Personal insurance premiums are amounts for pension and health insurance that each individual entrepreneur must pay. This obligation is not affected by absence of activity, employment, or retirement. Grace periods for temporary non-payment of insurance premiums by individual entrepreneurs for themselves in the absence of real activity exist only in a number of cases:

- the entrepreneur is on care leave (for a child, a disabled person, an elderly person);

- military service by conscription;

- living with a spouse who is a diplomat abroad or a military serviceman under contract.

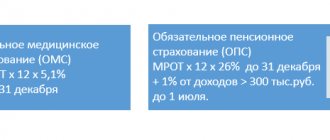

The calculation of insurance premiums depends on the minimum wage in force in the current year, so these amounts change every year. Mandatory insurance contributions of individual entrepreneurs are distributed to two funds - the Pension Fund and the Compulsory Medical Insurance Fund. The entrepreneur pays contributions to the social insurance fund voluntarily; they are not mandatory. In 2021, individual entrepreneurs’ contributions to the Social Insurance Fund for themselves amount to 2,159 rubles.

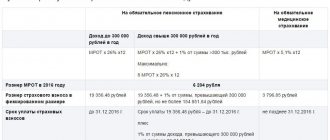

The amount of insurance contributions of individual entrepreneurs for themselves to the Pension Fund in 2021 is 19,356 rubles. Let’s add here the contributions for health insurance (3,797 rubles) and we get 23,153 rubles. This is the amount of mandatory insurance contributions for individual entrepreneurs in 2021 with an income of no more than 300,000 rubles per year. Insurance contributions to the Pension Fund in 2021 for individual entrepreneurs for themselves with income over 300,000 rubles, as last year, are equal to 1% of the amount exceeding this limit.

| Attention: Starting from 2021, the collection and accounting of insurance premiums will be transferred to the Federal Tax Service. Read more: Individual entrepreneurs’ contributions for themselves in 2021 |

For example, let’s calculate the amount of contributions to the Pension Fund in 2016 for an individual entrepreneur without employees who received 750,000 rubles in income for the year:

19,356 + ((750,000 – 300,000) * 1%) = 19,356 + 4,500 = 23,856 rubles.

Additional contributions to the Compulsory Medical Insurance Fund for incomes over 300,000 rubles are not paid, the amount remains the same - 3,797 rubles. Thus, individual entrepreneurs’ insurance premiums for themselves in 2021 in the above example will amount to 27,653 rubles.

Payment of insurance contributions to the Pension Fund in 2021 for individual entrepreneurs for themselves is made in full or in parts at any time, but no later than the end of the current year. But contributions to the Pension Fund for incomes over 300,000 rubles can be paid later - until April 1, 2021. In the example, we calculated the amount of contributions for a full year, but if the individual entrepreneur is registered in this status for an incomplete year, the amount will decrease accordingly.

Your payments

We are talking about the category of businessmen who work only for themselves and do not have employees. And, accordingly, they do not pay them income. Such payers, as before, make deductions from individual entrepreneurs’ insurance contributions to the Pension Fund of the Russian Federation and the federal health insurance system in strictly limited amounts and separately. This issue continues to be regulated by Art. 14 of the Law on Insurance Contributions No. 212-FZ.

The Pension Fund assures that the frequency of payment can be chosen from the following options:

- transfer all amounts at once;

- several payments per year, but no later than December 31 of the current period.

Reduction of tax on insurance premiums in 2021 for individual entrepreneurs

Entrepreneurs who have chosen the simplified tax system for income and UTII have the right to reduce the accrued tax at the expense of insurance premiums paid for themselves, but subject to a number of conditions.

- Individual entrepreneurs without employees on the simplified tax system Income or UTII reduce the accrued advance payment or tax by the amount of contributions without restrictions, so for small incomes the tax may be zero.

- If the entrepreneur has employees, the situation will be different. Individual entrepreneurs using the simplified tax system can deduct contributions paid for themselves and for employees, but so that the calculated tax is reduced by no more than 50%. Individual entrepreneurs on UTII do not have the right to take into account contributions paid for themselves when calculating tax. They are allowed to reduce the quarterly tax only at the expense of the contributions they paid for employees, and also by no more than 50%.

- Tax reduction premiums must be paid before you calculate your advance payment or quarterly tax.

You can familiarize yourself with examples of calculations for reducing tax due to paid contributions in the articles Insurance premiums for individual entrepreneurs 2021, simplified tax system 2021, UTII. In addition, each user of our site can receive free tax advice as a gift from 1C:BO professionals, who will make an individual calculation of the tax burden, taking into account the payment of contributions.

Get a free consultation

OPS

Keep in mind that the fixed contribution of an individual entrepreneur to the Pension Fund depends on the size of the basic income, which by law is 300,000 rubles. If the income is less than this amount, then one minimum wage is simply multiplied by the general tariff (26%) and multiplied by 12 (months). As a result, you will have to pay 19,356.48 rubles to the Pension Fund.

