Employer reporting

Olga Yakushina

Tax expert-journalist

Current as of May 27, 2019

Form 6-NDFL was approved more than three years ago, but disputes regarding the procedure for filling it out are still relevant. One of the difficult moments when filling out 6-NDFL is determining the date that needs to be entered in line 120 of the report.

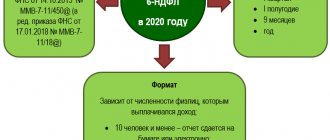

Deadlines for submitting 6-NDFL reports

The legislation defines the exact deadlines when it is necessary to submit 6-NDFL reports to the tax office. We will consider the exact dates in 2021 in the form of a table:

| For what period are reports provided? | Due in 2021 |

| For the 1st quarter of 2021 | No later than April 30, 2021 |

| For 6 months of 2021 | No later than July 30, 2021 |

| For 9 months of 2021 | No later than October 30, 2021 |

| Based on the results of 2021 | No later than April 1, 2021 |

If the last day for submitting reports falls on a weekend or holiday, then it is postponed to the first working day after the weekend.

6_ndfl.jpg

Thus, enterprises that do not operate during non-working days enter in the 6-NDFL calculation (line 120) the date 05/12/2020 for payments made during this time. Firms and individual entrepreneurs that were not affected by the non-working period of March-May record in line 120 the dates indicating the standard deadlines for paying tax on payments made. Organizations and individual entrepreneurs will have to submit the 6-NDFL calculation for the first half of 2021 to the Federal Tax Service no later than July 30, 2020.

Who submits 6-NDFL reports

All enterprises and individual entrepreneurs who have concluded agreements with individuals must report to the tax service for the income transferred to them and the personal income tax paid for them.

The certificate in form 6-NDFL indicates the entire income tax of individuals as a whole, 2-NDFL - for each employee separately.

6-NDFL reporting can be submitted to the tax service in two ways, namely:

- In paper form - if the number of employees in the enterprise is less than 25 people;

- In electronic form – if the company employs more than 25 people.

Results

Line 120 in 6-NDFL is formed according to the general rules for filling out section 2 of the form. When entering information into it, you should take into account the nuances of determining the deadline for payment to the budget for personal income tax, taking into account the norms of Art. 223, 226 and 6.1 of the Tax Code of the Russian Federation, and also take into account the changing clarifications of the Federal Tax Service.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Where can I get the 6-NDFL form to fill out?

Form 6-NDFL has a specific form approved by law. It is provided only to the tax service, to which the enterprise itself belongs, regardless of where their divisions are located.

A blank 6-NDFL reporting form can be obtained in various ways, namely:

- Download directly from the official website of the IFTS portal;

- Download from other sources on the Internet.

Important!!! The form must be filled out correctly and comply with the form established by law. If there are any differences, tax authorities may not accept 6-NDFL reporting.

In this case, the reporting deadlines will be violated, clarifications will need to be made and, naturally, a lot of time will be spent on corrections. In order to avoid this, you must immediately ensure that the reporting is filled out correctly and without any comments.

What data must be indicated in field 110 of form 6-NDFL?

The procedure for filling out form 6-NDFL states that in column 110 (tax withholding date) you must indicate the day on which tax was withheld from payments to employees. In a letter dated 02.25.2016 No. BS-4-11/ [email protected] , tax authorities clarify that this line must be filled out taking into account clause 4 of Article 226 of the Tax Code of the Russian Federation and clause 7 of Article 226.1 of the Tax Code of the Russian Federation, that is, one must always remember the form paid income.

At the same time, income tax should be withheld directly upon payment of income, regardless of what form it was in - cash, in kind or in the form of material benefit. That is, in most cases, lines 110 and 100 will contain common data.

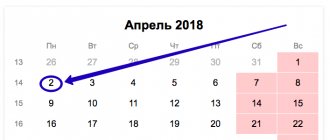

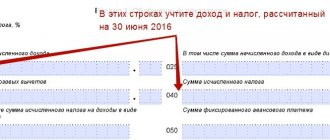

In some situations, the dates in columns 110 and 100 cannot and should not coincide. This happens in cases where the tax agent pays wages in the next month. For example, employees received their salaries, vacation pay and sick leave for April in May. Since these payments were accrued in April, line 100 indicates the last working day of this month. Due to the holidays, money was issued only on May 11th. This number should be recorded in column 110, since the tax was withheld on the same day. How to reflect this in the report is shown in the picture.

