From October 1, 2021, a new purchase ledger form must be used (to determine the amount of VAT). What exactly has changed in the purchase ledger form? Why did the adjustments need to be made? How have the filling rules changed? How can I keep a new purchase book now? In this article you will find answers to these and other questions, and you will also be able to familiarize yourself with and fill out the new book. Let us remind you that from October 1, 2021, a new invoice form will also be used.

Who should keep a purchase book and why?

To determine the amount of VAT to be deducted, an organization must maintain a purchase ledger. In the purchase book, buyers register electronic and (or) paper invoices issued by sellers (including adjustments, corrected ones). This approach to bookkeeping continues to apply after October 1, 2021.

The purchase book for the purpose of determining the amount of VAT can be kept in paper or electronic form according to the established format (clause 1 of the Rules for maintaining the purchase book).

All VAT payers must keep a purchase book, except for those who (clause 3 of Article 169 of the Tax Code of the Russian Federation):

- received exemption from the duties of a VAT payer;

- conducts only VAT-free transactions (in particular, for the sale of goods, works or services, the place of sale of which is not recognized as the territory of the Russian Federation).

Shopping book, its purpose and procedure for use

[ads-pc-3] [ads-mob-3]

The purchase ledger is a tax accounting ledger designed to record invoices from suppliers with incoming VAT. It is drawn up by the purchasing organization as these documents are received and attached to the declarations at the time of their delivery.

When filling it out, you must use the recommendations of Decree No. 1137 of December 26, 2011, which determines the mandatory form of this document. The register can be filled out manually using printed forms or using a computer. In the latter case, a printout is made for each tax period. In any case, it must be laced, numbered, and sealed with the manager’s signature and seal.

In many specialized accounting programs, the book is generated automatically, subject to the procedure for capitalizing the invoice.

Entries in columns with amounts are made in rubles and kopecks. If the invoice reflects the goods in a foreign currency, then you must first indicate its code in the appropriate column, and then the value. Incorrectly completed documents cannot be reflected in this register. It also does not record invoices received when carrying out activities in the interests of a third party under agreements of agent, commission, assignment, etc. Free receipt of material assets and the purchase and sale of foreign currency are not reflected in the purchase ledger.

For goods for which a VAT deduction is provided, taking into account payment, in case of partial payment it is necessary to make as many entries as the number of transfers made.

The purchase books reflect adjustment and correction invoices, and the values in the cost indicators can be either positive or negative. If you need to cancel an entry in the purchase book that was made in previous periods, then you need to fill out additional sheets to this register for the corresponding quarter. They are an important part of the shopping ledger.

The book needs to summarize the amount of VAT after each tax period so that their value is reflected in the declaration for this tax.

It is important to remember that only incoming invoices are recorded in this register.

The sales ledger is used to register outgoing documents .

Changes from October 1

The form and procedure for maintaining the purchase ledger are defined in Appendix 4 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. However, from October 1, 2021, the form of the purchase ledger and the rules for maintaining it will change. This is due to the entry into force of Decree of the Government of the Russian Federation dated August 19, 2017 No. 981. Next, we will consider in detail the most important changes.

Import of goods from other countries

The amendments stipulate that when importing goods from countries outside the EAEU, the cost of these goods should be indicated in column 15 as in accounting. Previously, there was no clear position on this matter. For example, in the Letter of the Federal Tax Service of Russia dated September 20, 2016 No. SD-4-3/17657, it was noted that when reflecting in the purchase book the cost of goods imported into the territory of the Russian Federation, it is recommended to indicate in column 15:

- the cost of goods stipulated by the agreement (contract);

- if there is no value in the agreement (contract), the value indicated in the shipping documents should be indicated;

- if there is no value in the agreement (contract) and shipping documents, you need the value of the goods reflected in the accounting.

There shouldn't be any more questions. From October 1, 2021, the book must record the accounting value of goods imported into the territory of the Russian Federation (except for imports from the EAEU countries).

