In many ways, the authorities have already simplified the task of taxpayers - more and more services are provided by municipal and state bodies online. Today, through the personal account of an individual entrepreneur or legal entity on the official website of the Federal Tax Service of Russia, you can get an answer to your question, submit an application, change the tax regime and receive comprehensive information about the services and operating procedures of the tax service. In addition to convenience, the method of electronic filing of reports and payment of tax fees simplifies document flow and allows Federal Tax Service specialists to quickly respond to the actions of entrepreneurs, process payments and respond to requests. We suggest finding out whether digitalization has affected such a report as 6-NDFL, whether it is possible to fill out 6-NDFL online and submit it electronically.

Unified form 6-NDFL

The calculation of 6-NDFL (KND 1151099) is approved and regulated by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450 (as amended on January 17, 2018). It contains instructions on how to fill out 6-NDFL 2021. The form is submitted to the territorial tax inspectorates quarterly in electronic form through specialized accounting programs and reporting services. If the staff of the institution consists of less than 10 people, a copy of the document is allowed to be submitted to the tax office on paper.

IMPORTANT!

From 2021, the delivery procedure will change. Now employers with 10 or more employees are required to report electronically. If the income is paid to 9 or fewer individuals, then it is allowed to submit a paper report.

conclusions

Form 6-NDFL for the 2nd quarter (first half of the year) 2021 serves for operational control over the fulfillment by tax agents of their duties to transfer income taxes. It shows the amount of income, accrued and withheld tax and the established deadlines for transfer. If difficulties arise in its preparation, you should first of all pay attention to the established date for transferring personal income tax for this type of income. If the question still remains, you need to be guided by letters from regulatory authorities explaining the relevant provision of the instructions.

If you find an error, please select a piece of text and press Ctrl+Enter.

Deadlines and responsibility for 6-NDFL

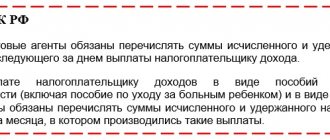

The report is generated and sent to the Federal Tax Service every quarter; the deadline for submitting 6-NDFL reports is the last day of the month following the reporting (quarterly) one.

IMPORTANT!

Annual reports are submitted by March 1 of the next financial year. This is a new deadline. Previously, institutions reported until April 1 (a month later).

During the year they report for each quarter. The table shows the deadlines for submitting 6-NDFL in 2021.

| Report period | Deadline for submission |

| For 2021 | Until 03/02/2020 |

| 1st quarter 2021 | Until 04/30/2020 |

| 2nd quarter 2021 - cumulative total for 6 months of the current year | Until July 31, 2020 |

| 3rd quarter 2021 - cumulative total for 9 months of the current year | Until 02.11.2020 |

| For 2021 - cumulative estimated amounts for the entire financial year | Until 01.03.2021 |

Penalties are provided for violation of deadlines. For each overdue month you will have to pay a fine of 1000 rubles (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). The person responsible for filing reports will also be held accountable: a fine of 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

If errors and distortions of information are detected in 6-NDFL, the institution will pay a fine of 500 rubles (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

If an organization, which according to the regulations must provide the form electronically, submits a package of documents on paper, it will be fined 200 rubles under Art. 119.1 Tax Code of the Russian Federation.

IMPORTANT!

If there are separate divisions, documents are drawn up separately for each of them. The form displays summary information for all employees. The total value of wages moving into the next billing period and the date of payment of the tax (the working day following the date when the tax is actually withheld) are indicated.

Title page

This section is devoted to general information about the entity providing the report and the parameters of the form itself:

- TIN and checkpoint codes. If a “segregation” is reported, then the checkpoint is given for the region where it is registered. If an individual reports, there will be no checkpoint.

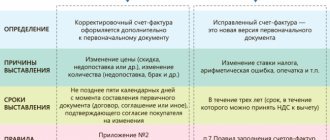

- Correction number. If the payer himself or the inspectors find errors in the submitted report, then a corrected version must be sent. This field is used to distinguish between the original version and subsequent revisions. For the primary version, we put “000” in it, then, if there are clarifications, “001”, “002”, etc.

- Submission period (code). The period for which this quarterly form is submitted is coded here. The codes are taken from Appendix 1 to the Filling Procedure, approved. Order No. 450 (hereinafter referred to as the Order).

