Not even the smallest organization or enterprise engaged in any type of activity can do without accounting. It is necessary in order to reflect all possible business transactions, settlements with counterparties and keep track of property.

As you know, all information about transactions and postings is carried out through special account registers, each of which reflects certain types of transactions. Among such operations is the accounting of funds related to debt, that is, loans and borrowings. They are taken into account by the 66 count. Today we will look at what the 66 account is, whether it is active or passive, what subaccounts of the 66 account exist.

Accounting is a system of accounting and analytics of all business transactions and property

Main characteristics of 66 accounts

According to the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its application (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), account 66 in accounting is called “Settlements for short-term loans and borrowings.”

Reflect on account 66 business transactions showing the status of short-term (for a period of no more than 12 months) loans and borrowings received by the organization.

Now about the score 66. It is active-passive:

- passive - because it takes into account debts to counterparties who lent funds to the organization, i.e. there is always a credit balance;

- active - there may be a balance of 66 debit accounts when borrowed funds are repaid in a larger amount or interest has been overpaid.

Also see “Short-term loans and borrowings: line item on the balance sheet.”

Results

Account 66 records funds borrowed for a period not exceeding one year.

Here you need to show transactions in terms of interest accrued on them. The number and numbers of sub-accounts opened for the account are established independently, taking into account the requirements for organizing the necessary analytics (by type of borrowed funds and counterparties). For borrowed foreign currency funds, records are kept in two currencies (the currency of the borrowing agreement and in rubles) with the calculation of exchange rate differences. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What about the credit of account 66

The amounts of short-term credits and loans received by the organization are shown in the credit of account 66 and the debit of accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts”;

- 60 “Settlements with suppliers and contractors”, etc.

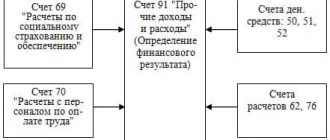

Interest payable on loans and borrowings received is reflected in the credit of account 66 in correspondence with the debit of account 91 “Other income and expenses”. In this case, accrued interest amounts are taken into account separately.

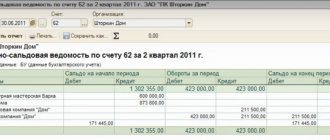

Analytical accounting on account 66 is carried out according to:

- types of credits and loans;

- credit institutions;

- other lenders who provided them.

The Ministry of Finance does not list possible subaccounts for account 66 in the Chart of Accounts. That is, organizations act here at their own discretion (also see below about bills).

Subaccounts

There is no list of required subaccounts. You can define them yourself by assigning numbers, names and sequences to them. This is done on the basis that analytical data on the register should present data of a separated nature:

- Divided by type of borrower funds, which are divided into funds not paid on time and those that require inclusion in the consolidated statements as of the reporting date;

- Divided into counterparties;

- Divided by calculated percentages.

For example, the following subaccounts may apply:

- 66.1 - for loans in national currency (Russian rubles);

- 66.2 - to determine interest on loans in national currency;

- 66.3 - for loans in national currency (Russian rubles);

- 66.4 - to determine interest on loans in national currency;

- 66.5 - for loans on bonds;

- 66.6 - for recording data on discount bills;

- 66.21 - for loans in foreign currency;

- 66.22 - to determine interest on loans in foreign currency;

- 66.23 - for loans in foreign currency;

- 66.24 - to determine interest on loans in foreign currency.

Important! With all this, in the reporting the word “short-term” should always be present in the name of the subaccount. For example, in the 1C program, subaccount 66 of account 66.03 will be called “Short-term loans in national currency (Russian rubles)” or “Short-term loans in rubles”.

It should also be remembered that funds received in the currency of a foreign country require accounting in two currencies: in the state currency in which the loan was issued, and in Russian rubles.

Subaccounts for 66 are determined independently

Bonds on the books. account 66

Separate entries in account 66 are made in relation to short-term loans raised by issuing and placing bonds.

| Situation | Solution |

| Bonds are placed at a price exceeding their face value | Make entries according to Dt 51 “Current accounts”, etc. in correspondence with the accounts:

The amount allocated to account 98 is written off evenly during the circulation period of the bonds to account 91 “Other income and expenses”. |

| Bonds are placed at a price below their face value | The difference between the placement price and the nominal value of the bonds is added evenly during the period of circulation of the bonds from the credit of account 66 to the debit of account 91. |

What does the entry Debit 51 Credit 51 mean?

Posting Dt 51 Kt 51 is often used to reflect the movement of money from one company current account to another.

Let me explain. The company has 2 current accounts: one in bank 1, the second in bank 2. To detail the flow of funds in both accounts, the company can open sub-accounts to account 51:

- 51.01 - settlements on account in bank 1;

- 51.02 - settlements on bank account 2.

Then, when transferring funds from an account in bank 2 to an account in bank 1, instead of the not very clear posting Debit 51 Credit 51, you can make an entry: Dt 51.01 Kt 51.02.

We should not forget that the subaccounts that will be used by your organization should be indicated in the working chart of accounts approved in the accounting policy.

IMPORTANT! Analytical accounting for 51 accounts can be built not only using subaccounts, but also subaccounts, which, in particular, are used in a number of accounting programs (for example, 1C).