Import of goods from EAEU countries

From October 1, 2021, amendments will be made to the Rules for filling out the purchase book on how to fill out the fields when importing goods from the EAEU countries. So, for example, in column 3 “Number and date of the seller’s invoice” you should indicate the number and date of the application for the import of goods and payment of indirect taxes (with marks from the Federal Tax Service on the payment of VAT).

Registration of invoices for prepayment

From October 1, 2021, when registering prepayment invoices in the purchase ledger, you will no longer need to mark “partial payment.” Previously, the requirement for the need for this phrase was directly stated in the order of filling out the purchase book:

How to register advance invoices

Starting from October 1, 2021, you can enter advance invoices into the purchase book for non-cash payments. Before October 1, this could not be done.

From October 1, 2021, subparagraph “d” of paragraph 19 of the Rules for filling out the purchase log is declared invalid. In this regard, apparently, there will be no more claims from the Federal Tax Service regarding deductions on such documents.

Tax authorities' claims for deductions, which are based on “non-cash” advance invoices, were not large even before October 1, 2021. Indeed, in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 (in paragraph 23), it was explained that the Tax Code of the Russian Federation does not contain any indication that the right to deduct tax arises exclusively upon payment of the price of purchased goods (work, services), property rights in monetary form. Consequently, the buyer cannot be deprived of the right to a deduction if the advance was paid by him in non-monetary (in-kind) form. Thus, changes in the procedure for filling out the purchase book from October 1, 2021, in fact, only consolidated the position of the judges of the Presidium of the Supreme Arbitration Court, which was expressed back in 2014.

Registration number of the customs declaration

From October 1, 2021, column 13 of the purchase book should indicate not the serial number, but the registration number of the customs declaration. Let us remind you that this column is filled in if the goods are imported, and its customs declaration is provided for by the law of the Eurasian Economic Union. It is worth noting that VAT declarations also record the registration numbers of customs declarations (on lines 150 of Section 8 and its appendices).

Instructions for filling out the book

Before making entries in the book, you must familiarize yourself with the contents of the Rules approved by government decree No. 1137. Filling out the columns of the purchase book:

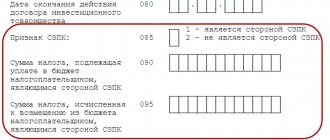

| Column number | Explanations for filling |

| 1 | Sequential numbering of table rows with registration records. |

| 2 | The transaction code is taken from the List attached to the order of the Federal Tax Service MMV [email protected] dated 03/14/16. Codes can be specified separated by commas if the registered s/f simultaneously reflects several operations. |

| 3 | No., day, month, year indicated in the registered document (from column 1 of the s/f). |

| 4 | The number and date are filled in if a corrected s/f is subject to registration, that is, data is transferred from line 1a to s/f. |

| 5 | The number and date of the adjustment type s/f is entered - an independent document drawn up in addition to the original one. |

| 6 | The number and date of the corrected s/f correction type are indicated. |

| 7 | Details of the payment document are filled in if the moment of tax payment precedes the acceptance of this tax for deduction:

|

| 8 | The day on which the valuables, services, and work specified in the s/f are capitalized. |

| 9-10 | Seller details from fields 2 and 2b s/f. |

| 11-12 | Details of the intermediary, if the tax account is drawn up when the company performs the functions of a tax agent. |

| 13 | No. of the customs declaration, if customs declaration is required for valuables imported into the Russian Federation. For adjustment (including corrected adjustment) s/f column you do not need to fill out. |

| 14 | The code and name of the currency are entered if the amounts in the account are expressed in foreign currency. If the amounts are in Russian rubles, the column is not filled in. |

| 15 | The total cost of the s/f, including VAT, from column 9 in the “total” line of the registered s/f. If an advance payment is registered, then the total amount of the advance including VAT is entered. |

| 16 | The total VAT on s/f, which the company has the right to deduct, is taken from column 8 of s/f in the “Total” page. |

Example of filling out a purchase book:

Making corrections

How to make corrections to the purchase book? This question is relevant to everyone. Effective October 1, 2021, the customer will cancel and record the corrected invoice on a supplemental purchase ledger sheet in the same quarter the first invoice was received. This follows from the new edition of paragraph 6 of the Procedure for filling out an additional sheet of the purchase book.

