Technological progress is modernizing the records management system, but in government agencies the “paper code” still has significant weight. Among the many clerical tricks, an inventory is an important component. The list of certificates and receipts not only confirms the fact of provision, but also eliminates their duplication in the future at the request of the competent authorities. Read on to learn how to correctly compile a list of documents for the tax office, a sample of how to fill it out, and details of submission.

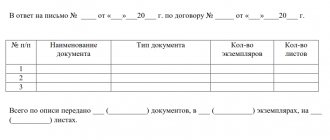

Inventory of documents for the tax office: sample

Why do you need to make an inventory of transferred documents?

An inventory of documents is necessary to record the fact of their transfer to the addressee, which can be either a government authority (IFTS, court, etc.) or a counterparty under the contract.

Drawing up an inventory is usually resorted to in situations where it is required to transfer not just one document (application, claim, certificate, etc.), but a certain set or set of documentation. When working remotely, it is necessary to exchange electronic documents with employees Start exchange

The inventory is most widespread when working with traditional paper documents. However, it is possible to compile an inventory when sending information electronically. Especially if this happens via regular email.

Consequences of failure to provide

It is important to keep a list of documents for transfer to the tax office as evidence of their transfer. For failure to submit the requested papers by the taxpayer (fee payer, insurance premium payer, tax agent) within the prescribed period, fines will be collected:

- 200 rubles - from the organization for each document not submitted (clause 1 of article 126 of the Tax Code of the Russian Federation);

- from 300 to 500 rubles - from the head of the organization (note to Article 2.4, Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Standards for compiling an inventory of documents

There are no uniform legal requirements for compiling an inventory of documents. Therefore, depending on the purpose of submitting documentation, both unified forms (for example, when sending registered letters) and those developed by the receiving or transmitting party independently can be used.

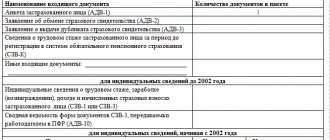

In any case, the inventory must contain information about the type (name, details) of each of the transferred documents (for example, purchase and sale agreement No. 1 or personal income tax declaration for 2019) and the number of copies. Additionally, if necessary, other information may be indicated - about the number of sheets of each copy of the document, the total number of sheets of all documents specified in the inventory, recipients, reasons for transfer, etc.

How to apply for an income tax refund

The declaration along with the documents is submitted to the Federal Tax Service at the place of permanent registration of the individual. This can be done by coming to the inspection office and submitting the documents in person; in this case, you need to print out a second copy of the declaration for yourself, on which they will put a mark of acceptance.

You can send the entire set by valuable letter with an inventory. Please note that the register of attached documents to 3-NDFL, the form of which we discussed above, cannot be considered such an inventory - it is filled out on a special postal form, where a stamp with the date of dispatch and the signature of a postal employee are affixed.

It is possible to prepare documents for income tax refund and send a declaration electronically, which requires the taxpayer to have an electronic digital signature. The attached documents, pre-scanned, are uploaded as files and sent to the Federal Tax Service through the “Taxpayer Personal Account” on the Federal Tax Service website.

The deadline for filing a personal income tax deduction return is not limited - it can be submitted throughout the year for the previous 3 tax periods. If, in addition to the deduction, an individual declares his income, he needs to meet the deadline of April 30 (in 2021, the declaration for 2021 must be submitted no later than May 3).

Register of documents for 3-NDFL form (sample)

List of documents to be submitted to the tax office

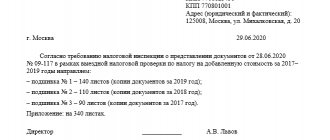

When communicating with the tax authority, it is only necessary to draw up an inventory if the documents are transmitted in classic paper form. The legislation does not establish requirements for the form of such an inventory. Therefore, it can be compiled in any form. Moreover, the inventory can be drawn up as a separate document or included as part of a cover letter (clause 6 of Appendix No. 18 to the Order of the Federal Tax Service of Russia dated November 7, 2018 No. MMV-7-2 / [email protected] ).

