Author: Ivan Ivanov

Every enterprise sooner or later faces the fact that some fixed assets (fixed assets) are not in use for a long time. They may not be used for months or even years, and the reason for this can be anything from seasonality, completion of work on a project or its freezing, to the fact that the volume of work being performed is simply reduced.

If such a situation arises, the best way out of it would be to preserve the object. What is it, how is it carried out and how is accounting and taxation carried out?

Procedure

Registration of conservation is regulated additionally for budgetary and state enterprises.

This procedure is less strict for commercial firms.

The process consists of the following steps:

- Stage 1. Decision making

The decision is made by an authorized employee of the organization. If management has the right to make such decisions, the document is replaced by an order to transfer the OS to conservation.

- Stage 2. Drawing up an order

After making a decision, the head of the enterprise issues an order.

The order specifies:

- list of conserved objects;

- causes;

- deadlines;

- OS translation activities;

- a commission is created - persons responsible for the conservation and then re-preservation of the OS;

- responsible for the storage and condition of objects.

Persons responsible for carrying out the procedure must familiarize themselves with the order.

The list of activities makes it possible to justify the economic feasibility of costs. This is considered one of the criteria for accepting expenses when calculating income tax. The deadline will help stop accrual of depreciation on fixed assets.

- Stage 3. Carrying out an inventory of conserved objects

One of the main activities carried out before canning OS is inventory. This procedure allows you to check the presence, condition and completeness of the property.

- Stage 4. Conservation of assets and drawing up an act

After preliminary work, an act of transferring the OS for storage is drawn up. The act is signed by the commission and the head of the enterprise.

- Stage 5. Reflections in accounting

After completing all the necessary documents, the transfer of the object is displayed in accounting.

Fixed assets in storage are accounted for in a special subaccount. A special mark is placed on the inventory card.

- Stage 6. Storage and maintenance of mothballed fixed assets

Specially appointed persons are responsible for the safety of mothballed objects.

Current costs form the expenses of the enterprise. Amounts are recorded in current periods.

- Stage 7. Extension of preservation

To extend the conservation period of objects, a separate order is issued.

Typical mistakes when filling out a document

Since the document does not have a single form, it is drawn up in any form. True, the practice of tax and audit audits shows that accountants, when filling out documents, systematically make mistakes. Here are the most basic ones:

- errors in writing words and numbers (in calculations);

- adding text;

- notes made in pencil;

- different ink colors;

- unspecified date of document preparation;

- the name of the organization is incorrectly indicated;

- the fact of economic or production activity has not been deciphered;

- signing a document by a person acting on someone else’s behalf without authority or in excess of the authority granted;

- conspicuous mechanical impact on the document (artificial aging, masking part of the text);

- the act was drawn up on sheets of varying quality.

Of course, all of the above errors cannot indicate the invalidity of the document. It is quite possible that such filling was due to objective reasons.

Important! The Federal Tax Service Inspectorate will always show interest in such documents, as it will consider them to be improperly executed. This means that the tax service will refuse to reimburse the organization for VAT and reduce the taxable base of the direct tax levied on the organization’s profits.

Documenting

Correct documentation is the main condition for recognizing costs when calculating corporate income tax.

Two main documents for formalizing the conservation of OS: an order and an act.

Sample order

The order to transfer OS for storage is signed by the management of the enterprise.

The document states:

- reasons for transfer;

- term of transfer for preservation;

- staff responsible for conservation.

After all measures have been taken, a certificate of transfer of objects for storage is drawn up.

order for conservation of fixed assets – word.

How to draw up a deed?

An act for recording is drawn up after conservation has been completed. The document is not necessary and is carried out at the request of management.

The act is signed by the commission members and the director. It contains the following data:

- a complete list of conserved objects;

- exact start date of the procedure;

- measures taken to transfer fixed assets to conservation;

- expenses.

After signing by the management of the enterprise, the act becomes the main document for:

- accounting for canning costs in expenses;

- suspension of depreciation for objects that are in storage for more than three months.

