Accounting

Olga Yakushina

Tax expert-journalist

Current as of September 11, 2019

Account 69 is used to reflect calculations for social insurance, pensions and compulsory medical insurance. Let's look at typical transactions for account 69 and tell you about the procedure for keeping records on it.

a brief description of

According to the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), in accounting account 69 is officially called “Calculations for social insurance and security.”

To put it quite simply, accounting account 69 for dummies is intended to summarize information about calculations for:

- social insurance of the organization’s employees (in case of temporary disability and/or maternity);

- pension provision;

- compulsory health insurance.

Regarding what the score is 69, it is active-passive. That is, it is possible to have both a debit and a credit balance on account 69.

Which subaccounts to open for account 69

Count 69 is active-passive. Credit accounts reflect business transactions for calculating insurance premiums, including fines and penalties. By debit - amounts transferred to the funds, as well as expenses incurred from these amounts.

Chart of accounts, approved. By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94-n, it recommends opening three main sub-accounts for this account:

- 69.1 - calculations for social insurance of employees;

- 69.2 - calculations for pension provision.

- 69.3 - calculations for compulsory health insurance.

Depending on the types of social insurance at the enterprise, you can open additional sub-accounts to account 69: for example, account 69.11 - compulsory social insurance against occupational diseases and accidents.

What about credit and debit

By virtue of the law, the credit of account 69 reflects the amounts of payments for social insurance and provision of employees, as well as their compulsory medical insurance, subject to transfer to the relevant funds (PFR, Social Insurance Fund, Compulsory Medical Insurance Fund).

In this case, postings to account 69 are made in correspondence with:

- accounts that reflect the calculation of wages - in terms of deductions made at the expense of the organization;

- account 70 “Settlements with personnel for wages” - in terms of deductions made at the expense of the organization’s employees.

In addition, the credit 69 account shows:

- in correspondence with the profit and loss account or settlements with employees for other transactions (regarding settlements with guilty parties) - accrued penalties for late payments;

- in correspondence with account 51 “Current accounts” - amounts received in cases where the corresponding expenses exceed payments.

But the debit of account 69 reflects:

- transferred payments (insurance premiums);

- amounts paid through payments for social insurance, pensions, compulsory medical insurance.

EXAMPLES OF WIRINGS

Accrued penalties for late payment of payments to the Federal Social Insurance Fund of the Russian Federation are reflected under Kt 69 in correspondence with Dt 99 “Profits and Losses”, and the payment of penalties on insurance premiums - according to Dt 69 and Kt 51 “Settlement accounts”.

Refunds for overpayments on insurance premiums are reflected as follows: Dt 51 – Kt 69.

Financing preventive measures to reduce occupational injuries:

Dt 69, 69-1 – Kt 76 “Settlements with various debtors and creditors” - reduction of debt to the Federal Insurance Service of the Russian Federation in terms of insurance premiums by the amount of expenses incurred for preventive measures.

Calculation of contributions for the amount of vacation pay: Dt 96 “Reserves for future expenses” - Kt 69.

Also see “How to record settlements with different debtors and creditors in accounting.”

Typical transactions for account 69 in the table

The correspondence used with account 69 is fixed in the chart of accounts approved by the above-mentioned Order of the Ministry of Finance No. 94-n. Here are the most common wiring:

| Debit | Credit | Business transaction |

| On account credit 69 | ||

| 08 “Investments in non-current assets” | 69 | Insurance premiums are calculated from wages when creating an OS object on your own |

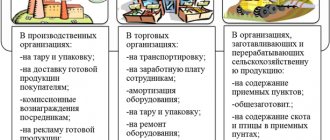

| 20 "Main production" 23 “Auxiliary production” 25 “General production expenses” 26 “General business expenses” 44 “Sales expenses” | 69 | Insurance premiums are calculated from:

|

| 28 "Defects in production" | 69 | Insurance premiums are charged from wages for repairing marriages |

| 51 “Current accounts” | 69 | Sick leave was reimbursed from the fund |

| 91 “Other income and expenses” | 69 | Insurance premiums are calculated from non-production premiums |

| 96 “Reserves for future expenses” | 69 | A reserve has been created for vacations in terms of accrued insurance premiums |

| 99 "Profits and losses" | 69 | Penalties and fines were accrued for late payment of insurance premiums |

| By debit of account 69 | ||

| 69 | 51 “Current accounts” | Insurance premiums transferred to the budget |

| 69 | 70 “Settlements with personnel for wages” | Amounts accrued to the employee on sick leave |

| 69 | 73 “Settlements with personnel for other operations” | Part of the cost of issued vouchers was written off from the Social Insurance Fund |

Account 69 “Calculations for social insurance and security”, as a rule, has a credit balance, showing the debt of the organization. If a debit balance arises, this means that the funds have a debt to the organization.