6-NDFL reporting structure

6-NDFL reporting consists of a title page, section No. 1 and section No. 2. We will consider all parts of the reporting in the form of a table:

| Section name | What is reflected |

| Title page | Reflects information about the tax agent, namely: INN, KPP, name of the enterprise, if an individual entrepreneur then full surname, first name and patronymic, OKTMO code, contact phone number. It is also necessary to indicate the reporting period, adjustment number, and tax office number. The title page is stamped and signed by the director. |

| Section No. 1 | This section reflects information about income for a certain period, and also reflects the total accrued tax for this period. The section is filled in with a cumulative total from the beginning of the year. |

| Section No. 2 | This section is completed based on data for the last reporting period. It reflects the date of receipt of income, the date of tax withholding, the deadline for transferring income, the amount of actual receipt of income, and the amount of personal income tax withholding. |

How not to get lost in dates: lines 100–120 of “form six”

The abundance of deadlines and dates that 6-NDFL is replete with is associated with the specifics of the information reflected in it. The fact is that they are accrued (both income and tax) most often in one month, and paid (or withheld and transferred) in another; and these months may well fall within different reporting periods. A strict time link to specific dates for different types of payments and deadlines for withholding and transferring taxes allows you to fill out the form correctly.

Table: common types of income, corresponding periods and dates in the report

| Type of income | Income form | Date of receipt of income (page 100) | Tax withholding date (page 110) | Tax payment deadline (page 120) | Base |

| Income in the form of wages (salary) | Cash or in kind |

| Income payment day | The day following the day of payment of income | clause 2 art. 223 Tax Code of the Russian Federation |

Non-salary income:

| Cash or in kind | Income payment day | Income payment day |

|

|

| Income not related to wages and arising in connection with reimbursement of travel expenses (for example, if expenses are not confirmed or are reimbursed in excess of current standards) | Monetary | The last day of the month in which the advance report is approved after the employee returns from a business trip | The nearest day of payment of income in cash | The day following the day of payment of income | subp. 6 clause 1 art. 223 Tax Code of the Russian Federation |

| Income not related to wages and arising from the use of borrowed funds. | Material benefit | The last day of each month during the period for which the loan (credit) was provided | The nearest day of payment of income in cash | The day following the day of payment of income | subp. 3 p. 1 art. 223 Tax Code of the Russian Federation |

| Remuneration under a civil contract | Cash or in kind | Income payment day | Income payment day | The day following the day of payment of income |

|

In fact, everything is not so complicated, it’s just important not to get confused in the subtleties. For example:

- The date of actual receipt of the salary is considered to be the last day of the month for which it was accrued (even if this day falls on a weekend).

- If the deadline for tax transfer (the day following the day of payment of income or the last day of the month) falls on a weekend or holiday, then the deadline is postponed to the next working day.

How it works

Without a doubt, the most common and familiar form of income is salary. Every NA deals with it all the time.

Let's assume that in September 2021, employees were paid an advance in the amount of 50 thousand rubles. The remainder of the September salary is 65 thousand rubles. — issued October 6, 2021. Personal income tax for employees at a rate of 13% was: (50 thousand rubles + 65 thousand rubles) * 13% = 14.95 thousand rubles. This is a so-called “transitional” operation, the beginning of which (payment of advance payment and calculation of wages and taxes for September) falls on one month (September) and the reporting period (nine months of 2021), and completion (issuance of wages, withholding and transfer of tax) - for another month (October) and reporting period (2017). That is, the data on this operation will be included in the second section as part of the report for the year.

If a tax agent performs an operation in one presentation period and completes it in another period, then this operation is reflected in the presentation period in which it is completed. In this case, the operation is considered completed in the submission period, in which the deadline for transferring the tax occurs in accordance with paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code.

