Advance report and general rules for its preparation

So, the organization issues money on account. To begin with, it should be said that the issuance rules have changed a lot recently. However, one thing remains unchanged - the mechanism for working with accountable amounts must be spelled out in the company’s internal documents.

In order for the employee to receive the required amount, the director issues an order . With this order, the accountable person goes to the accounting department and receives money. Currently, it is possible to receive another amount without reporting the previously received amount.

After the funds have been spent, the employee must provide an advance report on them no later than 3 days later, relative to the date established in the order. All supporting documents must be attached to the advance report. It should be remembered that since online cash registers are now widespread, the check can arrive electronically, but it must be printed and attached to the expense report. If the document is lost or not on hand, written explanations must be attached to the report. In this case, only the director (in accordance with the established internal procedure) decides whether to accept expenses without documents as part of the report or not.

If an employee often takes out funds on account and always has a certain amount left on hand, then the tax office may oblige such amounts to be equated to the employee’s income with all the ensuing consequences. In such cases, the courts make decisions in favor of the tax authorities.

What to pay attention to from July 1, 2021

The Law on Online Cash Registers has also made adjustments to the procedure for confirming the legality of using accountable funds. Here you need to pay attention to two main innovations that relate to the use of strict reporting forms and the content of cash receipts .

| Form of strict accountability | Cash receipt |

| Until July 1, 2021, strict reporting forms can be filled out manually. However, starting July 1, 2021, hand-filled forms will be outlawed. From now on, strict reporting forms should be generated automatically, using special devices | Since the new law regarding cash transactions, checks have also changed a lot. They have a huge number of new mandatory details, without which the check will be considered invalid. One of the most striking new details is the QR code. In addition, the check contains general information about the company, the tax system used, and the website of the tax office. The check can be checked through the tax inspection service. It should also be remembered that, for example, entrepreneurs using a simplified system may not print the name of goods on receipts until February 1, 2021 |

What documents will the accounting department not accept?

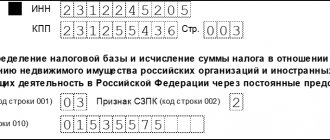

An electronic check printed on paper using cash register or printed for reporting to the accounting department will not be suitable as a primary document if it does not contain, in accordance with Art. 4.7 of Law No. 54-FZ and letter of the Ministry of Finance No. 03-01-15/63722 dated 08/20/2019 the following information:

- name and number;

- name of the company or full name of the individual entrepreneur;

- information about the taxation system used by the individual entrepreneur or organization and its tax identification number;

- date of payment for goods or services;

- calculation form;

- operations performed;

- quantity and price of purchased goods (services);

- the total cost;

- details of the primary document and the signature of the seller, if the goods were purchased for an organization or individual entrepreneur (you will have to additionally submit an invoice or sales receipt);

- registration number of the cash register and other data, the presence of which in the fiscal document is determined by Art. 4.7 of Law No. 54-FZ of May 22, 2003.

The accounting department will not accept the FCC even if the information displayed in it cannot be read, some of the details are missing as a result of damage, or the specified data does not correspond to those displayed in the report.

If the employee does not provide a receipt

An employee usually does not provide a receipt in two cases: he lost it or the seller works without a cash register.

It happens that the accountable person simply inadvertently loses the check or the check is damaged. Usually in such cases, a memo is attached to the expense report, where the employee explains where, when and for what reason he lost a specific check. If the director considers it necessary to reimburse such expenses, then the employee will receive the money spent, but it is better not to include such an amount in expenses, especially when applying the simplified tax system. After all, all expenses must be documented.

In the event that the seller does not issue a check due to the absence of a new cash register, you need to request a letter from the seller confirming the legality of the absence of cash registers or a copy of a document confirming that you are in special mode.

It is possible to receive a sales receipt or receipt without a cash receipt.

Purchasing goods using imprest amounts

Probably the most common way to spend accountable funds is to purchase goods.

In most cases of purchase, a cash receipt is issued immediately at the checkout. This is an ideal option when a check is taken, an advance report is drawn up and transferred to the company’s accounting department for reporting.

With the commissioning of online cash registers, there is another opportunity to receive a check. The seller sends all information regarding the check via SMS or email link . It is printed and attached to the expense report.

It happens that the accountable person receives money in cash, and payment is made by card. In this case, you must provide a receipt for payment using the card. If payment is made from the card of another person, for example, a relative, then it is necessary to explain in writing why the goods were paid for by someone else, as well as a receipt that the money was transferred to the person who paid with the card.

We answer new questions about online cash registers

We ran the CCP check (electronic payment) late: not the next day when we received the bank statement, but one more day later, because... there was a problem with the cash register software. In this case, is it correct to generate a correction check or just report it to the Federal Tax Service in any form?

- No, it's not worth it. The single tax can be reduced to 0 rubles for the amount of: insurance contributions to the Pension Fund and compulsory medical insurance;

- expenses for payment of benefits for temporary disability of employees;

- for payments under voluntary health insurance contracts;

- expenses for the purchase of cash registers.

Confirmation of accountable amounts for travel expenses

When confirming business expenses, you must keep in mind the following nuances:

- There may not be a receipt for accommodation, since hotels do not use cash registers until July 1 of the current year. In this case, only an invoice for payment can be provided

- If the employee went on a business trip in his own car, then fuel receipts and a voucher for the trip route are attached to the report

- If the employee traveled to the destination by train or plane, then it is necessary to provide not only a ticket, but also a document that will confirm that the trip actually took place. If you used an electronic ticket, you must provide a printout of it, as well as your boarding pass. If there is no coupon, then you can request from the carrier, for example, a certificate that will confirm that the employee was actually on the road. It is necessary to explain to employees that the boarding pass must be printed and this point must be fixed in the company’s internal documents that relate to travel expenses.