Reports provided in connection with the liquidation (reorganization) of a company are coded separately. The period in this case corresponds to the date of liquidation (reorganization). For a regular half-year report, you need to insert code 31. If the company was liquidated, for example, in May, then the report is also considered to be provided for the half-year. But in this case, a special “liquidation” code 52 is entered.

- Tax period (year). Enter the reporting year here in four-digit format.

- Provided to the tax authority (code). We provide the four-digit code of the tax office to which the report is submitted.

- By location (accounting) (code). This field of the report shows on what basis the tax agent submits the form to this division of the Federal Tax Service. The codes are taken from Appendix 2 to the Procedure and depend on the payer category. For an individual this is the place of residence, for a legal entity it is the location, and in case of reorganization it is the location of the legal successor.

- Tax agent. We provide the abbreviated (if not available, full) name of the organization. For an individual - full name without abbreviations.

- Form of reorganization (liquidation) (code) and TIN/KPP of the reorganized organization. These fields are filled in if the report is submitted by the legal successor of the liquidated company. The code is selected from Appendix 4 to the Procedure; it indicates the form of reorganization (liquidation).

- OKTMO code. We enter the code of the municipality where the tax agent is located (resides).

- Contact phone number.

- Information on the number of sheets of the report itself and (if any) attached documents.

- Signature of the responsible person with transcript. This may be the tax agent himself, his successor or representative. In the latter case, you must also provide the details of the power of attorney.

- Date the report was signed.

How to correctly fill out the information in the calculation for the 3rd quarter of 2020

Let's look at the procedure for applying the instructions for filling out, using the example of the State Budget Educational Institution of Children's and Youth Sports School "ALLUR".

GBOU "ALLUR" has four employees. Based on the results of the first half of 2020, the institution performed the following operations:

- accrued the total income for all employees - RUB 2,217,431.54;

- provided a standard deduction - 34,400 rubles;

- calculated personal income tax - 283,793 rubles;

- withheld personal income tax from income accrued and paid for the six months - 231,074 rubles;

- paid salaries for December 2021, bonuses for 2021 and withheld personal income tax from these incomes in the amount of 111,872 rubles.

In the third quarter, GBOU DOD SDYUSSHOR "ALLUR" carried out the following operations, broken down by date:

- 07/06/2020 paid vacation pay in the amount of 9,690 rubles, accrued and withheld personal income tax from vacation pay - 1,260 rubles;

- 07/06/2020 paid salaries for June in the total amount of 405,534 rubles, withheld from it and transferred to the personal income tax budget - 52,719 rubles;

- 07/20/2020 paid vacation pay in the amount of 24,363.08 rubles, accrued and withheld personal income tax from vacation pay - 3,167 rubles;

- 07/31/2020 transferred personal income tax from vacation pay paid in July in the amount of 4,427 rubles;

- 07/31/2020 calculated the salary for July - 343,780.25 rubles, calculated personal income tax from the salary - 44,691 rubles;

- 08/06/2020 paid wages for July, withheld personal income tax from it;

- 08/07/2020 transferred personal income tax to the budget from salaries for July;

- 08/17/2020 paid vacation pay in the amount of 98,677.26 rubles, calculated and withheld personal income tax from them - 12,828 rubles;

- 08/31/2020 accrued wages for August in the amount of 258,414.53 rubles, calculated personal income tax from the salary - 33,594 rubles;

- 09/01/2020 transferred personal income tax from vacation pay paid in August;

- 09/04/2020 paid vacation pay in the amount of 122,126 rubles, accrued and withheld personal income tax from them - 15,876 rubles;

- 09/04/2020 paid wages for August, withheld and paid personal income tax to the budget;

- 09/21/2020 paid temporary disability benefits in the amount of 3,918.92 rubles, accrued and withheld personal income tax from the benefits - 509 rubles;

- 09/30/2020 accrued wages for September in the amount of 339,813.70 rubles, calculated personal income tax from the salary - 44,176 rubles;

- On September 30, 2020, I transferred personal income tax to the budget from temporary disability benefits and vacation pay paid in September.

The institution submitted a report for 9 months of 2021 to the tax office on 10/19/2020.

