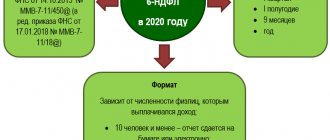

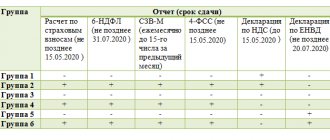

Deadlines and procedure for submitting calculations

The calculations are submitted by tax agents (clause 2 of Article 230 of the Tax Code of the Russian Federation).

A zero calculation is not submitted if income subject to personal income tax was not accrued or paid (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/ [email protected] ).

If a “null” is nevertheless submitted, then the Federal Tax Service will accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).

Calculations for the first quarter, six months and 9 months are submitted no later than the last day of the month following the specified period - clause 7 of Art. 6.1, clause 2 of Art. 230 Tax Code of the Russian Federation. This year, it remains to submit a report for 9 months - no later than October 31.

The annual calculation is submitted in the same way as 2-NDFL certificates - no later than April 1 of the following reporting year.

Calculation of 6-NDFL is submitted only in electronic form according to the TKS, if in the tax (reporting) period income was paid to 25 or more individuals, if 24 or less, then employers themselves decide how to submit the form: virtually or on paper (clause 2 of Art. 230 of the Tax Code of the Russian Federation).

As a general rule, the calculation must be submitted to the Federal Tax Service at the place of registration of the organization (registration of individual entrepreneurs at the place of residence).

If the employer discovers that last year he made a mistake and did not withhold personal income tax from payments to an employee who is still working in the organization, the tax must be withheld when paying income in the current year. There is no requirement to report your inability to do this last year. In addition, it will be necessary to clarify 6-NDFL and adjust 2-NDFL.

Letter of the Federal Tax Service of the Russian Federation dated April 24, 2019 No. BS-3-11/ [email protected]

If there are separate subdivisions (SP), the calculation in form 6-NDFL is submitted by the organization in relation to the employees of these subdivisions to the Federal Tax Service Inspectorate at the place of registration of such subdivisions, as well as in relation to individuals who received income under civil contracts to the Federal Tax Service Inspectorate at the place of registration of the subdivisions that entered into such contracts (clause 2 of article 230 of the Tax Code of the Russian Federation).

The calculation is filled out separately for each OP, regardless of the fact that they are registered with the same inspection, but in the territories of different municipalities and they have different OKTMO (letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

Form 6-NDFL, completed for each OP, must be submitted to the place of registration of each unit. Moreover, if the organization is registered with the Federal Tax Service at the location of each OP, then taxes on income from employees of the “separate unit” must be transferred to the budget at the place of registration of each of them.

Letter of the Federal Tax Service of the Russian Federation dated April 25, 2019 No. BS-4-11/ [email protected]

If the OPs are located in the same municipality, but in territories under the jurisdiction of different Federal Tax Service Inspectors, the organization has the right to register with one inspectorate and submit calculations there (clause 4 of Article 83 of the Tax Code of the Russian Federation).

The employee worked in different branches . If during the tax period an employee worked in different branches of the organization and his workplace was located at different OKTMO, the tax agent must submit several 2-NDFL certificates for such an employee (according to the number of combinations of TIN - KPP - OKTMO code).

Regarding the certificate, the tax agent has the right to submit multiple files: up to 3 thousand certificates in one file.

Separate calculations are also submitted in form 6-NDFL, differing in at least one of the details (TIN, KPP, OKTMO code).

If the company has changed its address , then after registering with the Federal Tax Service at the new location, the company must submit to the new inspection 2-NDFL and 6-NDFL:

- for the period of registration with the Federal Tax Service at the previous location, indicating the old OKTMO;

- for the period after registration with the Federal Tax Service at the new location, indicating the new OKTMO.

At the same time, in the 2-NDFL certificates and in the 6-NDFL calculation, the checkpoint of the organization (separate division) assigned by the tax authority at the new location is indicated (letter of the Federal Tax Service of the Russian Federation dated December 27, 2016 No. BS-4-11 / [email protected] ).

Updated calculation

Organizations and individual entrepreneurs must submit an updated calculation in form 6-NDFL if errors are found in the primary report or false information is provided.

The indication of the updated calculation is written on the title page in the “adjustment number” field (001, 002, 003, etc.). The clarification can be submitted without applications with a certificate. But if changes need to be made to the information from the certificates, you will have to submit the entire calculation.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Calculation form 6-NDFL

Form 6-NDFL is submitted as amended by Order of the Federal Tax Service of the Russian Federation dated January 17, 2018 No. ММВ-7-11/ [email protected]

It must show all the income of individuals from whom personal income tax is calculated. Form 6-NDFL will not include income on which the tax agent does not pay tax (for example, child benefits, payment amounts under a property purchase and sale agreement concluded with an individual).

