Receiving a large sum as a gift or winning a lottery is the cherished dream of any person, both a gambler and a non-gambler. Receiving such a “gift of fate” causes euphoria and joy. But do not forget that the larger the amount of such a gift, the greater the amount you will have to pay as tax to the state budget. Even the simplest lottery game is a kind of obligation, since in addition to the rules and rights of the party, it also contains obligations towards the winner. Ndeposit for winnings equal to 13%. According to current Russian legislation, before the amount is credited to an individual’s account, it is necessary to pay what is required of lottery services.

Differences in tax on lottery and share

The percentage charges on lotto winnings and the promotion prize charges will differ significantly. Agree, there is a difference in giving the state 35% of the amount of a lucky ticket or only 13% of the lotto prize.

If you win a promotional prize from a chip manufacturer, cigarette manufacturer or hardware store, this will be considered a promotional win. In this case, the tax percentage will be 35% of the total value of the lotto winnings.

Additionally, the promotion is often referred to as a “sweepstakes incentive.” Participation in it can be absolutely free or almost free. You don't have to pay extra money to participate in a drawing from a chip manufacturer if you've already bought a pack of it.

Personal income tax on lottery winnings, unlike promotions, is only 13%.

IMPORTANT! If you are unable to pay interest to the state for too expensive and “suddenly fallen happiness,” you have every right to refuse to receive the “big jackpot” in favor of its cash equivalent.

You can read more about tax rates in clauses 1.2 of Article 224 of the Tax Code of the Russian Federation.

Responsibility for non-payment of tax

If you do not pay personal income tax, then in the event of significant winnings, arrears may result in criminal liability. A tax debt is considered large if it is equal to:

900 thousand rubles, if this exceeds 10% of the amount of taxes payable over three years.

2.7 million rubles without reference to years and interest.

Art. 198 of the Criminal Code of the Russian Federation

The minimum penalty is a fine of 100,000 rubles, the maximum is prison for a year. If you voluntarily pay the arrears, penalties and fines, you will be released from punishment for the first time.

If the personal income tax arrears do not amount to a criminal offense, the tax penalty is 40% of the amount. They will be fined separately for failure to submit personal income tax returns: they will be charged 5% of the amount of tax not paid on time for each full or partial month of delay, but not more than 30% of the amount of arrears and not less than a thousand rubles.

clause 1 art. 119 Tax Code of the Russian Federation

clause 3 art. 122 Tax Code of the Russian Federation

The personal income tax itself will be collected in any case: both during criminal prosecution and during tax proceedings.

Is it possible to reduce the tax?

Even though any winnings are considered “income” by law, you can still avoid paying taxes on your lotto prize.

You will not have to pay tax on lottery winnings if the winning amount is 4,000 rubles per year or less.

In other words, if you played the lottery several times a year and won in total less than 4,000 or exactly 4,000 rubles. in lotto, you don’t have to pay fees. If the winning amount is 4001 or more, then the prize is taxed.

What to do if the winnings are too big

The tax rate does not depend on the size of the winnings.

But if the winnings are over 15,000 RUR, you may not have to report for it and pay tax yourself. They will account for you and pay you if you win in a Russian lottery or at a legal bookmaker. Promotion organizers will report and pay for you regardless of the size of your winnings.

You won RUB 1,000,000 in the lottery. You won’t have to submit a declaration or pay anything. In this case, the lottery organizer is the tax agent. He will pay you 870,000 RUR and report to the tax office.

You won a jackpot in a casino - 10,000,000 RUR. Until April 30 of the next year, you declare it yourself, and before July 15, pay 1,300,000 RUR. If you lose the money back, you will remain in debt to the state. Therefore, it is better to immediately postpone the amount of taxes and not touch them until payment. For example, open a savings account: then you can earn extra money on interest.

Tax up to 15,000 rubles

In cases where you win an amount from 4,000 to 14,999 per year in the lotto, you need to pay the interest yourself in the form of personal income tax. The amount of such collection will be 13%.

The tax return in this case is submitted in the same way as when paying any other income of an individual.

