The Regulations of the Central Bank of the Russian Federation dated June 19, 2012 N 383-P “On the rules for transferring funds” literally says the following about the “payer status” requisite (field 101):

101 — Information is indicated in accordance with the requirements of regulatory legal acts adopted by federal executive authorities jointly or in agreement with the Bank of Russia

And taking into account this requirement, the taxpayer code, starting from 2014, was established by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. (Appendix No. 5 - Rules for indicating information identifying the person or body that issued the order to transfer funds to pay payments to the budget system of the Russian Federation). And this Order of the Ministry of Finance was approved by the Chairman of the Central Bank of the Russian Federation E.S. Nabiullina. Separate changes to order No. 107n were made by Order of the Ministry of Finance of Russia dated September 23, 2015 N 148n “On amendments to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 N 107n.”

Payer status codes for 2021

- “01” - taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - legal entity;

- “02” - tax agent;

- “06” - participant in foreign economic activity (FEA) - legal entity;

- “08” - payer - a legal entity (individual entrepreneur, lawyer, notary, head of a farm), transferring funds to the budget system except for taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” - the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “13” - an individual paying taxes, fees for the performance of legally significant actions by tax authorities, insurance premiums and other payments administered by tax authorities;

- “16” - participant in foreign trade activities - an individual;

- “17” - participant in foreign economic activity - individual entrepreneur;

- “18” - a payer of customs duties who is not a declarant;

- “19” - organizations and their branches that transfer funds withheld from the wages (income) of a debtor - an individual to repay debts on payments to the budget on the basis of an executive document;

- “21” - responsible participant in the consolidated group of taxpayers (CGT);

- “22” - member of the group;

- “24” - payer - an individual transferring funds to pay fees, insurance premiums administered by the Social Insurance Fund, and other payments to the budget (except for fees for the performance of legally significant actions by tax authorities and other payments administered by tax and customs authorities);

- “28” - participant in foreign trade activities - recipient of international mail.

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

Documents confirming residence

According to the law, the tax agent himself keeps records of data about his employees and independently determines his status. And based on this, the tax amount is calculated. An employee's residence can be confirmed by the following documents:

- a passport containing information about the date of crossing the Russian border;

- a visa containing the appropriate notes;

- air tickets, railway tickets;

- papers on registration of foreigners temporarily living in the Russian Federation;

- contract with the employer, civil contract;

- a time sheet in which labor time was recorded.

Air ticket can confirm your residence

Where to indicate taxpayer status in a payment order

The status is entered in field 101 of the payment. Its form is given in Appendix No. 3 to the Bank of Russia Regulation No. 383-P dated June 19, 2012.

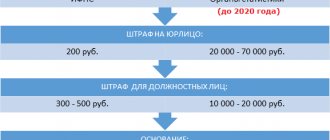

ATTENTION. If you fill out field 101 incorrectly, the money will fall into the category of unexplained payments, and the organization or individual entrepreneur will have a debt. Then you will have to make clarification. To do this, you need to submit an application to the tax office, indicate the payment details and report that an error was made in field 101. The Federal Tax Service will carry out a reconciliation and offset the funds against the arrears of the required tax, fee or insurance premiums.

Resident

The vast majority of Russian workers fall into this category. Therefore, in section 2.3 of the 2-NDFL declaration, accountants most often put code No. 1.

Tax resident is an individual who has lived in the state for at least one hundred and eighty-three days during the previous twelve consecutive months. These 183 days also include arrival and departure dates.

Who is a Tax Resident of the Russian Federation? Our article will help you figure this out. In it we will look at what the tax status depends on, documents for confirmation, as well as the regulatory framework for residents and non-residents.

If an individual did not live in Russia, but received treatment or education abroad, the period of his absence will not be counted towards 183 days.

For residents, the income tax rate is 13%

Video - Confirmation of Russian tax resident status

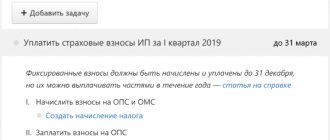

Sample payment order with payer status

IP Feofanov uses a simplified taxation system. He employs two employees.

