Bank, cash desk

Natalya Vasilyeva

Certified Tax Advisor

Current as of January 24, 2020

Individual entrepreneurs and organizations that have employees registered under an employment contract must pay insurance premiums for them, including mandatory social insurance VNiM. Let's consider how long it takes to transfer these payments and how to draw up a payment order for their payment in 2021.

Types of insurance premiums

There are four types of insurance premiums:

- Pension contributions. They are divided into contributions to the insurance pension and contributions to the funded pension;

- Medical fees.

- Contributions to compulsory social insurance in case of temporary disability and in connection with maternity (VNiM) . Using these contributions, the Social Insurance Fund pays sick leave benefits and maternity benefits.

- Contributions for insurance against industrial accidents and occupational diseases. Their unofficial name is “injury” contributions.

What determines the amount of insurance premiums?

When setting contributions for compulsory health insurance and compulsory health insurance, the following factors are taken into account:

- The group to which the taxpayer belongs is a legal organization or individual entrepreneur.

- The group to which an individual belongs.

- Early payments received to the accounts of an individual throughout the year. It is important to look at whether the amount exceeds the base limit.

Related article: Features of compulsory pension insurance in the Russian Federation

If the employer is not included in the program of those who can pay reduced rates, he must be guided by the general requirements.

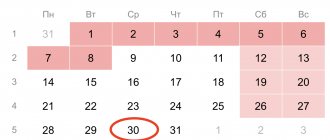

Deadline for payment of VNiM insurance premiums in 2020

Here is a table with the deadlines for insurance premiums for VNiM in 2021. They must be listed according to the details of the Federal Tax Service. Please note that for May-July there are new payment deadlines due to coronavirus, quarantine and non-working days in 2021.

| Type of insurance premiums | For what period is it paid? | Payment deadline |

| Contributions from payments to employees/other individuals for compulsory medical insurance | For December 2021 | No later than 01/15/2020 |

| For January 2021 | No later than 02/17/2020 | |

| For February 2021 | No later than 03/16/2020 | |

| For March 2021 | No later than 10/15/2020 (postponement) | |

| For April 2021 | No later than 11/16/2020 (postponement) | |

| For May 2021 | No later than 12/15/2020 (postponement) | |

| For June 2021 | No later than 11/16/2020 (postponement) | |

| For July 2021 | No later than 12/15/2020 (postponement) | |

| For August 2021 | No later than September 15, 2020 | |

| For September 2021 | No later than 10/15/2020 | |

| For October 2021 | No later than 11/16/2020 | |

| For November 2021 | No later than 12/15/2020 | |

| For December 2021 | No later than 01/15/2021 |

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2020 - from payments to individuals accrued for April, May and June 2020. For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

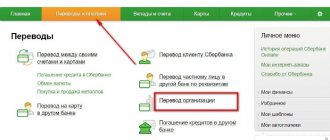

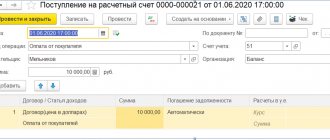

Payment order for VNiM contributions: sample 2021

You can fill out a payment form for the payment of insurance premiums for VNiM on paper or using special programs. When filling out a document manually, you must follow the rules approved by:

- By Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n;

- Regulation of the Bank of the Russian Federation dated June 19, 2012 No. 383-P.

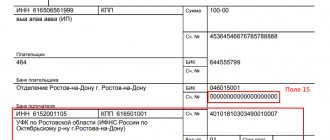

Payment order form 2020

The procedure for filling out each field of the payment order is presented in the table:

| Props name | Number (according to Appendix No. 3 to the Regulations of the Bank of Russia dated No. 383-P) | Note |

| Admission to the bank of payments. | 62 | Filled by the bank |

| Debited from account plat. | 71 | |

| № | 3 | When generating a payment manually, indicate the document serial number. It must be greater than zero. If the payment is generated electronically, the number will be entered automatically, there is no need to change it |

| date | 4 | The format for indicating the date depends on the form in which the payment order is drawn up:

|

| Payment type | 5 | Leave the field empty |

| Payer status | 101 | If the payment form is filled out by an organization, code “01” is entered; if an entrepreneur, code “09” is entered. |

| Suma in cuirsive | 6 | The field must be filled out taking into account the following features:

|

| Sum | 7 | Repeat the amount from the field in 6 digits. We do not write the words “ruble” and “kopecks”. We separate rubles from kopecks with a “-” sign. For example: "10105-50". If the amount is round, then after it we put the “=” sign. For example: "10105=" You can also write the round amount as follows: “10105-00” |

| TIN | 60 | TIN of the organization or individual entrepreneur transferring contributions to the budget. Companies indicate the number in a 10-digit format, entrepreneurs - in a 12-digit format |