If you have never encountered the problem of paying personal income tax on your own, and before winning the lotto, your employer solved all the technical difficulties for you, you can simply come to the tax office at your place of residence to receive detailed instructions.

Regulatory framework

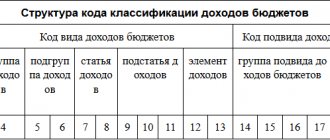

The issue of paying taxes on winnings received is regulated by the Tax Code, articles No. 214.7, 217, 224. The main points regarding taxable amounts and the amount of tax payments are outlined here.

Article 217 of the Tax Code of the Russian Federation “Income not subject to taxation (exempt from taxation)”

Article 214.7 of the Tax Code of the Russian Federation “Features of determining the tax base and calculating tax on income in the form of winnings received from participation in gambling and lotteries”

Article 224 of the Tax Code of the Russian Federation “Tax rates”

Tax equal to or higher than 15,000 rubles

If you are a little luckier, and the value of the lotto prize is more than 15,000 rubles, government fees are paid by the lottery organizer himself. Keep in mind that sometimes the organizers of the draws promise a high win in advance so that you receive a “clean” round sum after paying all the fees.

Therefore, if the company running the incentive lottery paid you 1 million instead of the promised 1.5 million, there is no point in accusing it of fraud.

Everything is exactly the opposite - the organizer made sure in advance that in the future you would not have to suffer and draw up declarations yourself. Thanks to the efforts of such an organizer, you can safely spend the amount you win in the lottery at your discretion.

Using a simple example, how to calculate the net amount of lotto winnings that you will receive in your hands:

If you received a prize worth 40,000 rubles, only 36 thousand of the entire amount will be taxed. Next, 36 thousand needs to be multiplied by 0.13, you get 4680 rubles. This is the amount of the payment that must be subtracted from 36 thousand.

As a result, you will receive an amount of 31,320 rubles.

Is it possible not to pay winnings or reduce the amount of payments?

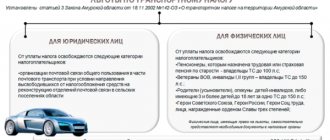

Let us immediately note that there are no tax benefits for paying such contributions. This also applies to privileged categories of citizens: disabled people, pensioners, combatants, etc. Note that if the prize went to a minor, the winner’s legal representatives: parents or guardians will be able to receive the winnings. They are the ones who will manage the funds.

Please note that an exception for minors will be participation in free lotteries and competitive events that are held at the school or municipal level. Such gifts or any services provided to a minor may be used by him at his own discretion.

Regarding exemption from tax payments, the law provides for this possibility. In particular, the state does not require paying taxes on small winnings. The legislator sets a limit of 4,000 rubles. If the total amount of winnings during the year is below the established financial limit, you do not need to pay. All winnings in excess of the established limit are subject to taxation in accordance with the established procedure.

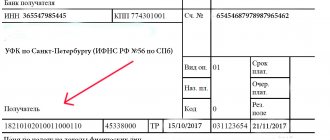

Where and when should I report my winnings?

The 3-NDFL declaration must be submitted to the tax office that is closest to your place of residence.

Today, you can submit an application remotely via the Internet in the taxpayer’s personal account. To do this, you need to go to the “Income from sources in the Russian Federation” section or to the “Income from sources outside the Russian Federation” section. Focus on your personal situation.

Now you know how to pay interest fees on winnings in Stoloto state lotteries and any other similar lotteries.

Gambling in casinos

The lucky ones who managed to hit the jackpot at the casino are required to pay a fee of 13% of the tax base. It is defined as follows: the value of the casino chips is minus the payment received.

The gambling establishment must provide the tax office with information about the value of chips and winnings by a specific player in the aggregate for the tax year. This data is recorded during cash transactions in the casino.

Afterwards, the tax office will independently determine the amount of tax and send the citizen a notification.

The taxpayer must make the payment no later than 01.12 of the year following the year in which the winnings occurred.

A rather controversial situation arises with the income received from playing in online casinos. On the one hand, this type of gambling does not belong to the territorial zones provided for by law, and therefore is prohibited. But any administrative or criminal liability for playing in online casinos is not provided for players. And the income received must be declared in the general manner with the subsequent payment of a tax of 13%. The receipt of income is not the date of the winning itself, but the day when the funds arrived on the electronic wallet (bank card) of the winner.