ATTENTION

When sending documentation to the Federal Tax Service in electronic form, there is no need to create an inventory, because The composition of the documents in this case is recorded automatically by the corresponding software.

Receive requirements from the Federal Tax Service and send the requested documents via the Internet Connect

As for the contents of the inventory, it is advisable to reflect not only data on the documents being transferred (date, number, name, number of sheets and copies), but also information regarding the reasons for their transfer, as well as the sender and addressee. Thus, this inventory will additionally contain the details of the organization (IP) transferring the documents, as well as the number and date of the request or other document from the Federal Tax Service, in connection with which the documentation specified in the inventory is provided. It would not be amiss to number the documents being submitted in the inventory, and not just provide a list of them.

Such preparation of the inventory will help, in the event of any further claims from the Federal Tax Service (or questions during the consideration of the dispute in court), to quickly navigate the composition of the transferred documents and promptly submit the necessary explanations or objections.

opis.jpg

The absence of a register is not considered a violation - clause 1.16 of the Procedure for filling out the 3-NDFL declaration (approved by Order of the Federal Tax Service of the Russian Federation dated December 24, 2014 No. ММВ-7-11/671) states that this is a taxpayer’s right, not an obligation. In this case, the register for 3-NDFL along with the attached documents will be filled out by the tax authorities themselves. They will also attach a new register if there is a discrepancy between the data specified by the taxpayer and the actual number of pages in the documents.

Inventory of documents for transfer to the archive

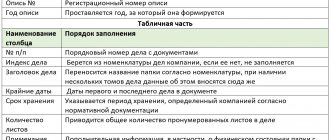

When transferring documents to the archive for each case, an internal inventory of the documents included in it is compiled. The form of such an inventory is given in Appendix No. 27 to the rules, which were approved by order of the Ministry of Culture of Russia dated 03/31/15 No. 526. And the procedure for its preparation is described in sufficient detail in clause 3.6.17 of the Rules for the work of archives of organizations (approved by the decision of the Board of the Russian Archive dated 02/06/02 ).

In particular, it is indicated that the inventory must be drawn up on a separate sheet and signed by the compiler. The internal inventory contains information about the serial numbers of the case documents, their indexes, dates, headings and sheet numbers of the case. And at the end of the inventory there should be a final record, which indicates in numbers and in words the number of documents included in it and the number of sheets of the internal inventory. In this case, the specific content of documents in the “archival” inventory is not required to be disclosed. Since documents of the same type are placed in the case, a heading (name of the counterparty, full name of the employee, etc.) is sufficient.

How to check the list

If a particular person still bothers to fill out the register for 3-NDFL for 2021, then the task of the Federal Tax Service employees will be to check the correctness of its registration. First of all, they will check the number and types of materials sent with those noted in the register. By the way, exactly the same figure should appear on the title page of these reports.

If you find an error, please select a piece of text and press Ctrl+Enter.

One of the important aspects of filling out the 2021 3-NDFL declaration form is the register of documents attached to it. It is sometimes called a register of supporting documents. What is it? And what should I write in this addendum to the declaration? We will try to answer these and other questions in the article.

To get started, we will provide links to fill out the form:

- The blank form 3-NDFL 2021 can be downloaded from this link.

- The program for filling it out is available for download at this link.

- An example form can be downloaded as a sample by clicking here.

Inventory of documents for transfer to another organization

The legislator has not established any special rules for preparing an inventory when transferring documents to a counterparty. Therefore, if the specific form of the inventory is not separately agreed upon by the parties (for example, as an annex to the contract), then it can be drawn up in free form. The main requirement is that the inventory must make it clear what, in what quantity, when, in connection with what, from whom and to whom it was transferred.

As in the case of the “tax” inventory, in addition to the actual details of the transferred documentation, it is worth supplementing the inventory with data on the grounds for the transfer (for example, making a reference to a clause in the agreement or correspondence), as well as an indication of the transferring and receiving parties. To certify the inventory, you must indicate your full name, position, affix the signature of the compiler and the date of compilation.

Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

Simple taxes

Please explain, can I get a tax deduction from the state if I purchased a house in the suburbs in 2021? I became a pensioner a year ago, but I’m still working. Please explain what documents need to be collected?

Good afternoon. Tell me what documents need to be filled out and prepared and from whom are the documents submitted from the husband or wife? We sold the apartment in 2021. (was owned by the husband), and purchased an apartment within a month in 2021 (recorded as the property of the wife). My husband owned the old apartment for less than a year. Sale and purchase were carried out for the same amount (RUB 2,060,000).

We recommend reading: Contract agreement, taxation of insurance premiums 2021

Responsibility

Desk and on-site inspections

If a businessman does not submit documents within the prescribed period, he will be fined in the amount of 200 rubles for each document not submitted (clause 1 of Article 126, clause 4 of Article 93, clause 6 of Article 93.1 of the Tax Code of the Russian Federation). Moreover, the amount of the fine increases to 400 rubles for each document if within a year he commits a similar repeated violation (clause 2 and clause 3 of Article 112, clause 4 of Article 114 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 24, 2012 No. 03 -02-08/64).

Let us note that a taxpayer cannot be held accountable if the number of documents he has not submitted is not reliably determined. Establishing the amount of the fine based on the presumable availability of at least one of the requested types of documents is unacceptable (letter of the Ministry of Finance of Russia dated October 17, 2013 No. 03-02-08/43377).

Judicial practice CollapseShow

If the requirement to submit documents necessary for a desk tax audit is not fulfilled by the taxpayer due to the request for documents that are not related to the subject of the audit, or due to the uncertainty of the documents requested, then there are grounds for applying the liability provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, not available (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 04/08/2008 No. 15333/07).

In addition, for failure to submit documents to the inspection within the prescribed period, an administrative fine is imposed on officials - from 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Counter checks

In this case, a person’s refusal to submit documents in his possession with information about the taxpayer at the request of tax authorities is punishable by a fine of 10,000 rubles (clause 2 of Article 126 of the Tax Code of the Russian Federation).

Judicial practice CollapseShow

In paragraph 2 of Art. 126 of the Tax Code of the Russian Federation, the subject of the offense is not the taxpayer himself, but a third party who has documents containing information about the taxpayer of interest to the tax authority (clause 18 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71).

Also, for failure to submit documents to the tax authorities within the prescribed period, an administrative fine is imposed on officials - from 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

If the document storage period has expired

In our opinion, if the requested documents are not presented due to the expiration of their storage period, then no fines under Art. 126 of the Tax Code of the Russian Federation is out of the question.

Judicial practice CollapseShow

The court found that the required documents were not provided due to the expiration of their storage period. Therefore, the arbitrators found it unfounded to hold the applicant to tax liability under clause 2 of Art. 126 of the Tax Code of the Russian Federation due to the absence of his guilt (resolution of the Federal Antimonopoly Service of the Far Eastern District dated June 3, 2013 No. F03-6629/2012).

The arbitrators note that according to sub. 8 clause 1 art. 23 of the Tax Code of the Russian Federation, taxpayers are obliged only for four years to ensure the safety of documents necessary for the calculation and payment of taxes, incl. documents confirming receipt of income and expenses.

Judicial practice CollapseShow

With regard to bringing the taxpayer to responsibility provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, for failure to submit an invoice dated October 31, 1997 to the tax authority, the courts proceeded from the absence of grounds for bringing to responsibility due to the expiration of the storage period for primary documents (Resolution of the Federal Antimonopoly Service of the Ural District dated November 17, 2009 No. F09-8891/09-S3 ( determination of the Supreme Arbitration Court of the Russian Federation dated March 4, 2010 No. VAS-1745/10)).

