At every accounting forum, the topic of not closing the 20th account has been repeatedly raised. The fact is that there is more than one or two reasons for this, and many factors need to be taken into account - these are the settings of the accounting policy, and the entry of production documents, and accounting by item groups, etc. Moreover, the account does not always have to be closed on 20! We will present in our publication the most common causes of this problem.

In general, to make it clear why we need the 20th account, let’s say this: to determine the cost of finished products.

During the entire production cycle, direct costs are debited to account 20. This is the cost of raw materials and supplies necessary for production, wages and insurance premiums for workers in the production workshop, rental of production space, depreciation of machines and other equipment, that is, everything that was spent on production. And the credit of the same account records the release of finished products.

Thus, if we divide the amount of expenses in debit 20 of account by the number of units of finished products, we will obtain the cost of production.

When you start the “Month Closing” processing in the “Operations” section, the program should automatically close account 20 so that the final balance on this account on the last day of the month is zero.

But it is not always the case. Let's look at situations where the closure of account 20 should not have happened, and how to distinguish this from an error.

What is account 20 used for in accounting?

Existing standards establish that all costs for the production of products, provision of services or performance of work until the completion of the established process are subject to reflection on account 20.

Here the accumulation of expenses associated with the main activity for which the company was created occurs. Therefore, it is called account 20 “Main production”.

All costs accumulated on this account are called work in progress. This is due to the fact that the invoice reflects them until the moment when they form the cost of the product.

This account is used in almost every enterprise, regardless of the field of activity, with the exception of trade. These can be industrial, agricultural enterprises performing construction and installation work, transport and communications, etc.

If a company creates finished products, then closing account 20 means that it is produced. For works and services, closing the 20th account implies that the entity has provided or fulfilled the obligations stipulated by the agreements.

Attention! For small businesses, a simplified accounting procedure is provided, which implies that all company expenses should be taken into account in account 20. Other accounts (23,25,26) are not applied in this case.

Accounting for information about incurred costs on account 20 is carried out on the basis of supporting documents and is used by management to manage the business entity.

What is included in the account

Account 20 reflects all costs associated with the main activity of the company.

Therefore, the following expenses should be taken into account on the account:

- Material costs are the cost of raw materials, materials, semi-finished products, fuel and others spent on production, that is, what forms the basis of the finished product.

- Costs of services and work of third-party companies involved in the creation of the finished product.

- Remuneration of key personnel with mandatory contributions to extra-budgetary funds.

- Depreciation charges for fixed assets involved in the creation of the finished product.

- Indirect costs that are superimposed on the cost of the finished product - costs of auxiliary production, non-production, factory overhead, sales costs, etc. - they should be reflected on account 20 in the case when the accounts for their accounting are closed at the end of the reporting period.

- Other costs for the production of finished products (taxes, duties, etc.)

The first items relate to direct costs - those that are directly related to production. The cost of the above expenses accumulates while the production process is taking place, and upon its completion they are all written off from account 20 to the cost of the finished product, work, service.

Attention! If the product did not pass technical control and was recognized as a manufacturing defect, the costs of its production previously recorded on account 20 should be written off to the production defect account (usually 28).

Characteristics of account 20 “main production”

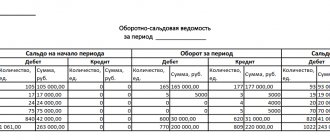

Account 20, according to the current Chart of Accounts, is active, since the company’s assets are reflected on it. It has a debit balance reflecting the cost of work in progress, that is, costs that have not yet formed the cost of a product or service.

Debit turnover reflects the expenses incurred by a business entity for the production of finished products, provision of services or performance of work. The credit of the account records the cost of production written off for finished products.

The balance at the end of the reporting period is determined by summing the balance at the beginning and the turnover on the debit side of the account and subtracting from it the turnover on the credit side of the account.

Attention! Many business entities, especially those who provide services and work, have a balance of 0 at the end of the reporting period for account 20.

However, this rule does not apply to organizations engaged in production activities. For them, this indicator reflects the products launched into production.

You might be interested in:

Write-off of receivables in an organization with an expired statute of limitations: procedure

Regulatory framework and document flow

Recording and accounting of account 20 is regulated in accordance with certain regulations. The display of this information is regulated by Order No. 94n dated October 31, 2000, issued by the Ministry of Finance - “On approval of the Chart of Accounts”, as well as Order No. 654 dated June 13, 2001, issued by the Ministry of Agriculture - “On approval of the Chart of Accounts”.

Primary type documents:

- Expenses of material type: invoice-request form M-11, when writing off inventory and materials - a summary statement.