| checkpoint | 102 | If an organization transfers contributions, it indicates its checkpoint. If they are paid by a separate division, then the checkpoint of this division is indicated. They don’t have a checkpoint IP, so they put “0” instead or leave this field empty |

| Payer | 8 | Name of the employer paying contributions to VNiM. Organizations enter a short or full name, and entrepreneurs enter their full name and legal status as an individual entrepreneur. For example: “Vasiliev Dmitry Anatolyevich (IP)” |

| Account No. | 9 | Bank account number of an organization or individual entrepreneur transferring contributions to OSS for its employees. It must consist of at least 20 characters |

| Payer's bank | 10 | Details of the employer's account from which funds are debited to pay contributions to VNiM |

| BIC | 11 | |

| Account No. | 12 | |

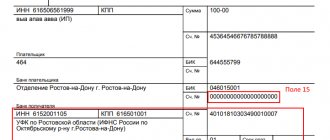

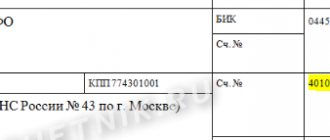

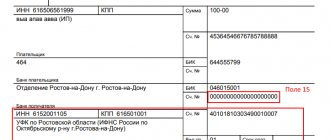

| payee's bank | 13 | Details of the tax office to which contributions to VNiM are transferred. You can check them in a free service on the Federal Tax Service website. To do this, you will need to indicate the address of the location (place of registration) of the organization and individual entrepreneur or the Federal Tax Service code |

| BIC | 14 | |

| Account No. | 15 | Correspondent account number of the recipient's bank. When paying VNiM contributions, this field does not need to be filled in |

| TIN | 61 | TIN and checkpoint of the tax office, to which contributions for social insurance of employees are transferred |

| checkpoint | 103 | |

| Recipient | 16 | We indicate the recipient of contributions - the Federal Treasury. The recipient must be entered as follows: “UFK for ___ (name of the region in which contributions are paid).” Then, in brackets, indicate the name of the Federal Tax Service to which contributions are transferred. For example: “UFK for Moscow (IFTS No. 4 for Moscow)” |

| Account No. | 17 | Payee's bank account number (UFK). You can find it out in the same service where we looked for the details of lines 13 (Recipient's Bank) and 14 (BIC) |

| Type op. | 18 | For all types of insurance premiums (including contributions to VNiM), code “01” is indicated |

| Payment deadline. | 19 | Leave the fields blank |

| Name pl. | 20 | |

| Essay. Plat. | 21 | The order of payment of contributions for employees (any) - code “5” |

| Code | 22 | If insurance premiums are paid on time, code “0” must be entered in this field. If contributions are paid at the request of the Federal Tax Service, the UIN from this document is transferred to this field |

| Res. field | 23 | Leave blank |

| Purpose of payment | 24 | Enter the name of the payment. For example: “Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for January 2020” |

| M.P. | 43 | A stamp is placed according to the sample included in the card. If the bank generates the payment at the request of the client, then the stamp can be omitted |

| Signatures | 44 | The signature of the person indicated in the sample signature card is affixed |

Payment details

Also see:

- BCC for insurance premiums in 2021: table

- New KBK in 2020: table

Payment details for transferring pension insurance contributions (CHI) can be found on the Federal Tax Service website - service.nalog.ru/addrno.do. You can also issue a payment order there – service.nalog.ru/payment/

From 2021, to pay insurance premiums you need to use the KBK, approved by the new Order of the Ministry of Finance of Russia dated 06.06.2019 N 86n.

To pay VNiM insurance premiums, which are transferred to the Federal Tax Service, as well as penalties and fines for them, the following BCCs are used:

- contributions – 182 1 0210 160;

- penalties – 182 1 0210 160;

- fines – 182 1 0210 160.

Read also

23.04.2020

How to fill out fields 104-109 in a payment order for VNiM contributions

Fields 104-109 in the payment order are the most important, so we have placed the order of filling them out in a separate table:

| Line title | Number | Note |

| 104 | Budget classification code | For contributions paid to VNiM, indicate code 182 1 0210 160 |

| 105 | OKTMO code | OKTMO inspection, to which contributions are transferred. Companies indicate the code at their location (legal address), individual entrepreneurs - at the place of registration, separate divisions - at their location |

| 106 | Payment basis code | If contributions are transferred on time, we enter the code “TP” (current payments). When paying off a debt voluntarily, you need to enter the code “ZD”, and when paying at the request of the Federal Tax Service - “TR” |

| 107 | Taxable period | The tax period for employee social security contributions is a calendar month. Therefore, the payment slip indicates the abbreviation “MS”, month number and year. For example, for contributions for January 2021 you need to indicate “MS.01.2020” |

| 108 | Document Number | We put “0” if the fees are paid on time, and the code “TP” is in field 106. If payments are transferred at the request of the Federal Tax Service (code “TR” in field 106), in these fields you must indicate the number and date of the request for payment |

| 109 | Document date |

Sample payment order for VNiM contributions

How to win a tender - checklist

Contributions for compulsory insurance are subject to most payments under GPC and labor contracts.

