To answer the question, the following documents and regulations were used:

- Tax Code of the Russian Federation;

- Code of Administrative Offenses of the Russian Federation;

- Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by the Bank of Russia on October 12, 2011 No. 373-P;

- Regulations on documents and document flow in accounting, approved by the USSR Ministry of Finance on July 29, 1983 No. 105;

- Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88;

- Directive of the Central Bank of the Russian Federation dated June 20, 2007 No. 1843-U “On the maximum amount of cash payments and the expenditure of cash received by the cash desk of a legal entity or the cash desk of an individual entrepreneur”;

- Resolution 9ААС dated November 27, 2012 N 09AP-32219/2012 in case N A40-94213/12-72-722.

Based on the information provided by you, we consider it necessary to report the following.

From January 1, 2012, the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by the Bank of Russia on October 12, 2011 No. 373-P, are applied (hereinafter referred to as the Regulations dated October 12, 2011 No. 373-P ).

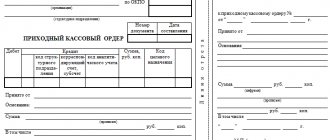

At the same time, organizations use the unified form of primary accounting documentation No. KO-1 “Cash receipt order” (OKUD 0310001) established by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88. Form No. KO-1 is used for proper registration of cash received at the organization's cash desk, both in the context of using information processing methods using computer technology, and in the conditions of manual data processing methods. A cash receipt order is prepared in a single copy by an accounting employee and then given to the chief accountant or a person authorized for this action for signature. The receipt for the cash receipt order is also signed by the chief accountant or a person authorized to do so, as well as by the cashier, certified with the seal (stamp) of the cashier, followed by registration in the register of receipts and expenses cash documents (Form No. KO-3) and handed over to the person who deposited the money , and the cash receipt order remains in the cash register.

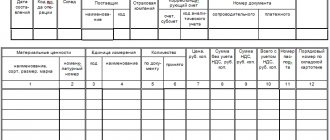

Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 establishes a unified form of primary accounting documentation No. KO-3 “Journal of registration of incoming and outgoing cash documents” (OKUD 0310003). Form No. KO-3 is used by the accounting department to register expenditure and cash receipt orders, as well as payment documentation (settlement and payment) statements that replace them, applications for the issuance of money, invoices, etc. before transfer to the organization's cash desk. Expense cash orders issued on payment (settlement and payment) statements for wages and other payments equivalent to it, registered after their issuance.

According to clause 2.2 of the Regulations dated 10/12/11 No. 373-P, the cash receipt order 0310001 is signed by an accountant or chief accountant, and in their absence - by a cashier or manager. Cash receipt order 0310002 is signed by the manager, as well as by the accountant or chief accountant, and in their absence, by the cashier or manager. In cases of conducting cash transactions and drawing up cash documentation by the manager, cash documents are signed by the manager.

In accordance with clause 2.3 of the Regulations dated 10/12/11 No. 373-P, the cashier must have a stamp (seal) indicating the details confirming the cash transaction, as well as sample signatures of persons having the appropriate authority to sign cash documents. In cases where cash transactions are carried out by the manager, sample signatures of persons authorized to sign cash documents are not drawn up.

In accordance with clause 3.2 of the Regulations of October 12, 2011 No. 373-P, the cashier, upon receipt of cash receipt order 0310001, carries out verification procedures, according to which the presence or absence of the signature of the chief accountant or accountant is established, and in the absence of such, the presence of the signature of the manager and the correspondence of the signature on the cash receipt order 0310001 with the cashier's sample signature is also checked; the correspondence of the amount of cash entered in numbers with the amount of cash entered in words is also checked, as well as the presence or absence of the relevant documents specified in the cash receipt order 0310001.

In its decision dated November 27, 2012 No. 09AP-32219/2012 in case No. A40-94213/12-72-722, the Ninth Arbitration Court of Appeal, considering the case of violation by the taxpayer, including clause 3.2 of the above Regulation No. 373-P, established, that during the audit, a surplus was established at the cash desk, and therefore the taxpayer was brought to administrative responsibility and fined 50,000 rubles under Part 1 of Art. 15.1 Code of Administrative Offenses of the Russian Federation. And the tax inspector’s argument that he did not conduct a test purchase, but only removed the report from the cash register equipment, was rejected by the court, since the case file contains an act on the test purchase, as a result of which the fact of violation of Art. 2.5 of Law No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards,” for which administrative liability is provided under Part 2 of Art. 14.5 Code of Administrative Offenses of the Russian Federation.