When the profit exceeds 300,000 rubles, an additional one percent of the amount over 300,000 is taken to the specified payment (19,356.48 rubles). True, there is a maximum limit, which is calculated based on eight minimum wages. In total, in 2021, an individual entrepreneur can pay a maximum of 154,851.84 rubles for himself to the Pension Fund.

Along the way, we will help you establish profit, from which an additional 1% for the contribution is calculated. All information is presented in the table.

| Type of tax | How and what to count |

| Payment of personal income tax, simplified tax system, unified agricultural tax | Take into account the actual income received from business activities |

| UTII | Imputed income |

| Patent (PSN) | Potentially receivable income |

| Multiple tax regimes | Income from different modes is summed up |

Within the framework of the Law on Insurance Contributions No. 212-FZ, the simplified tax system [fixed amount of insurance premiums for individual entrepreneurs] for compulsory social insurance is calculated the same way based on the amount of income and regardless of the object - “income” or “income minus expenses.”

Right not to pay

This right only exists if you have zero income for the year, so there is almost no point in it.

From 2021, the right not to pay contributions remains. However, it is regulated by other laws.

The payers specified in subparagraph 2 of paragraph 1 of Article 419 of this Code do not calculate and pay insurance contributions for compulsory pension insurance and compulsory medical insurance for the periods specified in paragraphs 1 (in terms of conscription military service), 3, 6 - 8 parts 1 of Article 12 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”, as well as for periods during which the status of a lawyer was suspended and during which they did not carry out relevant activities. (Clause 7 of Article 430 of the Tax Code Chapter 34 Insurance premiums)

Now look at 400-FZ, Article 12 of the Law on Insurance Pensions:

1) the period of military service, as well as other service equivalent to it

3) the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

6) the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

7) the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

However, you can not pay only if during the above periods no business activity was carried out (income 0 rubles) (Article 430, paragraph 8 of the Tax Code of the Russian Federation). It is necessary to submit documents confirming the absence of activity during the specified periods. As you understand, it’s easier to just close the IP.

For such an exemption, it is necessary to provide an Application for exemption from payment of insurance premiums (pdf, 615 kb.) (Letter of the Federal Tax Service of Russia dated 06/07/2018 N BS-4-11 / [email protected] “On the recommended form of the Application”).

Deadlines

Let's consider the deadlines for paying fixed contributions to individual entrepreneurs . The deadline for payment of the indicated amounts is generally December 31, 2021. But there is an exception. One percent of profits over 300,000 rubles can be transferred to the Pension Fund a little later: until April 1, 2021 inclusive.

As you can see, the deadlines remain the same. However, if you check the calendar, they are subject to rescheduling to a later time. Thus, the total fixed amounts must be transferred before January 9, 2021 inclusive, and the excess payment to the Pension Fund must be transferred no later than April 3, 2017 (since April 1, 2017 falls on a Saturday).

What can individual entrepreneurs expect in the coming 2021?

Currently, business entities are still calculating insurance premiums according to the old scheme. According to experts, it will change next year, since the Ministry of Labor has already prepared a corresponding bill and is trying to promote it in the State Duma. The following is known about the plans of legislators so far:

- Most likely, in 2021, all insurance contributions (FFOMS, Pension Fund, Social Insurance Fund) will be replaced by the Unified Social Insurance Contribution (ESS).

- In 2021, individual entrepreneurs will use an updated insurance premium payment scheme.

- It is planned that from 2021 business entities will pay ESSS not to the Pension Fund, FFOMS and Social Insurance Fund, but to the Federal Tax Service (FSN).

Example:

Today you can calculate the amount of insurance premium for yourself, which an individual entrepreneur will have to calculate in 2021, assuming that the calculation scheme remains the same.

If the minimum wage as of January 1, 2017 is equal to 7,500 rubles, then we will get the following results:

- Calculation of contributions to the Pension Fund of an individual entrepreneur for himself: (7,500 x 26% x 12 months) = 23,400 rubles.

- Calculation of contributions to the FFOMS for individual entrepreneurs for themselves: (7,500 x 5.10% x 12 months) = 4,590 rubles.

- In total, an individual entrepreneur will need to pay 27,990 rubles for the reporting year. If we compare this figure with the amount of insurance premiums that an individual entrepreneur must pay for 2016, then a significant difference is noticeable, increasing by 4,836.67 rubles.

Information has appeared in the media that as of January 1, 2017, the minimum wage will be increased to 8,800 rubles. Accordingly, this indicator will affect the increase in insurance premiums that an individual entrepreneur will have to pay for himself.

