An individual entrepreneur who needs funds for personal needs can take money from the cash register or transfer it from the individual entrepreneur’s account to his personal account. The owner of a legal entity does not have the right to perform such actions. You can legally satisfy your need for money by drawing up an interest-free loan agreement from your own enterprise. Current legislation does not prohibit this. It is important to know what tax consequences may accompany loan forgiveness to the founder.

Grounds for debt forgiveness by the founder

Debt forgiveness

- this is a firmly and clearly expressed will of the creditor to release the debtor from fulfilling obligations to repay borrowed funds and/or interest and penalties on the loan.

The possibility of debt forgiveness is provided for in Article 415 of the Civil Code of the Russian Federation. However, there is a caveat - writing off the debt should not affect the interests of third parties and the debtor. That is, if a debtor company objects to the forgiveness of its debt obligations, the creditor cannot carry out the write-off procedure on its own - such a transaction is not unilateral.

Moreover, if the creditor company refuses to accept funds to repay the debt, the debtor has the right to transfer the money to the account of a notary or judicial authority.

It is clear that since the founder himself manages his company, acting as a debtor, he will not interfere with debt forgiveness. However, in such a situation it is important to think about the interests of third parties. For example, you should check whether the interests of creditors to whom the founder himself has debt obligations will not be affected.

Creditors may be interested in the possibility of collecting debts from the assets of the business, including from the proceeds of a loan that was supposed to be forgiven. The lender may demand repayment of the debt by:

- destruction of the loan agreement from the founder;

- delivery of a promissory note;

- sending an official mail notification.

Important!

The debt can be forgiven by the founder in whole or in part.

Before executing a debt forgiveness transaction, the creditor must notify the debtor of his offer in writing. If he sends a letter of objection, debt forgiveness cannot be carried out. If the debtor does not take any actions that could be regarded as objections, or agrees to the transaction, the paperwork can begin.

The procedure for registering the issuance of borrowed funds to the founder

The Civil Code of the Russian Federation allows for issuing and receiving loans. One party to the transaction may be the founder, and the other – his own company. Moreover, both parties can act as both a lender and a borrower.

In a transaction where the founder acts as the borrower, it is important to comply with all legal rules:

- If a company is created by a group of people, it is necessary to obtain consent to issue borrowed funds from all founders. For this purpose, a council is assembled, the decision of which is documented in a special protocol. The document states the consent of the co-founders to issue a loan.

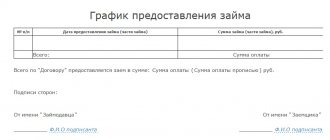

- The essential points of the agreement are preliminarily discussed: amount, terms, absence (presence) of interest for the use of borrowed funds, debt repayment schedule.

- A written agreement must be drawn up and signed by the borrower and the lender. In a situation where the borrower and lender are the same person, the agreement must be endorsed by an independent representative of the company. A chief accountant or financial director would be suitable for this role.

- After completing the documents, the founder receives money through the company's cash desk or by transfer to his current account.

Determining the rate in the loan agreement

Interest-free loans issued to subsidiaries are risky because the lender will be required to pay interest.

In this regard, it is strongly recommended to indicate the interest rate in the loan agreement - this approach is beneficial to the borrowing organization, since interest on the loan is taken into account in order to reduce the tax base for income tax.

Subsequently, the founder signs an agreement to forgive the debt. When the share in the authorized capital owned by the lender turns out to be more than 50%, the amount will not be included in the tax base.

Loan from the founder of your company: accounting and taxation

Who is most interested in ensuring that the organization runs smoothly and receives everything it needs to work on time? Of course, founder! Therefore, if suddenly there is an emergency need for funds, and your own resources are not enough, then a loan from the founder of your company will solve the problem.

Such a loan is good because it allows you to cover the organization’s need for money as quickly as possible, and does not require lengthy approvals or paperwork, as is the case with a bank. In addition, the founder can give his company more favorable conditions than a third party - long term, low interest rate. Because in the end, the profit will still return to him in the form of dividends.

