A manufacturing enterprise either purchases semi-finished products externally or produces them in-house. Semi-finished products purchased from third party suppliers are credited to the account. 10 “Materials”, subaccount 02 “Purchased semi-finished products and components”. Semi-finished products produced by the company independently can be accounted for in the analytical subaccount of account 20 “Main production”, or in a separate account 21.

The concept of self-produced semi-finished products (PSP) is economically similar to the concept of work in progress (WIP): just like WIP, semi-finished products have not gone through all stages of the technological process and are not the final product. The difference is that the PSP at the previous stage of production were brought to a certain degree of readiness and in the future they can be:

- released to the next workshop of the enterprise for the production of a finished product;

- sold externally;

- transferred to a structural unit of the enterprise (for example, auxiliary production).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Accounting for semi-finished products of own production and their evaluation

Semi-finished products of our own production are materials that have been processed at a completed technological stage. They can be used for subsequent processing at the same enterprise or can be sold to a counterparty for further processing.

At full-cycle enterprises, where raw materials go through several stages of processing or reprocessing, account 21 “Semi-finished products of own production” can be used to account for semi-finished products produced in each processing stage.

Semi-finished products of own production can be classified as work in progress (clause 63 of the Regulations on accounting and financial reporting No. 34n, approved by the Ministry of Finance on July 29, 1998). There are several methods of assessment:

According to the requirements of Article 319 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is determined based on the assessment of finished products. Therefore, in tax accounting only one assessment method is used:

- Direct costs of the enterprise.

The accounting policy must include a list of direct expenses (letter of the Ministry of Finance No. 03-03-06/4/78 dated August 26, 2010). For example, the list of direct expenses includes: material costs, labor costs, social contributions, accrued depreciation.

When calculating the cost of finished products, semi-finished products of own production are included in the calculation in the form of a complex item or are included in detailed cost items.

Who is it advisable to use accounting account 21?

For manufacturing enterprises with a single output of products, opening a separate account to account for the receipt and movement of goods and services does not make much sense. Such enterprises can keep records of PSP on account 20, a separate sub-account (a non-finished method of accounting).

Opening account 21 is advisable if the production is of a mass nature and contains a large number of positions (semi-finished accounting method). Using this method allows you to monitor and, if necessary, adjust production costs at each stage and accurately determine the cost of PSP when selling externally.

As a rule, accounting using 21 accounts is used by enterprises in the metallurgical, chemical, textile, and food industries. The technological process at such enterprises consists of several stages of processing, which are carried out in separate workshops. At the output, each workshop receives a product with certain characteristics, which is considered primary processing. When the product is sent for further processing, the product acquires qualities that make it suitable for the end consumer. At each stage of the production process, the product is endowed with characteristics that bring it closer to the final product.

In metallurgy, semi-finished products are considered to be slabs, cast iron, scrap, and pipe blanks; in the chemical industry - sulfuric acid; in textiles - raw materials, yarn, synthetic fibers; in mechanical engineering - castings, forgings; in the food industry various culinary semi-finished products.

The most appropriate method of accounting for PSP is determined by the enterprise independently and is enshrined in the accounting policy.

The method of organizing accounting for the receipt and movement of PSP is also determined by the enterprise, based on the characteristics of the technological process and the regulatory industry instructions for each specific industry.

The number of production stages is not limited (from 2 or more).

For example, the company produces snacks - crackers. The production consists of two workshops: a crackers drying workshop and a spice shop. As a result of the work of the first workshop, a semi-finished product is obtained - crackers (without spices), which can be sent for sale or for further processing in the spice shop.

Account 21 in accounting

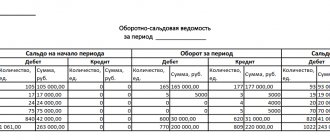

Semi-finished products of own production are accounted for on account 21 in correspondence with account 20 - when semi-finished products are used in own production, and with account 90 - when semi-finished products are sold to a counterparty:

The debit of account 21 reflects the receipt of semi-finished products and their surpluses discovered during inventory. The account credit takes into account the consumption of semi-finished products during transfer for subsequent processing, their sale or identification of shortages in the warehouse.

On account 21, analytical accounting can be maintained by storage location, by name, type, grade, and so on.

