In the process of activity of each organization, many documents are always generated. The main volume is related to conducting commercial activities, interaction with counterparties, communication with government agencies, etc.

Each document has certain storage periods. These terms depend on the type of document and the relations regulated by it. Copies of contracts, agreements, payment documents can and should be presented as evidence in court or a supervisory authority. All this determines their shelf life.

But in addition to the commercial activities of the enterprise, a huge amount of documentation is associated with labor relations. Personnel documentation has significant storage periods, which depend not only on the statute of limitations, but also on the average human life expectancy.

An enterprise employee is not only a well-functioning mechanism, but also a person who, at the end of his life, receives the right to various benefits from the state, and the amount of benefits may depend on the work performed and its duration.

All this is confirmed by documents, the shelf life of which depends on the duration of human life and is determined by the Federal Archive. The list and storage periods of documents are regularly updated. Thus, at the end of February 2021, the order of Rosarkhiv came into force, approving the list of standard documents created by government bodies and organizations, and their storage periods (Order of Rosarkhiv dated December 20, 2019 No. 236 “On approval of the List of standard administrative archival documents generated in process of activities of state bodies, local government bodies and organizations, indicating their storage periods" (registered with the Ministry of Justice of Russia on 02/06/2020 No. 57449)).

Below I offer revised excerpts from the approved list indicating shelf life.

How and who determines the retention period for documents?

Paragraph 1 of Article of the Federal Law of October 22, 2004 No. 125-FZ “On Archiving in the Russian Federation” states that organizations and individual entrepreneurs are obliged to ensure the safety of archival documents, including documents on personnel, during their storage periods.

These deadlines are established by federal laws, other regulatory legal acts of the Russian Federation, as well as special lists of documents. These lists include:

1) A list of standard administrative archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating their storage periods (approved by order of the Federal Archives of December 20, 2019 No. 236; hereinafter referred to as List No. 236);

2) A list of standard archival documents generated in the scientific, technical and production activities of organizations, indicating storage periods (approved by order of the Ministry of Culture dated July 31, 2007 No. 1182).

In addition, storage periods are determined by other legal provisions. Thus, the minimum storage time for tax documents is established in the Tax Code, and for accounting documents - in the Accounting Law. And, for example, for joint-stock companies there is also a Regulation on the procedure and periods for storing documents of joint-stock companies (approved by Resolution of the Federal Commission for the Securities Market dated July 16, 2003 No. 03-33/ps).

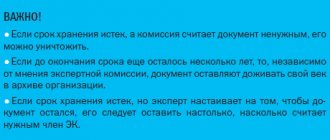

IMPORTANT

The inclusion of documents in the archival fund does not depend on the method of their creation and the type of media (Article Law No. 125-FZ). Therefore, it is necessary to ensure the safety of both “paper” and electronic documents. The type of media in most cases does not affect the period during which the document must be preserved. At the same time, legally significant electronic documents can be stored without printing (see “The Ministry of Finance explained how to store electronic invoices”).

Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

Regulations on structural divisions, collegial, expert and other bodies of the organization

Article 56 of the new List removed all doubts about the shelf life of provisions on units that are part of larger structural units:

| 56 | Regulations on divisions (directorates, departments, sectors) within structural divisions: | (1) After replacing with new ones |

| a) at the place of development and approval | Fast. | |

| B) in other organizations | 3 years (1) |

Storage periods for accounting documents

As already mentioned, the storage period is regulated by the norms of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. For most accounting papers it is five years. The nuances are related to the procedure for calculating this period.

Thus, for primary accounting documents, accounting registers, accounting records and audit reports thereon, the countdown of the five-year period begins after the corresponding reporting year (Clause 1 of Article No. 402-FZ). And in relation to documents related to the organization and maintenance of accounting, including accounting policies and tools that ensure the reproduction of electronic documents, as well as verification of the authenticity of an electronic signature, the five-year period is counted from the year in which they were last used to compile the accounting (financial) reporting (clause 2 of Art. Law No. 402-FZ).

Get a sample accounting policy for a small LLC Get it for free

Verified supporting documents (cash documents and books, bank documents, counterfoils of cash check books, orders, time sheets, bank notices and transfer requests, acts of acceptance, delivery, write-off of property and materials, receipts, invoices and advance reports, correspondence) are also relied upon store for at least five years, and in the event of disputes or disagreements - until a decision is made on the case, even if it is made outside this period (Article 277 of List No. 236). But the storage period for protocols, acts, certificates, calculations, statements, conclusions on revaluation, determination of depreciation, write-off of fixed assets and intangible assets begins to flow only from the moment of disposal of fixed assets and intangible assets (Article 323 of List No. 236).