The content of the article:

1. Loan from the founder of your company - we start with an agreement

2. What is most important in the loan agreement with the founder

3. How to record a loan from the founder in accounting

4. Interest-bearing loan from the LLC founder

5. When the transaction becomes controlled

6. Interest-free loan from the founder of the organization

7. Income tax on the founder’s loan

8. We received a loan from the founder - do we need an online cash register?

9. Conclusions: when to use cash register when borrowing from the founder

Now about all the points in order. And if you need to understand loan accounting and learn how to calculate interest on loans and borrowings, then another article will help you .

Loan for the founder of your company - start with an agreement

If the borrower is an organization, then regardless of who the lender is - an individual (founder, as in our example) or another legal entity, then the relationship is formalized in a written agreement (clause 1 of Article 808 of the Civil Code of the Russian Federation).

What important points should be reflected in the contract if there is a loan from the founder of his company:

- data of both parties;

- information about what exactly is being transferred into debt (it can be not only cash, but also materials, goods, etc.), the amount of money (the value of the transferred property);

- conditions for using borrowed funds (for what period, for what needs, interest rate, whether there will be collateral);

- the procedure for making and repaying loans and paying interest;

- other rights and obligations of the parties;

- liability that will arise if the terms of the contract are violated;

- procedure for action in force majeure circumstances;

- how controversial issues will be resolved.

In this article we will only talk about cash loans.

What is most important in a loan agreement with the founder

There are a number of points that will directly affect the accounting and tax treatment of a loan from the founder of his company.

- Loan repayment period. It affects the use of accounts 66 or 67 in accounting, and therefore the reliability of the organization’s balance sheet. It is recommended to indicate a specific date for repayment of the debt. If the return period is not specified in the contract, then in accordance with clause 1 of Art. 810 of the Civil Code, then the loan must be repaid no later than the 30th day from the date of the demand from the lender.

However, if the repayment of such a debt is delayed, the tax authorities may try to reclassify the relationship under the loan agreement as the provision of gratuitous financial assistance and assess additional taxes.

- The procedure and frequency of payment of interest under the agreement. If the organization receives an interest-bearing loan from the founder, then write down the payment schedule in the agreement. If there is no schedule, you will need to pay interest monthly.

- If the organization received an interest-free loan from the founder, then a clause about not accruing interest in the agreement. Because if this is not directly indicated, then interest will have to be calculated at the key rate of the Bank of Russia (clause 1 of Article 809 of the Civil Code of the Russian Federation).

- If the loan is issued for a specific purpose (this will be important, for example, when using online cash registers, more on this below), then indicate this purpose in the agreement.

How to record a loan from the founder in accounting

How to process a loan from the founder depends on the period for which the funds were received. In accounting, the account is used:

66 “Settlements for short-term loans and borrowings” - if the loan term is up to 12 months inclusive;

67 “Calculations for long-term loans and borrowings” - if the loan term is more than 12 months.

The loan from the founder is reflected by the following entry:

Debit 50 (51) – Credit 66 (67) – received the loan amount to the cash desk or to the current account.

When depositing a loan from the cash register, a cash receipt order is issued, which indicates the basis: deposit of funds under the loan agreement dated... No.... The loan agreement is attached to the order.

Further, the money can be deposited into the current account according to the announcement for a cash contribution. When making a deposit, indicate that these are borrowed funds.

Repayment of the loan to the founder is reflected by the posting:

Debit 66 (67) - Credit 50 (51) - the organization returned the loan amount to the founder

If interest was accrued, then transferring it to the founder forms the same posting. Cash proceeds cannot be used to repay the loan!

Thus, if you need to post a loan from the founder, then the transactions are no different from those for a bank loan.

Interest-bearing loan from the LLC founder

Let's look at an example of how to calculate interest on a loan agreement provided by the founder of an organization. Expenses in the form of interest in accounting and tax accounting are calculated monthly. Interest is paid based on the terms of the agreement.

Founder Osinin O.O. provided a loan to his organization Dubok LLC in the amount of 500,000 rubles. The loan was received to the current account on August 16, the purpose is to replenish current assets, the rate is 5% per annum. The maturity date is October 16 of the same year. Interest is paid at the end of the term along with the principal amount.