Accounting entries for accounting for semi-finished products

The chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, provides for a separate account 21 to reflect semi-finished products. If the accounting policy of the enterprise does not stipulate separate accounting for semi-finished products, then they are reflected as part of work in progress on account 20.

PSP is received at the warehouse by posting Dt 21 Kt 20 based on the invoice requirement (you can use form M-11 or develop it yourself). The transfer of PSP from the warehouse to further production is formalized by posting Dt 20 Kt 21 also on the basis of the invoice requirement.

form M-11 and learn about the rules for filling it out by reading the article “Procedure for filling out form M-11 requirement-invoice”.

ConsultantPlus experts clearly showed how to reflect the sale of semi-finished products of their own production in accounting records. Get trial access to the system for free and go to the Ready-made solution.

Typical postings for 21 accounts “Semi-finished products of own production”

The main entries for 21 accounts used in accounting are shown in the table below:

| Account debit | Account credit | Operation description |

| 21 | 20 | Receipt of semi-finished products of own production |

| 21 | 23 | Receipt of semi-finished products manufactured by auxiliary production |

| 21 | 40 | Receipt of finished products for subsequent use as semi-finished products |

| 21 | 91.01 | Surplus semi-finished products identified during inventory were capitalized |

| 20 | 21 | Semi-finished products are sent to production for subsequent processing |

| 23 (25;26) | 21 | The cost of semi-finished products is included in the costs of auxiliary production (overall production costs; general business expenses) |

| 28 | 21 | Write-off of defective semi-finished products of own production |

| 91.02 | 21 | The cost of semi-finished products of own production, written off or sold, is reflected in other expenses |

| 94 | 21 | The identified shortage of semi-finished products is reflected |

Accounting and evaluation of semi-products of own production

To begin with, it should be noted that the designated account is active, i.e. its debit part of the organization reflects the receipt of the specified category of goods, and the credit part reflects the decrease in the balance, for example, as a result of its transfer to the production process.

All costs related to the preparation of semi-products are recorded in the debit of item 21. As for the credit part, it should show the sale of this category of products to third organizations or their transfer for further processing.

The overwhelming number of organizations engaged in production activities prefer to display blanks that are classified as inventories at actual cost. However, it is quite acceptable to use initial or planned prices, and their further adjustment to the actual cost value by including transport costs associated with moving products between different workshops. Along with this, there are also methods for valuing semi-products, such as valuation based on the price of raw materials and materials, as well as on direct cost items.

Warehouse workers, who are financially responsible persons, are responsible for the quantitative accounting of semi-finished products. In this case, quantitative accounting is carried out according to such nomenclature characteristics as, for example, size, type, etc. If the movement of semi-finished products occurs between workshops, bypassing the warehouse, then control over the movement of these products is carried out by the workers of the workshops.

Examples of transactions on 21 accounts

Example 1. The cost of semi-finished products includes only the cost of raw materials and materials

Let's say VESNA LLC produces parts that are used in its own production. In January 2021, 150 parts were manufactured. The costs included:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products are valued at the cost of raw materials and materials. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69); 02 | 1 430 000 | Costs (wages, social contributions, depreciation) for the production of finished products are reflected | Payroll. Depreciation calculation |

| 21 | 20 | 1 200 000 | Semi-finished products are received into the warehouse | Shift production report |

| 20 | 21 | 1 200 000 | Semi-finished products transferred to production | Requirement invoice |

Example 2: Semi-finished products are valued at direct costs

Let's look at the previous example: VESNA LLC produces parts that are used in its own production. In January 2021, 150 parts were manufactured. Costs include:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products of own production are valued at direct costs: raw materials and materials; salary; social contributions; accrued depreciation and so on, according to accounting policies. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69) | 980 000 | The amount of salary and social contributions is reflected | Payroll. |

| 20 | 02 | 450 000 | Accrued depreciation reflected | Depreciation calculation. |

| 21 | 20 | 2 630 000 | Receipt of semi-finished products of own production to the warehouse (1,200,000 + 980,000 + 450,000) | Shift production report |

Advantages and disadvantages

Using account 21, a specialist can reflect the production cycle. This, in turn, ensures tighter control over the work of financially responsible employees. However, count 21 has a number of disadvantages. In particular, on the account. 20 “fictitious” turnovers are formed (in economic terms). They will expand as the number of processing steps increases. At the same time, account 21 will be used to calculate each intermediate stage of production. This, in turn, will increase the labor intensity of the specialist’s work. Accordingly, the semi-finished method is complex, cumbersome and economically unprofitable.

