Visual tips for Form 6-NDFL

Fill out Form 6-NDFL for the 1st quarter of 2021 on the form, approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can download it here.

But before you start filling out 6-NDFL for the 1st quarter of 2020, refresh your knowledge about this calculation using our visual tips.

So, the structure of calculating 6-NDFL:

The following hint diagram will remind you of the minimum necessary information related to 6-NDFL:

Another visual hint will tell you about the technical requirements for filling out calculation cells:

Next, we will tell you how 6-NDFL has changed for the 1st quarter of 2020.

How to fill out 6-NDFL correctly

It’s easier to fill out and submit declarations and other reporting forms through a special service.

Well, now let’s proceed to the instructions for correctly filling out 6-NDFL. Below we will look at a few examples.

Important! In the article, form 6-NDFL is filled out using the example of the 1st quarter of 2021.

Filling out the title card

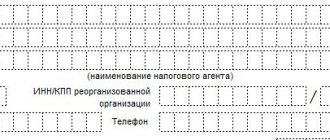

- We indicate the TIN and checkpoint of the legal entity (for individual entrepreneurs only the TIN);

- We enter the adjustment number (for the primary report we put “000”, if we are already submitting an adjustment report, then “001”, etc.);

- We put the code for the period for which the report was compiled (available in the Appendices to the order approving the form) and the year: if we submit a report for the 1st quarter, then the period code will be “21”, and the year “2019”;

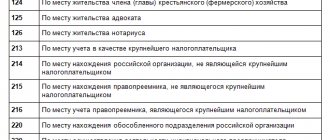

- Next, we put the code of the tax authority (where we submit the report) and the code of the place of submission (a table with them is also in the Appendices to the Order): when the report is submitted at the place of registration of the legal entity, we put “212”, if at the place of residence of the individual entrepreneur – “120”;

- We indicate the name of the legal entity or full name of the individual entrepreneur;

- We put the code OKTMO;

- We indicate the contact phone number, indicate the number of pages of the report and the number of sheets of attachments to it, if any;

- In those lines that are not filled in due to lack of data, dashes must be inserted.

The lower parts of the title page are filled out as standard: the left part is for the person submitting the report to the tax authority, the right part is for the tax employee.

Sample of a completed title page of the 6-NDFL report

Important! If you have more than one OKTMO code, you will need to fill out several 6-NDFL reports: a separate report for each code.

When can this happen?

- When wages to employees are paid by the parent organization and a separate division located in another territory, in this case, two separate reports are filled out, each submitted to its own tax office according to the OKTMO code entered;

- When a part of an individual entrepreneur’s activity is transferred to UTII or a patent, accordingly, he is registered as a payer of these taxes in another tax office - here the individual entrepreneur must enter OKTMO in accordance with the place of business transferred to these special modes.

That's basically it, the title page is complete. As you can see, there is nothing complicated in filling it out. Now let's move on to the sections. And here we will immediately divide all the following actions into two examples: when you pay employees wages before the end of the month and when you pay them the next month.

What does this mean?

Let me explain right away with an example. Salaries must be paid to the employee at least 2 times a month: usually the advance is paid first, and then the rest of the salary.

How does this happen in reality?

An advance for the current month is often paid on the 15th-25th of that month, that is, for example, an employee receives an advance for October on October 16th. And an employee can receive a salary for October either in October, for example, on October 31 - the last day of the month, or maybe already in November - this is usually what happens, employers pay salaries for the past period until the 5-10th of the next month. Dates may vary; they are set by the employer in the Remuneration Regulations. Accordingly, we have two situations:

- When employees' salaries for the current month are paid in the same month;

- When employees' salaries for the current month are paid in the next month.

It is important to distinguish between these situations precisely at the junction of periods. For example, now you will need to submit a report on the results of the 1st quarter. Accordingly, for each of the situations indicated above, its indicators will be different.

Fill out sections 1 and 2: If we pay salaries in the same month

Let's show an approximate calculation using an example: since the beginning of 2018, 5 people have been working, the number of employees has not changed. Let’s say that each employee has a salary of 26,250 rubles, respectively, the amount of accrued income, and in our case, when filling out the Declaration for the 1st quarter of 2021, we will display in the report the accrued income for the period December 2021 - February 2021, amounted to 26,250 *5 = RUB 131,250 (this is December 2021) and 26,250 *5 * 2 months. = 262,500 (January-February 2021), will be equal to 393,750 rubles. No dividend income was accrued.

