The article provides information on paying fees for land ownership: characteristics. When issuing a receipt for payment of the duty, the budget classification code is entered in field 104, which indicates the type of contribution - BCC for payment of land tax.

Citizens of the Russian Federation, businessmen and owners of Russian companies are required to pay a quarterly land tax. The tax is calculated on an accrual basis, so the reporting period is a calendar year. When filling out a receipt for payment of the duty, you need to enter the land tax code in the appropriate field.

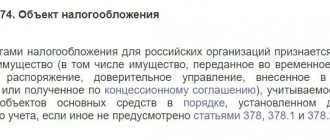

Objects and procedure of taxation

From the name it is clear that this fee is established for land owners. Since local authorities have a greater understanding of the land plots in their area of responsibility, this tax is local. The funds go to the budget of the corresponding municipality and local authorities are vested with great powers in regulating it: they set tax rates and payment deadlines; at the federal level, only their maximum and minimum limits are indicated.

In accordance with Art. 389 of the Tax Code of the Russian Federation, the objects of taxation are land plots. The following areas are not recognized as such:

- withdrawn from circulation or limited in circulation due to the location within their boundaries of water bodies of federal significance or particularly valuable objects of cultural heritage;

- members of the forest fund;

- located under apartment buildings.

Maximum bet:

- 0.3% - for agricultural land occupied by housing stock or its infrastructure, acquired for the purposes of horticulture and livestock farming;

- 1.5% - for all other areas.

This percentage is calculated from the cadastral value, which is the tax base in this case.

Payment Features

To credit funds to pay land tax, you will have to fill out a payment order. To do this, use the unified form OKUD 0401060. Please note that the payment form can be filled out online in a special service from the Federal Tax Service.

Enter the budget classification code (BCC) in field 104 of the payment document. When filling out a payment form online on the Federal Tax Service website, it is not necessary to indicate the KBK. The code will be filled in automatically after filling in the individual payment details.

Code meaning table

BCCs for land tax in 2021 are presented in the table.

| Payment (location of land) | KBK Primary Obligation | KBK Peni | KBK Fine | KBK Interest |

| Within the boundaries of municipal districts of federal cities | 1821 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within urban districts with intracity division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Thus, the BCC of land tax depends on the location of the object of taxation. There are also special BCCs “Penalties for land tax 2020”; separate values are provided for the payment of fines and interest.

Results

Local authorities have the right to introduce taxes and set rates. Owners should make tax transfers to the budget according to the BCC, which depend on the characteristics of the territorial location of the site.

“Sample application for clarification of tax payment (error in KBK)” will help you correct an error made in the KBK when transferring taxes .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

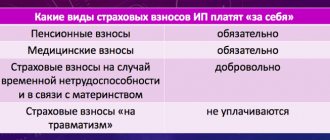

Specifics for legal entities

Legal entities, like ordinary citizens, are taxpayers for this fee in favor of the state. The tax system does not matter in this case; simplified regimes do not exempt organizations from fulfilling the obligation to transfer a fee for land ownership. But unlike citizens who receive notifications from the tax office indicating the amount of tax and attaching a document for payment (or in their personal account on the government services portal), companies are required to independently draw up and submit a declaration to the regulatory authority at the place of their registration. Local authorities may provide tax benefits for certain categories of persons. These norms must be sought in the land tax laws of individual municipal districts.

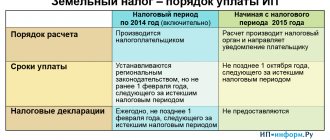

When to pay

Since land tax is a local tax, the frequency of payment, as well as the number of reporting periods, is established by the municipal authorities. You can check if advance payments are available in your municipality online. To do this, just go to the official website of the Federal Tax Service and select the municipality or city of federal significance you are interested in. It is also necessary to determine the tax period - the year for which information is required. And, of course, a type of fiscal obligation is land tax.

The system stores all legal acts establishing general and exclusive taxation rules.

General information

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The land tax is set depending on the location of the site, how well it is equipped with technical support, whether it generates income and other factors.

Failure to pay this tax may be classified as tax evasion and will result in appropriate penalties.

However, late payment of this tax can be of two types:

- intentional;

- unintentional.