Bonuses, vacation pay and sick leave

If we are talking about a monthly bonus, then it is reflected in the report in the same way as salary . The date of receipt of income will also be considered the last day of the billing month . If the bonus is paid along with the monthly salary, both amounts are added up and entered into one block in section 2. If a separate day is set for the transfer of the bonus, then it must be shown in a separate block of the second section.

When a premium is accrued for a period exceeding a month (quarter or year), the date of receipt of income should be considered the date of actual payment of the premium (letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115). In this case, on pages 100 and 110 sections. 2 you need to enter the date of payment of the bonus, and on page 120 - the next working day.

When paying vacation pay and sick leave, personal income tax must be transferred no later than the last working day of the month of payment. It is this date that should be entered on page 120 of section. 2 for such payments.

A special case is when vacation pay is paid in the last month of the reporting period, and the ending date of this month is a day off. For example, if vacation pay was paid in December 2017, then the date of transfer to the budget is postponed to the first working day of the new year - 01/09/2018. Therefore, this amount will be reflected in section. 1 report for 2021 and in Sect. 2 - report for the half year 2021. In this case, the date 01/09/2018 should be shown on page 120.

Checking the report

Before sending the calculation to the Federal Tax Service, be sure to check the control ratios and check the formal correctness of completion. In the letters of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] , dated March 13, 2017 No. BS-4-11/4371, dated March 20, 2019 No. BS-4-11/ [email protected] all are presented control ratios, with the help of which the inspector checks 6-NDFL. The first thing the inspector will pay attention to is the date the report was submitted. It must meet the deadline.

List of internal and inter-document control relationships:

- The amount of accrued income (field 020) is not less than the amount of deductions (030).

- The value from line 040 is equal to (020 – 030) × 010 / 100. A deviation from the calculated value is allowed in the amount of 1 ruble for each employee when taking into account each payment of income subject to personal income tax.

- The value from field 040 is not less than the value from 050.

- The total amount of tax transferred to the Federal Tax Service is not less than the difference between the personal income tax actually withheld (line 070) and the tax returned to the taxpayer (090).

- The date of transfer of the tax payment to the budget system must correspond to the value from line 120.

The annual form is checked using control ratios and by comparison with the data shown in the annual declaration forms 2-NDFL (KND 1151078) and “Profit” (1151006). For annual reporting, test ratios:

- The figure in line 020 (the amount of accrued income) is equal to the amount for all 2-NDFL certificates and the value from 020 of Appendix No. 2 of the profit report.

- Line 025 (amount of dividend income) is equal to the sum of lines from certificates 2-NDFL for 1010 and 1010 of Appendix No. 2 of the “Profit” declaration.

- Line 040 (calculated tax) is equal to the sum of the same indicator for all 2-NDFL certificates and line 030 of Appendix No. 2 of the profit reporting.

- Line 080 is equal to the total final unwithheld tax from each 2-NDFL certificate and line 034 of Appendix No. 2 of the profit reporting.

- Line 060 (the number of persons who received income) coincides with the number of 2-NDFL certificates and appendices No. 2 to the annual profit statements sent for control to the territorial bodies of the Federal Tax Service.

All parameters for monitoring reporting were approved by letter of the Federal Tax Service of Russia dated March 20, 2019 No. BS-4-11/ [email protected]

Reflection of “transitional” payments

Taxpayers have many questions regarding the inclusion of “transitional” payments in the form. We are talking about situations where income is paid in one reporting period, and tax is subject to transfer in another. For example, the salary for March 2021 was paid on 04/10/2018.

In this case, in the report for the 1st quarter, the March salary will be reflected only in section 1:

- On page 020 - the amount of accrued wages.

- On page 040 - tax on this amount.

All other information will already be included in the report for the first half of 2018:

- On page 70 section. 1 — amount of tax withheld.

- On page 100 section. 2 - 03/31/2018 (the date of receipt of income in the form of salary is the last day of the billing month).

- On page 110 section. 2 - 04/10/2018 (tax withheld when paying salaries).

- On page 120 section. 2 - 04/11/2018 (the date of transfer of personal income tax from wages established by the Tax Code of the Russian Federation is the next working day after payment).

- On page 130 section. 2 - amount of accrued wages.

- On page 140 section. 2 - the amount of tax withheld from this payment.