Letter of the Federal Tax Service dated April 5, 2021 No. BS-4–11/ [email protected] “On filling out the calculation according to Form 6-NDFL”

Table: reflection of the “transitional” salary in the second section of the report

| Line number | Line title | Meaning |

| 100 | Date of actual receipt of income | 30.09.2017 |

| 110 | Tax withholding date | 06.10.2017 |

| 120 | Tax payment deadline | 09.10.2017 |

| 130 | Amount of actual income received | 115000.00 |

| 140 | Amount of tax withheld | 14950 |

And here's what you should pay attention to:

- Although 09/30/2017 is a Saturday, line 100 reflects exactly this day as the last day of the month for which the salary was accrued.

- Although the tax payment deadline in this case formally falls on 10/07/2017 (the day following the day of income payment), it also falls on Saturday and, therefore, is postponed to Monday 10/09/2017.

How to reflect bonuses

Let's say your employees have worked long, happily and selflessly for the benefit of the organization, and you decide to reward them.

The date of actual receipt of income in the form of bonuses, which are an integral part of wages and paid in accordance with the employment contract, is recognized as the last day of the month for which the specified income was accrued (remember that for bonuses not related to wages, such date is the day bonus payments - see letter of the Ministry of Finance of Russia dated 04/04/2017 N 03–04–07/19708).

Letter of the Federal Tax Service dated April 19, 2017 No. BS-4–11/7510

If we are talking about monthly incentives, the rule “bonus = salary” works, and they are reflected equally in the report. What if we talk about a much longer period, for example, a six-month or annual bonus? When and how is such remuneration reflected in 6-NDFL?

In this case:

- the premium is shown in the 6-NDFL report for the period when the order for its payment was issued (Letter of the Federal Tax Service dated January 24, 2017 No. BS-4–11/1139);

- premiums paid at different times within the same period or according to orders issued in different months of the same period are reflected in detail;

- for each of them, fill out its own block of lines 100–140;

- in line 100 indicate the last day of the month in which the bonus order was issued;

- in line 110 put the day of payment of the bonus;

- in line 120 enter the next working day after the day the bonus was paid.

Good employees can be rewarded, but it is important to correctly reflect their “bonuses” in the 6-NDFL declaration

You can “collapse” in the second section of 6-NDFL only those incomes for which the values of lines 100–120 are completely identical.

In practice, this looks like this: suppose that on October 2, 2017, an order was issued to award employees bonuses based on the results of the third quarter for a total amount of 10 thousand rubles. The bonus was paid on October 10. Data about it will be reflected in the report for 2021.

Table: quarterly bonus in the second section of the report

| Line number | Line title | Meaning |

| 100 | Date of actual receipt of income | 30.10.2017 |

| 110 | Tax withholding date | 10.10.2017 |

| 120 | Tax payment deadline | 11.10.2017 |

| 130 | Amount of actual income received | 10000.00 |

| 140 | Amount of tax withheld | 1300 |

All of the above is true for performance-based bonuses. However, for “non-production” bonuses (for example, dedicated to an anniversary), the situation looks somewhat different: in this case, income is considered to be actually received at the time of its payment. So if employees were awarded not for conscientious work, but in honor of, for example, the fiftieth anniversary of the organization, the contents of line 100 will change.

Table: reflection of the “non-production” bonus in the second section of the report

| Line number | Line title | Meaning |

| 100 | Date of actual receipt of income | 10.10.2017 |

| 110 | Tax withholding date | 10.10.2017 |

| 120 | Tax payment deadline | 11.10.2017 |

| 130 | Amount of actual income received | 10000.00 |

| 140 | Amount of tax withheld | 1300 |

Bonuses, like salaries, can be “transitional”. In this case, it is necessary to remember that the operation is reflected in the report for the period in which its logical completion occurs - the payment of tax.

For example, in the case of a bonus for August, paid on the last working day of September according to the September order:

- the date of actual receipt of income (on line 100) will be 08/31/2017;

- tax withholding date (on line 110) - 09/29/2017;

- The deadline for transferring tax taking into account the transfer (on line 120) is 10/02/2017.