From October 1, 2021, the rules for registering corrected invoices in the purchase book have been changed. Now they can be registered in the purchase book for the tax period in which the invoice was registered before corrections were made to it. Previously, the question of in what period to register a corrected invoice did not have a clear answer. The tax authorities believed that the buyer should register the corrected invoice in the quarter in which it was received from the seller. However, the courts resolved such disputes in favor of taxpayers (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated October 5, 2012 No. A40-2529/12-90-12).

Registration for separate VAT accounting

For some transactions for which invoices (other documents) are issued, the law provides for a special procedure for their registration in the purchase book.

If an organization maintains separate VAT accounting, then register invoices in the purchase ledger only for the amount of VAT that is subject to deduction. That is, in column 15 of the purchase book, indicate the full cost of goods (work, services), which is reflected in column 9 of the presented invoice. And in column 16, indicate only the amount of VAT to which the organization has the right to deduct in the current quarter. This procedure is provided for by subparagraphs “t” and “y” of paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Similar explanations are contained in the letter of the Ministry of Finance of Russia dated March 2, 2015 No. 03-07-09/ 10695.

An organization can transfer an advance (partial payment) towards future deliveries of goods (work, services, property rights), which will be used in both taxable and non-VAT-taxable transactions. In this case, the invoice received from the supplier (contractor) for advance payment (partial payment) must be registered in the purchase book for the entire amount (paragraph 5, subparagraph “y”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If a product is purchased that the organization will use in tax-exempt transactions, there is no need to register such an invoice in the purchase ledger. After all, the buyer will not have the right to deduct on such an invoice. This follows from the provisions of subparagraph 1 of paragraph 3 of Article 169 and paragraph 2 of Article 171 of the Tax Code of the Russian Federation.

An example of filling out a purchase book. The organization carries out taxable and VAT-exempt transactions

The organization carries out taxable and tax-exempt transactions. The organization calculates the proportion for the distribution of input VAT on goods (works, services) for general economic purposes for the current quarter.

In October, the organization was provided with waste removal services in the amount of 59,000 rubles, including VAT - 9,000 rubles. On October 29, the contractor (Proizvodstvennaya JSC) issued invoice No. 2569 to the organization for the entire amount of services provided.

These services are of a general business nature. It is impossible to determine what specific type of activity they relate to. Therefore, part of the input VAT amount is deducted, the remaining tax amount is included in the cost of services.

To distribute input VAT, the organization's accountant determined the share of tax-exempt transactions for the fourth quarter.

The volume of sales of goods during this period amounted to 1,000,000 rubles. excluding VAT, including:

- 800,000 rub. – from the sale of goods subject to VAT;

- 200,000 rub. – from the sale of goods exempt from taxation.

The share of transactions exempt from taxation was 0.2 (200,000 rubles: 1,000,000 rubles). Accordingly, the amount of tax included in the cost of garbage removal services is equal to: 9000 × 0.2 = 1800 rubles.

VAT is accepted for deduction in the amount of: 9,000 rubles. – 1800 rub. = 7200 rub.

The Master's invoice for this amount was recorded in the purchase book.

Situation: is it possible to register an invoice for the entire amount of VAT in the purchase book if an organization purchased materials intended for use in taxable and non-VAT transactions? The supplier has issued one invoice.

No you can not.

This is due to the fact that VAT is deductible only on those goods (works, services) that are used in activities subject to VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation). The amount of VAT that can be deducted is determined based on the separate accounting of input VAT. In the purchase book, register an invoice for exactly this amount. The Russian Ministry of Finance made a similar conclusion in letter dated September 11, 2007 No. 03-07-11/394.

