Rules and terms for vacation pay of the Tax Code of the Russian Federation

In the general case, for income in the form of wages, the date of actual receipt of income is the last day of the month for which the employee was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation).

However, for vacation pay, this date is defined as the day of payment of income (letter of the Ministry of Finance of Russia dated January 26, 2015 No. 03-04-06/2187). Let us remind you that the employer-tax agent is obliged to pay vacation pay to the employee no later than 3 working days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation).

The date of withholding personal income tax will coincide with the date of payment of income, because the tax agent is obliged to withhold tax from the income of an individual upon their actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax from vacation pay, i.e., the deadline when the tax agent must transfer the personal income tax withheld from an individual, is the last day of the month in which the employee’s vacation pay was issued.

Vacation pay is considered received on the day of their payment, and the tax on these amounts must be transferred to the budget no later than the last day of the month in which they were paid (clause 1, clause 1, article 223, clause 6, article 226 of the Tax Code of the Russian Federation).

Example of filling out 6-NDFL with vacation pay

The need to reflect vacation pay in 6-NDFL is associated with 3 dates:

- Accrual of income from vacation pay and the corresponding amount of tax - in this regard, vacation pay is no different from other income, and is included in section 1 of form 6-NDFL on a general basis (i.e., when the income is recognized for the purposes of calculating tax on it ).

- Payments of vacation pay - its inclusion in section 2 of form 6-NDFL occurs by analogy with the payment of other income. The date of such income is the day the payment is made (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11/ [ email protected] , dated May 24, 2016 No. BS-4-11/ 9248).

- The deadline for paying the tax - it contains the significant difference between vacation (sick leave) and other income, which, without changing the procedure for filling out form 6-NDFL, leads to the existence of a special moment for entering data on vacation (sick leave) into this report.

Example

Let's say there are the following initial indicators:

| Month of 2021 | Number of employees | Accrued | Deductions | Tax calculated | Paid | Payment date | ||

| Salary | Vacation pay | Salary | Vacation pay | |||||

| July | 8 | 240 000 | — | 4 000 | 30 680 | 109 320 | — | 10.07.2020 |

| 100 000 | — | 24.07.2020 | ||||||

| August | 8 | 216 342 | 27 314 | 4 000 | 31 155 | 109 320 | — | 10.08.2020 |

| 23 763 | 21.08.2020 | |||||||

| 100 000 | — | 25.08.2020 | ||||||

| September | 8 | 227 143 | 25 476 | 4 000 | 32 320 | 88 738 | — | 10.09.2020 |

| — | 22 164 | 17.09.2020 | ||||||

| 100 000 | — | 25.09.2020 | ||||||

| Total: | 683 485 | 52 790 | 12 000 | 94 155 | 607 378 | 45 927 | ||

| Total: | 736 275 | 12 000 | 94 155 | 653 305 | ||||

In section 2 of form 6-NDFL, taking into account the fact that salary payments made before the end of each month are advances and personal income tax on them must be paid within the deadlines established for the final payment (letter of the Ministry of Finance dated February 13, 2019 No. 03-04-06/ 8932, dated July 13, 2017 No. 03-04-05/44802), these data will be reflected as follows:

Don't forget to check the generated report. To learn how to do this, read the publication “How to check 6-NDFL for errors?” .

An example of how vacation pay is reflected in 6-NDFL in 2020

Show vacation pay in 6-NDFL for the period in which they were paid. Do not include accrued but unpaid vacation pay in the calculation.

In Sect. 1 specify:

- in line 020 - all vacation pay paid in the reporting period, together with personal income tax;

- in lines 040 and 070 - personal income tax on paid vacation pay.

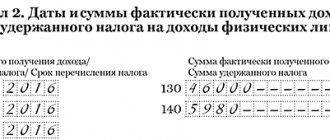

In Sect. 2 Show all vacation pay paid in the last quarter of the reporting period. Fill out separate blocks of lines 100 – 140 for all vacation pay paid on the same day, indicating:

- in lines 100 and 110 - the date of payment;

- in line 120 - the last day of the month in which vacation pay was paid. If it is a holiday, indicate the first working day of the next month;

- in line 130 - vacation pay along with personal income tax;

- in line 140 - tax withheld from vacation pay.