In January-February 2021, employees were provided with tax deductions for children in the total amount of 28 thousand rubles. For December 2018, standard deductions were not provided, since the total income of each employee exceeded 350 thousand rubles. It turns out that the calculated personal income tax for December 2021 amounted to 131,250 * 13% = 17,063 rubles, and for January-February 2021 - (262,500–28,000) * 13% = 30,486 rubles.

How should this be included in the report? Open Section 1 and fill in line by line:

- Page 010 – 13% (if there is accrued income subject to personal income tax at other rates, then the report will need to fill out several Sections 1 - each rate is entered on a separate sheet with continuous numbering);

- Page 020 – set 393,750 rubles, i.e. the entire amount of employee income for December-February 2021;

- Page 030 – we bet 28,000 rubles, i.e. the amount of deductions provided to employees;

- Page 040 – set 47,549 rubles, i.e. the entire amount of personal income tax calculated based on the results of 9 months;

- If, when filling out lines 025; 045; 050; 080; 090 there is no data, since dividends were not accrued, as in our case, then they are not filled with dashes, but 0 (see clause 1.8 of the Procedure for filling out the form, approved by Order of the Federal Tax Service of Russia No. ММВ-7-11-450 dated 14.05 .2015)

Now let’s move on to the final part of Section 1. Here you need to enter:

- Page 060 – 5 people, since the company has 5 employees;

- Page 070 – 47,549 rubles, i.e. the amount of tax withheld.

Lines 060 – 090 include the total amounts for all subsequent sections. Therefore, if you have several sheets when filling out, then this data is entered only on the first of them. On the remaining sheets, lines 060-090 are marked with dashes.

Important! If you pay wages for the current month during the same month, then ideally you will have the equality: line 040 = line 070. That is, how much personal income tax you calculated on employee income, so much you withheld. If part of the personal income tax amount is not withheld for any reason, it is shown in line 080. In this case, the equality will be as follows: line 040 = line 070 + line 080.

In Section 2 you now need to reflect the amounts by date. Please note that the following dates should be taken into account when paying salaries:

- The date of receipt of income (for the purposes of calculating personal income tax) is considered to be the last day of the month for which this salary is accrued, for example, January 31.

- The date of personal income tax withholding is considered to be the date of actual payment of money, which in our example is February 5.

- The date of payment of personal income tax to the budget is considered to be the day following the day of payment of money. In our example it will be February 6th.

Now we fill out each block of Section 2. In subsequent tax periods, the data is entered on an accrual basis.

- Page 100 – 12.2018;

- Page 130 – 131,250 rubles (employees’ salary per month);

- Page 110 – 01.2019; (payment date has been shifted due to New Year holidays)

- Page 140 – 17,063 rubles (the amount of personal income tax withheld for the month);

- Page 120 – 01.2019.

As a result, after you fill out Section 2, the sum of lines 130 for all months should be equal to line 020, and the sum of lines 140 for all months should be equal to line 070.

Sample of filling out the second page of 6-NDFL with sections 1 and 2

6-NDFL for the 1st quarter of 2021 using an example

An example of filling out 6-NDFL for the 1st quarter of 2021 will help us understand the nuances of the updated form.

Investstroyproekt LLC has 12 employees. In the 1st quarter of 2020, they received an advance (in the middle of the current month) and a final salary payment (no later than the 10th day of the month following the reporting month). According to the vacation schedule, no one planned a vacation during the winter months.

To collect data and fill out 6-NDFL for the 1st quarter of 2021, Investstroyproekt uses a special accounting register.

Find detailed recommendations on how to compile and maintain such a register in this article.

So, let's fill out 6-NDFL. At the same time, we will take into account that section 2 does not include the salary for December of last year (in our example, calculations for it were fully completed before the beginning of 2021) and the payment of the March salary of 2021 (it will be paid in April, and the amount will be reflected in the semi-annual calculation).

The following articles will tell you about the nuances of various calculations with practical examples:

- “How to calculate vacation pay for a year - an example”;

- “How to correctly calculate the trading fee - an example”;

- “How to calculate sick leave after maternity leave?”.