August 16:

Debit 51 – Credit 66 – in the amount of 500,000 rubles. - the organization received a loan

August 31:

Debit 91 – Credit 66 – in the amount of 1027.40 rubles. (500,000 * 5% / 365 * 15) – interest accrued for August

September 30th:

Debit 91 – Credit 66 – in the amount of 2054.79 rubles. (500,000 * 5% / 365 * 30) – interest accrued for September

November 16:

Debit 91 – Credit 66 – in the amount of 1095.89 rubles. (500,000 * 5% / 365 * 16) – interest accrued for October

The interest that the founder will receive is his income, and in this situation the borrower organization will act as a tax agent, withholding tax (clause 1 of article 224, clause 1 of article 209 of the Tax Code). Let's calculate personal income tax on interest on the founder's loan:

4,178.08 * 13% = 543 rub.

For correct accounting in the 1C: Accounting program, debt adjustment , i.e. transfer of interest debt from 66 to 73 (if the founder is an employee) or 76 account (if the founder is not an employee):

Debit 66 – Credit 73 (76) - in the amount of 4178.05 rubles.

Debit 73 (76) – Credit 68 – in the amount of 543 rubles. – withheld personal income tax from interest

Debit 66 – Credit 51 – in the amount of 500,000 rubles. – the organization returned the interest-bearing loan to the founder of the LLC

Debit 73 (76) – Credit 51 – in the amount of 3635.08 rubles. – the organization paid interest to the founder.

When the transaction becomes controlled

A transaction in the form of an interest-bearing loan will become controlled , and the amount of interest will be revised if the organization and the founder are interdependent persons, and also:

- resident founder and the amount of transactions between the parties for the year is more than 1 billion rubles.

— non-resident founder – regardless of the amount.

If you need to make adjustments to your accounting, use the recommendations from this article .

Interest-free loan from the founder of the organization

In a situation where an organization lends money to the founder, the individual borrower may have an economic benefit in the form of savings on interest, which is subject to personal income tax. Therefore, the question often arises whether such a benefit also arises in the opposite case - when an organization receives an interest-free loan from the founder?

Despite the fact that the loan does not accrue interest, the Tax Code does not contain rules for assessing the economic benefits that the borrower receives with an interest-free loan. Therefore, this type of income is not recognized by the borrower.

Confirmation: Letters of the Ministry of Finance of Russia dated 02/09/2015 No. 03-03-06/1/5149, dated 07/17/2008. No. 03-03-06/1/415, Federal Tax Service of Russia dated January 13, 2005. No. 02-1-08/ [email protected] , Federal Tax Service of Russia for Moscow dated 10/06/2006. No. 20-12/89193, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 3, 2004. No. 3009/04).

Thus, an interest-free loan from the founder of his company is beneficial for both parties.

The founder also has no obligation to pay personal income tax when he issues an interest-free loan to an organization, because no income. Although in this case the situation is controversial and the tax authorities may insist that, based on the interdependence of the persons, the transaction is recognized as controlled and income appears in the form of lost interest (letter of the Ministry of Finance of Russia dated May 27, 2016 No. 03-01-18/30778).

Over time, the life of the company will improve and then it will no longer be the founder who will help the company, but the company will pay him income, for example, in the form of dividends. Read how to account for them .

Income tax on the founder's loan

Receipt and repayment of a loan in tax accounting, as well as in accounting (clauses 2.5 of PBU 15/2008, clause 2 of PBU 9/99, clause 3 of PBU 10/99), are not recognized as income and expenses of the organization ( paragraph 10, paragraph 1, article 251, paragraph 12, article 270 of the Tax Code).

If the loan of the founder of his company is interest-bearing, then the interest accrued by the borrower (organization) is:

- — other expenses in accounting (clauses 6, 7 PBU 15/2008, clause 18 PBU 10/99);

- — non-operating expenses in tax accounting (clause 2, clause 1, article 265 of the Tax Code).

They are accepted in full and are recognized as expenses in tax accounting for OSNO on a monthly basis (clause 8 of Article 272 of the Tax Code, clause 8 of PBU 15/2008):

- - on the last day of the month;

- - on the loan repayment date.