Do not show in section. 2 vacation pay paid in the last month of the quarter if the last day of this month is a holiday. Reflect them in section. 2 6-NDFL for the next quarter. For example, do not include vacation pay paid in December 2021 in section. 2 6-NDFL for 2021. After all, the deadline for paying tax on these vacation pay under Art. 226 of the Tax Code of the Russian Federation – 01/09/2020.

Example:

In December, two employees were on vacation. The first one started his vacation on December 3, the second one – on December 24th. Vacation pay paid:

11/29/2018 to the first employee - 47,000 rubles. Personal income tax from them is 6,110 rubles;

12/20/2018 for the second employee - 25,000 rubles. Personal income tax from them is 3,250 rubles.

Personal income tax on these vacation pay is transferred on the day they are paid.

The total amount of vacation pay paid for the 4th quarter is RUB 72,000. (47,000 rubles + 25,000 rubles), personal income tax from them is 9,360 rubles. (6,110 rub. + 3,250 rub.).

In 6-NDFL for 2021, vacation pay is reflected as follows:

Vacation pay paid on December 20, 2018, in section. 2 6-NDFL for 2021 do not need to be shown. These vacation pay will be reflected in section. 2 6-personal income tax for the 1st quarter of 2021

Source: General Ledger

How to show carryover vacation pay and their recalculation?

How to reflect vacation pay that transfers to another month or quarter in form 6-NDFL? This is done according to the general rules:

- accrual of income in the form of vacation pay and related tax, regardless of which period they relate to, in accordance with the actual date of these accruals and the payment deadline established for them will fall into the general figures of section 1 of form 6-NDFL;

- payment of vacation pay will be shown in section 2 of form 6-NDFL, highlighted by the date of its implementation and the deadline for paying the tax.

That is, the need to include vacation pay relating to different reporting periods in 6-NDFL will determine the fact of their accrual and actual payment, and not the period with which they are associated (letter of the Federal Tax Service of Russia dated May 24, 2016 No. BS-4-11/9248) .

The need to recalculate vacation pay after submitting reports with data on it may arise in 2 situations:

- An error was made when calculating vacation, and incorrect data was included in the report. In this case, you must submit an updated 6-NDFL report with the correct information in it.

- The recalculation has statutory reasons and is legally carried out later than the initial calculation of vacation pay (for example, when recalled from vacation, upon dismissal, when vacation is postponed due to untimely payment of vacation pay). In such a situation, data on it can be included in the corresponding lines of the report for the period in which the recalculation was made (letter of the Federal Tax Service dated May 24, 2016 No. BS-4-11/9248, Federal Tax Service for Moscow dated March 12, 2018 No. 20-15/049940 ).

See also “Clarification 6-NDFL: when not needed when recalculating vacation.”

Read about the deadlines set for submitting the report in this material..

How to reflect study leave in 6-NDFL, explained N. N. Taktarov, adviser to the state civil service of the Russian Federation, 3rd class:

If you don't have access to the system, get a free trial online.

Rules for reflecting vacation pay in ambiguous situations

Vacation pay was paid after the employee went on vacation

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Vacation pay must be issued no later than three days before the employee goes on vacation (Article 136 of the Labor Code). But even if the money was paid out late, the date of income does not change - this is the day the vacation pay is actually issued.

If vacation pay is paid late, then give the employee compensation - at least 1/150 of the Central Bank rate (Article 236 of the Labor Code). This payment is not subject to personal income tax, so do not include it in your calculations.

Vacation pay was issued on the last day of the month

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Income in the form of vacation pay is recognized on the date of payment, and personal income tax is transferred on the last day of the month in which the money was given to the employee (clause 6 of Article 226 of the Tax Code, letter of the Ministry of Finance dated March 28, 2018 No. 03-04-06/19804).

Paid vacation pay for vacations that transfer from one month to another

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

The employee receives income in the form of vacation pay on the day the money is paid (subclause 1, clause 1, article 223 of the Tax Code). It doesn’t matter what days the rest falls on. Fill out the payment in one block of lines 100–140 in the period when the vacation pay was issued.