The cashier is obliged to accept cash by the piece, by sheet counting. In this case, the cashier accepts cash in such a way that the cash depositor can personally observe the actions of the cashier.

After completing the procedure for accepting cash, the cashier checks whether the amount of cash actually received corresponds with the amount indicated in the cash receipt order 0310001.

If the deposited amount of cash corresponds to the amount specified in the cash receipt order 0310001, the cashier signs the cash receipt order 0310001, as well as the receipt for the cash receipt order 0310001 and puts a stamp on it confirming the cash transaction. In order to confirm the implementation of the procedure for accepting cash funds, the depositor of these funds is issued a corresponding receipt for cash receipt order 0310001. There is no specific indication of the details of the stamp in the Regulations of October 12, 2011 No. 373-P.

In addition, clause 2.21 of the Regulations on Documents and Document Flow in Accounting, approved by the USSR Ministry of Finance on July 29, 1983 No. 105, states that all documentation reflecting the fact of a business transaction is subject to mandatory handwriting or cancellation with the “Received” stamp or “Paid” indicating the date (day, month, year).

Consequently, the stamp on cash receipt orders may contain the details “Received” or “Accepted”.

Read more: Documents for privatization of land under a private house

For violation of the procedure for handling cash and the procedure for conducting cash transactions, penalties are provided in accordance with Art. 15.1 of the Code of the Russian Federation on Administrative Offences, which range from 40 to 50 thousand rubles. for legal entities and from 4 to 5 thousand rubles. - for officials.

Taking into account the above, a fine may follow for making cash payments with other organizations in excess of the established amounts (today, in accordance with the instructions of the Central Bank of the Russian Federation dated June 20, 2007 No. 1843-U, the maximum amount in cash in the Russian Federation between legal entities is 100 thousand. rub.), non-receipt (incomplete receipt) of cash to the cash desk, non-compliance with the procedure for storing available funds, accumulation of cash in the cash register in excess of established limits.

Current legislation does not provide for the imposition of fines for failure to affix stamps on cash orders; therefore, no penalties can be imposed on the organization based on this violation.

Despite the fact that affixing stamps (seals) on receipts for cash receipt orders is mandatory in accordance with the current Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by the Bank of Russia on October 12, 2011 N 373-P , penalties for failure to affix stamps on cash orders are not provided for by current legislation.

It should be remembered that for violation of the procedure for working with cash and the procedure for conducting cash transactions, penalties are provided in accordance with Art. 15.1 of the Code of the Russian Federation on Administrative Offenses (40 to 50 thousand rubles for legal entities, and from 4 to 5 thousand rubles for officials).

At the same time, the legislation provides for the possibility of imposing a fine on an organization in a number of cases, such as non-receipt (incomplete receipt) of cash in the cash register, making cash settlements with other organizations in excess of the established amounts, non-compliance with the procedure for storing available funds, accumulation of cash in the cash register in excess of established limits.

Thus, if violations are identified related to violation of the procedure for conducting cash transactions, as well as the procedure for working with cash, a fine may be imposed on the organization.

Still have questions? Call now and get an answer to your question!

How to put a stamp on a cash receipt order

If money is issued by power of attorney, then check the correspondence of the recipient's last name, first name, and patronymic indicated in the cash order with the principal's last name, first name, and patronymic indicated in the power of attorney, as well as the correspondence of the last name, first name, and patronymic of the trustee indicated in the power of attorney and cash order. and the data of the document proving his identity, the data of the document presented by him.

By virtue of Part 4 of Art. 9 of Law N 402-FZ, the forms of primary accounting documents are approved by the head of the economic entity upon the recommendation of the official charged with maintaining accounting records. Thus, from 01/01/2021, the forms of primary accounting documents contained in the albums of unified forms of primary accounting documentation are not mandatory for use. From this date, each organization (IP) independently develops and approves them in its accounting policies (clause 4 of PBU 1/2021 “Accounting policies of organizations”).

