Acceptance of an object of fixed assets in an organization occurs according to an inventory card to record all operations that are carried out with the object during its use. For this purpose, companies use form OS-6. For small enterprises, a special form OS-6b has been developed, which is called an inventory book for recording fixed assets.

The difference between forms OS-6 and OS-6b is that the first includes information about all fixed assets accepted by a small enterprise, and the second is intended for filling out information for each individual object.

Purpose of the document

Acceptance of fixed assets for accounting occurs on the basis of an inventory card in the OS-6 form. Small organizations have the right to use a simplified register system and submit less complex reporting.

In this regard, small-sized enterprises may not draw up an inventory document for each asset received by the company.

For companies with a small number of non-current assets, it will be enough to create a consolidated journal recording all actions (acceptance, movement, disposal) performed with the property.

This type of document is called an inventory book and has the form OS-6b.

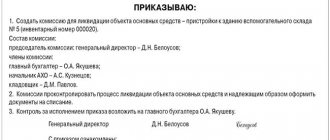

Inventory is carried out in companies by a special commission, the composition of its members and the timing of the implementation are indicated by order of the director.

If during the work of the commission it is discovered that fixed assets are not accepted for accounting or are missing from it, and also if the initial information in the inventory book contains incorrect data, then the commission’s task is to include the correct information in the inventory. An inventory of the name of the OS is filled out in accordance with their purpose.

Fixed assets located outside the territory of the enterprise can be inspected only after their return. In the event that the commission identifies OS objects that are unsuitable for further use, they are entered into a special list recording the cause of the malfunction.

Accounting for fixed assets in small companies is carried out on the basis of an inventory book. It contains information about both the presence of OS objects and their movement.

general information

Large enterprises use OS-6 forms, and for small ones they have developed their own. Form OS-6b was approved by the State Statistics Committee, Resolution No. 7 of January 21, 2003. Since 2013, the form has ceased to be mandatory for use. Companies can use their own forms, developed taking into account convenience and necessity. But OS-6b is actively used, despite this, because it contains all the necessary information and is familiar to experienced workers and employees of inspection bodies.

The management of the organization decides which forms to use, unified or their own. This choice must be recorded in the accounting policy.

Who fills it out?

Filling out the form falls on the shoulders of the company's accountant.

The inventory book form records information about fixed assets stored on the territory of the enterprise, leased and written-off fixed assets.

When an asset is deregistered (regardless of when it is sold or moved for repair work), an entry is made in the journal.

Which form should I use?

To fill out the accounting information for fixed assets in the organization, the inventory journal form OS-6b is used.

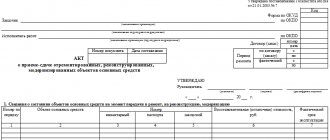

It is drawn up in a single version on the basis of acts OS-1, OS-1a, OS-1b.

The book is maintained simultaneously for each type of primary document and is actually compiled using inventory cards.

Filling out OS-6b upon receipt of OS objects

The inventory book in form OS-6b consists of a title page and a list of information about the property.

The first sheet of form OS-6b contains the name of the organization or division (if necessary), OKPO code.

Next, the starting date for filling out the book is written down, below is the full name of the financially responsible person with the designation of his personnel number.

The second page of the form consists of a table. Information about the property accepted for accounting is entered in the rows and columns. Each fixed asset is recorded on a separate line.

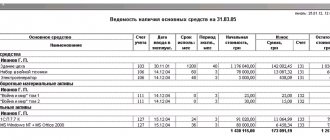

Numbers and meaning of columns of the OS-6b form:

- Serial number of the registered property.

- Name of the object registered with the company (recorded on the basis of the acceptance certificate).

- Fixed asset number (inventory).

The following columns in form OS-6b reflect information about the acceptance of property for registration of a small enterprise:

- Details of the act (number, date), which is the fundamental document for putting the facility into operation.

- Full date (day, month and year) of acceptance of the asset for accounting.

- The structural unit (if any) that accepted the asset.

- Last name and initials of the employee responsible for storing the fixed asset.

- The cost of the property including all costs incurred.

- The period of use of the fixed asset (useful).

Columns 4, 8-9 are filled in on the basis of a signed act of acceptance and transfer of property for subsequent use.

The initial cost consists of all the company's expenses incurred for the acquisition and commissioning of fixed assets (less VAT).

In the course of the company’s economic activities and the use of acquired property in it, the property is revalued.

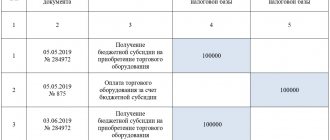

To reflect the results of the revaluation of this, you should additionally enter information about the object into the inventory summary book in columns 12 to 14:

- Date of revaluation.

- Conversion factor.

- The final cost received after the events.

Sometimes property is moved from one unit to another, written off due to moral or physical wear and tear. All of these transactions are also recorded in the inventory book.