As a general rule, the storage period for travel documents is 5 years. But this period increases to 50 years if there are no other documents confirming harmful and dangerous working conditions (Article 553 of List No. 236).

ATTENTION

Here and further in the text, the storage period of 50 years established in List No. 236 applies to documents created after January 1, 2003. Similar documents drawn up before this date cannot be destroyed for 75 years.

Fill out waybills indicating the route and mandatory details in a special service

Retention periods for personnel documents

Personnel documents completed after January 1, 2003 must be stored for 50 years (Clause 2, Article 22.1 of Law No. 125-FZ). This is the period that applies to employment contracts, as well as all additional agreements to them, including termination agreements; personal files and personal cards of employees (Articles 435, 444, 445 of List No. 236).

Also, all orders and instructions regarding personnel, including documents (memos, certificates, statements) to them, are stored for at least half a century. We are talking about orders for admission, transfer, relocation, combination, part-time work, dismissal, remuneration, certification, advanced training, assignment of class ranks, ranks, titles, encouragement, awards, changes in biographical data, parental leave, leaves without pay (Article 434 of List No. 236). A similar storage period also applies to original personal documents (work book, diplomas, certificates, certificates) that were not claimed by employees upon dismissal (Article 449 of List No. 236).

Draw up local acts using ready-made templates and prepare all personnel reports

IMPORTANT

A half-century storage period is also established for civil contracts with individuals, as well as acts on them (Article 301 of List No. 236).

There are exceptions to the general rule. For example, documents related to the application of disciplinary sanctions can be destroyed after three years (Articles 454 and 434 of List No. 236). The same storage period is defined for vacation schedules (Article 453 of List No. 236) and consents to the processing of personal data. True, in the latter case, the countdown of the three-year period begins after the expiration of the consent or its revocation (Article 441 of List No. 236). Please note that this concession does not apply to basic documents (regulations or instructions) on the processing of personal data. They must be stored permanently (Article 440 of List No. 236). You will also always have to take care of orders, instructions and other personnel documents related to the main activity (Article 19 of List No. 236). For example, such documents include orders on approval of the structure of the organization, on the creation of divisions (branches), on taking office, on assigning the duties of the chief accountant to the manager, on early resignation, on the appointment of responsible persons, on the approval and implementation of LNA.

A five-year preservation period is established for work time sheets (if working conditions are dangerous or harmful, this period increases 10 times), orders, instructions and other documents on administrative and economic issues (Articles 402 and 19 of List No. 236). A similar period is allocated for storing orders for the provision of annual paid and educational leave, as well as orders for sending on business trips for workers not engaged in work with harmful and dangerous working conditions. If the work is “harmful,” then orders for business trips cannot be destroyed for 50 years (Article 434 of List No. 236).

Compose HR documents using ready-made templates for free

In addition, copies of reports, applications, lists of employees, certificates, extracts from protocols, conclusions, correspondence and other documents on the payment of benefits, payment of sick leave and the issuance of financial assistance are kept for five years (Article 298 of List No. 236). But payrolls and documents for them, payslips for the issuance of wages, benefits, fees, financial assistance and other payments will have to be preserved for a year longer - for six years (Article 295 of List No. 236).

ATTENTION

Pay slips and payslips should be kept for six years only if the employer maintains personal accounts for employees. Otherwise, these documents must remain preserved for 50 years (Article 295 of List No. 236).

Calculate your salary and benefits according to current rules Calculate for free

Retention periods for tax documents

Accounting and tax accounting data and other documents necessary for the calculation and payment of taxes, including documents confirming receipt of income, expenses, as well as payment (withholding) of taxes, must be stored for four years. These are the rules of subparagraph 8 of paragraph 1 of Article 23 and subparagraph 5 of paragraph 3 of Article of the Tax Code of the Russian Federation. The countdown of the period begins after the end of the tax period in which the document was last used for preparing tax reports, calculating and paying taxes, confirming income received and expenses incurred (letter of the Ministry of Finance dated July 19, 2017 No. 03-07-11/45829).

IMPORTANT

An exception is made for documents confirming the amount of loss incurred. They are supposed to be kept for the entire period when it reduces the tax base of the current tax period by the amounts of previously received losses (clause 4 of Article 283, clause 7 of Article 346.18 of the Tax Code of the Russian Federation).

A four-year shelf life is specified for the purchase ledger and sales ledger, including additional sheets to them. In this case, the countdown is carried out from the date of the last entry in the book (clause 24 of the Rules for maintaining the purchase book and clause 22 of the Rules for maintaining the sales book, approved by Government Decree No. 1137 of December 26, 2011). As for invoices, they should be kept for five years (Article 317 of List No. 236).

