenum of the Supreme Economic Court of the Republic of Belarus No. 21 of November 26, 2009. , I ASK: 1. provide information about the enforcement actions taken within the framework of enforcement proceedings No. __________; 2. provide information on responses to requests to the agency for state registration and land cadastre, the State Automobile Inspectorate of the Ministry of Internal Affairs of the Republic of Belarus, the Ministry of Taxes and Duties of the Republic of Belarus, banks and other financial organizations regarding the availability of other accounts and property by the Debtor. The director ____________ ___________ usually forces the court to do this. performers to be a little more active. Well, in my opinion, when filing a complaint, having an answer to such a request will not hurt. migorn [e-mail hidden] Belarus, Minsk Wrote 171 messages Write a private message Reputation: 20 #3[2947] March 14, 2011, 14:00 Considering that the Code of Criminal Procedure is supplemented by Article 407 with the following content: “Article 407. Providing information on enforcement proceedings initiated against debtors by the Economic Courts, information is provided on the existence and number of enforcement proceedings initiated against the debtor; about the amount of debt to be collected; on encumbrances against the debtor’s property committed within the framework of enforcement proceedings. The information specified in part one of this article is provided by the economic court on the basis of a written application from an individual entrepreneur or legal entity, subject to payment of the state duty in the manner and amount established by legislative acts. “, and the rate is 3 basic units for information about each debtor, I wonder how the courts will react to such letters. !

Due to the fact that the above acts relate to state fees, they do not define a specific legal mechanism for the return of court fees. According to paragraph 4 of Art. 83 of the Code of Civil Procedure of Ukraine, unlike the Decree, court fees are refundable, firstly, not only.

Comparison

To understand whether a state duty is a tax or a fee, it is necessary to analyze these two concepts according to the following criteria:

- Target. Any fee is intended to ensure the activities of those bodies that provide a service or register the right to something. The tax is not directed towards anything specific.

- Regularity. The fee is paid one-time, and the tax is paid at regular intervals.

- Legislative support. The need for collection is determined individually. It depends not on the subject, but on the nature of the service provided. Taxpayers are determined at the legislative level.

- Sum. For collection, the fee is fixed; for tax, it depends on the base, rate and possible benefits.

- Date of. Fees are not tied to time, but are determined by the need of the payer. Taxes are paid at the end of the reporting period within a limited period.

- Termination of obligations. Taxes are collected from legal entities until the company ceases to exist. Individuals pay for them for life. An exception is a number of taxes that are not levied on certain categories of citizens, for example, property tax on pensioners. Fees are one-time amounts for services.

- Individual characteristics of the payer. Counted for taxes and not relevant for fees.

- Result. Paying a tax only saves you from unpleasant consequences, but collecting a fee gives you the right to something.

- Failure to pay: the tax threatens to be subject to forced collection along with penalties and fees - will lead to non-receipt of the service.