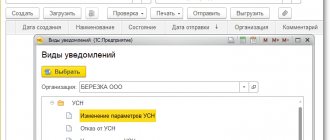

Loans from founders under the simplified tax system are reflected in accounting in the same way, and in tax accounting, expenses are recognized after they have been paid. Because The organization's expenses arise on the date of transfer of interest to the founder (subclause 9, clause 1, article 346.16 of the Tax Code).

Received a loan from the founder - do you need an online cash register?

The next important question that arises in light of recent changes to Law No. 54-FZ on cash transactions is whether an online cash register is needed when receiving a loan from the founder or not? “Thanks to” vague wording in the law itself and the current lack of clear and understandable explanations, it is impossible to give an unambiguous answer to this question. But let's try to figure it out anyway.

We rely on Article 1.1 of Law No. 54-FZ: “settlements also mean... the provision and repayment of loans to pay for goods, work, services...”

We will also need clause 4 of Article 4 of Law No. 192-FZ dated 07/03/2018 (amended 54-FZ): “Organizations and individual entrepreneurs when making settlements with individuals who are not individual entrepreneurs by bank transfer (except for settlements using electronic means of payment), ..., when providing loans to pay for goods, works, services, ..., has the right not to use cash register equipment ... until July 1, 2021.”

What conclusions can be drawn from unclear wording, and when is a check still needed when borrowing from the founder?

Conclusions: when to use cash register when borrowing from the founder

1) The purpose of obtaining a loan matters. If an organization receives a loan from the founder to pay for goods, work, or services, then the cash register must be used . If the goals are different, for example, paying salaries to employees, then an online cash register does not seem to be required, either before 07/01/2019 or after.

Why “seemingly”? Because the expenditure of funds received in the form of a loan will need to be proven. If the loan is received in cash to an “empty” cash register and the entire amount is immediately issued in the form of a salary, then this is easy. And if borrowed funds are mixed with the company’s money, then the situation becomes more complicated, because money is impersonal.

2) Article 1.1 does not specify the parties, who exactly gives the loan and who receives it. Those. We are talking about a loan from the founder of the organization, and vice versa .

3) In the second quote, where a deferment is given, we are talking only about the provision of a loan. Not about repayment! Those. There is no deferment for the situation of repaying the loan to the founder. If you are repaying a loan from the founder, use cash register.

4) From the second quote it is not clear whether the non-cash procedure is important for applying the deferment specifically for loans or not. If we analyze the grammar of the sentence, then the enumeration takes place: when making payments..., when providing loans... And it turns out that the deferment on loans until 07/01/2019 does not depend on the type of payment - in cash or by bank transfer.

However, most consultants, when giving explanations, prefer to play it safe and recommend using an online cash register now when receiving a loan from the founder in cash or using electronic means of payment (payment by card).

Loan from the founder of your company: accounting and taxation

How to apply for debt forgiveness by the founder - legal procedure

The procedure for debt forgiveness by the founder can be formalized in several ways:

| Method for completing a debt forgiveness transaction | The essence of the method |

| Conclusion of an agreement according to which the subject of the transaction will be the release of the debtor from his debt obligations to the founder. | Such a document must be submitted to the lender by the borrower at the time of receipt of borrowed funds from him. The text of the agreement must refer to Article 415 of the Civil Code of the Russian Federation. The text of the agreement is formed in any form, but it is necessary to indicate the amount of the debt written off, the name of the organization, details of the parties to the agreement, details of the loan agreement under which the company received a loan from the founder. |

| Conclusion of an additional agreement between the debtor and the founder. | The subject of such an agreement is the founder’s waiver of the right to collect debt from the debtor organization. This document does not cancel the debt, but allows you not to repay borrowed funds without causing legal consequences. |

| Execution of a gift agreement, the parties to which are the founder-lender and the debtor company, and the subject is the amount of debt. | This method is only possible if the founder is an individual. The law prohibits two legal entities from gifting assets to each other. A donation agreement can be concluded:

|

Can a member forgive their organization's debt?

The founder can legally waive the right to claim funds provided to the company under the terms of the loan.