Carry out automatic reconciliation of invoices with counterparties Connect to the service

A five-year retention period is established for tax returns and calculations for all types of taxes. The exception is individual entrepreneur declarations for the period up to 2002 inclusive. They must be stored for 75 years (Article 310 of List No. 236). But the calculation of insurance premiums cannot be destroyed for 50 years from the date of its preparation (Article 308 of List No. 236).

Documents necessary for the calculation and payment of insurance premiums must be kept for six years (subclause 6, clause 3.4 of Article of the Tax Code of the Russian Federation). Such documents include, in particular, individual accounting cards for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums (Article 309 of List No. 236).

ATTENTION

In the absence of personal accounts or payroll records, individual accounting cards will have to be protected for 50 years (Article 309 of List No. 236).

From what point does the storage period for documents used to calculate insurance premiums begin? There is no direct explanation. In our opinion, in this case an analogy with tax documents can be applied. That is, the deadline is counted after the end of the billing period in which the document was last used to calculate and pay contributions and prepare reports on them.

Fill out, check and submit insurance premium calculations online

All correspondence with the tax office (notifications, demands, acts, decisions, resolutions, objections, complaints, applications) is required to be kept for five years. This period is doubled if the complaint is filed based on the results of an on-site or desk inspection (clauses 148 and 314 of List No. 236). All electronic documents with UKEP, and certificates of keys for verifying the electronic signature with which complaints and technological documents are endorsed, must be stored for at least five years. Here, the deadlines are counted from the date of receipt or sending of the relevant document (clause 3 of the Procedure given in Appendix No. 4 to the Federal Tax Service order dated December 20, 2019 No. MMV-7-9 / [email protected] ).

REFERENCE

Contracts for the purchase of goods, works, and services to meet state and municipal needs must be kept for five years after the termination of obligations under them (Article 224 of List No. 236).

Receive notifications about government procurement for small and medium-sized businesses Set up newsletter

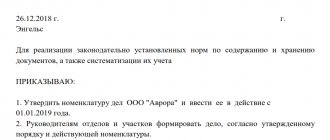

How to switch to a new nomenclature: step-by-step instructions

To organize the current paperwork process and the subsequent transfer of documents for storage, you need a nomenclature of cases. This is a systematized list of the titles of cases entered into office work during the year, indicating the periods of their storage. Such a list is necessary for the correct formation of documents, organization of their recording and safety, as well as quick search.

We must strive to ensure that the nomenclature of cases reflects all the functions and areas of work of the organization or individual entrepreneur. Otherwise, during the paperwork process, documents will inevitably appear that are not included in the nomenclature, which can lead to a violation of the storage order and even loss of documents.

Based on the form of case nomenclature approved by Order of the Ministry of Culture dated March 31, 2015 No. 526, we can recommend the following procedure for transition to the new nomenclature. First, you need to enter the numbering of the organization's structural divisions. These numbers will be required to create a case index, since it includes the serial number of the case, as well as the number of the structural unit.

REFERENCE

With a multi-level internal structure of an organization, you can enter complex indices consisting of groups of numbers separated from each other by a hyphen. For example, separate numbers can be assigned to departments, departments within departments, and work groups within a department.

The second step when transitioning to a new nomenclature is to develop rules for forming case headings. In this case, one must proceed from the fact that the title in a clear but generalized form should reflect the main content and composition of the case documentation. Therefore, you cannot simply indicate “documents” or “correspondence”. It is necessary to specify “hiring documents” or “correspondence with the Federal Tax Service”.

ATTENTION

You cannot use non-specific wording in the title of the case: “Miscellaneous”, “General correspondence”, “Incoming documents”, etc.

The third stage involves the distribution of all cases by storage period, and the introduction of an appropriate paperwork procedure, in which documents are immediately generated by case, based on the storage period. If, when creating documentation, it is difficult to accurately distribute according to storage periods, then a binary system is introduced: initially, all documents relate to cases of either permanent or temporary storage. And the division of temporary storage cases into specific periods is carried out at the next stage by specialists responsible for managing affairs in the organization.

IMPORTANT

Is it necessary to include electronic documents in the nomenclature? Clause 96 GOST R 7.0.8-2013 “SIBID. Record keeping and archiving. Terms and definitions" defines an electronic file as an electronic document or a set of electronic documents and metadata for them, formed in accordance with the nomenclature of files. Therefore, electronic files are included in the nomenclature common to paper files. When adding electronic documents to the general nomenclature, you must be guided by the same rules that apply to “paper” documentation.