Consequently, data on such premiums will be included in the second section of the 2021 Report.

Video: Federal Tax Service on bonuses in the 6-NDFL report

Awards are a wonderful thing, but, unfortunately, they do not occur as often as we would like. However, there are “income” payments that are as widespread as salaries.

When one is sick and the other is on vacation

From a Form Six perspective, sick leave and vacation pay are significantly different from other types of income. And the point here is not in the nature or source of payments, but in the timing of the tax transfer. This period for both cases under consideration is the last day of the month of income payment.

Let’s say that in October an employee received vacation pay (payment date 10/03/2017, amount 2 thousand rubles) and sick leave (payment date 10/27/2017, amount 700 rubles).

Table: reflection of vacation and sick leave in the second section of the report

| Type of income | Line | Line title | Meaning |

| Vacation pay | 100 110 120 130 140 | Date of actual receipt of income Date of tax withholding Deadline for transfer of tax Amount of income actually received Amount of tax withheld | 03.10.2017 03.10.2017 31.10.2017 2000.00 260 |

| Sick leave | 100 110 120 130 140 | Date of actual receipt of income Date of tax withholding Deadline for transfer of tax Amount of income actually received Amount of tax withheld | 27.10.2017 27.10.2017 31.10.2017 700.00 91 |

In the second section of the annual report, these transactions must be reflected in two separate blocks, since the values of lines 100 and 110 for the two types of income differ from each other.

How material benefits are reflected in 6-NDFL

A rather specific type of income - the material benefit received - is also reflected in the report in Form 6-NDFL.

Let’s assume that an employee took out a one-time, repayable, interest-free loan from an organization for a certain (not very long) period. For example, for six months. It would seem, what kind of income can there be? The loan is repayable. A person will use other people’s money for a short time and return everything to the last penny.

This is true, of course. Only the loan is not just repayable, but also interest-free. And those interests, which the employee saved by not paying, provide him with material benefits and form income subject to taxation.

The situation is somewhat unusual. After all (according to the rules of the Tax Code of the Russian Federation), the actual receipt of such income occurs on the last day of each month included in the period of use of the loan. That is, over a six-month period, income will arise six times. And this loan was issued only once. And what about taxes in this case? When and from what sources of income should I deduct it monthly?

The tax agent should know that even with interest-free loans you will need to pay personal income tax

In fact, tax is withheld from cash payments of any type of income. The main thing is that this payment should be closest to the day the “materially beneficial” tax is calculated. Most often, as a result, wages “suffer”, of course.

For example, on November 30, 2017, an employee received an income of 1 thousand rubles, having saved through an interest-free loan received from the organization three months earlier. The salary of this employee for November amounted to 11 thousand rubles. In this case, the tax on the material benefit received is: 1 thousand rubles. * 13% = 130 rub. Salary tax: 11 thousand rubles. * 13% = 1.43 thousand rubles. The salary payment date for November is 12/05/2017.

Table: reflection of the material benefits received in the second section of the report

| Line number | Line title | Meaning |

| 100 | Date of actual receipt of income | 30.11.2017 |

| 110 | Tax withholding date | 05.12.2017 |

| 120 | Tax payment deadline | 06.12.2017 |

| 130 | Amount of actual income received | 12000.00 |

| 140 | Amount of tax withheld | 1560 |

This is exactly the case when different types of income are reflected “collapsed” in one block of the second section of 6-NDFL. Because the indicators in lines 100–120 are completely identical.

"Dividend" happiness

Let's talk about the founders. In the context of "form six", of course.

People who own shares in the authorized capital of an organization participate in the distribution of its profits and receive corresponding dividends. What are dividends? That's right: taxable income. And the organization paying them becomes a tax agent for its founder.

Reflecting dividends in “form six” has several features:

- firstly, dividends are taxed at different rates depending on whether they are paid to a resident or non-resident;

- secondly, the deadline for transferring the tax depends on the legal form of the tax agent (LLC or JSC).