Forgiveness of such a debt is carried out in accordance with the norms of the Civil Code of the Russian Federation, namely, Article 415 of this legislative act.

Thus, the provisions of this article allow the co-owner of the company to forgive its debt to him.

However, the founder will be able to use this option only if the rights of other entities are not violated.

For example, we may be talking about the legitimate interests of third parties who are creditors of a shareholder who intends to forgive the debt of his organization.

It must be taken into account that the shareholder’s obligations to these creditors can be repaid at the expense of his own assets, one of which, of course, is a loan forgiven to the company.

How to apply for debt forgiveness by the founder - accounting

The company to which the founder has forgiven the debt, after the completion of the transaction, reflects the transactions in the accounting registers:

- DEBIT 66 CREDIT 91, subaccount “Other income”

- if the loan is short-term; - DEBIT 67 CREDIT 91, subaccount “Other income”

- if the loan is long-term; - DEBIT 68, subaccount “Tax Calculations” CREDIT 99

– additional entry in case the amount of the written off debt does not belong to the taxable base (such an entry allows you to update the asset of the enterprise represented by the unpaid tax on the funds written off by the founder).

Debt write-off

A loan issued to the founder can be written off if it is repaid by the borrower or after the debt is forgiven. If the return of money is a standard procedure, then writing off (forgiveness) the debt has its own nuances of registration and tax consequences for both the borrower and the lender.

The return of the amount of money by the borrower of the company is reflected in the accounting by the following entries: Dt 50 (51) Kt 66, (67) - cash return to the cash desk (through the bank) of a short-term (long-term) loan.

How to apply for debt forgiveness by the founder - taxation

Let's return to the accounting entries we examined. The amount that will be entered in the first entry is the amount of debt to the founder. The amount indicated in the second entry is the amount of tax deduction that is nominally accrued on the debt. If the taxpayer applies the OSNO regime (general taxation regime), the amount will be 20% of the debt. If the founder owns less than 50% of the authorized capital of the debtor company, the amount of debt is reflected exclusively in the first entry.

In this case, the amount of debt is not subject to tax.

Loan accounting

Legislative standards require mandatory recording of the movement of funds within a business entity. To do this, the accountant must create the appropriate entries.

Registration of a loan also requires recording in accounting, and it does not matter who the creditor is: the founder or the financial structure. It is necessary to record accounting entries for any loan, both with and without interest.

To fix a loan for a period of up to 1 year, account 66 “Short-term loans” is used. If funds are provided for a period of more than a year, then account 67 “Long-term loan” is used.

If the founder provides money to his company, this will be accompanied by an increase in accounts payable in the legal entity’s liability. Forgiveness or return of funds is accompanied by a decrease in accounts payable by a certain amount.

Depending on the operations carried out, borrowed funds are recorded using the transactions described in Table 1.

| Operation | Dt | CT |

| If borrowed funds are deposited by the founder into the current account of a legal entity | 51 | 66 (or 67) |

| Money can be processed using other transactions | 52 “Currency account” 10 "Materials" 41 "Products" | 66 (or 67) |

| When depositing borrowed money into the organization's cash desk | 50 | 66 (or 67) |

| Subsequently, borrowed funds are transferred from the cash desk to the current account | 51 | 50 |

| When returning borrowed funds | 66, 67 | 50 (51, 52, 10, 41 and so on) |

How to take into account a loan issued from the founder, watch the video:

How to apply for debt forgiveness by the founder - tax accounting

How it is necessary to keep tax records will depend on what share in the authorized capital is owned by the founder who issued the loan:

| Share in the authorized capital of the lender | Tax accounting |

| Less than 50% or 50% | The written-off debt must be included in the company's revenue (the amount of debt is included in the taxable base), since the debt becomes property received free of charge - this means that the company has increased its net assets. |

| More than 50% | The forgiven debt will not be recognized as income of the enterprise for tax purposes, and therefore the debt will not be taxed on the basis of Art. 251 Tax Code of the Russian Federation. |

Important!

Whatever the share of the authorized capital in the ownership of the founder-lender, the interest on the loan must be included in the tax base of the enterprise when the borrower's debt is written off.