Vacation followed by dismissal

Vacation pay:

- line 100 – date of payment of vacation pay;

- line 110 – the same date as on line 100;

- line 120 – the last day of the month in which vacation pay was paid*;

- line 130 – amount of income;

- line 140 – amount of tax withheld;

Salary:

- line 100 – last working day before vacation;

- line 110 – the same date as on line 100;

- line 120 – the next business day after the date on line 110;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Read also

23.03.2017

Results

Reflection of vacation pay in form 6-NDFL has its own characteristics associated with the establishment of a special deadline for paying tax on them. At the same time, the existing procedure for filling out the form does not fundamentally change.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law of December 29, 2006 No. 255-FZ

- Letter of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Extension of vacation will not affect 6-NDFL

In accordance with Art. 124 of the Labor Code of the Russian Federation, annual leave is subject to extension for the period of such circumstances as:

- illness confirmed by sick leave;

- performance of government duties, for the period of which a release from work is provided;

- other cases provided for by industry legislation or internal regulations.

In such cases, there will be no consequences for personal income tax accounting, since payment for all vacation days has already been made, and no recalculation is made. As for disability benefits, the amounts of income and personal income tax on sick pay are reflected in 6-NDFL in the period in which they were paid.

ConsultantPlus experts spoke in detail about the nuances of reflecting sick leave in 6-NDFL. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Upon agreement with the employee and in order to ensure the normal operation of the enterprise, vacation days unused due to illness or other reasons can be postponed to another date, and then the recalculation of vacation pay in 6-NDFL will be necessary.

When is additional leave replaced by compensation?

Additional leave is considered to be leave due to an employee in addition to the mandatory annual paid rest time, the duration of which is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). The obligation to provide it arises under working conditions (Article 116 of the Labor Code of the Russian Federation):

- harmful or dangerous;

- special;

- with irregular days;

- in the Far North and similar areas;

- established for certain categories of persons or areas in which labor is carried out;

- stipulated by the employer himself in addition to those provided for by law.

Due to additional vacation days, the employee’s regular annual rest period increases. If at the time of dismissal the additional leave (or the next one together with the additional one) turns out to be unused, then the employee is compensated with money for the rest time (Article 127 of the Labor Code of the Russian Federation).

For additional vacations, there is another rule that allows days exceeding the mandatory 28-day part of the annual vacation to be replaced by payment of monetary compensation for them without dismissal (Article 126 of the Labor Code of the Russian Federation).

An exception here arises in relation to holidays relying on:

- pregnant women;

- minors;

- those carrying out their work in harmful or dangerous conditions - during the mandatory 7 calendar days (Article 117 of the Labor Code of the Russian Federation).

We correct the report during a shortened vacation

When an employee leaves vacation ahead of schedule, as a rule, it is associated either with his illness during vacation, or with a recall due to production needs.

In both cases, the amounts of overpaid amounts and withheld personal income tax can be counted against other income for the reporting period. In the calculation of 6-NDFL, the method of adjustment will depend on the period in which the vacation interruption occurred.

If the employee’s vacation began and was interrupted in the same reporting period, then the amount of overpaid income in Section 2 of the report is counted as wages, and the amount of vacation pay is reflected taking into account the adjustment. But in the case when the recalculation affected the previous quarter, it is necessary to act similarly to the situation with the adjustment when reducing the amount of accrued income.

Answers to the most frequently asked questions about filling out Form 6-NDFL

77 city of Moscow Publication date: 05/06/2016

Edition: Accounting. Taxes. Law Topic: 6-NDFL Source: https://e.gazeta-unp.ru/article.aspx?aid=458632

In the editorial office of the newspaper “Accounting. Taxes. Right." A webinar was held on the topic: “Filling out and submitting quarterly reports.” During the webinar, the lecturer was asked more than 200 questions. Olga Petrovna Stolova, Deputy Head of the Individual Taxation Department of the Federal Tax Service of Russia for Moscow, answered the most interesting of them.

How to fill out the calculation if the company issued salaries on January 29?