There is no specific established form for drawing up an act and an order. They are performed in any form.

act on conservation of OS - word.

Depreciation on mothballed fixed assets

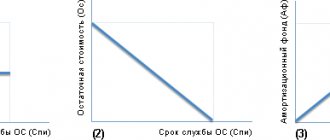

The gradual decrease in the value of a company's fixed assets, associated with wear and tear, through the monthly inclusion of part of its cost in the cost of production, is called depreciation.

After conservation, fixed assets continue to be included in the fixed assets of the enterprise. If the period exceeds 3 months, the object is removed from the list of depreciable objects.

Depreciation stops accruing on the first day of the month. Accrual is suspended one month after the order is published.

One of the main goals of conservation is to temporarily stop the calculation of depreciation.

In accounting, the length of time during which fixed assets are stored does not affect the time of its useful use.

According to accounting law, depreciation can be calculated even after the end of its useful life.

Consequently, after reactivation, accrual can continue in the same amount until the cost is fully paid off.

What is conservation?

Conservation represents measures to temporarily stop the operation of a number of fixed assets. After the specified period, re-preservation is carried out. It involves the resumption of operation of funds. The purpose of the procedure is to reduce costs and ensure proper storage of the OS. Such an event is usually carried out in relation to those objects that temporarily do not bring economic benefit.

Basis for conservation

The event is relevant in the presence of these circumstances:

- Completion of seasonal work, and therefore some of the equipment will not be used (for example, this may apply to snow removal equipment, harvesting machines).

- Production downtime (the company did not receive the thread on time, and therefore the work of the weaving machines stopped).

- Reduction in production due to an unfavorable economic situation (for example, the company can no longer finance the work of one of the workshops).

- Sending equipment for repair.

- The need for repairs, but the impossibility of carrying them out due to the lack of spare parts.

- Change in production profile.

- No orders.

Conservation ensures the preservation of the properties of fixed assets for their subsequent operation. The procedure involves taking measures to ensure the equipment is in good condition and limiting third party access to the OS. As a rule, the preserved object is sent to storage areas.

Components of conservation

In fact, the procedure involves working in these areas:

- Actual preservation (sending the OS to storage locations, restricting access to third parties).

- Creation of related documents.

- Reflection of conservation in the accounting program.

All of the above are integral components of the process. The property must be moved indoors to ensure its safety. But it is not enough to put the equipment into storage. It is also necessary to document all measures taken.

What property can be sent for conservation?

The conserved property must meet a number of conditions:

- The OS is used in production, rented, or required for the provision of services. You cannot preserve a marble statue.

- The operating life of the OS is less than a year. For example, product packaging cannot be subjected to the procedure.

- The company does not intend to resell the OS. You cannot preserve a batch of equipment purchased for further sale.

- In the future, the OS can bring economic benefits. The event does not apply to annual plants intended to decorate the territory.

If an object does not meet these conditions, it cannot be preserved. For example, the procedure is not relevant for natural resources.

Accounting and postings

After the management signs the order and approves the act, the OS is transferred to canning.

After conservation of fixed assets, they remain listed in accounting as part of fixed assets in account 01.

Fixed assets that are in storage are accounted for in one account, along with exploited fixed assets.

To ensure correct accounting, in the enterprise’s chart of accounts it is necessary to provide for the “Fixed Assets” account, a subaccount “Fixed Assets for Conservation”.

When transferring equipment, entries are made to transfer their value from the main sub-account, where fixed assets are accounted, to the sub-account for accounting for mothballed objects - D 01 “OS for conservation” K 01.

During depreservation, reverse wiring is performed.

Error correction

If an accounting specialist notices an error in the act, he has the right to correct it. For example, if the amount was entered incorrectly in the document, it can be edited by crossing it out and indicating the correct value. However, do not forget that corrections in the document must be certified correctly. For this it is enough:

- put in the act the date when the correction was made;

- write “Corrected Believe”;

- sign the employee who is responsible for the correction;

- decipher this signature.