Since we are now interested in dates and deadlines, let’s focus on “secondly”:

- for an LLC, the deadline for transferring personal income tax when paying dividends to the founder is no later than the next business day after payment in cash or transfer to an individual’s bank account (clause 6 of Article 226 of the Tax Code of the Russian Federation);

- for joint-stock companies, the period for transferring personal income tax is no more than a month from the date of payment of dividends (clause 3, clause 9, article 226.1 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated 08/09/2016 No. ГД-4–11/14507).

Let’s assume that it happened that Shilo LLC and Mylo JSC, without agreement, in March 2021 accrued 100 thousand rubles each to their founders. dividends each and paid them (also completely by accident) on the same day - 04/10/2017. That is, we have exactly the same initial data, which, nevertheless, will be reflected differently in the second section of the report.

Table: reflection of “dividend” payments in the report of LLCs and JSCs

| Line number | Line title | Value (LLC) | Value (AO) |

| 100 | Date of actual receipt of income | 10.04.2017 | 10.04.2017 |

| 110 | Tax withholding date | 10.04.2017 | 10.04.2017 |

| 120 | Tax payment deadline | 11.04.2017 | Date of actual tax payment, but no later than 05/10/2017 |

| 130 | Amount of actual income received | 100000.00 | 10000.00 |

| 140 | Amount of tax withheld | 13000 | 13000 |

There are some nuances here too. For example, clause 3, clause 9, art. 226.1 of the Tax Code of the Russian Federation does not clarify the concept of “month”. How many calendar days is it - 30 or 31? Therefore, delaying payment of tax “until the last minute” is actually not recommended.

Filling out line 120 in 6 personal income tax

Line 120 reflects the deadline for transferring personal income tax to the tax service. This means that the payment order must be sent no later than this date. This is the date on which the Federal Tax Service controls the sending of personal income tax.

If the taxpayer is late to pay personal income tax, then this does not affect the completion of line 120 in the 6-NDFL reporting. Line 120 still contains the date by which personal income tax must be paid.

When filling out 6-NDFL reports, mistakes are often made when filling out line 120. This may be due to the fact that the wording of the definition of lines 100-120 is not entirely clear:

- Line 100 – the date when the employer paid wages to the individual;

- Line 110 – the date when the individual was paid wages and income tax was withheld from it;

- Line 120 is the deadline by which income tax must be remitted.

Let's look at how to fill out line 120 for various payments in the form of a table:

| Type of income | Filling line 120 |

| Wage | Since wages are paid on the last day of the month, then line 120 will reflect the date of the next working day after payment |

| Production bonus | Accruals are made on the last day of the month, then line 120 reflects the date of the next working day after payment |

| Income in the form of material benefits from interest savings | Accruals are made on the last day of the month of the entire period for which the borrowed funds were issued. Line 120 reflects the date of the next business day after payment |

| Excess daily allowance | The last day of the month in which the advance report was approved. Line 120 – next business day after payment |

| Compensation for unused vacation | Accrual is made on the day of dismissal. The date on line 120 is the next business day after payment |

From the income listed above, we can conclude that the tax agent has the right to withhold the accrued tax in his current account without penalties and fines no longer than until the next day after the payment of income to an individual. Line 120 is the deadline by which the tax agent must transfer personal income tax. When checking, IFNM employees compare the date reflected on the payment order with the date reflected in line 120 of the 6-NDFL reporting.

Algorithm for entering data into lines 100, 110, 120, 130, 140

To better understand the purpose of line 120, let’s analyze the general algorithm for generating section 2 of the report. In structure, it consists of separate blocks consisting of repeating lines to contain data. Each block of Section 2 of 6-NDFL is composed of lines 100, 110, 120, 130, 140 and is tied to one actual payment of income to individuals. Each line is designed to reflect certain information:

- Line 100 is the day an individual (or individuals) receives income from an employer (according to the rules of Article 223 of the Tax Code of the Russian Federation).

- Line 130 - the amount of income received on the day indicated on the corresponding line 100 (in full, including personal income tax intended for withholding).

- Line 110 is the day the tax is withheld from the income indicated on line 100 of the block. For payments not specifically named in the Tax Code (salary, vacation pay and disability compensation), the dates in line 100 and line 110 must match (clause 4 of Article 226 of the Tax Code of the Russian Federation).