- Payment of wages to employees: payroll sheet, orders or orders, accumulative sheet.

- Expenses to cover social needs: declaration used for reporting under the unified social tax, accumulative statement.

- Depreciation is a reporting normative act on depreciation.

- Other costs: invoices from counterparties, issued on a business trip as identification, fiscal documents.

What subaccounts are used?

Analytical accounting on account 20 is usually carried out by types of products produced, services provided, work performed, divisions existing in organizations, as well as by types of costs. For example, in agriculture it is customary to open sub-accounts “Crop production”, “Livestock production”, “Industrial production” and others.

Account 20 may have the following subaccounts by type of cost:

- "Depreciation".

- "Labor costs."

- "Material costs."

- “Deductions for social needs.”

- "Other expenses."

Attention! On account 20, it is possible to keep track of costs at standard cost with a separate accounting of excess costs. Then a sub-account “Excessive costs” can be opened.

Distribution and write-off of expenses

Costs, in order to be included in the cost of the product, are subject to distribution. The company has the right to independently determine the indicator by which this will be carried out. This could be the amount of materials and the size of raw materials or the volume of payments to pay workers.

Invoice costs are written off to the cost of goods produced.

They can be written off:

- according to the planned or regulated cost price;

- at the actual cost of write-offs.

Account correspondence

Account 20 can correspond with the following accounts.

From the debit of account 20 to the credit of accounts:

- Account 02 - regarding write-off of depreciation on fixed assets;

- Account 04 - when writing off depreciation of intangible assets without using account 05;

- Account 05 - regarding depreciation of intangible assets;

- Account 10 - regarding the write-off of materials for production;

- Account 11 - regarding the write-off of fallen or slaughtered animals;

- Account 16 - regarding the write-off of deviations in the cost of materials;

- Account 19 - regarding the write-off of non-refundable VAT;

- Count 20 - for internal movements of products in production;

- Account 21 - regarding the write-off of own semi-finished products for production;

- Account 23 - regarding the write-off of auxiliary production costs to the main production;

- Account 25 – regarding the write-off of general production costs for main production;

- Account 26 – regarding the write-off of general business expenses for the main production;

- Account 28 - regarding the return to production of products with corrected defects or the write-off of irreparable defects;

- Account 40 - when using products for the needs of main production;

- Account 41 – when using purchased goods for the needs of the main production;

- Account 43 – when using main products for the needs of main production;

- Account 60 - when included in the cost of suppliers' services;

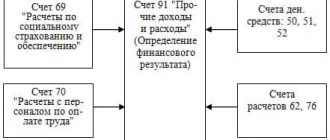

- Account 68 - regarding the inclusion of certain taxes in the cost price;

- Account 69 - regarding accrued social contributions for key workers;

- Account 70 – regarding accrued wages for main employees;

- Account 71 - write-off of accountable amounts for production needs;

- Account 75 - in terms of acceptance as a contribution to the authorized capital of unfinished products;

- Account 76 - regarding the write-off of other services;

- Account 79 - when taking into account the costs of branches or separate divisions in the cost price;

- Account 80 - when contributing to a friend’s capital with products in the work-in-progress stage;

- Account 86 - in terms of receiving as targeted financing an object with work in progress;

- Account 91 - when accepting for accounting unfinished products identified by inventory;

- Account 94 - Regarding the write-off of identified shortages and losses for production;

- Account 96 - regarding the accrual of contingent liabilities;

- Account 97 - regarding the write-off of deferred expenses for production.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 10 – regarding the return of materials from production to the warehouse;

- Account 11 - When reflecting the offspring of animals;

- Account 15 - when forming the cost of raw materials from own production;

- Count 20 – for internal movements of products in production;

- Account 21 - When reflecting semi-finished products of own production;

- Account 28 - when taking into account product defects;

- Account 40 - when posting products at planned cost;

- Account 43 - when recording products at actual cost;

- Account 45 - when writing off the cost of products, which in this case cannot be recognized in accounting;

- Account 76 - regarding the write-off of expenses due to other services;

- Account 79 - regarding the reflection of costs by structural divisions or branches;

- Account 80 - when returning a share to a friend at the expense of unfinished products;

- Account 86 - when writing off target financing funds after paying expenses;

- Account 90 - when writing off cost by direct sale;

- Account 91 - when writing off the cost of unfinished orders upon their cancellation;

- Account 94 - when identifying shortages and losses in production;

- account 99 - when writing off production costs in emergency situations.