If yes, what responsibility does the employer have for the absence of this data (about occupational risks) in the employment contract during a scheduled inspection of the State Labor Inspectorate?

To give the correct answer to the question you need to watch the video. After viewing, you will not need to seek help from specialists. Detailed instructions will help you solve your problems. Enjoy watching.

Quite often there are situations when one person falls under several categories of insurance premium payers. In this case, insurance contributions must be made on each basis. For example, an individual entrepreneur who has employees. In this case, he must pay for himself and for his employees.

For individual entrepreneurs making insurance contributions for themselves, fixed amounts are provided. On OPS, if the amount of income does not exceed 300,000 rubles:

- RUR 26,545 - for 2021;

- RUB 29,354 - for 2021;

- RUB 32,448 — for 2021

Such offset/reimbursement relates to excess expenses for benefits based on the results of the reporting (calculation) period. And within the reporting period, the following rule applies: the amount of contributions to VNIM is reduced by the amount of expenses incurred for the payment of benefits for this type of insurance.

It should be borne in mind that compensation for health damage through social insurance does not include moral damage, which is compensated only in court.

Then the inspection transmits to your FSS department appendices 2-4 to section 1 of the calculation with data on accrued contributions to VNiM and paid benefits. The inspection has 5 working days for this from the date of receipt of the calculation in electronic form and 10 working days on paper.

What are insurance premiums and when did they arise?

Categories of insurance premium payers who have the right ... to apply reduced tariffs Insurance premium rate, % In ... which - not. Payments (remunerations) are subject to insurance contributions. Payments (remunerations) are not subject to insurance contributions. For...

As for insurance payments in case of accidents and accidents, an individual entrepreneur has the right not to make them “for himself”.

OSS is a component of the overall state social protection system. The task of the OSS is to protect citizens from serious changes in their financial/social situation in the event of problematic (insurance) situations.

Deductions for compulsory medical insurance, regardless of the amount of income, are:

- 5840 rub. - for 2021;

- 6884 rub. - for 2021;

- 8426 rub. — for 2021

One of the fundamental systems for ensuring the financial security of Russians is compulsory social insurance. This system is complex, consisting of several component elements, which will be discussed further.

Option 1 – the base for calculating insurance premiums did not exceed the established limit, the salary was 20,000 rubles.

If you look at the KBK for 2021, the changes did not affect insurance premiums. So this year there will be fewer mistakes. However, they may occur in the process of filling out other fields in the payment order.

You can pay earlier, but not later. However, if you are late in payment, you still need to pay as soon as possible, since penalties will then be charged for each day of delay.

Insurance contributions to extra-budgetary funds must be paid by all organizations and entrepreneurs, although there are differences in individual insurance contributions for companies with and without employees. There is one detail on which the correct transfer of insurance premiums in 2021 depends - KBC. We will find out what it is, why it is needed and how it changes.

In this case, the average earnings from which the benefits are calculated are assumed to be equal to the minimum wage established on the day the insured event occurred.

What payments are not subject to insurance premiums?

Where is the employer obliged to pay them, and what liability can he incur for non-payment? Answers to these questions in the article Firmmaker. The history of insurance premiums is quite young. The emergence of social insurance was facilitated by the development of the economy and the emergence of labor relations, as a result of which employees began to need social protection. The first mentions of social insurance go back to the 19th century, at which time the Bismar Code of Imperial Laws appeared in Germany.

The amount of additional pension contribution rates is determined depending on the fact of a special assessment of jobs. These contributions are paid in addition to the basic tariffs; they allow certain categories of workers to retire earlier and receive pension benefits.

The codes also allow you to directly differentiate between deductions, penalties and fines for late payment.

Transfer of contributions to the budget is carried out according to the rules of Art. 432 of the Tax Code of the Russian Federation - no later than the 15th day of the month following the reporting period.

Voluntary OSS insurance in case of VNIM

The policyholder pays insurance premiums from the organization’s funds, without deducting this amount from the employee’s salary.

Insurance against accidents and illnesses resulting from the performance of work duties.

Fact! The assignment of insurance compensation is not the main form of classification of OSS. Typically, classification is based on the authorities responsible for insurance payments.

Center for Accounting Services Comprehensive accounting support for organizations and individual entrepreneurs, registration and liquidation of legal entities, legal advice, etc. 353925 Russia Krasnodar region Novorossiysk st.