Basic Concepts

A defect is a product, work process or its component that does not meet established requirements and standards. A defective product cannot be used for its intended purpose without correction.

Identifying and sending the finished product for revision is the concern of the quality control service, which is the most important component of the organizational structure of enterprises.

Based on the specifics of detection, marriage is divided into two large categories:

- external defect identified by the consumer;

- internal defects identified either by quality control department employees or workshop and warehouse workers.

External defects are more expensive for the enterprise, as they contribute to:

- a decrease in customer loyalty to the manufacturer and its products immediately after purchasing the first defective product;

- the formation of losses not only due to the costs of creating products, but also related costs - transportation, sales, compensation, etc.

Correspondence and postings

For credit with debit:

- wear – 02;

- NMA – 04;

- wear and tear of intangible material – 05;

- raw materials for the manufacture of goods -;

- animals at the stage of growing or fattening – 11;

- the difference between the planned cost of materials and the actual one – 16;

- VAT on funds spent on the purchase of goods, services or works – 18;

- main production (OS) – 20;

- semi-finished products manufactured at the enterprise – 21;

- auxiliary production – 23;

- expenses for general needs of manufactured products – 25;

- marriage – 28;

- finished goods – 43;

- payment of invoices to suppliers and contractors - ;

- tax bills and fees – ;

- social insurance costs and contributions for its provision – ;

- salary - ;

- write-off of funds for settlements with accountable persons -;

- payments to the founders of the enterprise - 75;

- covering accounts payable and settlements with debtors – 76;

- write-off of on-farm expenses – 79;

- financing of targeted expenses – 86;

- income level and write-off of funds for the current state -;

- other income and expenses –;

- shortages and losses associated with breakdown or damage to property –;

- payments in reserve – 96;

- expenses planned for the future period – 97.

By debit with credit:

- accounts 10, 11, 16, 20, 21, 28, 43, , 79, 86, 90, 91, 94, 96 – with the same semantic values are displayed on the debit position;

- 15 – purchase or production of materials;

- 75 – products that have been shipped.

For debit, accounting is done using postings (the first account is Dt, the second is Kt):

- 20 02 – accrued cost of depreciation of the operating system;

- 20 04 – launch of production using new technologies;

- 20 05 – accounting for wear and tear of intangible assets;

- 20 10 – write-off and display of the cost of purchasing materials, workwear, necessary tools and equipment necessary for the manufacturing process;

- 20 16 – deviations in the cost of written-off materials;

- 20 19 – information about non-refundable VAT that was charged on services or work;

- 20 21 – valuation of semi-finished products involved in the process of production of goods;

- 20 23 – information about the funds used for the VP;

- 20 25 – accounting for expenses for general production;

- 20 26 – fixation of expenses for general business needs;

- 20 28 – cost of defects included in the manufacture of goods;

- 20 40 or 43 – goods sent for processing or finished goods that were written off for production needs;

- 20 41 – price of goods written off for manufacturing needs;

- 20 60 – services provided by contractors included in the cost of production (PP) of products;

- 20 68 – taxes and fees in this area;

- 20 69 – contributions for insurance of workers involved in the process;

- 20 70 – wages;

- 20 71 – covering the amounts used for production and calculated in the reports;

- 20 73 – compensation payments to cover the costs of the employee involved in the manufacture of goods;

- 20 75 – expenses for OP, which are included in the authorized capital;

- 20 76.2 – downtime and claims made to contractors for failure to fulfill the terms of the contract;

- 20 79 – expenses recorded on the balance sheet of divisions that participate in production;

- 20 80 – production of products that are in an unfinished stage, but included in the capital of the authorized type;

- 20 86 – work in progress, which was used to finance the intended purpose;

- 20 91.1 – use of surplus unfinished production of products;

- 20 94 – damages and losses, without identifying the guilty workers within the established standards;

- 20 96 – valuation of reserves accounted for in the PP;

- 20 97 – covering planned production costs.

By loan:

- 10 20 – goods that were returned or their own valuables were written off;

- 15 20 – accounting of work performed or services provided by the EP;

- 21 20 – used semi-finished products;

- 28 20 – costs that were required to eliminate the defect;

- 40 (43) 20 – write-off of manufactured products or display of their cost;

- 45 20 – transfer of goods, performance of work and provision of services to contractors;

- 76.01 20 – insurance compensation;

- 76.02 20 – reduction in the level of expenses for claims presented to counterparties and downtime;

- 79 20 – the needs of targeted financing for production are taken into account;

- 90.02 20 – write-off of the cost of services provided;

- 91.02 20 - write-off of funds that occurred due to the disposal of certain assets or expenses due to emergencies in the unfinished production of goods that were included in other losses;

- 94 20 – the amount of shortage in this category of the company’s activities;

- 99 20 – losses included in the section of uncompensated costs that arose due to an emergency.

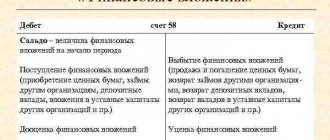

Using account 28 in accounting

Account 28 is active. The formation of a debit account turnover, which includes correction costs incurred during the production of defective goods, occurs within one reporting month. Credit turnover refers to the amount of funds received as reimbursement of expenses from those responsible for defective products (for example, the cost of serviceable spare parts to be returned to production). The balance in this case is final and equal to the sum of all losses - it is written off monthly at the end of the period. Write-off occurs based on the costs of manufacturing similar products or to account 25.