Situation: how to keep a purchase book if an organization conducts taxable and non-VAT activities? The tax amounts subject to deduction are determined at the end of the quarter as a percentage based on the cost of goods (work, services) shipped.

Register invoices issued by suppliers (performers) when shipping goods (performing work, providing services, transferring property rights) at the time of determining the amount of VAT to be deducted. That is, on the last day of the quarter. In this case, in column 16 of the purchase book, indicate the amount of tax that can be deducted in accordance with the calculation. Column 15 - the total cost of goods accepted for registration (including VAT).

This procedure follows from subparagraph “y” of paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: how to register an invoice in foreign currency in the purchase book?

If the obligation under the terms of the transaction is expressed and paid in foreign currency, the supplier organization has the right to issue an invoice in foreign currency (clause 7 of Article 169 of the Tax Code of the Russian Federation). In the purchase ledger, such an invoice must be registered in the invoice currency. In this case, in column 14 you should indicate the name and code of the currency according to the All-Russian Classifier of Currencies, and in column 15 - the total cost of purchases (including VAT) in the invoice currency. Column 16 indicates the amount of VAT in rubles and kopecks. To do this, recalculate the amounts indicated in the invoice into rubles at the official rate in effect at the time of registration of goods (work, services) and property rights. This procedure follows from the provisions of paragraph 4 of paragraph 1 of Article 172, paragraph 5 of Article 45 of the Tax Code of the Russian Federation.

New form and sample filling

From October 1, 2021, the name of two columns in the purchase book form has changed:

- the column “Information about the intermediary (commission agent, agent)” will be called “Information about the intermediary (commission agent, agent, forwarder, person performing the functions of the developer);

- The column “Customs Declaration Number” will be called “Registration Number of the Customs Declaration”.

We can say that the changes in the form of the purchase book are minor. However, despite this, the purchase ledger form will have to be updated for all taxpayers from October 1, 2021. Therefore, we suggest downloading the necessary documents.

new form of purchase book, applicable from October 1, 2021, in Excel format.

a new form of an additional sheet for the purchase book (as amended by the Decree of the Government of the Russian Federation of August 19, 2017 No. 981.

You can also fill out a sample purchase ledger on the form, which should be used from October 1, 2021.

Read also

30.05.2017

Registering an invoice for an advance payment

If an organization has received an advance (partial payment) from the buyer for upcoming deliveries (including in non-monetary form), it must register an invoice for the advance (partial payment) issued to the buyer in the sales book (clause 17 of Section II Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

At the time of shipment of goods (performance of work, provision of services, transfer of property rights), for which an advance payment (partial payment) was received, register previously issued invoices in the purchase book (clause 22 of section II of Appendix 4 to the Decree of the Government of the Russian Federation dated 26 December 2011 No. 1137).

The same rules apply if the buyer refuses delivery before shipment and the seller returns the previously received advance payment (partial payment). In this case, previously issued invoices for advance payments (partial payment) are recorded in the purchase book after all adjustments related to the return are reflected in the accounting records. In this case, in column 7 of the purchase book, you must indicate the details of the document confirming the return of the advance payment to the buyer (letter of the Ministry of Finance of Russia dated March 24, 2015 No. 03-07-11/16044). An invoice can be registered in the purchase ledger no later than one year after the buyer’s refusal to deliver. This is stated in paragraph 2 of paragraph 22 of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Continued >>

Book design

Tax registers can be drawn up both in paper and electronic form (clause 1 of Appendix No. 4 and clause 1 of Appendix No. 5 to Resolution No. 1137).

IMPORTANT!

Tax registers are sent to the Federal Tax Service only in electronic form (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Registration of documents is carried out in chronological order in the period in which the obligation to pay or refund VAT arose.

At the end of the quarter, by the 20th day of the next month, paper versions of the registers are required:

- number the sheets;

- lace;

- certified by the signature of the manager or authorized person. In the case of keeping records of individual entrepreneurs, the entrepreneur personally signs.