Depending on the situation, the citizen will be required to pay various penalties. In the first case it will be slightly larger than in the second. This does not apply to tax-exempt people.

Tax payment deadlines

Payment must be made before the first of December. If the tax has not been paid before this deadline, a penalty will automatically begin to accrue.

How to identify your debt?

When an individual has a debt to the tax office, a notification is sent to him from this body. It contains a requirement to pay tax. This right of the tax inspectorate is regulated by Article 69 of the Tax Code of the Russian Federation .

The owner or user of the land must receive notification no later than three days from the date of delay in payment. If the debt is less than 500 rubles, the tax authority can send notice within a year from the date of non-payment.

An individual receives a letter demanding payment by mail. Tax officials must be notified of receipt of the letter.

The request for payment shall indicate:

- the name of the tax office that sends the request;

- who received the notification;

- a warning that you are in arrears;

- total amount of debt;

- proposal for repayment of land tax debt;

- a detailed explanation of the reasons for collecting the fee;

- the date by which the tax must be paid;

- measures that the inspectorate will take in the event of non-payment of the debt within the specified period;

- signature of the person who sent the notification;

- signature of an individual.

If you have not received a notification demanding payment of tax, although you are the owner of the land, then you need to go to the tax office in the area where the property is located. You need to find out the reason why you still have not received the document. There may have been a delay in the mail or some kind of error.

If you were not sent a notification at all, then according to Article 57 of the Tax Code of the Russian Federation , you are not obliged to pay tax until you receive the letter by mail. If the inspection requires you to pay, then their actions are unlawful.

IMPORTANT! The land owner will not receive a notice if the tax is less than 100 rubles (perhaps part of the tax is unpaid).

The notification comes to the owner only after three years, when the tax service loses the right to show you Article 122 of the Tax Code of the Russian Federation.

Basic information on land tax

According to ch. 31 Tax Code of the Russian Federation Federal Law No. 117 of 08/05/2000 (as amended on 12/25/2018), the land tax is paid by individuals and legal entities every quarter, filling out the appropriate declaration, coded KND 1153005. The declaration is submitted once a year - before February 1 of that year, which goes for reporting. The tax amount is calculated in an incremental period for each quarter using the formula:

NB x StN, where

NB - tax base;

StN - collection tariff.

The tax base is the cadastral price of land property, which is calculated in accordance with the legislation of the Russian Federation.

The duty rate depends on the type of site. Tax authorities divide the latter into two categories and the land corresponds to the tariff:

- 0.3% - areas:

- for agricultural production;

- for housing construction and engineering infrastructure;

- for the construction of summer cottages, gardening;

- to ensure security, placement of customs zones.

- other types of land.

According to Art. 395 ch. 31 of the Tax Code of the Russian Federation Federal Law No. 117, tax authorities extend tax preferences to federal and municipal ones. Some types of organizations are generally exempt from paying duties.

Individuals contribute tax funds once a year - before December 1 of the reporting year. Federal Tax Service employees independently calculate the amount and send a notification to the citizen. Organizations pay the advance quarterly, and calculate the amount independently. The date for payment of the fee is set by local authorities.

According to Art. 122 of the Tax Code of the Russian Federation No. 146 of July 31, 1998 (as amended on December 27, 2018), a fine is imposed for late payment of the fee to the tax budget:

- 20% of the duty amount - in case of primary unintentional non-payment;

- 40% of the fee is for a secondary or intentional violation.

Before paying the tax amount, an individual or legal entity fills out a payment order, which indicates the type of payment, encrypted in 20 numbers. The Ministry of Finance changes codes every year, including the KBK for land tax 2021 for 2021. For companies and individuals, the codes classifying budget money are different.

Reference materials on resources with regulatory documentation indicate codes without indicating the administrator code, which indicates the direction of funds. Considering that the land tax is a land tax, the administrator code is “182” according to the list of main codes for revenue administrators, which is regulated by Order of the Ministry of Finance No. 65n dated 07/01/2013 (as amended on 11/26/2018), therefore, instead of the first three digits “000”, you need to write "182".

Tax collection period

The taxation period for the required fee includes twelve calendar months, starting from the first day of the year and continuing until the end of December of the same year. The report is submitted to the tax service by tax organizations four times:

- after the first three months of the year;

- after half a year;

- for nine months;

- in year.