Connect to the Diadoc system for electronic document management with counterparties

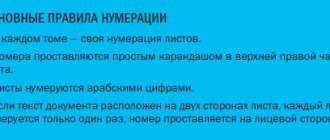

FEATURES OF DESIGN OF TEXTS OF ORDERS

- The text of the order consists of two parts. The text of the order, unless the document is drawn up according to the form approved by the State Statistics Committee, always has a clear structure. It is divided into two parts: ascertaining and administrative. The parts are separated from each other by the word “I ORDER” (see Examples 2 and 3).

- Management decisions in the order are numbered. If the decisions are drawn up as a bulleted list, then it will be impossible to refer to any of the points of the administrative document in this case. There are simply no points. There are dots, check marks, or other symbols, depending on what the secretary likes. And it’s quite difficult to refer to the point. For comparison, here are two options for designing the administrative part of the order text:

- The text of the order is presented in the first person. Secretaries are often embarrassed by the need to formulate the management decision of the manager in the first person and use phrases such as: “I ORDER”, “prepare a project and submit it to me for approval”, “I leave control to myself”, etc. However, this is exactly how an administrative document issued under conditions of unity of command should be drawn up. Despite the fact that the author of the text of the order is almost always an ordinary employee of the organization, the document is issued on behalf of the manager, hence the grammatical form of the first person singular.

Fines for violating the document storage procedure

The most common situation when violation of the procedure or storage period can result in a fine is failure to submit a document at the request of the Federal Tax Service. Let us remind you that such a request can be sent both during an inspection of the taxpayer himself (on-site or office), and as part of a counter inspection, or without ordering an inspection at all (Articles 93 and 93.1 of the Tax Code of the Russian Federation; for more details, see “The Federal Tax Service Inspectorate requires documents: for which requests need to be answered, and which ones can be ignored” and “The Federal Tax Service Inspectorate requested data on a counterparty or transaction: when is this legal, and what will happen if the request is not answered”). In all cases, failure to submit or untimely submission of each document that the taxpayer must have will result in a fine of 200 rubles. (clause 1 of article 126 of the Tax Code of the Russian Federation).

ATTENTION

You can facilitate and speed up the process of sending documents to the inspection using special services, for example, the “Connector Kontur.Extern” web service. It makes it possible to send tens of thousands of electronic documents to tax authorities at a time. Through the “Connector” you can transfer to the Federal Tax Service any electronic documents created in approved formats (for example, invoices, TORG-12 invoices, etc.), as well as scanned images of any documents created on paper: acts, contracts, payments and etc.

Connect to the Kontur.Extern system

In addition, the absence of primary documents or invoices may result in tax liability for gross violation of accounting rules. Here the size of the fine depends on the consequences. If the violation did not lead to an understatement of the tax base, then the fine will range from 10,000 to 30,000 rubles. (Clause 1 and 2 of Article 120 of the Tax Code of the Russian Federation). If, due to the lack of documents, the tax base was underestimated, then the fine will be equal to 20% of the amount of unpaid tax, but not less than 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation).

Failure to comply with the storage deadlines for documents may become the basis for bringing the organization and its employees to administrative liability. For example, for failure to fulfill the obligation to store documents of a JSC or LLC within the time limits provided for by current legislation, a fine is imposed. Its size ranges from 2,500 to 5,000 rubles. for officials and from 200,000 to 300,000 rubles. for society itself (parts 1 and 2 of article 13.25 of the Code of Administrative Offenses of the Russian Federation). And for failure to comply with the storage deadlines for accounting and reporting documents on currency transactions, a fine of 4,000 to 5,000 rubles is provided. for officials and from 40,000 to 50,000 rubles. for organizations (Part 6 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation). Slightly smaller penalties (from 1,000 to 2,000 rubles for officials and from 10,000 to 20,000 rubles for legal entities) are provided for violation of the terms of storage of accounting documents for foreign economic transactions with goods, information, works, services or results of intellectual activity for purposes of export control (Part 2 of Article 14.20 of the Code of Administrative Offenses of the Russian Federation).

Conclusion

Legal entities and individual entrepreneurs are required to organize the storage of personnel, accounting, tax and other necessary documentation. To do this, you need to allocate a special room or use the services of an archive.

For most types of documents, storage periods range from 1 to 6 years. But personnel documentation related to the calculation of seniority and accrual of income must be stored much longer - from 50 to 75 years.

You can destroy documents with an expired storage period yourself or use the services of special organizations. When liquidating a company or closing an individual entrepreneur, all documents subject to long-term storage must be archived.

For violations of the procedure for working with documents, fines are provided for organizations, individual entrepreneurs and officials.