4.3 average of 53 ratings

Create, save and display acts for free on our website. Individual entrepreneurs and LLCs can issue a certificate of completion of work without restrictions. The procedure for issuing a certificate is very simple: below, read the step-by-step instructions for generating and sending certificates online from our website.

Free sending of reports via the Internet is provided by Kontur.Accounting - an online service for maintaining records, calculating salaries and sending reports via the Internet. If you do not yet have an accountant, then you can always turn to trusted partners of SKB Kontur for help. Submit your application!

general information

Any company has some assets, and it is important not only to reliably protect them, but also to operate them effectively. To do this, they should be clearly controlled, transferred for temporary possession to other legal entities (without changing ownership), if this is economically beneficial, and this fact should be reflected in the accompanying documentation of the enterprise.

Please note that the legislation does not require the use of any one standard form. Any organization has the right to develop its own, convenient for employees and, in principle, simple sample of an acceptance certificate for goods and materials (inventory assets) - the main thing is that the form contains all the required details, a full list of which we will provide below. If you don’t have time for this, you can do it even more logically and fill out the MX-1 form, because it has several advantages:

- traditional for document management practice and therefore familiar to representatives of various authorities;

- unified and therefore understandable;

- convenient for adjustments - it’s not a problem to add the necessary data to it or delete unnecessary ones.

In practice, this is what most companies prefer, so it can be considered a standard. Just remember that it must be certified in any case so that it complies with the accounting policies of the enterprise.

Who signs it on the customer’s side?

Not all company employees have the right to sign such documentation. If a private entrepreneur works alone, then only he has the right to sign. If he has a staff, then he is obliged to give them the right to sign documents. One-time permission to sign a deed or other paper is also practiced. For this purpose, a power of attorney is issued.

Important! When signing the act, all participants in the process must provide powers of attorney to confirm the authority to endorse the document.

If for each operation you do not draw up a new document confirming the completion of work or provision of services, then this will be a gross violation of the law. This may be regarded as concealing the company's income. Such actions are assessed by the tax service, and the organization may be subject to a large fine. Therefore, you should not take risks, but it is better to draw up and sign the document in advance.

Why is an act of transfer of material assets required?

It is proof of the fact of a change in the user of the property. Its error-free execution implies that the responsibility for the safety of the asset will be borne by the recipient, who will have to pay compensation in the event of loss or damage. With his name on hand, you can safely go to court with a statement of claim to recover the appropriate amount from the guilty party.

The one who gives something for a while is considered a depositor, the one who receives is considered a custodian. Information about these legal entities is necessarily written down in the business paper, along with the period and terms of the agreement. Immediately after the expiration of the agreed period, another document is created - indicating the return of the property.

When performing external operations, it is drawn up as an annex to the concluded business agreement. It also helps to record the fact of the direction of an asset from one structural division of the company to another, as a result of which the control of transferred objects is simplified (especially when branches are geographically remote from the head office and administrations). This approach allows you not to travel for business papers and not to carry them with you, but to use those that are locally available.

Is it needed for individual entrepreneurs?

Agreement with a self-employed person - sample standard document

Not all individual entrepreneurs require the preparation of this document. If the “self-employed person” simply sells products, he does not need this document, but if he accepts orders, provides services or places an order for his company to perform work, then drawing up an act is necessary. You can add any task that is related to the services provided to this documentation and determine the monetary equivalent of payment.

For your information! The Tax Code determines that each service must be remunerated if its performance satisfies the customer. The act confirms the fact that all obligations have been fulfilled.

Application of the act of acceptance and transfer of inventory items

Here are the most common cases of relevance of its design:

- During the inspection, a discrepancy in the quality/quantity of available goods was recorded;

- products are sent for storage;

- products arrive without accompanying documents;

- property is transported from one structural unit to another or redistributed between authorized persons;

- assets are alienated for someone else's benefit by decision of the commission;

- a contract is concluded for short-term use, for a period of several days or even hours.

In all of the above situations, it is permissible to fill out the business paper in question arbitrarily (by entering the necessary details).

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Sample form 2021 simple

To draw up the simplest act, it is enough to prepare a regular table with a list of transferred goods.

But in 2021, when drawing up an APP, it is recommended to use one of the two generally accepted samples of this document. (they can be downloaded for free in word and excel format).