Section 1 of the calculation is filled out with a cumulative total, it reflects:

- on page 010 – the applied personal income tax rate;

- on page 020 – income of individuals since the beginning of the year;

- on page 030 - deductions for income shown in the previous line;

- on page 040 - calculated from personal income tax;

- on pages 025 and 045 – income in the form of dividends paid and the tax calculated on them (respectively);

- on page 050 - the amount of the advance payment paid by the migrant with a patent;

- on page 060 - the number of those people whose income was included in the calculation;

- on page 070 - the amount of tax withheld from the beginning of the year;

- on page 080 - personal income tax, which the tax agent cannot withhold;

- on page 090 – the amount of tax returned to the individual.

When using different personal income tax rates, you will have to fill out several blocks of lines 010–050 (a separate block for each rate). Lines 060–090 show the summed figures for all bets.

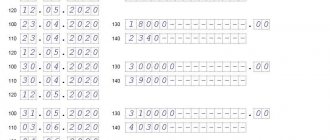

Section 2 includes data on those transactions that were carried out over the last 3 months of the reporting period. Thus, section 2 of the calculation for 2021 will include payments for the fourth quarter.

For each payment, the date of receipt of income is determined - on page 100, the date of tax withholding - on page 110, the deadline for paying personal income tax - on page 120.

Article 223 of the Tax Code of the Russian Federation determines the dates of occurrence of various types of income, and Art. 226–226.1 of the Tax Code of the Russian Federation indicate the timing of tax transfer to the budget. We present them in the table:

| Main types of income | Date of receipt of income | Deadline for transferring personal income tax |

| Salary (advance), bonuses | The last day of the month for which the salary or bonus for the month was calculated, included in the remuneration system (clause 2 of Article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14507, dated 08/01/2016 No. BS- 4-11/[email protected], letter from the Ministry of Finance dated 04/04/2017 No. 03-04-07/19708). If an annual, quarterly or one-time premium is paid, the date of receipt of income will be the day the premium is paid (letter of the Ministry of Finance of the Russian Federation No. dated September 29, 2017 No. 03-04-07/63400) | No later than the day following the day of payment of the bonus or salary upon final payment. If the advance is paid on the last day of the month, then in essence it is payment for the month and when it is paid, personal income tax must be calculated and withheld (clause 2 of Article 223 of the Tax Code of the Russian Federation). In this case, the advance amount in the calculation is shown as an independent payment according to the same rules as salary |

| Vacation pay, sick pay | Payment day (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated January 25, 2017 No. BS-4-11/ [email protected] , dated August 1, 2016 No. BS-4-11/ [email protected] ) . | No later than the last day of the month in which vacation pay or temporary disability benefits were paid |

| Payments upon dismissal (salary, compensation for unused vacation) | Last day of work (clause 1, clause 1, clause 2, article 223 of the Tax Code of the Russian Federation, article 140 of the Labor Code of the Russian Federation) | No later than the day following the day of payment |

| Help | Payment day (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated May 16, 2016 No. BS-4-11/ [email protected] , dated August 9, 2016 No. GD-4-11/14507) | |

| Dividends | No later than the day following the day of payment (if the payment is made by LLC). No later than one month from the earliest of the following dates: the end of the relevant tax period, the date of payment of funds, the date of expiration of the agreement (if it is a JSC) | |

| Gifts in kind | Day of payment (transfer) of the gift (clauses 1, 2, clause 1 of Article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated November 16, 2016 No. BS-4-11/ [ email protected] , dated March 28, 2016 No. BS-4-11 / [email protected] ) | No later than the day following the day the gift was issued |

The date of tax withholding almost always coincides with the date of payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation), but there are exceptions. So, the date of personal income tax withholding:

- from the advance payment (salary for the first half of the month) there will be a payday for the second half (letter of the Federal Tax Service of the Russian Federation dated 04/29/2016 No. BS-4-11/7893, Ministry of Finance of the Russian Federation dated 02/01/2017 No. 03-04-06/5209);

- for excess daily allowances - the nearest salary payment day for the month in which the advance report was approved (letter of the Ministry of Finance of the Russian Federation dated 06/05/2017 No. 03-04-06/35510);

- for material benefits, gifts worth more than 4 thousand rubles (other income in kind) - the nearest salary payment day (clause 4 of article 226 of the Tax Code of the Russian Federation).