Loan without interest: what taxes are possible

What tax consequences does an interest-free loan from the founder have? For a loan taken without interest, the issue of taxation also turns out to be related to the presence of mutual dependence between the parties to the transaction and whether the founder is a resident or non-resident. The situations here are:

- There is no dependency. In this case, the lack of taxable income in the form of interest from the lender is completely legal (Clause 1, Article 105.3 of the Tax Code of the Russian Federation). Accordingly, the borrower has no expenses.

- There is a dependency. For her, the inclusion of the founder as a resident becomes significant. If the founder is the founder, then the transaction to provide an interest-free loan is not recognized as controlled (subclause 7, clause 4, article 105.14 of the Tax Code of the Russian Federation). If the founder turns out to be a non-resident, then the absence of interest on the loan makes the transaction not subject to control, since in this case the conditions for him, provided for in Art. 269 of the Tax Code of the Russian Federation.

Thus, an interest-free loan will not have tax consequences in any case.

Read about the reflection of a loan in accounting in the material “Accounting for loans and borrowings in accounting.”

Common mistakes

Error:

The borrower did not make demands for payment of the debt from the debtor company. The debtor regarded the lack of demands as a desire to forgive his debt.

A comment:

The lender has the right to demand payment of the debt, but he is not obligated to do so. And the fact that the debtor did not receive demands does not mean that the borrower has expressed his will to forgive debt obligations.

Error:

The founder forgives the organization’s debt, and a gift agreement is concluded, in which the lender sets its own conditions for canceling the debtor’s obligations.

A comment:

The gift transaction assumes the absence of any additional conditions from the person to whom the debt is forgiven. It also assumes gratuitousness and voluntary consent of the debtor to enter into a gift agreement.

What is a loan from the founder?

The founder can, under a loan agreement, provide his company with funds, and then, as a lender, has the right to release the debtor from his obligations to pay the debt. This process is called “debt forgiveness.” This concept means a clearly and firmly expressed desire of the creditor to relieve the debtor from fulfilling obligations under the loan agreement. It should be remembered that the absence of demands from the lender to pay the debt cannot be considered an expression of will to forgive debt obligations. The creditor has the right to demand fulfillment of debt obligations, but is not obligated. Therefore, he may be willing to refuse to pay the debt from his company if this does not affect the interests of third parties.

We will tell you how to carry out this procedure in accordance with the law. And also how to reflect debt forgiveness by the founder in accounting and tax accounting.

Answers to common questions about how to apply for debt forgiveness by the founder

Question #1:

Is it possible to exercise the right to forgive a company's debt to the founder in order to redistribute funds within the enterprise?

Answer:

Yes, issuing a loan and forgiving the debt is beneficial, since the money will be distributed, and the debtor will not have income if the debt is forgiven by the founder with less than 50% of the share capital. If the share of the founder-lender exceeds 50% of the authorized capital, this method is not profitable.

Question #2:

What should you pay attention to when a company’s debt is forgiven by its founder?

Answer:

The Federal Tax Service of the Russian Federation insists on including the amount of interest on the loan in the non-operating expenses of the debtor company in the event of debt forgiveness. The founder did not pay interest, and the company itself accrued it and included it in expenses - such an operation cannot be recognized as a gratuitous transfer of property from the point of view of law, and therefore tax benefits do not apply. The amount of debt that has been written off is not included as an expense for tax purposes. These are not justified economic expenses (according to the approval of the Ministry of Finance of the Russian Federation).

Redistribution of company funds

What does the founder's debt forgiveness agreement entail?

It is believed that obtaining debt forgiveness is a complex operation that takes a lot of time and effort. However, this is not always the case. This procedure allows you to find a simple and affordable way to redistribute funds, for example, within one holding company. The benefit of giving a loan and forgiveness of debt in this case is that the funds are distributed between companies, while the debtor does not generate income if the debt is forgiven by the founder with a 50% share in the authorized capital. When distributing money between companies that are members of the same group, a loan agreement is often used. We remind you once again that this method is beneficial when the founder giving the loan has a share in the authorized capital of 50 percent or less.