Semi-finished products of own production: accounting features - Audit-it.ru

Elisova I. N. , leading expert of the magazine “Accounting in Production”

Magazine “Accounting in Production” No. 10, October 2010

Accounting provides several methods for evaluating semi-finished products of own production. But in tax accounting they are assessed based on direct expenses. Although the enterprise can establish a list of them independently (letter of the Ministry of Finance of Russia dated August 26, 2010 No. 03-03-06/4/78).

Accounting for semi-finished products

In accounting, semi-finished products of own production are recorded on account 21 of the same name. The debit of this account reflects expenses associated with the production of semi-finished products (in correspondence with account 20 “Main production”).

The loan reflects the cost of semi-finished products transferred for further processing or sold externally (in correspondence with accounts 20 or 90 “Sales”). Or you can keep records of semi-finished products in a separate sub-account opened to account 20. In fact, semi-finished products belong to work in progress (clause

63 Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

In accordance with paragraph 64 of the Regulations, the following methods for assessing semi-finished products of own production are possible: 1) at the cost of raw materials; 2) for direct cost items; 3) at actual cost;

4) according to standard (planned) production costs.

Valuation based on the cost of raw materials and materials

This is the easiest way. It is usually used when raw materials make up the largest share in the costs of manufacturing semi-finished products.

Example 1.

Shtraim LLC produces wooden parts and assembly units for tents. Most of these semi-finished products are used to make tents (used in our own production).

In September, raw materials and materials worth 35,000 rubles were spent on the production of parts. At the same time, 1000 pieces of one type of parts were produced. In the same month, 800 parts were used to produce tents.

The accountant made the following entries in the accounting of Shtraym LLC:

DEBIT 21 CREDIT 20

– 35,000 rub. – manufactured semi-finished products are capitalized;

DEBIT 20 CREDIT 21

– 28,000 rub. (RUB 35,000: 1000 pcs. × 800 pcs.) – part of the semi-finished products intended for the manufacture of products (tents) was written off.

Valuation based on direct cost items

The list of direct costs included in the cost of semi-finished products is determined by the enterprise independently. › | It usually includes the cost of raw materials and supplies, workers' wages (including deductions), and the amount of depreciation of fixed assets that are used in the manufacture of semi-finished products.

Example 2.

Let's change the data from the previous example. Let's assume that Shtraim LLC evaluates semi-finished products based on direct cost items. At the same time, they amounted to: – for raw materials and supplies – 35,000 rubles; – for workers’ salaries, taking into account deductions – 30,250 rubles; – for depreciation of equipment – 12,000 rubles. The accountant of the enterprise made the following entries in the accounting:

DEBIT 20 CREDIT 10

– 35,000 rub. – raw materials and supplies are written off for production;

DEBIT 20 CREDIT 70 (69)

– 30,250 rub. – the wages of the workshop workers have been calculated (including deductions);

DEBIT 20 CREDIT 02

– 12,000 rub. – depreciation of workshop equipment has been calculated;

DEBIT 21 CREDIT 20

– 77,250 rub. (35,000 + 30,250 + 12,000) – the cost of semi-finished products of own production was formed;

DEBIT 20 CREDIT 21

– 61,800 rub. (RUB 77,250: 1000 pcs. × 800 pcs.) – the cost of semi-finished products intended for the manufacture of own products has been written off.

Valuation based on actual production costs

This method of assessment includes all costs associated with the production of semi-finished products - both direct and indirect. As a rule, it is used for single and small-scale production.

Example 3.

Let's change the conditions of the previous example and assume that the company values semi-finished products at actual production costs. Let us assume that the enterprise produces two types of semi-finished products. Direct costs for the production of the first type of semi-finished products amounted to 61,800 rubles.

(including the cost of raw materials and materials - 35,000 rubles), the second type - 72,500 rubles. (including the cost of raw materials - 39,500 rubles). All expenses for raw materials and materials amounted to 74,500 rubles. (35,000 + 39,500). General business expenses are equal to 152,000 rubles.

Let's calculate the distribution coefficient of general business expenses based on the cost of raw materials and materials used in the production of semi-finished products, which will be: - to take into account costs in the cost of the first type of semi-finished products - 46.98 percent (35,000 rubles: 74,500 rubles.