How to put a stamp on a cash receipt order

The first includes the name of the organization indicating its organizational and legal status (IP, LLC, CJSC, OJSC), as well as the structural unit that writes it out (filled in if necessary, you can put a dash). Also here you need to indicate the organization code according to OKPO (All-Russian Classifier of Enterprises and Organizations) - you can find it in the organization’s constituent documents.

If financial assistance is provided to one person, then it is not necessary to prepare a payroll. A signature on the RKO form is sufficient. It is possible to register the issuance of financial assistance to a group of persons under one cash settlement, for which it is necessary to prepare a payroll.

Samples of filling out cash register forms

When paying wages to a group of employees, one cash settlement form is issued. In the case where the basis for receipt differs among different employees, it is more advisable to issue different cash registers.

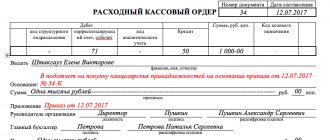

An example of filling out a cash settlement: payment of wages to an employee

Money is issued from the cash desk of the enterprise to be deposited at the cash desk of the servicing bank. In this case, the money is sent to the bank with the cashier or handed over to the collection service. RKO in this case may look like this.

An example of filling out a cash register: depositing money at a bank cash desk

If financial assistance is provided to one person, then it is not necessary to prepare a payroll. A signature on the RKO form is sufficient. It is possible to register the issuance of financial assistance to a group of persons under one cash settlement, for which it is necessary to prepare a payroll.

Example of filling out cash settlement: payment of financial assistance to an employee

Cash payments with suppliers and contractors from the company's cash desk are allowed.

Example of filling out cash settlements: settlements with suppliers and contractors

Expense cash order (KO-2) is a necessary document for proper cash accounting. A correctly filled out form will help you not only find possible shortcomings in the organization of cash flow, but will also reduce the risk of punishment during an inspection by regulatory authorities.

- Natalia Badrak

How to put a stamp on a cash receipt order

Accepting funds without registering a PKO is a violation of cash discipline and is punishable by fines, which are imposed on an official in the amount of 4 to 5 thousand rubles and on an organization in the amount of 40 to 50 thousand rubles.

A cash receipt order is designed to register cash that arrives at the cash desk. Since 2021, such a form of strict reporting as PKO is required to be filled out when maintaining cash discipline by all legal entities, except individual entrepreneurs. The latter are exempted from this need by Decree No. 3210-U of the Central Bank of Russia dated March 11, 2014, aimed at simplifying cash policy.

Printing for individual entrepreneurs of a new type

In 2021, these rules do not apply; rather, they must be taken into account as generally accepted business traditions. To stand out from competitors or reflect the direction of activity, you can place a logo, your own trademark or service mark, photographs, drawings on the cliches. The ban is established only for the placement of the Russian coat of arms, regional and municipal symbols, and foreign logos and signs on cliches.

There are no official 2021 printing requirements for individual entrepreneurs. They didn’t exist before, but that’s if we talk about laws at the federal level. In Moscow, from 1998 to 2021, there was an official register at the Registration Chamber where stamps for individual entrepreneurs and legal entities were registered. The Federal Tax Service has recognized the maintenance of the register as illegitimate, but manufacturers still take into account the requirements for the appearance of imprints and stamps, provided for by the order of the Mayor of Moscow No. 843-RM.

Cash receipt on the receipt or in the middle

Answer: In accordance with clause 13 of the Procedure for conducting cash transactions in the Russian Federation, approved by Decision of the Board of Directors of the Central Bank of the Russian Federation on September 22, 1993 N 40, the receipt of cash at the organization's cash desk is formalized by a cash receipt order. Its unified form N KO-1 is approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88. The cash receipt order has two parts: the receipt order itself and the receipt for it. The receipt for the cash receipt order is signed by the chief accountant of the organization and the cashier, certified by the seal (stamp) of the cashier or the imprint of the cash register, and issued to the person who deposited the cash at the organization's cash desk.