— The collective agreement states that we pay wages for the first half of the month on the 15th day, and for the second half on the last day of the month. January 31st is Sunday. Therefore, we paid out salaries for January on the 29th - 516 thousand rubles. Personal income tax was withheld in the amount of 67,080 thousand rubles. How to fill out section 2?

- On line 100 write January 31, on line 110 - January 29, and on line 120 - February 1. In line 100 of the 6-NDFL calculation, the company reflects the dates of receipt of income from Article 223 of the Tax Code of the Russian Federation. For salaries, this is always the last day of the month. In January, the last day is the 31st. On line 110, write down the day when the company withheld personal income tax from the actual payment. That is, January 29.

In line 120, write down the period when the company has the right to transfer personal income tax. According to the code, this is the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation). This deadline falls on January 30th. But since this is Saturday, write down the next working day - February 1st.

Comment "UNP"

The company has no right to withhold personal income tax before the employee has received income. And income in the form of salary is considered received on the last day of the month. That is January 31st. Therefore, some programs generate an error if the personal income tax withholding date in line 110 is earlier than the date in line 100. If the company issued wages before the 31st, then it actually has the right to withhold personal income tax from the next income in cash. For example, from an advance in February. Then in line 110 the company will record the date of issuance of the advance, and in line 120 the next business day.

How to show benefits and salary to a fired employee?

— On March 3, the employee resigned. On this day, they gave him a salary along with compensation for vacation - 60 thousand rubles, and also paid sick leave - 9 thousand rubles. Personal income tax on all amounts was transferred on March 3. How to reflect these payments in section 2 of the 6-NDFL calculation?

— Show your salary upon dismissal and sick leave benefits in different blocks of lines 100–140 of section 2 of the 6-NDFL calculation. The company shows different payments in one block of lines 100–140 of Section 2 if all three dates of income coincide: receipt of income, withholding personal income tax and the deadline when the company has the right to transfer tax to the budget. If an employee resigns, then the date of receipt of income in the form of wages is considered to be the last day of work (paragraph 2, paragraph 2, article 223 of the Tax Code of the Russian Federation).

And the date of receipt of income in the form of compensation for vacation and sick leave is the day of their payment. You gave the employee a paycheck, vacation compensation and benefits on the last day of work. On the day of payment, the company also withholds personal income tax. This means that the dates in lines 100 and 110 will be the same - March 3. At the same time, the deadline for transferring personal income tax in line 120 will be different. For wages and compensation, the deadline for paying personal income tax is the day following the payment - March 4. And for benefits - the last day of the month in which the company issued the money (clause 6 of Article 226 of the Tax Code of the Russian Federation). That is, March 31st.

Is it possible to show aid and vacation pay on the same line?

— From March 21 to March 31, the employee was on vacation. On March 15, they gave out vacation pay - 15 thousand rubles and 5,000 rubles - financial assistance for the vacation. Are we allowed to show the payouts in one block of lines 100–140?

— No, show the payments in different blocks. The date of receipt of income and withholding of personal income tax on vacation pay and financial assistance is the date of payment. That is, March 15th. Reflect this date in lines 100 and 110 of section 2. Personal income tax on vacation pay can be transferred until the end of the month in which the company issued the money (clause 6 of article 226 of the Tax Code of the Russian Federation). That is, the tax payment deadline is March 31. Financial assistance for vacation is not vacation pay. For such payments, personal income tax must be transferred no later than the day following the issuance of money. That is, March 16th. This means that the dates on line 120 will be different.

How to reflect carryover payments in 6-NDFL?

— On January 12, salaries for December were paid. And the March salary was issued on April 5. How to reflect carryover payments in 6-NDFL?

— Reflect the salary for December in section 2, for March - in section 1. The company issued the salary for December in January. The operation was completed in the first quarter, so it must be reflected in the calculation (letter of the Federal Tax Service of Russia dated 02.25.16 No. BS-4-11 / [email protected] ). But only in section 2. In line 100 put 12/31/2015, in line 110 - 01/12/2016, and in line 120 - 01/13/2016. On the contrary, reflect the salary for March only in section 1 (letter of the Federal Tax Service of Russia dated March 23, 2016 No. BS-4-11 / [email protected] ). In line 020 show the accrued salary, in line 040 - the calculated tax. In line 070, show the withheld personal income tax from your salary for March if you submit the payment after April 5. In section 2, the company will reflect this operation in the half-year calculation.