- If an employee travels by taxi while on a business trip, then you need to have a receipt for such transportation and attach it to the advance report

We accept a cash receipt from an accountable person

To confirm the expenses incurred, an individual provides the organization with a receipt as a document confirming payment for the goods, as well as a sales receipt, if there is no decoding of the purchased goods in the cash register receipt. In addition, an advance report must be prepared.

This is interesting: How much noise can you make in Tyumen?

The accountable person purchases goods under a supply agreement

Thus, taking into account expenses a cash receipt that does not indicate the mandatory details listed in paragraph 6.1 of Article 4.7 of Federal Law No. 54-FZ of May 22, 2003, provided that the other necessary conditions are met, is a possible option.

In 2021, several amendments came into force that relate to documents confirming the expenditure of accountable funds - checks - paper and electronic. Although the list of documents required from accountants in the second half of the year has not changed so that the company can take into account costs when taxing, it is important that the evidence provided meets the new requirements.

This data is important if the employee purchases goods or services on behalf of a company or individual entrepreneur. If he spends money on a taxi, car wash or car repair, he must be given a receipt, not a BSO; such a replacement of a cash receipt remains in exceptional cases.

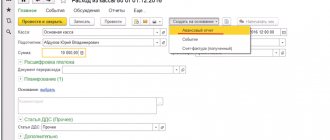

Registration of cash documents in electronic form

Thanks to the decisions of the Central Bank, it has become easier to conduct settlements with accountable persons in 2021, taking into account the latest changes: now cash documents when issuing and returning money can be executed electronically (clauses 5.1 and 6.2 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). Thus, when registering cash receipt order 0310002 in electronic form, the recipient of the money has the right to put an electronic signature. And when registering a cash receipt order 0310001 (when returning unspent money to the cash desk), the depositor of the money is allowed to send a receipt to his email address, without paper registration.

This position is also reflected in the letter of the Ministry of Finance of Russia dated June 25, 2007 No. 03-03-06/1/392. Officials indicated that the consignment note (form No. TORG-12) is the primary accounting document confirming the costs. Papers that indirectly justify the expenses incurred (in particular, invoices) can only serve as an addition to the already existing “primary document”. Thus, expenses for the purchase of goods received without a delivery note from the supplier are considered undocumented.

And don’t forget that according to the Ministry of Finance today, a correctly executed cash document can only serve as confirmation of payment. To take into account, for example, paid materials, you need a delivery note or UPD.

Receipt without decryption of goods

The new BSO is almost no different from a regular online check. It must contain all the details, as in a cash receipt, including a QR code. The only difference is that it is called a strict reporting form (clauses 2 and 4 of Article 1.2 of Law No. 54-FZ).

We also note that until July 1, 2021, business entities named in paragraph 4 of Article 4 of Law dated July 3, 2020 No. 192-FZ (including participants in legal relations) may not use cash registers - if they have the right not to issue a document alternative to a cash receipt in the field of housing and communal services, major repairs, some areas of consumer lending) - LINK.

This is interesting: How to register an unfinished house on a plot of land in 2021

The employee spent his own funds – is this accountable or not?

Sometimes this situation happens - an accountable person travels on work matters, and the organization urgently needs a particular product. Often in such cases, the employee spends his personal funds on the purchase, and does not specifically return to the office for money. He buys the necessary goods, takes a check or other document confirming the fact of the transaction, and then, together with the expense report, provides all the documents to the company’s accounting department.

If the director agrees with such expenses, then the employee is returned the purchase amount without any problems.

It must be borne in mind that in such a situation we are not talking about accountable funds, since the organization did not issue funds to the employee in advance for specific purposes. Accordingly, the rules that apply to imprest amounts do not apply here. Refunds are made at the request of the employee. It is also not necessary to prepare an advance report; you can simply provide supporting documents.

If the accountant does not have documents confirming expenses

As for the taxation of accountable amounts with insurance premiums, this topic was not touched upon in the court decision. But by analogy, we can conclude that unconfirmed expenses of an accountable person must also be subject to contributions (Part 1, Article 7 of Federal Law No. 212-FZ of July 24, 2009). After all, in essence, accountable money must be considered as remuneration to an employee, and the opposite it will not be possible to prove due to lack of documents. In the case under consideration, the company decided not to demand from the employee the money paid for the product or service. And accept an advance report without documents confirming expenses. However, according to the court, since these expenses were not supported by documents, the employee must withhold personal income tax at a rate of 13% from the money that was issued for reporting. The servants of Themis explain this by saying that the base for personal income tax must take into account all the taxpayer’s income received by him both in cash and in kind, or the right to dispose of which he has acquired (Article 210 of the Tax Code of the Russian Federation).

Please note => What a Muscovite’s social card for pensioners looks like

Issuing a report when the cash register limit is exceeded

Another reason why organizations like to issue money on account is if the limit at the cash register is exceeded. The excess amount is simply given to the responsible person, thereby regulating the balance. Such amounts are spent and confirmed in the general manner.

By the way, if necessary, the accountable person can return the funds back to the cash desk as excess accountable amounts.

The accountant is a financially responsible person. He receives funds from the accounting department's cash desk, or directly to the employee's bank card and spends them on the needs of the organization. For all amounts spent, you must provide an advance report, to which all supporting documents are attached. The Law on Online Cash Registers makes its own adjustments to this procedure. Now it is very carefully necessary to check whether all the necessary details are contained in the check and whether strict reporting forms are issued correctly.