Footnotes

CollapseShow

- "GOST R 7.0.8-2013. National standard of the Russian Federation. System of standards on information, librarianship and publishing. Record keeping and archiving. Terms and definitions" was approved by order of Rosstandart dated October 17, 2013 No. 1185-st (hereinafter referred to as GOST R 7.0.8-2013). come back

- "GOST R 6.30-2003. State standard of the Russian Federation. Unified documentation systems. Unified system of organizational and administrative documentation. Requirements for the preparation of documents” was approved by Decree of the State Standard of Russia dated 03.03.2003 No. 65-st (hereinafter referred to as GOST R 6.30-2003). come back

- https://asozd.duma.gov.ru/main.nsf/%28Spravka%29?OpenAgent&RN=688389-6 Go back

- Appendix No. 1 to the Procedure for receiving and delivering domestic registered mail, approved by Order of the Federal State Unitary Enterprise Russian Post dated May 17, 2012 No. 114-p. come back

- https://pochta.ru/form?type=F107 Go back

Look through the demo version of the printed magazine

List of register of documents for deductions

To the regular personal income declaration. persons are not required to provide documents. But to submit an application for a deduction, the register of documents will have to be filled out without fail. After all, the deduction is provided only along with supporting documents. We will understand all the features of the documentation and register for deductions of different types.

The list of documents required to submit form 3-NDFL to the tax office is not defined for an ordinary taxpayer. But according to the letter from the Federal Tax Service of the Russian Federation, there is still a certain register of documents that confirm the right to a property type deduction.

This notice specifies the documents that need to be attached to the 3-NDFL declaration form. These include:

- Agreement on the acquisition of real estate in various forms (purchase or sale, deed of gift, inheritance, etc.).

- Documents on payments of funds to the seller.

- Ownership of real estate, certificate of registration in the state register.

- Agreement on the transfer or acceptance of residential premises.

- Application for redistribution of compensation between husband and wife.

- Mortgage agreement and certificate of interest that has been paid, as well as a loan repayment schedule.

- Certificate filled out in form 2-NDFL.

All of the listed papers are submitted along with the declaration in form 3-NDFL.

To approve the right to a social deduction, the following documents may be required:

- Certificate of education (original and copy).

- Agreement for treatment at the clinic on an extra-budgetary basis (a photocopy of it is additional).

- Documents confirming all transfers made to charitable organizations.

- Documents on completed payments.

- Various types of receipts for medications.

- Permission issued by the educational institution (photocopy).

- Permission issued by a medical institution (photocopy).

- Extracts on receipt of medical prescriptions and their implementation.

- A document that can confirm that the applicant is related to the person who received treatment or training.

- Help 2-NDFL.

- If required, you must provide a document confirming information about full-time study.

Attention! The papers that are attached to the declaration of standard 3-NDFL for tax with losses on education must necessarily include copies of a certificate or other document that can confirm the right of the institution to carry out educational activities. If there are no licenses, a basic charter can be provided, which approves the status of the institution in which the process of acquiring knowledge takes place.

Additional supporting documents

| Any user will be able to fill out a 3-personal income tax form online on our website in literally 15 - 20 minutes and order a free check by our specialists. It is very important to us that you ultimately receive a tax return without errors and with the maximum possible deductions according to your situation. Below are instructions for filing a tax return with the inspectorate, as well as a list of additional documents that may also be needed. Fill out the 3-personal income tax declaration online |

Print out the completed 3-NDFL tax return in 2 copies (only one-sided printing is allowed) and pay attention to the following:

- on the title page of the declaration, almost at the very bottom, on the right, above the block “To be filled out by a tax authority employee,” you need to indicate the number of sheets of supporting documents that you will submit along with the declaration;

- on the Title Page of the declaration, at the very bottom, on the left, in the block “I confirm the accuracy and completeness of the information specified in this declaration” - you must put a Signature and Date;

- on each printed sheet of the declaration, at the very bottom, starting with Section 1, you must put a Signature and Date.

You can find out what documents need to be attached to the declaration in the Tax Deductions section of our website.