Should the bonus be reflected separately from the salary?

— Employees' wages consist of salary and bonus. We calculate these amounts at the end of the month and issue them on the same day. For example, for January - February 4. Employee salaries for January are 760 thousand rubles, bonuses are 420 thousand rubles. How to show these payments in section 2?

— There are 100–140 lines in different blocks. The date of receipt of salary income is the last day of the month for which it is accrued. In terms of salary for January, this is the 31st. A bonus is an incentive payment. Its specific amount is not provided for in the employment contract. Therefore, the date of receipt of bonus income is the day on which the company actually issued the money. In your case - February 4th. Personal income tax must be withheld from both payments on the day the money is issued - February 4, and paid no later than February 5. Reflect these dates on lines 110 and 120. But since the dates on line 100 are different, record salary and bonuses in different blocks on lines 100–14.

Comment "UNP"

If the bonus is part of the salary, it can be reflected in section 2 along with the salary. The date of receipt of income for such payments is also the last day of the month, even if the company issued the bonus earlier. Judges also think so (resolution of the Arbitration Court of the North-Western District dated December 23, 2014 No. A56-74147/2013).

Should the calculation show vacation pay that the employee returned?

— On February 3, the employee was paid vacation pay for 28 days - 20 thousand rubles. We paid personal income tax - 2600 rubles. The employee only took two weeks off work, and then we recalled him from vacation. Vacation pay during this time is 10 thousand rubles. The employee returned the second part of the vacation pay, but minus personal income tax - 8,700 rubles. How to complete sections 1 and 2?

— In sections 1 and 2, show only vacation pay for the rest days used. In 6-NDFL, the company shows the income that the employee received. The employee used half of his vacation. The rest of the days he worked, and the company accrued wages for this period. In line 020 of section 1, fill in only vacation pay for the rest days used. That is 10 thousand rubles. In lines 040 and 070, write down the accrued and withheld tax on this part - 1,300 rubles. Similarly, fill in income and tax in lines 130 and 140 of section 2. When paying vacation pay, the company paid personal income tax - 2,600 rubles. 1300 rubles is an excessively transferred tax. The company has the right to apply to the inspectorate for a refund of this amount.

Should three average earnings be reflected in 6-NDFL upon dismissal?

— On February 15, the employee was fired by agreement of the parties. They paid him 70 thousand rubles - this is 17 thousand rubles more than three times the average monthly salary of an employee. How to show such a payment in the calculation of 6-NDFL?

— Reflect 17 thousand rubles in sections 1 and 2. Payments upon dismissal within three average monthly earnings are exempt from personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation). Therefore, if the company issued compensation within these amounts, it has the right not to reflect them in 6-NDFL. If the company issued more, reflect the difference of 17 thousand rubles in line 020 of section 1 and line 130 of section 2. In lines 070 and 140, write down the personal income tax on the excess - 2,210 rubles (17,000 rubles - 13 percent). The date of receipt of such income and the day of personal income tax withholding is the day of payment. On lines 100 and 110, write February 15th, and on line 120, write the next day, February 16th.

How to fill out section 2 if the company delays wages?

— Due to financial difficulties, salaries and vacation pay are constantly being issued with a delay. For example, salaries for January were issued only on March 15. And the salary for February was transferred only in April. How to fill out 6-NDFL?

— In section 1, reflect all accrued wages for January - March 2016. And in section 2, show only the amounts paid in the first quarter. The date of receipt of salary income is the last day of the month for which the company accrued it. Write this date in line 100 of section 2. By the way, January 31st falls on a day off. But write down this date on line 100 anyway. The terms in lines 100 and 110 are not carried over. In line 110, reflect the date when the company withheld personal income tax. The company withholds tax from the salary actually paid, even if it was transferred with a delay. Therefore, write down March 15 on line 110. And in line 120 the next day is March 16. As for the salary for February, it does not need to be shown in section 2 of the calculation for the first quarter. Since the company issued salaries for February in April, you will fill out lines 100–140 for these amounts in the calculation for the six months. If the company paid wages for the last year late, then also show it in section 2. In line 100, write down the last day of the month for which the wages were calculated. In line 110 - the actual day of payment, in line 120 - the next working day.