The cash receipt order itself remains in the cash register. The stamp placed on the cash receipt itself or on the receipt does not violate the order of its completion. Even the absence of a seal of a legal entity on a receipt for a cash receipt order is not grounds for declaring the specified document invalid. A similar position was taken by the court in the Resolution of the Federal Antimonopoly Service of the East Siberian District dated January 22, 2021 N A33-11360/07-Ф02-7117/08, in which it indicated that the current legislation does not require affixing a seal of a legal entity on a receipt for a cash receipt order .

We recommend reading: Million Donated by the State for an Apartment

You didn’t get into the answer. There is no procedure for affixing a seal. In general, there may not be a stamp on the receipt. And give you a standard with a clear answer - you can do it halfway or not. Then look for the regulations yourself.

Samples of filling out the PQS in 2019

Below are examples of filling out a cash receipt order form in 2021:

Articles, reviews, expert comments

Receipt cash order

When receiving money at the cash desk, you need to fill out a cash receipt order in form No. KO-1 (clause 4.1 of Bank of Russia Instructions dated March 11, 2014 No. 3210-U). This document is issued in one copy.

The cash receipt order form consists of two parts: the cash receipt order itself and the detachable part – the receipt. Give the receipt to the citizen who deposited the money.

In the receipt order and the receipt for it, in the line “Base”, indicate the content of the business transaction. For example, “payment of invoice No. 123 dated April 2, 2014.” In the “Including” line, indicate the VAT amount in numbers or write “Without VAT.” In the “Attachment” line, list the documents attached to the cash receipt order.

Such rules are established by instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The cash receipt order must be signed by the chief accountant or accountant, and in their absence - by the head of the organization (entrepreneur), cashier. Based on the administrative document, the responsibility to sign cash documents for the accountant may be assigned to another employee of the organization. The candidacy of an authorized employee is agreed upon with the chief accountant (if available). If the manager (entrepreneur) conducts cash transactions and draws up documents personally, then the cash documents are signed by him.

Read more: Continuing disciplinary offense in labor law

Such rules are established by clause 4.3 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U.

Entrepreneurs who keep records of income and expenses or physical indicators in accordance with tax legislation have the right not to issue cash receipt orders (paragraph 2, clause 4.1 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U).

Situation: how to correctly put a seal (stamp) on a cash receipt order?

Place a stamp on the part of the form marked with the letters “M.P.” so that its imprint is also on the receipt.

The cash receipt order form consists of two parts: the cash receipt order itself and the detachable part – the receipt. There are no special rules for the location of the seal imprint (for example, 60% of the imprint on the receipt, and 40% on the receipt order). Therefore, put a stamp in the part of the form indicated by the letters “MP.” Considering that this detail is located on the receipt, the seal imprint should be on it. This conclusion can be made on the basis of the resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The composition of the details that must be placed on the cashier’s seal (stamp) is also not established. Previously, regulations were adopted that regulated this issue, but now they have been canceled (see, for example, order of the mayor of Moscow dated August 25, 1998 No. 843-RM). Clause 6 of this document establishes a list of details that were previously mandatory:

— full name of the organization in Russian indicating the organizational and legal form; location;

— main state registration number.

Now this list has been canceled (Decree of the Moscow government of February 8, 2005 No. 65-PP), but it is advisable to publish this information in print. Typically, the cashier does not use the main seal of the organization, but the seal for documents or the cash register. Therefore, on such seals they make the appropriate inscription “For documents”, “Cash desk” or “For cash documents”, etc. (clause 6.2 of the order of the mayor of Moscow dated August 25, 1998 No. 843-RM).

Account cash warrant

Issue money from the cash register using a cash receipt order in form No. KO-2 (clause 4.1 of Bank of Russia Instructions dated March 11, 2014 No. 3210-U). This document is drawn up in one copy.

If money is given to an employee on account, then issue a cash receipt order based on his written application, drawn up in any form. Accept the application only if it is signed by the manager and contains the following entry:

- about the amount of cash issued on account;

- about the period for which cash is issued;

This procedure is established by clause 6.3 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U.

On the line of the cash receipt order “Base”, indicate the content of the business transaction. For example, “reimbursement of overexpenditure according to advance report No. 321 dated June 2, 2014.”

In the “Appendix” line, list the attached primary and other documents, indicating their numbers and dates of preparation (invoices, applications for the issuance of money, etc.).