When moving the OS, log columns 10-11 and 15-18 are filled in:

- 10 - accounting for depreciation of a fixed asset (the accrued amount as of the date of disposal, movement or write-off of property);

- 11 - residual value (difference between 8 and 10 columns);

- 15 - details of the document on the basis of which the external movement or disposal of property is carried out;

- 16 - changed location of the object within the organization, indicate the name of the structural unit;

- 17 — full name of the employee appointed responsible for maintaining the safety of property at the new location;

- 18 - reason for disposal or write-off (for example, sales contract number).

Using the inventory book, depreciation groups are distributed according to the place of operation, or some other characteristic.

The document also takes into account leased property. In this case, the inventory number of the object in the book indicates the one assigned by the lessor.

Every month, the book data is summarized and compared with synthetic accounting data (accounting for the arrival and departure of fixed assets).

Each fixed asset object has its own inventory number. Even if the property consists of several items (parts), this number is repeated on all components of the asset.

Rented funds (under safekeeping) are accounted for in a different statement.

If the inventory of property cannot be carried out in one day, then the building where the property that has not yet been inspected is located is sealed before the commission resumes its work. Fixed assets are classified during the period of their accounting into groups that include objects.

and sample

Below we offer a standard form OS-6b and a completed example of a consolidated accounting journal for acquired assets for a small enterprise.

Inventory book form OS-6b in excel -

Sample of filling out form OS-6b upon receipt of fixed assets - ecxel

What the completed form looks like:

Maintaining a book of fixed assets

Entries in the book are made on the basis of other documents:

- OS-1 (or OS-1a, b) - upon admission (the date on the papers must match);

- OS-2 - during internal movement of an object;

- OS-4 (or OS-4a, b), if there was a write-off of objects.

Important! The inventory book is kept in one copy. This is what an accountant does. After the end of the accounting period, the document is sent for storage for 5 years.

Download the inventory book (form OS-6B). Form and sample

Download sample forms for accounting for fixed assets at an enterprise: Form OS-1.

Filling out the act of acceptance and transfer of fixed assetsForm OS-1a. Filling out the building acceptance certificateForm OS-2. Invoice for internal movement of fixed assets Form OS-3. Certificate of acceptance and delivery of fixed assets after repair Form OS-4. We fill out the act on write-off of fixed assetsForm OS-4A. Vehicle write-off certificate Form OS-6. Inventory cardForm OS-14. Certificate of acceptance and transfer of equipmentForm OS-15. Certificate of acceptance and transfer of equipment for installationForm OS-16. Defective actOrder for write-off of fixed assetsRetirement of fixed assets (postings, examples)Accounting for the lease of fixed assets (entries, examples)Accounting for the receipt of fixed assets (documents, postings) Methods for calculating depreciation of fixed assets

Rules for filling out the register

The OS-6b book consists of a title page and a tabular part, while there can be quite a lot of internal sheets.

The title page displays information about the owner of the OS, and also indicates the period for which the book was opened. Mandatory details are the position and full name of the employee responsible for maintaining the book.

Information about each OS object is entered in a separate line (and only in one). That is, a record about one object is made once, and as the situation with the object changes, new information is added to the line (up to and including deregistration of the object).

There are only 18 columns in a line. When revaluing an asset, information about this is entered into gr. 12–14, when moving - in gr. 15–17, and when deregistered (sale, write-off) - in gr. 18.

IMPORTANT! In the columns where the amount of depreciation should be indicated, information about the depreciation accrued for the entire period of operation should be displayed.

Design graph

To fill out a card for an inventory item, the accountant needs to submit:

- transfer deed or invoice;

- technical certificate;

- another document that will display the action performed on the OS, for example, write-off, overhaul, acquisition, sale, etc.

When filled out, each card must receive its own number, which is placed in the corresponding line. Other columns contain information related to the OS.

So, in the card for each object you should enter:

- the date of completion, it must coincide with the date of the transfer deed;

- classifier code;

- No. of depreciation group;

- inventory number assigned to the object;

- serial number, which can be taken from the technical passport, acceptance certificate;

- the date of acceptance for accounting, which corresponds to the date of inclusion of the property in the fixed assets, it also coincides with the date of the acceptance certificate;

- date of write-off from accounting, when necessary;

- information about the location, manufacturer, series data, type (for construction), model, brand, everything that can be taken from the technical documentation.

Further, the text form contains 7 sections:

| First section | Filled in with information about the OS at the time of transfer under the transfer deed. If the company acquires new property, then the section is not filled out. |

| Second | This should include data on the initial cost of the property and the period of its use. To be completed at the time the property is registered. |

| Third | Information about revaluations, if they were carried out, i.e. the section can only be filled out while using the OS. As a result of revaluation, the value of the fixed assets is recalculated to bring it closer to the market value. After each revaluation it is necessary to enter in the section:

|

| Fourth | This section contains data on movement (receipt, internal movement between departments, write-off, disposal). |

| Fifth | The section contains information regarding operations carried out with the OS that changed its value. These may include completion, re-equipment, repair, modernization, etc. |

| Sixth | Designed to enter information about the company's costs for repairs. |

| Seventh | The individual characteristics of the OS are described here. |

After registration, the card must be signed by the responsible accountant.

Form T-13 is required to generate a time sheet. How tax calculations are carried out on the amounts of income paid to foreign organizations and taxes withheld - we will tell you here.