Filling instructions with examples

The procedure for reflecting compensation upon dismissal

The compensation that is issued upon dismissal must be reflected in the report separately from the rest of the salary for the month.

Section 2 is completed as follows:

- Position 100 - date of occurrence of income, ending the day at the employee’s workplace;

- Position 110 - payment date, coincides with the previous date;

- Position 120 - tax payment date, usually the next day after the date of issue;

- Position 130 - payment amount;

- Position 140 is the tax amount.

How to reflect bonuses

When setting the bonus payment as a basis, it is necessary to take the order on which it was assigned. The last day of the month in which it was compiled and issued and will be the day the income was received.

In section 2, information is entered in the following order:

- Position 100 - date of occurrence of income, the ending day of the month when the order was issued;

- Position 110 is the actual date of issue of the bonus;

- Position 120 - tax payment date, usually the day after the day of issue;

- Position 130 is the amount of the bonus issued;

- Position 140 is the tax amount.

The procedure for recording sick leave

Only hospital payments that are taxable should be reported on the report. If this is not observed, the control indicators in section 1 will not match. For example, maternity benefits do not need to be included in the report!

Section 2 is compiled as follows:

- Position 100 and 110 - date of actual issuance of sick leave;

- Position 120 - tax payment date - the final day of the month when sick leave was paid. If this day falls on a weekend or holiday, you need to set the nearest working day.

- Position 130 - the amount of sick leave with tax;

- Position 140 is the tax amount.

How to reflect vacation pay in 6-NDFL

Vacation pay is shown in the report in the same months in which it was paid to the employee. If vacation pay was calculated, but its payment did not take place, then there is no need to show this amount in the report.

The report in section 1 is completed as follows:

- Position 020 - the sum of all vacation pay that was issued in a given month;

- Position 040 and 070 - tax amount.

In section 2 you need to fill in the lines like this:

- Position 100 and 110 - date of actual issuance of vacation pay;

- Position 120 - tax payment date - the final day of the month when vacation pay was paid. If this day falls on a weekend or holiday, you need to set the nearest working day.

- Position 130 - amount of vacation pay;

- Position 140 is the tax amount.

If several vacation pay are listed on the same day, they can be combined in one entry.

Attention: if vacation pay is issued in the final month of the quarter (March, June, etc.), and the tax payment day falls on a non-working day and moves to the next quarter, then such payments are included in the report of the next quarter.

How to take into account the salary issued next month

By law, the company must pay wages at least twice a month - first the advance and then the rest. The advance must be paid in the same month, for which the salary will then be calculated.

Since the advance is not recognized as employee income (but only if it is not paid on the last day of the month), there is no need to reflect this payment in the report. The final payment to the employee is made in the first half of the following month.

The report reflects this as follows:

- Position 100 is the date of income occurrence, the ending day of the month for which the salary was accrued;

- Position 110 - actual salary payment date;

- Position 120 - tax payment date, usually the next day after the date of issue;

- Position 130 - the amount of payment for this month along with the advance;

- Position 140 is the tax amount.

How to take into account salaries issued in the same month

Current legislation establishes that a business entity does not have the right to delay payment of wages to its employees. At the same time, it says nothing about the situation in which the employer will pay wages before the actual end of the month in which they were accrued.

This step is especially relevant at the end of each year, when companies try to pay their employees December salaries, rather than postponing them to January.

The payment must be indicated in the report as follows:

- Position 100 - date of occurrence of income, the ending day of the current month;

- Position 110 - date of actual payment;

- Position 120 - the date of transfer of the tax, usually the next day after the date of issue;

- Position 130 - payment amount;

- Position 140 is the tax amount.

Upon dismissal

If the report indicates payments to a dismissed employee, the following feature must be taken into account. Such payment, as a rule, consists of salary for the current month and compensation for unused vacation. All these payments are issued to him on the final day of work.

In this case, the date of receipt of income will not coincide with the rest of the working employees. For the latter, it will be the last day of the month, and for the fired person, it will be his last working day. Therefore, it will not be possible to show such payments together with others in one block.

Thus, the lines are filled in as follows:

- Position 100 - date of occurrence of income, the last day of work of the employee;

- Position 110 - payment date, coincides with the previous date;

- Position 120 - date of transfer of the tax, usually the next day after the date of issue;

- Position 130 - payment amount;

- Position 140 is the tax amount.