Example No. 4: December 21, 2021 Kondratyev S.T. won the amount of 74,613 rubles at the Split online casino. The money arrived in Kondratiev’s account on January 13, 2021. How is this winnings taxed?

Since Kondratyev received the money on January 13, 2020, he is required to file a declaration for 2021. Kondatiev must fill out and submit the document to the Federal Tax Service by April 30, 2021. Kondratyev must transfer the fee by July 15, 2021 in the amount of 9,699 rubles. (74.613 * 13%).

Example No. 5: Visitor to the Oracle casino Khomyakov D.L. placed a bet of 1,840 rubles. and won 1,420,600 rubles. Since the size of the bet made does not affect the tax base, Khomyakov must pay the fee in the full amount of 184,687 (1,420,600 * 13%).

How to distinguish a lottery from a promotion or competition

Since the tax rate varies significantly depending on the type of drawing, it is important to understand the differences between the two.

Only the state organizes lotteries. They are entrusted to operators - specialized companies that are officially allowed to engage in this type of activity. Operators are appointed by local authorities, a corresponding agreement is concluded with them, and the conditions for holding lotteries are officially approved. The lottery ticket must contain the following information:

- name of the authority that organized the lottery;

- name of the operating company;

- number and cost of the lottery ticket.

Only if the above conditions are met, the drawing is called a lottery. Accordingly, the amounts won will be subject to income tax at a rate of 13% (for non-residents - 30%).

Otherwise, the event cannot be considered a lottery. Even if participants are encouraged to purchase tickets, this may only be a promotion, competition or other event organized by a commercial enterprise. Such sweepstakes are often held by hypermarkets, retailers, large retail chains, product manufacturers and service providers. Winnings in this case are taxed at a rate of 35%.

What kind of income does the limit apply to?

The Tax Code provides for a number of reasons under which the 4 thousand ruble limit applies. Among them it should be noted:

- Cost of gifts received from individual entrepreneurs or companies

- The value of winnings received as part of the competition

- The value of winnings received in the lottery, gambling

- Amount of financial assistance from the employer to the employee

- The cost of prizes received as part of competitions and contests under the auspices of the state

There is a very important detail here. The 4 thousand ruble bar, which exempts a citizen from paying income tax, applies to each of these grounds. To put it simply, over a certain tax period, a citizen can receive a gift worth 4,000 rubles from a company, win another 4,000 rubles in a competition, acquire 4,000 rubles thanks to a lottery, and enrich themselves by 4,000 rubles using the help of their employer. And he will not have to pay taxes, since in each individual case the amount does not exceed the established limit.

By the way, if you look at the conditions of sweepstakes from various companies, then often the potential winnings per person do not exceed 4,000 thousand rubles. In this way, companies protect potential participants from having to give up part of their rightful winnings.

How much tax do you need to pay for winnings at a bookmaker?

Recently, absolutely all bookmakers are tax agents who withhold taxes on winnings from their clients. It is also worth noting that bookmakers are the most transparent and orderly organizations that operate in our country. The whole point is that a person receives winnings at such points in its pure form, while these offices themselves report to the relevant services.

The most important advantage is the fact that the percentage of tax that is taken from a person does not include the bet placed by the player. In practice, it all looks like this: if a person bet 500 rubles and immediately lost them, while the second similar bet brought a winnings of 2000 rubles, then the tax will be calculated according to the following formula: 2000-5000=1500, and it will be from the final amount 13% tax was removed.

Many players have a counter question – why this calculation is not used in land-based domestic casinos. The thing is that if a person places a bet in foreign bookmakers, then the payment method will be similar to that in an online casino. The thing is that such winnings are much more difficult to control. But at the same time, if a person has supporting documents on hand, then there will be no problems with tax deductions.

Most gambling people simply do not know their rights and responsibilities in the event that the winnings were lost. It is for this reason that many misunderstandings most often arise.