- Line 140 - the amount of personal income tax withheld from the payment shown on line 130 of the block.

- Line 120 is the day no later than which the personal income tax shown on line 140 must be transferred to the budget. The general requirements for this day are established in paragraph 6 of Art. 226 of the Tax Code, however, there are nuances on which filling out line 120 of form 6-NDFL will depend.

How these deadlines will look in a real example in the report, see ConsultantPlus. If you do not have access to the K+ system, get trial online access for free.

Nuances when filling out line 120 of the 6-NDFL reporting

The largest number of questions related to the inclusion of data in line 120 is related to the payment of income on the days preceding weekends or holidays. Many organizations time various incentive payments to coincide with public holidays, and salaries at the end of the working week, before the weekend.

Accordingly, in this case, the general rule applies: payments that are made on the last working day before non-working days, then the deadline for transferring personal income tax to the budget must occur no later than the first weekday after non-working days. Which should be reflected on line 120 in 6-NDFL. If this day moves into the next reporting period, then the entire group of lines related to it will be included in the next report.

General rules for forming section 2 lines

Section 2 6-NDFL provides regulatory authorities with information about the income that individuals actually received from their employer.

At the same time, this section also displays information about the employer’s withholding of tax from these payments and the transfer of withheld amounts to the budget. The algorithm for generating the report (its form was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ) reflects the following features regarding section 2:

- The information in this section is in addition to data already presented in previous reports during the year. Thus, in the report for the 1st half of the year (after the first quarter), it will reflect information about income and personal income tax deductions from it, which took place only in the 2nd quarter. The report for 9 months contains data on payments of income and related personal income tax only for the 3rd quarter. And so on until the end of the tax year.

- The information in Section 2 is also summarized according to the following principle: if for 2 or more individuals the days of payment of money, personal income tax withholding and the deadline for transferring personal income tax to the budget coincide (for example, when paying salaries), this data is summarized in one block of Section 2.

Note! Section 1 6-NDFL includes combined information determined on an accrual basis from the beginning of the year.

For more information about filling out lines in section 1 of the report, read:

- “Procedure for filling out line 020 of form 6-NDFL”;

- “Procedure for filling out line 040 of form 6-NDFL”;

- “Procedure for filling out line 060 of form 6-NDFL”;

- “Procedure for filling out line 090 of form 6-NDFL.”

How to fill out 6-NDFL: title page

Legal entities indicate the TIN and KPP, entrepreneurs indicate only the TIN, and put dashes in the “KPP” field. If you are submitting 6-NDFL for the first time in this period, then the “Adjustment Number” is 000. If you are submitting an updated declaration, then the field corresponds to the serial number of the adjustment (001, 002, etc.).

The presentation period contains a digital code:

- for the report for the first quarter – 21;

- for half a year – 31;

- for 9 months – 33;

- per year - 34.

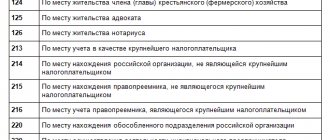

Tax period – the year of filling out form 6-NDFL. In the “Submitted to the tax authority” field, you must indicate the tax office code. The field “At location (accounting) (code)” includes one of the following:

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the individual entrepreneur (when using PSN and UTII);

- 212 – at the place of registration of the Russian legal entity;

- 212 – at the place of registration of the largest taxpayer;

- 220 – at the location of a separate division of a Russian legal entity.

The tax agent indicates the abbreviated name in the field of the same name in accordance with the charter. An individual who is a tax agent enters his full name in full according to his passport data. On the first sheet you also need to write down the OKTMO of the enterprise, its telephone number and the number of pages contained in the 6-NFDL calculation.

Next, you need to indicate who confirms the information specified in the calculation:

- 1 – the tax agent himself;

- 2 – representative of the tax agent (if the report is submitted by a representative, you must indicate the details of the document confirming the authority).

The “Date and Signature” column is signed by the person who confirms the information in the report. The lower right quarter of the title page is intended only for the tax inspector's notes.