.

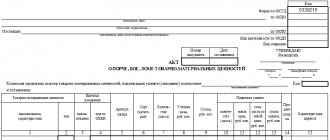

Form MX 1

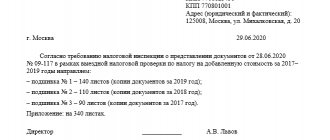

The standard APP template (MX-1) assumes that the following data is entered into the document header:

- name and address of the organization accepting inventory items for safekeeping;

- the name of the structural unit to which the received property will be sent for storage;

- information about the organization transferring the item;

- OKPO codes (of both parties), as well as the number and date of the agreement under which the object is transferred (this information is written in the upper right part of the page);

- number and date of drawing up the act itself.

Sample form MX-1

The main block below records the fact that the property was transferred and accepted.

The period for which the object is left for storage is also indicated there, and a table with the identification characteristics of the accepted values (name, quantity, cost) is also filled out.

MX 3

When goods and materials that were in safekeeping are returned to the depositor, the receiving organization draws up a corresponding act. As an example for its preparation, a unified document form is used - MX-3.

The return certificate is drawn up in two copies.

Its signing by both parties becomes the basis:

- to write off inventory items for warehouse accounting ;

- to receive payment for storage services.

The title part of the document contains information about the storage agreement and the parties who entered into it. Next, a table is given with the characteristics of the returned goods and materials, and after it a list of mutual settlements is indicated, confirmed by the signatures of representatives of both parties.

Sample form MX-3

What is he like?

The simplest act of acceptance and transfer of goods and materials (inventory), the form of which we will separately provide below, is precisely the primary accounting documentation. Therefore, it must contain a detailed description and key distinctive characteristics of those things that become the objects of the transaction:

- purchase and sale;

- deliveries, one-time or regular;

- registration of a lease agreement (relevant not only for real estate);

- responsible storage.

The property described by this paper includes goods, raw materials for the manufacture of products, auxiliary materials such as additives or dyes, spare parts, semi-finished products, containers, and fuel. The main thing is that the work of the enterprise is simplified.

When is it compiled?

Whatever sample form for the act of acceptance and transfer of material assets you choose, remember that it should be drawn up, checked, and signed directly on the day the user of the property changes. This is usually done by the recipient or his authorized representatives: they indicate a specific date for the actual completion of the transaction.

In practice, control over the correct filling and approval is most often carried out by the head of the enterprise. He also determines which of his subordinates will be responsible for storing and ensuring the safety of the asset, as well as what compensation will have to be compensated in the event of damage, theft, or loss of the agreed items.

How to draw up an act of acceptance and transfer of material assets

Keeping in mind two things: firstly, that there is no single form of registration, which means there is a certain freedom in decision-making, and secondly, that there are still mandatory details, without which the document will not be have legal force.

Taking into account both of these points, we propose to act according to the following algorithm:

- Take MX-1 as a basis - understandable, standard and already containing fields for indicating the necessary information.

- You add data that is relevant specifically to your transaction, for example, evidence of product quality, an addition to the contract, the exact number of pieces in the shipment, existing complaints, etc.

- Remove unnecessary (outdated) information.

With this approach, you get the most concise and easy-to-check primary documentation.

Submit certificates of completed work online with us

Convenient to use

Print and send documents from the service. Save time.

Reliable

Your documents will not fall into the wrong hands: after sending they are automatically deleted

Simple and clear

Even a beginner can submit an act online in the service; no knowledge of accounting is needed

Fast

We will fill in the details automatically using the Taxpayer Identification Number (TIN), and instantly evaluate the counterparties.

Economical

No need to waste paper or install additional paid programs

Available

Use the service anywhere in the world where there is Internet

What is contained in the act

First of all, the mandatory details that have already been repeatedly mentioned, and secondly, important details that are relevant for a particular case, for example, about existing defects or the rental period. It is simply necessary to provide a place (point) for indicating claims - so that later there will be somewhere to enter your demands for compensation for damage suffered. If the subject of the transaction is not one object, but a whole group of them, different in type, value, character, this fact also needs to be reflected.

It should be filled out in at least 2 copies - for each party, so that there is an opportunity to subsequently go to court and resolve the controversial issue in their favor.

Content

The form of the acceptance and transfer act is not established by law.