If we assume that this indicator will be approved at the legislative level, then the amount of insurance premiums for 2021 will be as follows:

- Calculation of contributions to the Pension Fund of an individual entrepreneur for himself: (8,800 x 26% x 12 months) = 27,456 rubles.

- Calculation of contributions to the FFOMS for individual entrepreneurs for themselves: (8,800 x 5.10% x 12 months) = 5,385.60 rubles.

- In total, an individual entrepreneur will need to pay 32,841.60 rubles for the reporting year. Compared to 2021, the amount of the insurance premium payable will increase by 9,688.27 rubles (32,841.60 - 23,153.33).

Recently, the Federal Tax Service published in specialized media a letter registered on July 28, 2021 under the number BS-3-11 / [email protected] This explanatory document states that individual entrepreneurs, starting from January 1, 2021, will have to calculate and pay insurance premiums for yourself in accordance with the regulations of the Tax Code in force in Russia (in particular, Article 430).

The changes also affected the rules for calculating income for individual entrepreneurs that do not employ hired workers. From January 1, 2021, total income will be determined in accordance with the regulations of the following articles of the Tax Code of the Russian Federation:

| Determination of income for an individual entrepreneur who uses the following tax regime | Article of the Tax Code of Russia |

| Personal income tax | 210 |

| PSN | 346.47 (51) |

| Unified agricultural tax | clause 1 art. 346.5 |

| UTII | 346.29 |

| USN Income minus expenses | 346.15 |

| More than one tax regime | All income is determined accordingly and then summed up |

KBK

Budget codes are perhaps the only thing that individual entrepreneurs should pay special attention to in 2021. The point is that there are changes here.

Fixed contribution to the Pension Fund for all merchants – 392 1 02 02140 06 1100 160.

Additional payment to the fixed contribution (income for 12 months - more than 300,000 rubles) - 392 1 0200 160.

Fixed contribution to the federal health insurance – 392 1 02 02103 08 1011 160.

These are the KBK of fixed contributions for individual entrepreneurs for 2021.

Calculation of a fixed payment for an incomplete year

If an individual received the status of an individual entrepreneur not from the beginning of the calendar year, or the entrepreneur was excluded from the Unified State Register of Individual Entrepreneurs before the end of the year, fixed insurance premiums are considered only for the period of entrepreneurial activity, and:

- fixed payments for individual entrepreneurs begin to be calculated from the day following the day of its state registration (letter of the Ministry of Labor dated 04/01/2014 No. 17-4/OOG-224);

- upon termination of activity, the day of exclusion of the individual entrepreneur from the Unified State Register of Individual Entrepreneurs is not included in the calculation of contributions (clause 4.1 of Article 14 of Law No. 212-FZ).

If the month has not been fully worked as an individual entrepreneur, then we calculate contributions based on the number of days of entrepreneurial activity:

Fixed payment = minimum wage X contribution rate: number of calendar days in a month X number of days in a month in which the individual entrepreneur’s activities were carried out

Example

The day of state registration of IP Lastochkina is February 1, 2021. The day of termination of Lastochkin’s activities as an individual entrepreneur and his exclusion from the register is December 15, 2021. During this period, entrepreneur Lastochkin’s revenue amounted to 500,000 rubles. We will calculate a fixed payment for individual entrepreneurs for 2021.

Contributions for February are calculated starting from the 2nd day, because... The day of registration of an individual entrepreneur is not included in the calculation:

Contribution to the Pension Fund for February = 6204 rubles. X 26%: 29 days X 28 days = 1557.42 rubles.

Contribution to the Compulsory Medical Insurance Fund for February = 6204 rubles. X 5.1%: 29 days X 28 days = 305.49 rubles.

The next 9 months were fully worked out by the individual entrepreneur:

Contribution to the Pension Fund for March-November = 6204 rubles. X 26% X 9 months = 14,517.36 rubles.

Contribution to the Compulsory Medical Insurance Fund for March-November = 6204 rubles. X 5.1% X 9 months = 2847.64 rubles.

For December we take into account days from the 1st to the 14th, because December 15 is the day of exclusion of individual entrepreneurs from the register:

Contribution to the Pension Fund for December = 6204 rubles. X 26%: 31 days X 14 days = 739.74 rubles.

Contribution to the Compulsory Medical Insurance Fund for December = 6204 rubles. X 5.1%: 31 days X 14 days = 142.89 rubles.

In total, fixed individual entrepreneur contributions for 2021 will be:

In the Pension Fund = 1557.42 rubles. + 14517.36 rub. + 739.74 rub. = 16814.52 rub.

In the Federal Compulsory Medical Insurance Fund = 305.49 rubles. + 2847.64 rub. + 142.89 rub. = 3296.02 rub.

Lastochkin will also have to pay an additional contribution to the Pension Fund on 200,000 rubles of income:

Additional contribution to the Pension Fund = (500,000 rubles – 300,000 rubles) X 1% = 2000 rubles.