Line 110 6-NDFL, if salaries are paid on different days

Let's assume that workers in different departments are paid on different days. Line 110 6-NDFL indicates the day of actual payment of wages. The remaining lines will be filled in like this:

Table 1. 6 Personal income tax: lines 100, 110, 120

Field

date

the last day of the month for which salaries were accrued

the next business day after the date indicated on line 110

amount of tax withheld

In this situation, report the salary in different blocks of lines 100–140. Despite the fact that the date of receipt of income for all employees on line 100 will be the same - the last day of the month (clause 2 of Article 223 of the Tax Code). But the date of personal income tax withholding will be different, since you withhold tax on the day the money is issued.

How to fill out column 120 if income tax cannot be withheld

This situation is possible when physical. the person received a profit in kind and until the end of the year, income in cash was not accrued. A legal entity does not have the right to transfer tax from sources.

Date of actual receipt of income in 6 personal income tax

Filling out the second part will be as follows:

- 100 – date when income was received;

- 110, 120 – 0;

- 130 – valuation of income;

- 140 – 0.

Income tax, which is not possible to withhold, is reflected in the first section of the declaration 6 in column 080.

In addition, the fiscal authorities and the individual who received the income should be notified by March 1 of the following year about the reasons for not withholding personal income tax.

How to fill out 6-NDFL correctly: section 1

The amounts in section 1 are indicated from the beginning of the year on an accrual basis.

- On page 010, the accountant fixes the income tax rate. If the employer pays income at different personal income tax rates, a separate section 1 is needed for each rate;

- Page 020 contains the amount of accrued income, taking into account payments within the framework of labor relations, dividends and sickness benefits;

- On page 025, dividends are shown as a separate amount;

- Page 030 – amount of tax deductions;

- Page 040 – amount of calculated tax (that is, 13% of the difference between accrued income and tax deductions);

- Page 045 – personal income tax on dividends;

- Page 050 contains information about the fixed advance payment that the company pays for a foreign worker on a patent;

- The number of employees must be indicated on page 060 - all persons who received payments from the employer during the reporting period must be taken into account;

- On page 070, the accountant will indicate the amount of tax withheld, and the money that the tax agent did not withhold from the employee must be indicated on page 080;

- For the amount of tax that the employer returned to the employee, page 090 is intended.

Read more: Dividends in 6 personal income taxes 2021 example of filling

What questions may arise when filling out 6-NDFL in section 1? Some accountants believe that the amount of property deduction received by the employee from the employer should be indicated on page 090. The Federal Tax Service, in a letter dated March 18, 2016 No. BS-4-11/4538, explained that this line is intended to return excessively withheld amounts in accordance with Art. . 231 Tax Code of the Russian Federation. The tax deduction has already been counted in the indicators line 040 and line 070; it cannot be counted again on line 090.

Should there be equality between page 040 and page 070? No, if you have carryover income: for example, a March salary issued in April. Since salaries were accrued in March, the tax on it is included in line 040. And the company will deduct it from employees and transfer it only in April. The indicator on page 070 will be less than the indicator on page 040, tax authorities will not consider this an error (letter of the Federal Tax Service dated March 15, 2016 No. BS-4-11/4222). A similar situation occurs with July, September and December payments to employees.

An example of displaying information in field 120

Let's look at an example with a practical situation. The company paid earnings for month 04 in advance on April 28 with the upcoming holidays. At the same time, employees were awarded bonuses according to the order. In addition, employees submitted applications for regular vacations, and accrued vacation pay was transferred in April.

The breakdown of the analytical register for April is as follows:

- April 25 – vacation pay in the amount of 40,000 rubles was transferred;

- April 26 – vacation pay was paid in the amount of 25,000 rubles;

Filling out the block of lines in the second part of the half-year report for these payments is as follows:

- 120 (for payments from April 25) – (May 2, due to vacation payments), the tax is due on the last day of the month – April 30. According to the calendar, the payment deadline falls on a weekend, May 1 is a holiday. This rule is explained in BS 4-11-8312;

- 120 (for payments from April 26) – May 2 – similar situation;

- 120 (based on salary for month 04) – May 02. Salaries were paid ahead of schedule on the 28th. However, this is the last working day of the month, and therefore does not equate to advance payments.