In October, Feofanov transferred pension contributions from the salaries of his employees for September 2021. He entered “09” in field 101 of the payment slip.

When transferring insurance premiums “for himself” in 2021, Feofanov also put code “09” in field 101. The same value is indicated in payment orders for the payment of a single “simplified” tax. And when transferring personal income tax from the salaries of employees, the individual entrepreneur reflects the payer status “02”.

Please note: errors when filling out payment slips for taxes and insurance premiums can be avoided if you generate payment slips automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in one click based on data from the declaration (calculation) or the request for tax payment (contribution) sent by the inspectorates. All necessary details - codes for payer status, KBK, UIN, recipient data - are updated automatically in the service, without user participation. When filling out the payment slip, the current values are entered automatically.

Special props

By indicating the status in the payment slip, the accountant identifies:

- type of payment and purpose: at the expense of what funds settlements are made and the target direction of payment;

- category of the paying organization: which group the organization that makes the payment belongs to;

- recipient group: which category the recipient of the funds falls into.

The value should be entered in special field 101, which is marked in the figure:

IMPORTANT!

Field 101 Budget status of the payer is required! That is, when making calculations with budgets of all levels, this field must be filled in without fail. Please note that for other types of calculations this detail is not filled in.

conclusions

The payment order contains many details that must be filled out. Field 101 contains information about the originator of the document. This code is filled in only for payments made to the budget.

At the legislative level, there are 26 statuses to be indicated in this column. It is necessary to choose the right status depending on who is transferring the money.

If the status is incorrectly indicated, the money may not reach the recipient, causing a debt.

In such cases, it is necessary to verify mutual settlements with the government agency where the money was sent, and if a debt is identified in connection with an unpaid payment, it is necessary to write a statement requesting clarification.

Status 01, 08, 09, 14

In 2021, insurance premiums were transferred to the tax authorities, who will regulate their calculations and payments. In this regard, managers and accountants had a question regarding filling out section 101 of the payment order.

If before 2021, when paying insurance premiums, code 08 was indicated, then when filling out the payment from January 1, 2021, the Federal Tax Service recommends indicating the following statuses: (click to expand)

| Code | Explanation |

| 01 | Organizations |

| 09 | Individual entrepreneur when paying insurance premiums and tax deductions personally for himself |

| 14 | When paying contributions for employees |

Thus, in 2021, when generating a payment order in section 101, code 08 is not indicated.

Personal income tax for foreigners from the countries of the Commonwealth of Independent States (CIS)

For citizens of some neighboring countries, there are special tax conditions that also apply to personal income tax.

Personal income tax for Ukrainians who receive payments in Russia

Russia and Ukraine signed an Agreement on the Prevention of Double Taxation. According to this document, a Ukrainian working in Russia pays income tax in the Russian Federation. But, if he worked in the Russian Federation for less than 183 days, then the tax will have to be paid in Ukraine.

A Ukrainian employee must provide a document confirming the fact of permanent residence in this country. The document must be issued by the fiscal service of Ukraine. This can be either confirmation that the employee is a Ukrainian resident, or documents on income and payment of taxes to the Ukrainian budget.

Confirmation must be provided:

- employer;

- the fiscal department in which the employing company is registered.

Income tax for citizens of Belarus

If a contract is signed between a Russian company and a native of Belarus requiring the employee to reside on Russian territory for more than 183 days, the income tax rate is 13%. This rule applies from the first day the employee begins his work duties.

But, if the employment agreement was terminated in less than 183 days, the tax amount is subject to recalculation upward - 30%. The employer in this situation is not obliged to calculate the missing tax from the income of his former employee. This responsibility rests with the Belarusian employee himself.

Income tax for citizens of the Republic of Kazakhstan

The Russian and Kazakh sides signed a convention eliminating double taxation.

The convention provides for several situations when an individual is obliged to pay tax only in the Republic of Kazakhstan:

- Remuneration for labor is not paid by an institution located on the territory of the Russian Federation.