Its content depends on the specific situation. But some general features of the design of an APP should be taken into account by everyone.

Required details

A valid acceptance certificate contains the following details:

- name of the subject of the operation;

- characteristics of the specified product (number, brand, article);

- the person transferring the object;

- the person receiving the object;

- name of the organization transferring the item;

- date of registration of the APP;

- link to the document supplemented by the act (lease agreement, sale and purchase agreement, etc.);

- cost of the object (with and without VAT);

- number of copies of the APP.

If the receiving party has any complaints about the quality of the item received, all comments are recorded in the act itself and indicate the place of transfer of the item.

The effect of the APP can extend to both individual units of goods and their complexes. But the act must indicate and describe all transferred objects.

Acceptance and transfer acts have legal force and limit the list of requirements that the parties can make to each other. In case of disagreements between the parties to the agreement, the APP is used to defend their interests in court.

What form of the act of acceptance and transfer of material assets should be used?

It is not mandatory, but there are standard ones, that is, the most common and universal ones - we will consider them below.

MX-1: features of its filling

It looks like this:

Pay attention to the number and location of fields - they are designed so that you can clearly present all the important data. And the law does not prohibit removing some of them or adapting them to your needs. Why? Because the document itself is proof of a change in the user of the asset - it confirms an already accomplished fact, and does not give permission to carry out a transaction, so it is not subject to particularly strict requirements.

This form is convenient to use as a basis when concluding agreements, leases or temporary possession agreements. When you own the asset, be sure to leave space to record your complaint so that if you receive an item back that is defective, you can state your dissatisfaction and take the matter to court to resolve the dispute. And so that the chances of winning the case are subsequently as high as possible, it is worth immediately indicating as much information as possible about the parties to the transaction and its object (quality characteristics, consumer properties, etc.).

Attention, the document will not be considered valid if it is signed by persons who do not bear any obligations in the event of theft, damage, or partial damage to property.

Sample act of acceptance and transfer of goods and materials between financially responsible persons

Again, the legislation does not provide for one form as mandatory. But a certain practice still exists: for example, catering enterprises and related fields most often use the OP-18 form, and other companies can also adopt it. It is convenient enough to become the basis on which you can easily develop your own primary document, including details in it in accordance with paragraph 2, paragraph 9, article of Federal Law No. 402. The main thing is that it has legal force, and for this it should be approved in the accounting policy by order of the manager and make sure that he gives a whole range of information.

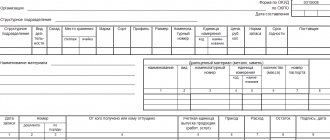

The act of transfer of material assets between MOL organizations must contain:

- name, place and date of filling;

- Full name, passport details of persons receiving and donating assets;

- an employment contract, order, other papers explaining the need to change the user of the property;

- a list of objects, which is most conveniently presented in a table - with serial and inventory numbers, name of the item, units of measurement, number of pieces in the batch, cost;

- confirmation of a competent inspection and absence of claims on both sides;

- a note about how many copies have been created; usually there are two of them, but you can make three - for accounting or inspection authorities.

At the end - the signatures of the manager (or his authorized subordinates) and the MOL. In general, the document looks like this:

Form for the act of acceptance and transfer of material assets to the employee (sample)

It is relevant when the asset remains on the balance sheet of the enterprise, but the one who bears the obligation to store it quits or goes on vacation. In such a situation, it is necessary to appoint a new MOL - according to the following scheme:

- An inventory is carried out to find out if there is a shortage, and its results are included in special reports. You can simplify this process using software from Cleverence, for example, Sklad15.

- The first person signs that he is parting with the agreed upon items, the second - that he receives them.

All this can be done not only directly, but also through a third party, which is the company itself. In this option, more bureaucratic work and confirmation will be required: first, that the objects have returned to the balance sheet of the enterprise and there are no claims against the subordinate who held them, then, that their next custodian has been found and appointed.

Developed on the basis of OP-18, the document looks like this:

Are there any differences between the act of works and services?

Any work process implies material benefits. By result we mean that the customer will pay money for the work done. The service does not have material significance in the literal sense of the word. She is not material. It means creating something or performing a specific task. In accounting, these two positions have different entries and are reflected in the report in different columns. The work and service are prescribed in the contract, on the basis of which the document is left.