When filling out a document, it is unacceptable to use line corrections, blots, corrections and erasures.

Tax accounting

The company pays both transport tax and property tax on mothballed property.

If the company is on the general taxation system, the amount of contributions is reduced by this amount.

There is no need to reinstate value added tax.

But, in some cases there is such a need:

- The company switches to another method of taxation.

- Fixed assets in storage are transferred to the authorized capital of another enterprise.

- The property, after reactivation, will be used in work that will not be subject to value added tax.

In all of the above cases, it is necessary to have primary documentation and then restore the value added tax.

Form of the act in 2021

Today, the legislator does not establish the use of unified forms as a mandatory condition for the preparation of the documents under consideration, but does not prohibit them either. At the same time, many organizations prefer to use internal templates for these purposes, developed taking into account their type of activity and needs .

If the compiler does not have experience in creating business documentation, we recommend filling out a standard form, which will help save time and avoid many mistakes.

simplified tax system

The tax base of simplified organizations that pay a single tax on income is not reduced by the costs of mothballing unfinished construction. With this object of taxation, no expenses are taken into account (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

It is also impossible to take them into account on the basis of subparagraph 5 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation as material expenses (purchase of works and services of a production nature), since the investor does not enter into direct relations with the contractor.

For information about the procedure for accounting for expenses when simplifying a contractor, see How to record the contractor's expenses under a construction contract.

UTII

The activities carried out by the contractor under the contract (investment agreement) are not transferred to UTII (clause 2 of Article 346.26 of the Tax Code of the Russian Federation). Taxation of such activities is carried out in accordance with the general or simplified taxation system.

If an investor pays UTII, then the costs of conserving an unfinished construction site will not affect the calculation of this tax. Payers of UTII calculate this tax based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

About the timing of equipment conservation in 2021

Although, the person acting as the initiator of sealing the equipment independently sets the period of inactivity for the mothballed property - certain restrictions in this regard are established by the legislator himself! The minimum period of “freezing” by law is 3 months, and the maximum can reach 3 years .

The starting point for the conservation period is the day of approval of the equipment conservation act by the general director of the organization that owns the property.

Don't have time to delve into legal nuances? Asking a lawyer is faster than reading ! Get a FREE online consultation from the best legal experts - right now !

About extending the deadline

Sometimes the above-mentioned deadlines can be extended, for which the director issues a corresponding order, which must be issued no later than a month before the end of the previously established main deadline.

In addition, sometimes situations arise when re-opened equipment needs to be re-frozen. According to the current legislation of the Russian Federation, this can be done no earlier than 5 months!

Who makes the decision to preserve equipment?

According to current Russian legislation, the decision to “freeze” equipment can only be made by the general director. However, even if there is permission, employees must conduct an appropriate inventory - a check that will show the condition and quantity of the property.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

To do this, the manager issues an official order to form a group of employees who will take responsibility for the inspection and actual preservation of the equipment, after which it will be possible to carry out the procedure in accordance with the established requirements of the legislator.

But what to do if the procedure must be carried out in the absence of the general director (for example, this person is on sick leave or on vacation)? In this case, all responsibility for the correct implementation of conservation falls on his deputy or a person with such powers that must be fully spelled out in their job descriptions.

Order on the creation of a commission for the re-opening of the facility

The judges emphasize that the costs of an enterprise during conservation are the costs of maintaining fixed assets.

We recommend reading: Hotline on black wages

And maintaining property in proper condition is directly related to production activities, aimed at generating income, since it maintains temporarily unused production assets in proper condition (Resolution of the Federal Antimonopoly Service of the Central District dated February 15, 2007 N A09-4610/06-13-16). It is impossible to include the amount of unreimbursed tax in the cost of materials (work, services), since Art. One copy is transferred to the accounting department for drawing up a matching statement, and the second remains with the financially responsible person.

Comparison statement of the results of inventory of fixed assets (Form N INV-18).