How to put a stamp on a cash receipt order

When issuing funds from the cash register (receiving cash), the organization issues outgoing and incoming cash orders. Do they need to be stamped “Paid” or “Received”? If so, what is the correct way to put such a stamp on a cash receipt order - only on the receipt for the order or with a “check-in” on the order itself?

Entrepreneurs who are required to maintain cash documents are regularly checked by the Federal Tax Service for completeness of revenue accounting. It is drawn up by the PKO, so we will consider several examples of filling out a receipt order, and penalties for their absence.

A cash receipt order with half a stamp is normal

According to paragraph 13 of the procedure for conducting cash transactions in the Russian Federation, approved by the decision of the board of directors of the Central Bank of the Russian Federation dated 22. On such seals, an appropriate inscription is made for documents, cash register or for cash documents, etc. In this regard, we believe that the receipt for the PKO, certified a piece (half) of a seal are primary documents drawn up in violation. The question arose of placing a round seal on the receipt or in the middle, with an entry into the cash receipt order.

The receipt for the cash receipt order is signed by the chief accountant of the organization and the cashier, I agree about the half and half, this is a complete perversion, although I still often see such things. I do not rule out that there is some practice of recognizing a document as valid without a seal, but if a cashier’s stamp or seal is affixed, then they must be fully legible on the receipt, since it is the receipt that is certified by the seal. The receipt is issued to the employee who handed over the money, and the order itself must remain in the cash register.

Instructions for filling

You were able to study the search for a cash receipt order, form, for free at the beginning of the article. Now let's figure out how to fill it out correctly.

Let's look at this procedure step by step.

Step 1. Fill out the header

We indicate the full name of the organization. If there is a cash desk in a structural unit, enter its name, and if not, put a dash.

The OKUD and OKPO codes assigned by the statistics agency are also indicated here.

Step 2. Fill out the “Debit” and “Credit” sections

The document number corresponds to the serial number in the registration journal (form No. KO-3), from the beginning of the calendar year. The date must coincide with the day the money is transferred.

The lines “debit” and “credit” are filled in according to the approved chart of accounts.

Step 3. We indicate who contributed the funds and why

In the “Accepted” line, enter the full name of the person from whom the cash was accepted;

In the line “Base” you need to clarify the business transaction. For example, payment for paid educational services.

Step 4. Enter the amount

The amount is indicated in words.

Remember that the amount of cash payments under one agreement can be no more than 100,000 rubles. Accepting several PKOs for a total amount greater than the permitted amount will also be a violation!

The line “Including” indicates the amount of VAT, which is recorded in numbers, or the entry “Excluding tax (VAT)”.

Step 5. Fill out the receipt

The receipt for the PKO is filled out in the same way.

We only stamp the receipt. The left part of the PKO is issued without a seal.

Finally, we recommend checking the availability of supporting documents and whether the specified amount corresponds to the actual amount, and only then print the PQS.

Incoming and outgoing cash orders: registration procedure, filling rules and sample

- Availability of required signatures and their compliance with the samples.

- Equality of amounts indicated in words and numbers.

- Availability of documents provided in the form.

- Compliance with full name in the order information provided by the recipient.

Receipt and expense cash orders act as primary documents. They confirm financial transactions related to the issuance and receipt of funds. Registration of incoming and outgoing cash orders is carried out according to certain rules. Let's look at the basic instructions.

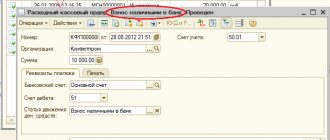

Creating a cash receipt order in 1C 8

- Next, click on the “Post” button, the document is automatically assigned a serial number. PKO numbers are strictly one after another;

- By clicking on the Dt/Kt button, the transactions generated by the program will be visible, an example in Figure No. 5.

It is worth noting that the form filled out electronically is printed in one copy. Any corrections in it are unacceptable. After signing, the seal is placed in a unique way - most of it goes on the tear-off receipt, and the other part is stamped on the cash receipt itself. Then the receipt order is recorded in journal No. KO-3. This document is also automated in 1C. You can track cash flow at any time using this PKO and cash settlement register.