Rules for drawing up a contract

What papers can be replaced

It is interesting that in itself it is not a complete equivalent to a purchase and sale or lease agreement, but can only act as an annex to it. But the act of moving material assets, an example of which we gave above, is not the only thing that can be used. You have the right to draw up anything that confirms the need for a decision to transfer an asset and contains mandatory information.

This could be a delivery note - with information about the product, parties to the transaction and other relevant data.

But there are also cases in which the alternative is unacceptable. Typically, these are situations where it is necessary to leave the possibility of making claims (or asserting their absence), for example, when concluding a contract for the purchase of large industrial equipment or expensive property.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Features of the MOL change

The order of action comes to the fore - the following steps must be taken:

- Issue an appropriate order, certified by the manager.

- Check the availability and completeness of assets through inventory.

- Establish the real number of items or the fact of their absence, damage, shortage.

- Let the “old” and “new” responsible employee sign.

We remind you that the act of acceptance and transfer of goods and materials (inventory) to an employee, a sample of which we have already given, can be drawn up directly, between subordinates, or with the participation of an intermediary - the company itself. But in both cases, it is more practical to draw it up in 3 copies: one will be received by the parties, and the third by the accounting department. The main thing is that the document will confirm: the asset is in storage and is in proper condition, and there are no claims against its previous holder - transferring to another position, going on vacation or resigning.

Why is it compiled?

APP is a two-sided document containing a description of the material assets being transferred and received, as well as their value.

Documents

The APP of documents confirms the fact of transfer of the papers listed in the act from one person (individual or legal) to another.

This transfer option is used in the following cases:

- transfer of an employee to a new position;

- dismissal of an employee;

- liquidation of a structural unit, etc.

The APP is always drawn up in two copies (one for both parties), each of which is an original with the necessary details and data.

Product

The APP of the goods confirms that the goods specified in the document were transferred from one person to another.

In the store to the seller

The seller receives a standard APP and signs it, having first made sure that the transferred goods fully comply with the characteristics specified in the document. It is also important to make sure that the goods are delivered on time.

Immediately after signing, the document acquires legal force.

Upon return

The return certificate confirms that the supplier has received the goods back.

It provides a list of inventory items (TMV) with data on their identification indicators:

- type;

- variety;

- labeling;

- quantity, etc.

The reasons and purposes (repair, exchange, restoration, receipt of money paid) for the return are also indicated.

For implementation

Such paper is drawn up if products intended for sale are provided under a storage or commission agreement.

But, if there is no special indication in this regard in the main document, then the transfer and acceptance certificate can be replaced by the TORG-12 invoice.

According to the supply agreement

This APP is an annex to the supply agreement (which is reflected in the contents of the act itself).

In addition to standard data about the product, it contains delivery terms duplicated from the text of the main agreement.

Movable property

APP of movable property is a document confirming the fact of transfer of a vehicle (vehicle). It usually accompanies a contract for the purchase and sale of a car or its rental.

Car

A vehicle's accident manual can be compiled:

- buyer and seller;

- tenant and lessor (vehicle owner);

- customer and car service employee.

Within the organization, the car is transferred for temporary use by order of the manager (without drawing up an act).

Rented

The APP of the vehicle transferred for use is drawn up in accordance with a single legally approved form.

This paper is an annex to the main rental agreement and contains complete information about the technical condition of the car, its configuration, existing damage and defects.

The detail of this description reduces the likelihood of conflict situations when returning the vehicle.

For repairs

The APP for repairs can be drawn up as a separate form or as a clause in the main contract. The description is as detailed as when renting out a vehicle.

Separately indicate:

- date of vehicle acceptance;

- approximate date of completion of car repairs;

- signature of the service station manager;

- official seal of the receiver.

The APP is drawn up in 3 copies (1 for the owner, 2 for service workers) and is accompanied by a service book and registration certificate.

When sent for examination

When sent for examination, the APP indicates not only the characteristics of the vehicle, but also the reasons for its transfer to specialists. Draw up the document in 2 copies.

Real estate

The presence of an APP of real estate indicates that the residential premises were transferred into ownership from one person to another, or leased with all rights and obligations for its maintenance.

Important to remember!

Through the APP, real estate can be transferred to the authorized capital of an organization by one of its founders. It is allowed to draw up similar acts under a property donation agreement.