The authorities of municipalities and cities of federal significance have the right to change the timing and frequency of reporting.

The amount of tax deduction for land ownership, intended by the country's treasury, is determined as a percentage of the tax base, that is, the cadastral price of the object.

For organizations, the tax amount is paid several times in the form of advance payments and at the end of the year in the form of a balance received as the difference from the total amount accrued for the year and the advance payments previously paid to the country's treasury subtracted from it.

If, during the current tax period, the ownership of a specific plot of land to the owner is terminated, then the amount of the fee due to the fee will be calculated using a specialized coefficient, which is the ratio between the number of monthly periods during which the plot was in possession to the twelve-month period for the entire tax period.

That is, the formula for calculating it will look like this:

K = A:B

Where K is the coefficient, A is the time the plot was in possession for the current reporting period, B is the total number of months in the year.

There is a list of organizations that are completely exempt from paying the required fee. These include:

- executive structures of the state Ministry of Justice using land plots to conduct their main activities;

- companies that own Russian roads;

- organizations of a religious orientation, for them we are talking about areas where churches, temples and other buildings of a similar orientation are located;

- companies for people with disabilities, within the state, of which at least 80% of the target representatives are with disabilities, also regarding lands used for carrying out activities of the main focus;

- companies whose statutory capital is formed through contributions from organizations for people with disabilities, while the number of employees with disabilities is at least half;

- companies whose property owners are the mentioned unions for people with disabilities, regarding plots of land that are used for rehabilitation purposes, providing assistance to people with disabilities of a legal nature, etc.;

- organizations where artistic folk crafts are carried out;

- individuals, representatives of indigenous Siberian peoples, in relation to the lands on which they live according to the traditional way of life;

- companies that are members of special economic zones, in relation to lands that they have owned for at least five years.

Payers

Taxpayers are legal entities and individuals who have land plots at their disposal under special conditions. For individuals, these conditions are expressed as follows:

- The land was purchased, privatized or received as a gift, and the owner registered his rights with Rosreestr.

- The allotment is issued for indefinite use.

- The plot was inherited by the new owner on the basis of lifelong maintenance rights.

Organizations that have purchased land are also required to pay tax contributions annually. But if the plot is leased or provided for free use, then the tax should not be paid by the tenants.

The full list of taxpayers obliged to pay contributions for land is set out in Article 388 of the Tax Code of the Russian Federation,

Code structure, or what the numbers in KBK mean

The KBK number consists of 20 digits, each of which has its own meaning. An error in just one digit will result in the payment being lost. That is, it will not reach its intended destination: the money will be transferred to another department or the payment will get stuck in unclear transactions.

As a result, incorrectly indicated BCC for land tax for legal entities in 2021 or ordinary citizens in the payment order will lead to fines and penalties. But getting money back or clarifying an erroneous payment is sometimes quite problematic and will take some time. And nerves.

Let's understand the structure of the budget classification code:

- The first three digits are the code of the chief budget administrator. For example, when transferring funds to the Federal Tax Service, you should indicate “182”, for payments to the Pension Fund - “392”, to the Social Insurance Fund - “393”, for customs duties - “153”.

- Numbers 4 through 13 are codes for types of budget income or expenses. Each type of operation has its own codification. To pay tax fees and contributions to the Federal Tax Service, use grouping codes by type of income, since for the state treasury your payment is a revenue stream.

- From 14 to 20 numbers are a classification by subtypes of income and expenses of the state treasury. Here the group of subtypes of income or expense transactions is indicated, and their analytical group is deciphered.

The BCC does not have to be determined independently. You can find out the required code in other sources of information. For example, you will definitely find the current BCCs for land tax for individuals in 2021:

- In the receipt for payment of the fiscal tax, which the Federal Tax Service sends out annually to taxpayers’ addresses.

- On the official website of the Federal Tax Service, if suddenly the receipt for payment got lost and did not arrive.

- At the territorial office of the inspectorate, just call or visit the Federal Tax Service in person.

- Or in our article, where we will provide the current values of the BCC for land tax for 2021 for individuals, individual entrepreneurs and organizations.