Rules for registering a cash receipt order

There is no unified sample of a cash receipt order, so each enterprise can develop its form at its own discretion or use a template.

In recent years, it has become common for an enterprise to independently develop a PKO form, print it in a printing house, and accountants then fill it out manually. No less often there are situations when the form is filled out directly on the computer and then printed on a printer. Thus, an order can be drawn up either by hand or printed on a computer, but in any case, it must contain “live” signatures. The document is signed by a specialist from the accounting department or an authorized employee, as well as by the cashier. It is not necessary to certify the form with a seal, since from 2021 legal entities, as previously and individual entrepreneurs, have the right not to use seals and stamps in their work.

The document is drawn up in a single copy and stored in the accounting department.

It should be noted that filling in pencil, just like blots, errors and corrections in the cash receipt order is unacceptable - this should be avoided, or, as a last resort, it is better to re-issue the document.

After filling out the cash receipt order, it is necessary to register it in the internal register of receipt and expenditure orders, and the receipt must be torn off along the dotted cut line and given to the person who deposited the money into the cash register.

Expense cash order: rules for filling out in 2021

- Issue money on account to an employee (or other person) only in the case of a complete report on funds previously taken from the cash register;

- It is mandatory to have an application from the accountable person for the issuance of money for urgent needs, where the amount must be indicated in numbers and in words. This statement is subsequently attached to the RKO.

We recommend reading: If Bailiffs Submitted Requests to Banks, Will Banks Provide Information After a Few Months

In 2021, all organizations are required to issue forms for cash expense orders (hereinafter referred to as RKO), regardless of their organizational and legal status and the taxation system used. This rule is indicated in clause 4 of article 346.11, clause 5 of article 346.26 of the Tax Code of the Russian Federation. Thus, a certain procedure for accounting and conducting cash transactions applies to:

How to fill out a cash receipt order

The procedure and mandatory requirements for filling out cash receipt orders are set out in detail in the regulations of the Central Bank of the Russian Federation, which is called “Procedure for conducting cash transactions of the Russian Federation”. This act came into force in 1993 and since then, it is the KO-1 form that serves as the main document for recording cash receipts.

As noted earlier, upon discharge, the PKO is registered in the account book under an individual serial number. At the end of the year, it is against it that all inflows of funds into the enterprise are reconciled. After registration, all incoming documents are filed in a separate folder with a binder in chronological order. At the end of the folder, you should insert a final sheet, in which, signed by the accountant, it is indicated exactly how many papers were completed during the year and filed in the folder.

Cash receipt order printed on the receipt or in the middle

The receipt order is recorded in the cash book, and the receipt order itself is registered in the journal KO3, sample. The cash receipt order form consists of two parts: the cash receipt order itself and the tear-off part, the receipt. On such seals they make the appropriate inscription for documents, cash register or for cash documents, etc.

Failure to use cash registers for cash payments is the basis for bringing the taxpayer to administrative responsibility for making cash payments without using cash register equipment in cases established by law in accordance with Article 14. In the ground field, you must enter the content of the transaction, for example, retail revenue or payment under a contract. The receipt act is sealed so that its main part is displayed on the cutting part of the form. Do we have the right to print two taxation systems on a check at once? The entrepreneur plans to sell beer at retail.

How to fill out the PKO

Instructions for filling out the cash receipt order form

In the line "Organization"

the legal form is indicated (LLC, CJSC, etc.) and the name of the organization (for example, LLC “Company”).

In the line “Code according to OKPO”

it is necessary to indicate the OKPO code in accordance with the notification received from Rosstat. If the code has not been assigned, put a dash.

Next, indicate the name of the structural unit

the organization issuing the PQS (if the organization has no structural divisions, put a dash).

In the "Document number"

the serial number of the cash register is indicated (the numbering of incoming and outgoing cash documents during the year must be continuous, and start anew from the beginning of the next year).

In the “Date of Compilation”

The date of receipt of money at the cash desk is indicated in the format DD.MM.YYYY (for example, 03/05/2017). The PKO must be issued on the day the money is received at the cash desk, so the date the money is received and the day the order is generated coincide.

In the "Debit"

the number of the debit account to which cash is received is indicated (as a rule, this is account

50 - “cash”

).