You might be interested in:

Account 90 in accounting: what is it used for, characteristics, examples of postings

Procedure for closing an account

The method by which account 20 is finally closed must be specified in the accounting policy. In addition, if this is necessary, the distribution base is indicated in the same document.

There are three ways in which you can close your account 20.

Direct method

During the billing period, the cost of production cannot be determined. In this case, products that have already left production should be accounted for at some conditional prices. After the month is closed, the cost of output is adjusted to the actual level.

When using this method, it is not possible to determine the actual cost during the billing month.

Intermediate method

When using this method, account 40 “Product Output” is used in accounting. It records the planned cost (on the credit of the account) from the actual cost (on the debit of the account). After the month is completed, the amount of deviations is proportionally written off to accounts 43 and 90.

Direct sale of manufactured products

With this option, the created products do not remain in the warehouse, but are sold immediately from production. In this situation, all production costs are immediately transferred to cost of sales account 90. Typically, service costs are closed in this way.

Results

The credit of the 20th account shows the cost of the finished product, whether it is intended for sale or for one’s own needs, the cost of services sold, work performed.

This amount is transferred to the 40th, 43rd, 90th or other account, as required by the accounting policy of the enterprise and the nature of the transaction performed. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Examples of accounting entries

The following transactions can be made with this account:

| Debit | Credit | Content |

| Postings for accumulating costs | ||

| 20 | 02 | Accrued depreciation of fixed assets |

| 20 | 04 | Write-off of depreciation of intangible assets if account 05 is not used |

| 20 | 05 | Depreciation of intangible assets accrued |

| 20 | 10 | Materials and components written off for production |

| 20 | 11 | Cost of animals written off |

| 20 | 16 | Variance in materials cost written off |

| 20 | 19 | Non-refundable VAT amounts are written off to the cost price |

| 20 | 20 | Turnover within production |

| 20 | 21 | Transfer of self-made semi-finished products into production |

| 20 | 23 | The costs of auxiliary production are written off to the main production |

| 20 | 25 | The cost includes general production costs |

| 20 | 26 | The cost includes general business expenses |

| 20 | 28 | Losses from defects are written off to cost |

| 20 | 29 | Services of servicing industries are written off as main production |

| 20 | 41 | Goods for resale were used for own needs |

| 20 | 43 | Finished products were used for our own needs |

| 20 | 60 | Utilities costs written off for production |

| 20 | 68 | Taxes are written off against the cost price |

| 20 | 69 | Calculation of social contributions on the basic salary |

| 20 | 70 | Payroll for key employees |

| 20 | 71 | Amounts of accountable persons are written off for production |

| 20 | 76 | The cost includes services from other suppliers (for example, insurance) |

| 20 | 79 | The cost includes the costs of branches or separate divisions |

| 20 | 94 | Shortages and losses are written off to cost |

| 20 | 96 | The cost reflects the formation of a reserve for future expenses |

| 20 | 97 | The cost includes amounts of deferred expenses |

| Postings to write off expenses | ||

| 10 | 20 | Return of unused materials from production to warehouse |

| 11 | 20 | Increasing the number of animals due to weight gain |

| 21 | 20 | Own semi-finished products accepted for accounting |

| 28 | 20 | Main production defect reflected |

| 40 | 20 | Capitalization of finished products at planned cost |

| 43 | 20 | Capitalization of finished products at actual cost |

| 90 | 20 | Actual cost of work written off |

| 94 | 20 | Deficiencies identified in the main production are reflected |

| 99 | 20 | Writing off expenses due to an emergency |

Postings Dt 20 and Kt 20, 10, 26, 25, 02, 60 (nuances)

: 20,000 rub. = 1.3.

Let's determine the amount of depreciation after revaluation:

6,000 rub. x 1.3 = 7,800 rub.

The amount of additional assessment of depreciation is:

7,800 rub. – 6,000 rub. = 1,800 rub.

Let's make accounting entries:

Debit 01 “Fixed assets” Credit 84 “Retained earnings (uncovered loss)”

- for the amount of revaluation of the object within the amount of the previously made depreciation - 3,000 rubles;

Why account 20 is not closed in 1s 8.2 and 8.3 in accounting

Sometimes an accountant may have a situation when he closes account 20 in 1s 8.3, but after the operation there is a balance left on the account.

Typically, the cause of such an error is incorrect information in the accounting documents on costs.

The thing is that when closing, costs are distributed according to analytics by item groups. This means that the cost analytic attribute must be set to the same as that of the item group. The program performs the distribution within the group proportionally.

Attention! If any cost's analytics attribute does not match any of the products produced, it hangs on the account. To resolve the error, you need to open the “Analysis of subconto Item groups” report and see for which group the costs remain.