How to record dividends

Dividends must be reflected in the 6-NDFL report. It is necessary to remember that if the owners of the company include both Russian and foreign persons, then they need to calculate personal income tax at different rates - 13% and 15%, respectively. For each bet, a separate block is drawn up in section 1.

In normal situations, filling is done in the following order:

- The tax calculation rate is entered in position 010;

- Position 025 reflects the total amount of dividends before tax withholding;

- Position 020 records the amount of all income received, including dividends;

- Position 030 records the amount of deductions provided;

- Position 040 indicates the amount of calculated tax on all income;

- Position 045 highlights the tax withheld from dividends.

- Position 060 shows the total number of persons who received payments;

- The total amount of tax withheld is entered in position 070;

- In position 080 the tax that could not be withheld is recorded.

Section 2 is formatted according to the following scheme:

- Position 100 - dividend payment date;

- Position 110 - tax withholding date, usually coincides with the payment date;

- Position 120 shows the date the tax was transferred to the budget. This must be done no later than the next day after payment;

- Position 130 - the amount of dividends received;

- Position 140 is the amount of tax withheld.

Attention: if the company itself received dividends, the tax amount can be reduced. To do this, a deduction is entered in line 030, for which the company has the right to reduce income (deduction code 601).

No payments: what to do with 6-NDFL

To answer this question, let's change the conditions of the example:

Due to the seasonal nature of the activities of Investstroyproekt LLC, no income was paid to individuals in the 1st quarter of 2021. They decided not to issue a zero calculation in form 6-NDFL.

This article will tell you about zero 6-personal income tax.

The director of Investstroyproekt LLC (in order to avoid sanctions from the tax authorities for failure to submit 6-NDFL) sent a letter to the controllers:

“Explanations on Form 6-NDFL

for the 1st quarter of 2021

Investstroyproekt LLC reports that during the 1st quarter of 2020 it did not conduct business activities and did not pay wages.

In such a situation, Investstroyproekt LLC is not recognized as a tax agent for personal income tax and is not obliged to submit 6-personal income tax calculations (Articles 226 and 230 of the Tax Code of the Russian Federation).”

The director signed the notice, putting it on the company's letterhead (containing all the necessary details) and indicating on it the name and number of the inspection (to which the payment should be received).

Where is it provided?

Form 6-NDFL must be submitted to the following Federal Tax Service by business entities:

- Enterprises and institutions - they send 6NDFL to the Federal Tax Service at the place of their registration.

- Representative offices, branches and separate divisions - they must report to the Federal Tax Service with which they are registered as these structural units, that is, at their location. However, if they are large taxpayers, the Tax Code of the Russian Federation allows them to choose the Federal Tax Service to which they must submit reports. They may be considered the Federal Tax Service authority at their location or main company.

- Entrepreneurs must report at the place of registration, that is, at their registration.

- Individuals acting as a source of income for other people, as well as doctors, notaries and lawyers, submit form 6-NDFL to the territorial body of the Federal Tax Service at the place of registration indicated in the passport.

The latest clarifications from the Federal Tax Service establish that when closing a separate division, the report must be submitted at its location, and the reporting period is the time from the beginning of the reporting period until the moment of closure.

If the reporting has not been submitted, then it should be sent to the Federal Tax Service at the location of the main company, indicating its TIN, and OKTMO and KPP should be indicated for the liquidated division.

Important: when changing the tax office due to a change in the location of the company during the reporting period, the business entity needs to submit form 6 personal income tax twice at once. The first with information before the move is submitted according to the old OKTMO to the new inspection, the second - with the new OKTMO with data after the move also to the new Federal Tax Service.

Results

To fill out 6-NDFL for the 1st quarter of 2021, use the form approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] Carefully fill out the new cells of the title page if you are the legal successor of a reorganized company, and it has not submitted this calculation before the end of the reorganization. In addition, do not confuse the code for the place where the calculation is submitted - now the list of codes has expanded, and the code “212” has been replaced by “214”.

The structure of the calculation and the procedure for filling it out have not changed fundamentally. The above example of filling out 6-NDFL for the 1st quarter of 2021 will help you understand how to fill it out.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.