When calculating the costs of losses due to defects, it is necessary to take into account only that part of the costs that is not written off to the culprits or rejected materials. At the same time, the reporting documentation must indicate all business transactions related to the marriage.

Accounting for manufacturing defects is extremely important from a tax point of view, since it is directly related to VAT and NP (income tax): losses resulting from defects reduce the tax base.

Accounting for VAT on defects discovered in production is not without a large number of controversial issues. To avoid troubles with the tax authorities, businesses use VAT recovery.

General production expenses

Indirect costs associated with servicing production are recorded on account 25. These include:

- depreciation of machinery and equipment;

- OS maintenance costs;

- remuneration of employees;

- insurance deductions;

- rent;

- utility costs for production premises;

- expenses for repairs of machines, buildings for general production purposes, etc.

During the month, actual costs are collected by DT from the credit of accounts for inventory, materials, settlements with personnel: DT25 KT02 (05, 10, 60), etc. Then they are written off to account 20 in accounting. This is reflected by the wiring of DT20 KT25. That is, the final balance on the account. 25 equals 0. Analytics is carried out by departments and expense items.

Subaccounts and analytics

Maintaining a 28th account is advisable in enterprises specializing in mass production of various products. At the same time, all subaccounts used in analytics must be specified in an individual accounting policy.

Analytical accounting for account 28 makes it possible to collect information about the defect and the persons responsible for its occurrence. This approach allows us to improve production processes, increase their efficiency and track the sources of defects.

What sub-accounts are opened by the 20th account?

A small number of subaccounts are opened to the main production account, if necessary. Most popular subaccounts:

- 20.1 "Crop production"

- 20.2 "Livestock"

- 20.3 "Industrial production"

- 20.4 “Other main production”

If necessary, the company can open additional sub-accounts.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

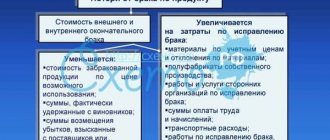

Correctable and irreparable marriage

- A fixable marriage . If it is possible to correct the defect, then the debit of account 28 collects funds for correction. A certain amount of these expenses is written off from the credit of account 28 to the cost of production to the debit of account 20 “Main production”.

- An irreparable marriage. In this case, a certain amount of money is withheld from the employee who released the defective product. Returnable waste also appears, which goes to the warehouse for further use.

What is marriage like?

Depending on where the defective product is found, the defect occurs:

- internal, i.e. discovered by the company's technical department;

- external, i.e. already identified by the buyer.

It is more economically profitable for a company to detect internal defects, since this will significantly reduce the cost of correcting the situation, will allow maintaining consumer loyalty to the product and will not cause significant damage to the reputation of the enterprise.

If a defect is detected, it is determined which category it belongs to:

- correctable (i.e. subject to improvement, thanks to which the shortcomings are eliminated);

- incorrigible (in which modification is impossible or unprofitable).

To summarize information about losses from defects, accounting account 28 “Defects in production” is used.

Example of using count 28

At a plant producing various metal parts, the quality control service identified a defective product, which a specialist characterized as an irreparable defect. The acceptance committee conducted an inspection and determined that the defect arose through the fault of the employee. The following calculation was made:

- the cost of creating a part, including costs for casting, wages, experimental work and experimental work, amounted to 50 thousand rubles;

- It is possible to sell a defective part for scrap and receive 12 thousand rubles;

- 10 thousand rubles were collected from an employee of the enterprise;

- Uncompensated damage amounted to 28 thousand rubles.

Closing

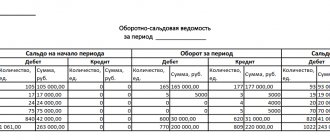

The methodology that should be used for closing is necessarily indicated in the accounting policy documents of the enterprise. If necessary, a distribution base is prescribed.

Methods:

- Straight.

- Intermediate.

- Direct sale of goods.

Before proceeding with the procedure for closing account 20, it is necessary to identify and record the balances of the refinery.

Straight

It is characterized by the fact that during the reporting period the cost of products is not known and its accounting is carried out at conventionally designated prices (planned cost). To close, the cost of manufactured goods is adjusted to the actual cost.

Wiring:

- Debit 43 Credit 20 – correction of manufactured products.

- Debit 90.02 Credit 43 - the amount of deviations from the planned cost and write-off to sales costs.

It is worth noting that when using this method it will be impossible to take into account the actual price during the reporting month.

Intermediate

Count 40 is involved here - about production. It shows the difference between the actual and planned cost of expenses. For credit, the planned one is described, and for debit, the real one.

At the end of the month, upon closing, the difference amount must be written off to account 43 (finished products) and 90.02 (cost of sales).

Posting at the beginning of the month:

- Dt 43 Kt 20 – finished products with a planned price were used.

- Dt 90.02 Kt 43 – write-off of goods sold at the planned cost.

End of period:

- Dt 40 Kt 20 – write-off of the actual cost.

- Dt 43 Kt 40.

- Dt 90.02 Kt 40 – correction of the planned price to the actual cost.

Direct sales of manufactured products

With this method, all produced goods are sold directly from the enterprise and are not stored. Manufacturing costs are taken into account immediately.

Closing of the account (sale of services) is carried out at the end of the month (reporting): Dt 90.02 Kt 20 (writing off the real cost of sales).

What to do if account 20 is not closed? Details are in the video.