Purchase and sale of apartments

From the moment of signing such an act, the buyer becomes the legal owner of the property. In this case, the previous owner must provide him with the keys to the apartment and all the papers that will need to be presented to the state registration authorities of residential premises.

According to the lease agreement

APP of this type is attached to a previously signed rental agreement or free use agreement and contains the following data:

- about the location of the property, its cadastral number;

- about the condition of the apartment, the property located in it;

- on the place and date of signing the APP;

- about the serviceability of equipment and devices located in the premises.

The execution of this document obliges the tenant to maintain the original appearance of the property. He also assumes financial responsibility for the property located in the apartment.

When renting housing owned by local authorities, an APP of municipal property is drawn up.

Required details

- name – explains what kind of business paper it is;

- place and full date of filling;

- information about the parties to the transaction (names of companies, full names of managers and their passport details, legal addresses, contact numbers);

- reference to important parameters of the contract (subject, date of conclusion, serial number);

- a detailed and detailed description of the product (quantitative and qualitative indicators, key features, and, if any, defects);

- company seals and MOL signatures.

The cost of stocks sent for storage must also be entered. So the act of acceptance and transfer of the warehouse (the sample of which coincides with the forms already given above) will reflect the value of the asset. To complete the picture, you also need to indicate VAT (or a legal reason for non-payment of tax) - this will help avoid disputes and misunderstandings with the other party.

When concluding transactions directly, information about receipt of full or partial prepayment is optional, but highly desirable, as it significantly simplifies further mutual settlements. If third parties are involved, this information must be provided.

Sample filling

.

.

The form of the certificate of work performed is not prescribed by law, so an organization can develop its own form to fill out and use.

In order to correctly (and in as much detail as possible) draw up the act, you must indicate the following points:

- The serial number of this document for its registration in the accounting department.

- Date of document creation.

- Number of the contract according to which the work completion certificate is drawn up.

- Deadlines for completing the agreed work.

- Volumes of work performed.

- Total cost of work (including mandatory VAT).

- The invoice number that is provided to the customer to pay for the work (service) performed.

- Full name of the customer and contractor, according to the constituent documents.

- Stamp of the seal of both interested organizations.

- Signatures of the contractor and the customer, or persons authorized to sign.

.

.

Legal nuances

The document should be drawn up in at least 2 copies - so that you receive one of each of the “old” and “new” MOL. Only authorized people have the right to sign; if the buyer is a legal entity and is represented by an individual, this fact must be confirmed by a power of attorney.

The contract should indicate that an act of issuing material assets to the employee has been drawn up: the sample application in this case will have the same legal force as the main contract.

This paper helps to successfully resolve controversial issues in court. Because it confirms both the change of user of the asset and the proper quality of the property. The following information indicates the legality and timeliness of the procedure:

- delivery within the agreed time frame and without any associated violations;

- signature of the MOL confirming the correctness of the inspection;

- coincidence of the number of product units;

- no claims against the counterparty.

Transfer of documentation upon change of director (managing officer)

Most often, a transfer deed is used when changing the head of an enterprise. Because it involves the transfer of important information. These include:

- documents received upon registration of the enterprise (Charter);

- licenses allowing the company to conduct special types of activities;

- accounting reporting forms;

- results of inspections carried out by regulatory authorities (tax, etc.);

- certificates of ownership of property (buildings, equipment, other types of property);

- agreements with counterparties;

- payment documentation.

The sample and procedure for filling out when changing the manager is different from others; the presence of witnesses (employees of the organization) is required. Sometimes a notary is involved when drawing up and signing a deed of transfer. This will ensure the legality of the transfer. The difficulty of registration lies in the fact that before drawing up the document, an inventory of all papers is carried out.

Sample act of acceptance and transfer of documents (doc)

Storage of primary documentation

According to Article 29 of Federal Law No. 402, it is carried out for 5 years - to meet the needs of accounting. The tax requirements are somewhat more modest - 4 years (based on paragraph 1 of Article 23 of the Tax Code of the Russian Federation), but only in the general case. If you receive losses, evidence of expenses cannot be archived for at least 10 years.

If you need an electronic version of the acceptance certificate for goods and materials (material assets), you can download a sample form from here:

- for goods;

- for property;

- for storage (xls format).

Number of impressions: 7428