A debit balance on account 69 is more often inherent in social insurance calculations, when the amount of accrued contributions is less than the amounts paid to staff through social insurance payments (sick leave, maternity benefits, etc.)

Is count 69 active or passive?

To answer the question whether account 69 is active or passive, you must first understand what it is used for. In accounting, account 69 is used to display calculations for various types of compulsory social insurance:

- pension;

- medical;

- in case of occupational diseases/injuries at work;

- in case of temporary disability.

Account 69, as a rule, corresponds with cost accounts, and in the case of calculating benefits at the expense of the employer, with accounts related to the accrual and payment of wages. It also reflects penalties for late payments made to government funds through the tax office. The debit reflects payments made in the form of mandatory insurance contributions. Based on this, we can conclude that this accounting account is active-passive.

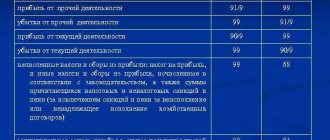

Correspondent accounts of account 99

The organization’s income and expenses on account 99 correspond with other accounts that reflect the company’s activities in the context of:

- profitability of ordinary activities – score 90;

- balance of profitability or unprofitability of other types of activities - account 91;

- losses and income from emergency circumstances - corresponding accounts for recording material assets, personnel wages, etc.;

- taxation and tax sanctions - account 68.

At the end of the financial year, account 99 is closed to zero, and the existing balance is transferred to account 84 “Retained earnings (uncovered loss).”

Typical wiring

Key transactions for the designated position are recorded using the following accounting entries:

1) Dt 69

Kt 51 – transfer of insurance contributions to an extra-budgetary fund;

2) Dt 20

Kt 69 – insurance premiums for employees of primary production;

3) Dt 44

Kt 69 – calculation of insurance premiums for employees responsible for ensuring the process of product sales;

4) Dt 51

Kt 69 – return by extra-budgetary funds of overpaid funds, etc.

What does debit 69 credit 69 show?

Correspondence Dt 69 Kt 69 is reflected in the instructions.

In this case, the debit of account 69 shows:

- Accrued amounts of benefits, which is accompanied by the posting of debit 69 credit 70.

Example 1

The employee was on sick leave. After his illness, he submitted a certificate of incapacity for work. As a result, the following entries were reflected in the accounting for amounts compensated by the Social Insurance Fund:

- Dt 69 Kt 70 - temporary disability benefits accrued;

- Dt 70 Kt 51 - payment of benefits;

- Dt 51 Kt 69 - FSS reimbursed the benefits.

- Payment of insurance premiums, penalties, fines.

- Adjustments related to excessive assessment of insurance premiums or reimbursement of benefits by funds.

Credit account 69 is mainly found when calculating insurance premiums, penalties and fines on them. At the same time, we note that the moments of calculation of contributions and payments to employees coincide, and the correspondence of account 69 is similar to the cost account used to reflect the specified payment.

Example 2

The production organization paid wages to employees:

- production personnel RUB 570,000;

- management staff RUB 800,000;

- commercial department 650,000 rub.

Contribution rates for VNIM - 2.9%, for compulsory health insurance - 22%, compulsory medical insurance - 5.1%, for NS and PZ - 0.2%.

For insurance premium rates, see this article.

An example of accounting for insurance premiums for the purpose of calculating income tax from ConsultantPlus A trading organization accrued and paid a bonus to employees in June for the 20th anniversary of the company. The total amount of insurance premiums accrued for all employees is RUB 755,000. You can view the entire example in K+ by getting free trial access.

The accounting records reflect the following entries:

- Dt 20 Kt 70 - payroll for employees in production 570,000 rubles;

- Dt 20 Kt 69.01 - accrual of contributions from VNiM 16,530 rubles. (570,000 × 2.9%);

- Dt 20 Kt 69.02 - contributions to the mandatory insurance policy 125,400 rubles. (570,000 × 22%);

- Dt 20 Kt 69.03 - compulsory medical insurance contributions 29,070 rubles. (570,000 × 5.1%);

- Dt 20 Kt 69.11 - contributions from NS and PZ 1140 rubles. (570,000 × 0.2%);

- Dt 26 Kt 70 - salary calculation for management staff 800,000 rubles;

- Dt 26 Kt 69.01 - from VNiM 23,200 rub. (800,000 × 2.9%);

- Dt 26 Kt 69.02 - for OPS 176,000 rubles. (800,000 × 22%);

- Dt 26 Kt 69.03 - for compulsory medical insurance 40,800 rubles. (800,000 × 5.1%);

- Dt 26 Kt 69.11 - contributions from NS and PZ 1600 rubles. (800,000 × 0.2%);

- Dt 44 Kt 70 - salary of the commercial department 650,000 rubles;

- Dt 44 Kt 69.01 - from VNIM 18,850 rub. (650,000 × 2.9%);

- Dt 44 Kt 69.02 - for OPS 143,000 rubles. (650,000 × 22%);

- Dt 44 Kt 69.03 - for compulsory medical insurance 33,150 rubles. (650,000 × 5.1%);

- Dt 44 Kt 69.11 - contributions from NS and PZ 1300 rubles. (650,000 × 0.2%);

- Dt 69.01 Kt 51 - payment of contributions from VNiM 58,580 rubles;

- Dt 69.02 Kt 51 - payment of contributions to the OPS 444,400 rubles;

- Dt 69.03 Kt 51 - payment of contributions for compulsory medical insurance 103,020 rubles;

- Dt 69.11 Kt 51 - payment of contributions from NS and PZ 4040 rubles.