× 100); – to take into account costs in the cost price of the second type of semi-finished products – 53.02 percent (39,500 rubles: 74,500 rubles × 100).

Thus, the actual cost of self-produced semi-finished products of the first type will be 133,209.60 rubles. (RUB 61,800 + RUB 152,000 × 46.98%).

And the cost of self-produced semi-finished products of the second type amounted to 153,090.40 rubles. (RUB 72,500 + RUB 152,000 × 53.02%).

Estimation at standard cost

In practice, this method is most often used in workshops with large-scale and mass production. Then the semi-finished products are valued at the enterprise at standard cost. › | Then the actual cost of semi-finished products is determined.

After this, the difference between the actual and standard costs can be written off to a separate subaccount of account 21 (by analogy with the procedure prescribed for finished products in clause 206 of the Methodological Instructions, which were approved by order of the Ministry of Finance of Russia dated December 28, 2001.

No. 119n).

Example 4.

Valdai LLC evaluates semi-finished products at standard cost, which consists of the costs of raw materials. The actual costs for the production of semi-finished products were: – cost of raw materials and materials – 25,000 rubles.

; – workers’ wages including deductions – 18,500 rubles; – depreciation of equipment – 15,600 rubles; – general business expenses – 7500 rub. The standard cost will be 25,000 rubles.

The accounting will record:

DEBIT 21 CREDIT 20 subaccount “Production of semi-finished products”

– 25,000 rub. – semi-finished products were capitalized at standard cost;

DEBIT 20 subaccount “Production of semi-finished products” CREDIT 20 subaccount “Production of products” – 66,600 rubles. (25,000 + 18,500 + 15,600 + 7500) – reflects the actual cost of semi-finished products;

DEBIT 21 CREDIT 20 subaccount “Production of semi-finished products”

– 41,600 rub. (66,600 – 25,000) – the difference between the standard and actual cost of semi-finished products is written off.

Tax accounting of semi-finished products at the enterprise

As follows from the provisions of paragraph 4 of Article 254 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is assessed based on the assessment of finished products (work, services) in accordance with the requirements of Article 319 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated January 25, 2010 No. 03-03 -06/1/21).

In other words, based on the direct expenses of the organization. Let us also recall that the enterprise must establish the list of direct expenses independently, enshrining it in its accounting policies (letter of the Ministry of Finance of Russia dated August 26, 2010 No. 03-03-06/4/78).

It is recommended to include material costs, labor costs (including deductions) and the amount of accrued depreciation as direct costs.

Important to remember

An enterprise can evaluate semi-finished products in accounting in one of the following ways: at the cost of raw materials, at direct cost items, at actual or at standard (planned) production costs. In tax accounting, the only method that can be used is based on direct expenses.

Source: https://www.audit-it.ru/articles/account/buhaccounting/a7/263131.html

Concept of semi-finished products

What are semi-finished products?

For different industries, regulatory documents, as a rule, give different definitions of self-produced semi-finished products.

In the Methodological Regulations on planning, formation and accounting of costs for the production and sale of products (works, services) of enterprises of the metallurgical complex (approved by the Ministry of Industry, Science and Technology of the Russian Federation dated December 23, 2001), semi-finished products are understood as products completed by the processing process at separate stages of the technological cycle, intended for further processing at this enterprise.

But regardless of industry affiliation, semi-finished products of own production are considered to be semi-finished products obtained in production shops or at separate stages that have not yet gone through all stages of production established by the technological process and are therefore subject to further development (in subsequent production units, workshops or processing areas of the enterprise) or assembly into products .

ACCOUNTING SERVICES, MOSCOW

Processing is the process of processing raw materials to obtain semi-finished products for further processing. Thus, in the metallurgical complex, the main types of processing include melting and casting of metal, pressing and rolling, pipe and hardware production.

Typical semi-finished products in metallurgy include, in particular: slabs, cast iron, scrap, and pipe blanks.

Most mechanical engineering and metallurgical enterprises have semi-finished products, the sequential processing of which is the technological process of production. However, not every WIP can be considered a semi-finished product. If production is characterized by a single technological cycle of processing raw materials into a production unit, then the intermediate state of the manufactured product (from work in progress to production process) may not correspond to the concept of a semi-finished product - a product brought to a certain degree of readiness by a specific workshop.