Bills of exchange on account 66 in the accounting department

A separate sub-account to account 66 reflects settlements with credit institutions for accounting (discounting) bills and other debt obligations with a maturity of no more than 12 months.

| Situation | Solution |

| Accounting (discount) operation for bills and other debt obligations | The organization-bill holder reflects according to Kt 66 (face value of the bill) and Dt 51 “Settlement accounts” or 52 “Currency accounts” (actually received amount of funds) and 91 “Other income and expenses” (account interest paid to the bank). |

| Closing the accounting (discount) operation of bills and other debt obligations | Based on the bank’s notification of payment by reflecting the amount of the bill under Dt 66 and the credit of the corresponding accounts receivable accounts |

| Return by the organization-bill holder of funds received from the bank as a result of discounting (discounting) bills or other debt obligations due to failure by the drawer or other payer of the bill to fulfill its payment obligations on time | Make an entry according to Dt 66 in correspondence with cash accounts. At the same time, the debt for settlements with buyers, customers and other debtors, secured by overdue bills of exchange, continues to be reflected in the accounts receivable. |

Analytical accounting of discounted bills is carried out according to:

- credit institutions that have discounted bills of exchange or other debt obligations;

- drawers;

- separate bills.

Accounting for settlements with credit institutions, lenders and bill drawers within a group of interconnected companies, the activities of which are compiled under consolidated accounting records, is kept separately on account 66.

An example of applying for a loan and calculating interest on it

The company issued and received a loan for 12 months in the amount of 400,000 rubles at an interest rate of 20% with the condition of monthly interest accrual. In accounting, the situation will be reflected as follows:

- Dt 51 - Kt 66 Loan transfer to account - 400,000.

- Dt 91.02 - Kt 66 Interest accrual for 1 month 6666.67 (400,000 x 20%: 12).

- The previous posting is repeated throughout the loan term.

- Dt 66 – Kt 51 Repayment of the loan and interest on it 480,000 (400,000 + 6666.67 x 12).

Examples of accounting entries 66 accounts

Below from the table it becomes clear what the 66 score shows.

| Operation | Account debit | Account credit |

| Received a short-term loan (loan) in money | 50 “Cash desk” 51 “Current accounts” 52 “Currency accounts” 55 “Special bank accounts” | 66 |

| Received a loan for materials/goods | 10 “Materials” 41 “Products” | |

| Reflected expenses on loans and borrowings recognized as other expenses | 91 “Other income and expenses” | |

| Interest on a short-term loan (loan) is charged to the increase in the value of the investment asset | 08 “Investments in non-current assets” | |

| Debt on a short-term loan has been repaid | 66 | 50, 51, 52, 55, 10, 41 |

Read also

16.09.2019

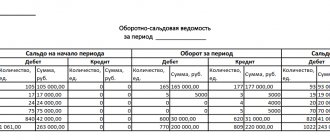

Debit and credit display

The debit of account 66 reflects transactions related to the repayment of loans for a period of up to one year. Credit 66 of the account shows transactions that take into account the receipt of short-term loans to an organization or enterprise.

Important! Register 66 can work in debit with accounts 55, 52, 50, 51, depending on where the money comes from to repay loans. To separate loans and their sources as accurately as possible, transactions with registers 62 and 76 (debit) are used. Analytics for writing off interest on a loan, the difference in the cost of contracts and securities, as well as exchange rate differences are taken into account when corresponding with 91 registers.

66 also interacts with credit accounts depending on where exactly the assets were sent. If they were invested in tangible assets, then these are 07, 08, 11, 11 and 41 accounts. If the contribution was to quickly sold assets, then these are 50, 51, 52 and 55 accounts. For settlements with counterparties and suppliers, postings to 60 and 76 accounts are used. Replenishment of reserve capital is taken into account in register 82.

All accounts have debit and credit display

Standard postings

So, typical accounting entries for account 66 are drawn up as follows:

1) Dt 50, 51,52

Kt 66 – a loan raised for a short-term period in national or foreign currencies;

2) Dt 91.1

Kt 66 – accrued interest expenses and bank commission on attracted short-term resources;

3) Dt 66

Kt 91.1 – a reflection of the positive exchange rate difference in the income structure;

4) Dt 41 (10)

Kt 66 – receipt of goods (material assets) under a short-term lending agreement;

5) Dt 91.2

Kt 66 – accounting for negative exchange rate differences, etc.

The role and significance of position 66

As you know, funds can be raised for short and long periods. In the first case, the period of attraction does not exceed an annual period.

Account 66 is designed to summarize data on the state of borrowed and credit funds attracted by the organization for a short period. By nature he is considered passive. Therefore, on its credit side, organizations reflect the volume of attracted financing. In this case, correspondence with 50, 51, 52, 55 and 60 accounts can be observed.

If short-term funds are raised through the issue of bonds, then these resources are accounted for separately. If the company managed to place securities at a cost higher than their nominal value, then accounting entries are entered for the debit part of 51 positions and the credit part of 66 and 98 accounts. In this case, the positive difference between the market and nominal value of the securities is reflected.

It is also necessary to emphasize that for the credit part of item 66, accounting also reflects interest expenses accrued on attracted resources.

The debit part of the company's account shows the volume of repaid obligations. If the company is late in payments on short-term borrowed funds, then these amounts are also accounted for separately.

Just like with account 67, analytics for 66 is reflected by type of borrowed resources and financial and credit institutions.