- The tax must be transferred the next day. 04/29 and 04/30 are days off, and 05/01 is a holiday. Accordingly, field 120 reflects the first weekday;

- 120 (for bonus) – May 02. A one-time bonus relates to the general taxation procedure. The reporting procedure is defined in Article 226, paragraph 3. Income tax must be withheld on the day the bonus is transferred, and transferred to the treasury the next day. Transfers due to weekends and holidays are explained above.

Withheld tax, but forgot to pay: how to fill out 6 personal income taxes in such cases

A similar algorithm for reflecting carryover income: if the profit was accrued in the last month of the quarter, it is paid in another period.

Date of UN when providing loans

Savings on interest are also subject to income tax and information is reflected in 6-NDFL.

You need to fill out the line with the UN date in the following cases:

- the loan is transferred in rubles and the interest for using the loan is no more than 2/3 of the refinancing rate;

- the loan is provided in foreign currency, and the rate is within 9%;

- funds in any currency are issued on interest-free terms.

The date of accounting for the profit received in the form of a loan is considered to be the day of the nearest money transfer. Typically this is the date the employee receives their paycheck.

A gift means income received in kind.

Features of tax calculation and withholding

In the course of the operating activities of any company, there are situations in which the withholding of income tax is not followed by its transfer to the state budget. Such oversights occur due to financial difficulties, oversight of the employee responsible for this process, or temporary blocking of the current account.

If such circumstances arise, you should adhere to a simple rule: the sooner the personal income tax is transferred, the less material losses in the form of penalties will be.

Advance payments under the GPC agreement and the employment agreement have a number of differences

What and how to put in line 120

According to the general rule (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation), the employer-tax agent is obliged to transfer the withheld personal income tax to the budget no later than the day following the day when the income was paid to the individual taxpayer.

Exceptions to this rule are given in paragraph. 2 of the same paragraph: in relation to payments made in favor of an individual in terms of settlements for vacations and sick leave, settlements with the budget for personal income tax are made no later than the last day of the month in which these payments were made.

For more information about calculations for sick leave and their reflection in the new personal income tax report, see the material “How to correctly reflect sick leave in 6-personal income tax - an example .

When determining the payment deadline, one should not forget about the provisions of Art. 6.1 Tax Code of the Russian Federation. According to this rule, if the established deadline for paying tax to the budget falls on a non-working day (weekend or holiday), then payment can be made on the working date following this day.

Thus, the date to be shown on line 120 must meet the following criteria:

- If the data for the entire block refers to a standard payment falling within the definition of paragraph. 1 clause 6 art. 226 of the Tax Code, on line 120 indicate the day following the day on the calendar that appears on line 110.

- If the data for the block relates to sick leave payments or vacation payments, line 120 contains the last day of the month to which the payment relates.

- If the day determined according to the rules above falls on a weekend or holiday, a shift in the payment date is required in accordance with Art. 6.1 Tax Code of the Russian Federation. That is, in line 120 you need to enter the first working day following weekends or holidays, due to which the payment cannot be made within the usual established time frame.

Display of advance amount

Payments under a civil law agreement are the basis for the transfer of income income. However, the date of accounting under the civil process agreement differs from the date of accounting for wages.

Table 1. Display of the “advance” date of UN in 6-NDFL

| Type of advance | UN date | Comments |

| Salary | The last day of the month in which the profit was accrued | An advance is not considered income and does not require tax withholding. |

| GPC advance | Day of receiving material reward | Payment for part of the work performed within the framework of the GPC agreement involves the withholding of personal income tax |

The display of the UL date for payments in accordance with the civil and process agreement has one peculiarity: if the customer transferred advances to the employee in the course of his employment, from a tax point of view they are considered as income and are subject to taxation in the same way as profit.

If a company has paid income to a foreign citizen who works in the Russian Federation on the basis of a patent, fixed advance payments are entered in line 050. It is necessary to display the UI date if the advance payments are less than the accrued personal income tax.