If an organization underestimates the amount of insurance premiums or pays them later than due, it will have to accrue and pay penalties and fines.

Important! Hint from ConsultantPlus Depending on the situation, entries for accrual of penalties can be made on the following dates (clause 16 of PBU 10/99): on the date of the decision...; on the date of demand...; Read more about the date of reflection of penalties on contributions in K+. Trial access is available for free.

Example 3

The organization paid insurance premiums from VNiM on September 25 instead of September 15, 2020, and therefore it was charged penalties for violating the payment deadlines. The amount of contributions from example 2.

Amount of penalty = 10 × 1/300 × 4.25% × 58,580 = 83 rubles,

Where:

10 — number of days of delay;

4.25% - refinancing rate;

Dt 91 Kt 69.01 - accrual of penalties 83 rubles.

Dt 69.01 Kt 51 - payment of penalties 83 rubles.

Our article will help you fill out payment forms.

Account characteristics

Let's consider the characteristics of account 69, as well as what is reflected in debit and credit.

Considering the order in which transactions are reflected helps determine whether this is an active or passive account. The debit of the account records transactions involving the transfer of contributions, and the credit records their accrual.

Since at any given time there can be either an overpayment of any contribution (debit balance) or an underpayment (credit balance), this indicates that the account is active-passive.

Attention! When determining the final score, it is necessary to take into account which side of the account the initial one is on. If it is in debit, then this balance must be added to the debit turnover and subtracted from the credit turnover. A positive balance will show a debit ending balance, a negative balance will show a credit balance, which is reflected without a negative sign.

In the balance sheet, account balances 69 are reflected in two places at once:

- Debit on line 1260 “Other current assets” in the asset;

- Credit on line 1550 “Other liabilities” in liabilities.

What is account 69 used for in accounting?

The law obliges every employer to pay contributions to social funds on almost all remunerations (salaries) of its employees. Let's look at what it is.

Contributions to the funds are mandatory payments that guarantee each employee medical care, pensions, and insurance compensation in case of disability.

There are currently four types of such contributions:

- To the Pension Fund;

- To the social insurance fund - divided into two, payment of disability and compensation for injuries;

- To the health insurance fund.

Attention!

Since 2021, the Federal Tax Service has been managing these contributions (except for injuries). They are transferred by the 15th of each month in separate payment orders. To carry out accounting of accrued and paid amounts for each type of contribution in the chart of accounts, account 69 “Calculations for social insurance and security” is used. Since this information is widely used to fill out various reports, it is necessary to organize accounting in the context of each fund, as well as the type of transfer to it (contribution, fine, penalty, etc.).

The value of position 69 for accounting

When calculating wages, employers withhold insurance and other payments from the indicated amount. This obligation is imposed on business entities by current legislation.

Any enterprise that makes payments to its employees in accordance with concluded employment contracts is obliged to charge insurance premiums for their further payment to extra-budgetary funds. According to the requirements of current legislation, a similar obligation is imposed in relation to medical, social and pension insurance of employees. Along with this, a similar obligation is imposed on employers in the event of temporary disability of employees, as well as accidents that may occur at work.

It is position 69 that is used to record amounts accrued and paid to extrabudgetary funds.

According to its credit part, companies reflect the amount of obligations to social insurance authorities, which is financed from the employer’s own funds.

The stated position typically has a credit balance. However, it may also happen that at the end of the reporting period a debit balance is formed, showing the volume of obligations of the designated bodies to the enterprise.

Analytics for the designated position is carried out for each type of calculation.

Subaccounts to account 99

To calculate the economic indicators of the enterprise’s activities with the calculation of profits and losses, additional sub-accounts are opened to account 99, in accordance with the accounting policy of the organization:

- 99.1 – to display information on income and expenses for the main type of activity;

- 99.2 – to account for cash flows in other aspects of business;

- 99.3 – in case of emergency income;

- 99.4 – in case of emergency expenses;

- 99.5 – to display tax deductions;

- 99.6 – to take into account tax sanctions;

- 99.9 – to display net profit or loss at the end of the reporting month.

Subaccount 99.3 is exclusively credit, subaccounts 99.4–99.6 are debit, and subaccounts 99.1 and 99.2 can have both credit and debit balances. The balances for each subaccount are written off at the end of the month to subaccount 99.9.