IMPORTANT!

The total amounts must be identical (identical) to the data presented in the submitted VAT return.

Tax registers are kept for four years from the date the last entry was made.

Purchase book, form

How to fix errors

If the taxpayer discovers that the invoice data is reflected incorrectly, he must make corrections. There are two ways to make corrections. If an error is found before the end of the quarter, the incorrect entry must be reflected with negative values. Then register the invoice again with the correct indicators.

If the error occurred in the last quarter and the VAT return has already been submitted, you must follow the steps described in the first method, but in an additional sheet of the sales or purchases book. After this, you must submit an updated declaration. The forms of additional sheets were also approved by Resolution No. 1137, but they have undergone minor changes in 2021.

Sales book form 2021 (valid from 04/01/2019)

Shopping book form 2020

Changes in the purchase book from 2021

The 2021 changes in the purchase book are small:

- columns 14 and 17 – the VAT rate is 20%;

- new columns 14a and 17a appeared to reflect transactions at a rate of 18%;

- The requirement for the buyer to register an invoice for the return of goods accepted for registration has been excluded from the rules for filling out the purchase book.

According to the law, the new form of the purchase/sales book is valid from April 1, 2021, but since new rates must be applied from 01/01/2019, a new form of the book can be maintained from that time on.

New rules for creating a book: fundamental differences from the previous order

More than others, the following fundamental innovations attract attention:

- Please fill out column 3.

If the taxpayer imported goods from a state that is not part of the EAEU, then in column 3 he records the registration number of the declaration issued at customs.

Similar information is indicated when importing goods into the Kaliningrad region and receiving a deduction based on clause 14 of Art. 171 of the Tax Code of the Russian Federation (but columns 4 to 9 and 11 to 15 are not filled in).

Information on multiple declarations is separated by a semicolon.

If the goods are imported from another EAEU country, then in column 3 the details (number, date of preparation) of the application for import and payment of indirect taxes are recorded (with notes on the transfer of VAT to the budget).

Sellers selling goods on an advance payment basis to persons who do not pay VAT now indicate in column 3 information about the financial document that was previously registered in the sales book as the basis for issuing an invoice for the advance payment.

- Please fill out column 13.

The registration number of the declaration issued at customs when selling imported goods is recorded here, if their declaration is provided for by the regulations of the EAEU. If there are several declarations, then information on each of them is given and separated by a semicolon.

The column is not filled in when registering information on adjustment (and corrected adjustment) accounts and when registering advance accounts.

Important Features

The following rules must be kept in mind:

- The purchase book can be kept on paper or in electronic format.

- Price parameters must be indicated in rubles. There is only one exception in the form of column 15, which is issued when receiving goods, services or rights to property for the currencies of other states).

- In order not to violate the rules and correctly correct the erroneous mark, the taxpayer must record the invoice on an additional sheet for the same tax quarter when the first invoice was issued. You can cancel the document in the same way.

- A paper purchase book at the end of the next quarter (no later than the 25th day of the month following the end of the quarter) must be signed by the boss (or responsible employee), all pages numbered and laced, sealed.

- Purchase books must be kept for 4 years from the date of the last entry.

What is not included in the document?

Invoices that do not comply are not entered into the purchase ledger (according to paragraph 3 of the Rules for maintaining the purchase ledger):

- the provisions of Article 169 of the Tax Code of the Russian Federation;

- established samples (Appendices 1 and 2 of Decree No. 1137).

Also, invoices drawn up (clause 19 of the Rules of Maintenance) are not entered:

- when provided free of charge, technical specifications containing tangible and intangible assets;

- commission agent (agent) from the principal (principal) for goods and services intended for sale, property rights, as well as advances issued on account of this sale;

- commission agent (agent) from the supplier of goods and services or property rights received for the principal (principal), counting allocated advances;

- on the amount of advance payment for goods and services received in actions that do not require VAT payments;

- advance invoices issued after the supplier receives shipping invoices.