Basic payments upon dismissal provided for by labor legislation

Upon termination of the employment relationship, the employee is entitled to the following payments:

- Unpaid wages for hours worked prior to the date of dismissal.

- Compensation for all vacation days that the employee did not have time to take off (Article 127 of the Labor Code of the Russian Federation).

- Severance pay and other compensation (Articles 178–181.1 of the Labor Code of the Russian Federation) are paid in certain cases.

All due payments must be made on the day specified in the dismissal order as the employee’s last working day (Article 140 of the Labor Code of the Russian Federation). If on that day the employee was on vacation, on sick leave or absent for other reasons, then the payment is made the next day after receiving a request from him for the payment of the required amounts.

Read about the nuances of taxation of payments upon dismissal in the section “Personal Income Tax upon Dismissal” .

Examples of filling out Section 2 of the 6-NDFL calculation for vacation compensation

Example 1

Satisfying the employee’s request, the employer awarded him compensation for 3 days of additional leave due to his position for irregular working hours. The payment amount was 5,100 rubles. It was issued on August 15, 2019, on the same day as the salary for July 2021, amounting to 50,000 rubles.

Payments will have to be shown separately. One set of lines 100-140 will display the salary:

- pp. 100 - 07/31/2019;

- pp. 110 - 08/15/2019;

- pp. 120 - 08/16/2019;

- pp. 130 – 50,000;

- pp. 140 – 6,500.

Another set of lines 100-140 will be devoted to compensation;

- pp. 100 - 08/15/2019;

- pp. 110 - 08/15/2019;

- pp. 120 - 08/16/2019;

- pp. 130 - 5 100;

- pp. 140 - 663.

Example 2

On September 23, 2019, the employee is paid the settlement amount upon dismissal, amounting to RUB 74,200. Its amount includes wages for days worked in September (RUB 45,700) and compensation for rest days unused at the time of dismissal, including those attributable to additional leave (RUB 28,500).

Since for payments upon dismissal all the dates characterizing the set of lines 100-140 coincide, there is no need to separate salary and compensation: in the 6-NDFL report there will be only one set of lines 100-140:

- pp. 100 - 09/23/2019;

- pp. 110 - 09/23/2019;

- pp. 120 - 09/24/2019;

- pp. 130 - 74,200;

- pp. 140 - 9,646.

6ndfl_1-3.jpg

How to reflect “carryover” vacation pay in 6-NDFL

Situations with so-called “rolling over” vacation pay arise when vacation begins in one month and ends in another, or when vacation pay is paid at the end of one month, and the vacation itself begins in the next.

Such “rolling” vacation in 6-NDFL does not have any reflection features, since the dates of payment of vacation pay, withholding and transfer of tax are taken into account here, based on which, according to the general rules, the calculation is filled out.

For example, an employee received vacation pay on March 28, and went on vacation on April 2. Payment of vacation pay, withholding and transfer of personal income tax will be reflected in 6-personal income tax of the 1st quarter, because The tax is withheld immediately - March 28, and the deadline for its transfer is March 31.

Recalculation of vacation pay: 6-NDFL

Often in practice, situations arise when vacation pay paid in the previous period has to be recalculated for various reasons, both upward and downward. How to reflect vacation pay in 6-NDFL in this case:

- If the recalculation led to a decrease in the amount of vacation pay, you need to make corrections to the previously submitted 6-NDFL regarding accrued and received income and the tax on it (lines 020, 040, 130). In the report of the period in which the recalculation was made, this will be reflected in the amount of withheld tax on lines 070 and 140, and if the excessively withheld personal income tax was not offset against future payments, but was returned to the individual, it is reflected on line 090.

- If during recalculation the amount of vacation pay has increased, you will not have to submit an “adjustment” for the previous period. It is enough to reflect the amounts of additional accruals of vacation pay and tax on lines 020, 040, 070, 130, 140 of the 6-NDFL calculation of the period in which the recalculation was made. The additional payment made to the employee will be the income of the month in which it is paid.