Gifts from relatives

We need to consider gifts received from citizens on a slightly different plane. Previously, we said that taxes are imposed on gifts that we received from individual entrepreneurs or legal entities. But if another individual gives you 10 thousand rubles, then you won’t have to share it with the state.

However, as always, there are certain nuances and subtleties. For example, there is a list of certain property, if you receive it as a gift, you will still have to pay tax. Tax authorities include in this list:

- Apartments, garages, other real estate

- Cars

- Securities

An exception to the rule is made only for very close relatives. This includes parents, children, brothers, grandchildren, grandparents, etc.

Thus, the following picture is obtained. Suppose a famous writer received an apartment as a gift from his individual fan. He will have to pay a tax of 13%, since there are no close family ties here. But if his sister gives him the same gift, then there will be no tax payment.

We determine the amount of personal income tax on the won car

You can win not only with money. Often, as a bonus, the winner is given, for example, car keys.

It would seem that this is happiness. However, to get this happiness, you will have to pay a tax, which, depending on the type of lottery, is 13% or 35% of its cost. The organizer of a gambling event is obliged (by law) to please the winner with an announced or even written amount that he owes to the state for the won vehicle.

If a car costs 2 million rubles, then the tax on it will be 260 thousand rubles, if the lottery is not a promotional event. If the game is organized for advertising purposes, then the payment will be 700 thousand rubles!

There is no need to fall into despair, this car can be sold (this is not prohibited by law), then the long-awaited prize will finally reach its owner, however, in a shortened version, so to speak - minus not only the tax on luck, but also the tax on the purchase -sales. Of course, it won't be a shiny car, but the money it will turn into after all this.

You can also add that if the organizer of the game or lottery for some reason did not inform, then you can contact an independent appraiser and do it yourself. And then submit a declaration of income received.

An independent assessment can also be carried out if the organizers have clearly unjustifiably inflated the cost of the prize car, however, it is better to discuss the chances of reducing the tax amount with a lawyer.

Reviews

People have different opinions about the need to pay tax on small winnings. The majority believe that the likelihood of being charged for non-payment of such a tax is minimal, and they prefer not to pay. After all, the winnings are mostly small, and a commission is also charged for withdrawing this money.

The very fact of taxing small lottery wins is a stopping factor for many people not to play at all. It turns out that the lottery is too expensive, and the chance of getting at least something is already small, and you will also have to give part of it to the state.

Regular gamblers claim that they spend more on lotteries than they receive in winnings. Only when calculating personal income tax does no one care about the costs of lottery tickets.

The decision whether or not to declare small winnings (up to 15,000 rubles) remains on the conscience of the player himself. Only gambling with the tax office can lead to even greater losses of funds due to fines for non-payment of taxes.

Now you know all the necessary information about taxes on winnings, and you can register on the Stoloto website and try your luck.

Legal aspect of winnings and bet size

The term “winning” means profit received as a result of winning various lotteries, promotions and other events that give away inventory items or money.

Almost all prizes won are subject to income tax.

Over the last decade, there has been a tendency on the part of the authorities to tighten control over both the income of the gaming industry and tax residents who receive profit from these sources. For example, a law was recently introduced according to which a subject has the opportunity to receive the monetary reward due to him at a bookmaker's office only upon presentation of a passport. This measure was introduced in order to streamline the flow of spontaneous winnings and put them on the taxation conveyor.

There are many questions that arise for the lucky winner of a super prize: from payment responsibility to the size of the rate provided for in 2021. In addition, an important point is the need to submit declarations in Form 3-NDFL to the fiscal authorities.

There are several betting options designed for winnings: 13%, 30% and 35%. In some cases there is no need to pay tax.

Features of paying tax at a rate of 35%

As a rule, the organizers of promotions and promotional giveaways formulate the conditions in such a way that the amount of tax is already taken into account in the cost of the prize.

This means that the winner receives the amount that was originally promised, and the tax is paid by the organizer.

Moreover, from a legal point of view, everything looks like the tax is withheld from the winnings and paid by the person who received the income. The form of the winnings in this case does not matter: it could be a car, an apartment, money, services (for example, a tourist trip to an exotic country), or others.