- The employer is a non-resident of Russia.

- The recipient of the income lives in the Russian Federation for less than 183 days.

Thus, if a Kazakh citizen works and lives in Russia for less than 183 days a year or the payment is issued by a tax non-resident of Russia, he is obliged to pay taxes in Kazakhstan. But for this, the employee must provide documents confirming that he is a tax resident of the Republic of Kazakhstan.

On a note! The tax rate on the income of Kazakhstanis, including non-residents, is 13%.

Income tax rate for citizens of Armenia

It does not matter whether a citizen of Armenia is a resident or non-resident of the Russian Federation. If he is a resident of Armenia, his income received in the Russian Federation will be taxed at a rate of 13%.

Income tax rate for citizens of Kyrgyzstan

In 2015, Kyrgyzstan joined the Eurasian Economic Union. As a result, Kyrgyz people can work in Russia without having a patent.

The period of stay of an employee from Kyrgyzstan on the territory of the Russian Federation is equal to the duration of the employment contract concluded with the Russian employer. If the contract is terminated, the foreigner must leave the country within 90 days. But you can conclude a new agreement without leaving the Russian Federation. The next contract must be signed within 15 days.

On a note! Citizens of Kyrgyzstan may not confirm in the Russian Federation educational documents that were issued by authorized Kyrgyz authorities.

For citizens of Kyrgyzstan, the general taxation procedure applies. The income tax rate for Kyrgyz who work in the Russian Federation is 13%.

Filling out a payment slip in Sberbank Online

The payment order is filled out either at the bank office or through the Sberbank Business online system. The document states:

- details and name of the recipient;

- bank of the sender and addressee;

- required amount.

For the payer status, there is a special field in the upper right corner, next to the “Type of payment”. If money is transferred to the treasury of the Russian Federation, then you need to indicate the appropriate code. In cases where the transaction is carried out between private individuals, the column should be left empty.

For remote translation, you need:

- log in to the system;

- go to the “Payment orders” section through the “Ruble transactions” tab;

- create a “New Document”;

- fill in the required fields;

- Confirm the operation via SMS.

The document will be sent to the bank for processing. If you are transferring money to your account again, you don’t have to enter the recipient’s details again, but choose from those offered.

Important: if the sender’s account is opened with Sberbank, then when registering a document online, the sender’s code will be determined automatically.

What may need to be specified

When filling out a standard document form, it is the Russian payer column that causes problems (2 digits of the checkpoint or an attempt to enter the number 14) in Sberbank Online. With such taxpayers, the Federal Tax Service is forced to carry out parallel work aimed at further clarifying their situation - because of this, the process of processing an application for payment may be delayed. When performing the next inspection, you do not need to provide additional papers, but you will have to collect information such as:

- date (or period), amount, type and purpose (often issued upon request by the organization);

- information about the selected recipient (TIN, OKATO, KPP of the individual payer);

- payment number and details (BIC of the domestic bank and its full name).

On the territory of Russia, the status of a current payer is the main central element of document flow, which helps tax authorities to quickly identify an individual or company that regularly carries out financial transactions addressed to the state budget. Error-free recording of your own status will make it possible to reduce the number of arrears in payment and large fines.

Refugee

Since October 2014, all income paid to refugees and those who have received temporary housing in the Russian Federation is subject to a reduced income tax rate of 13%.

Code 5 in the “Taxpayer Status” section is entered only if the employee is a non-resident of the country. For non-residents, only income received as a result of work is subject to a thirteen percent tax. All other payments (gifts, financial assistance) are subject to taxation at the same percentage for all non-residents - 30%.

On a note! A refugee cannot count on standard group deductions before he receives Russian tax resident status.

To receive a deduction for children, a refugee must legalize documents (birth or adoption certificate) in the territory of our state. This can be done at the consular offices of the republic that issued the document.

If the country in which the certificate was received is a party to the Hague Convention, it is enough to certify the document with an apostille