In most cases, if the purpose of preparing a declaration is a tax refund, you need to attach a Tax Refund Application (form and completed sample below, in paragraph 1), as well as a certificate in Form 2-NDFL and documents confirming expenses.

You can submit a declaration to the tax office in person, through a representative by proxy, or by Russian post with a list of the contents.

Please also pay attention to our article: In what cases does the inspector have the right to refuse to accept a 3-personal income tax declaration

Additional documents that may also be needed along with the declaration:

1. Tax refund application Download the completed sample

In the case of preparing a tax return 3-NDFL for the purpose of obtaining tax deductions (tax refund), an Application for Tax Refund is also submitted along with the declaration.

If you filled out the declaration on our website, then after paying for it, the Application can also be filled out online in your Personal Account!

Please note the following:

1) on the first sheet of the Application, line-by-line data - amount to be returned, OKTMO Code and Budget Classification Code - you will find in Section 1 of the declaration you prepared;

2) after filling out the Application, click “Save as...”, otherwise the entered data may not be saved.

2. Register of supporting documents when submitting the 3-NDFL declaration Download the completed sample

In case of filing a tax return 3-NDFL, the taxpayer has the right to fill out and attach the Register of supporting documents (2 copies). If he does not do this, then the tax inspector himself will form one. Also, the inspector can prepare a new Register if there are any inconsistencies or errors in the Register provided by the taxpayer.

The Register provides additional fields where you can add other documents that are not directly named in it.

3. Inventory of the attachment Download the form Download the completed sample

If a 3-NDFL tax return is submitted by mail, the taxpayer is required to draw up an Inventory of Attachments in 2 copies indicating all the documents being sent.

4. Application for distribution of property deduction Download completed sample

In the case of preparing a tax return 3-NDFL for the purpose of obtaining a property deduction in connection with the purchase of housing in common joint ownership or in the sole ownership of one of the spouses and deciding to establish the proportion of which of the spouses will receive the deduction and in what amount, it is also necessary to attach a corresponding application on the distribution of deductions between spouses.

5. Agreement on the distribution of actual expenses Download the completed sample

In the case of preparing a tax return 3-NDFL in order to obtain a property deduction in connection with the purchase of housing in common shared ownership and a decision to establish the actual costs of the purchase of each of the owners, that is, which of the spouses will receive a deduction and in what amount, it is also necessary to attach relevant Cost Sharing Agreement.

6. Application for the distribution of property deductions regarding mortgage interest Download the form Download the completed sample

From 01/01/2014, taxpayers - spouses have the right every year anew, according to the Application, to distribute the actual mortgage interest paid, that is, to determine who will receive a deduction and in what amount. To do this, you must attach the appropriate Application for the distribution of interest paid.

Source: https://ndflservice.ru/dopolnitelnie-soprovoditelnie-dokumenti

Deadlines for submitting documents

Desk and on-site inspections

Documents that were requested during a tax audit are submitted within 10 working days (20 days when checking a consolidated group of taxpayers) from the date of receipt of the corresponding request (clause 3 of Article 93 and clause 6 of Article 6.1 of the Tax Code of the Russian Federation).

Example 4 CollapseShow

On October 30, 2015, the businessman received a request to submit documents for a desk audit.

In this case, the deadline for submitting documents is November 16, 2015. The fact is that only working days are taken into account: November 2, 3, 5, 6, 9, 10, 11, 12, 13, 16.

If the individual entrepreneur is not able to submit the required documents within the established period, then you can ask for a deferment (Example 5). This must be done within the day following the day the request was received. The notification indicates the reasons why the documents cannot be submitted on time and the new deadline for submitting documents (clause 3 of Article 93 of the Tax Code of the Russian Federation).

Within two days from the date of receipt of such notification, the head (deputy head) of the inspection has the right to extend the deadline for submitting documents or refuse, for which a separate decision is made (clause 3 of Article 93 of the Tax Code of the Russian Federation).

Let us note that the arbitrators have repeatedly said that the legislation does not allow for an unmotivated, arbitrary refusal by tax authorities to extend the deadline for submitting documents if there is a corresponding request from the taxpayer.

Example 5 CollapseShow

Judicial practice CollapseShow

The Tax Code of the Russian Federation provides, along with the right of the tax authority to extend the deadline for submitting documents, the right of the taxpayer to apply for an extension of such a period if the required documents cannot be submitted within the specified period (resolution of the Federal Antimonopoly Service of the Volga District dated January 22, 2009 in case No. A55-8517/ 2008).

In case of refusal to extend the deadline for submitting documents, the tax authority is obliged to justify such refusal (resolution of the Federal Antimonopoly Service of the North-Western District dated November 12, 2010 in case No. A44-152/2010).

When extending the deadline for submitting documents, tax officials take into account the reasons indicated by the taxpayer, the volume of documents, the presence of the fact of partial submission of documents, and the time frame within which the audited person, upon notification, can submit documents. Thus, the Federal Tax Service independently determines for what period it is possible to extend the deadline for submitting documents (letter of the Ministry of Finance of the Russian Federation dated August 5, 2008 No. 03-02-07/1-336).

Note CollapseShow

If the tax authority sends a request by registered mail, the date of its receipt is considered to be the 6th working day from the day the letter was sent (clause 6, article 6.1, paragraph 3, clause 4, article 31 of the Tax Code of the Russian Federation). In this case, the specified period does not depend on the actual date of receipt by the taxpayer of this requirement (letter of the Ministry of Finance of the Russian Federation dated May 6, 2011 No. 03-02-07/1-159).

Counter checks

The requirement to submit documents in case of counter checks must be fulfilled within 5 working days from the date of receipt. The second option is that within the same period the taxpayer reports that he does not have the specified documents (clause 5 of Article 93.1 and clause 6 of Article 6.1 of the Tax Code of the Russian Federation). For a sample notice for this situation, see Example 7.

Example 6 CollapseShow

On November 2, 2015, the individual entrepreneur received a request to submit documents regarding the counter-inspection. In this case, what is the deadline for submitting documents? 11/10/2015, since only working days are taken into account: November 3, 5, 6, 9, 10.

Example 7 CollapseShow

The deadline for submitting documents can also be increased at the request of the person from whom the documents are requested (clause 5 of Article 93.1 of the Tax Code of the Russian Federation).

Taxation system and tax authorities of Russia

All persons registered or permanently residing on the territory of the Russian Federation pay taxes on their income and property.

The country's tax system is divided into three levels:

- federal;

- regional;

- local.

Correct execution of documents is the basis of working with the Federal Tax Service

The legislative framework of the Russian tax system consists of:

- Constitution;

- Tax Code of Russia;

- Criminal Code of Russia;

- Legislative acts of the constituent entities of the Russian Federation;

- Regulatory legal acts of local government bodies;

- Explanations from authorized government bodies and court decisions.

Understanding the principles of the tax system will simplify interaction with the authorized body

In this case, taxation affects the following points:

- principles of taxation, amounts of payments and cases of exemption from them;

- payment procedure;

- rights and obligations of the state represented by authorized bodies and taxpayers;

- sanctions for non-performance, improper performance or deliberate evasion of obligations;

- control over the fulfillment by the parties of their obligations.

Important! Tax authorities are prohibited from requiring resubmission of documents, except for the cases established by clause 5 of Art. 93 Tax Code of the Russian Federation. Confirmation of the submission of documents at the request of the tax authority are: an inventory, a register with a mark from the Federal Tax Service of Russia on receipt; postal receipt, list of attachments in a valuable letter, notification; special operator's receipt confirming receipt of documents.

Despite the complexity of the tax collection system, the biggest problem for the average payer is filling out reporting forms and their timely and complete submission to the tax authority. A list of documents for the tax office is a sample auxiliary document when communicating with an authorized body, which significantly saves time and helps to avoid conflicts, and also prevents the possibility of re-submitting the subject of the audit.