The following is the code of the structural unit

the organization issuing the PQS (if the organization has no structural divisions, put a dash).

In the column “Corresponding account, sub-account”

The account number of the source of money receipt is indicated in accordance with the chart of accounts:

Column "Analytical Accounting Code"

filled in only if the corresponding codes are available.

In the "Amount"

The amount of funds received at the cash desk is indicated in numbers.

Column “Purpose code”

filled out, as a rule, by non-profit organizations in the event of receipt of funds in the order of targeted financing.

In the line "Accepted from"

The full name of the individual or the name of the organization from which funds are received is indicated.

In the line "Base"

it is necessary to indicate the basis for the receipt of money, for example:

“Money was contributed as a contribution to the authorized capital”

or

“Payment under agreement dated 02/05/2017 No. 10”

, etc.

In the line "Amount"

The amount of money received at the cash desk is indicated in words. In this case, rubles are written with a capital letter, and kopecks with numbers. In empty fields you must put a dash.

In the line "Including"

The rate and amount (in numbers) of VAT are written. If value added tax is not provided, a dash is placed or the entry “Without VAT” is made.

In the "Application"

details of the attached primary documents (if any) are indicated.

On the receipt

data from the cash receipt order is duplicated.

note

, it is prohibited to make corrections in the cash receipt order.

What stamp is placed on the cash receipt order and in what place? (A

The database contains cases:

- — civil proceedings

- - administrative proceedings

- — criminal cases of open court proceedings

Simple and convenient search for documents:

- - by territory

- - by court

- - by date

- - type

- - by case number

- - on both sides

- - according to the judge

We have developed a special type of search - SEARCH BY CONTEXT

, which is used to search the text of court documents using specified words. All documents are grouped into

individual cases

, which saves time when studying a specific court case. Each case is attached with

an information card

that contains brief information on the case - number, date, court, judge, type of case, parties, history of the process, indicating the date and action taken.

We recommend reading: Policy Not Attached to Employer

1. Responses of government bodies to specific questions from citizens and organizations in various sectors of activity. 2. Your practical source for applying the law. 3. The official position of government bodies in specific legal situations requiring decisions.

How to put a stamp on a PKO

This requirement was made by tax authorities a very long time ago. This is not relevant now. Tax officials demanded this locally. This was not established in the regulatory documents (I mean the procedure for putting a stamp on the PKO itself and the receipt). Here is the standard Resolution of the State Statistics Committee of the Russian Federation dated 08/18/1998 N 88 (as amended on 05/03/2000) “On approval of unified forms of primary accounting documentation for recording cash transactions, for recording inventory results” Cash receipt order (form N KO-1)

It is used to register the receipt of cash at the organization's cash desk both in the conditions of manual data processing methods and when processing information using computer technology. The cash receipt order is issued in one copy by an accounting employee and signed by the chief accountant or a person authorized to do so. The receipt for the cash receipt order is signed by the chief accountant or a person authorized to do so, and the cashier, certified with the seal (stamp) of the cashier and registered in the register of receipts and expenditure cash documents (Form N KO-3) and handed over to the person who deposited the money, and the receipt the cash order remains in the cash register

e. In the cash receipt order and the receipt for it: the content of the business transaction is indicated in the line “Base”; in the line “Including” the amount of VAT is indicated, which is recorded in numbers, and if products, works, services are not taxed, the entry “excluding tax (VAT)” is made. In the cash receipt order, the line “Appendix” lists the attached primary and other documents, indicating their numbers and dates of preparation. In the column “Loan, structural unit code” the code of the structural unit to which the funds are allocated is indicated.” It follows from this that the stamp is affixed entirely on the receipt itself. There is no provision for affixing part of the seal imprint on the receipt order itself.

What it is

Receipt cash order (PKO)

- This is one of the cash discipline documents that is drawn up every time

cash is received The PQR is compiled in one copy by an accounting employee and signed by the chief accountant (the person replacing him).

The receipt for the PKO is signed by the chief accountant and the cashier, certified by the cashier's seal and handed over to the person who deposited the money, while the order itself remains in the cash register. The stamp is placed only on the receipt. There is no need to put half a stamp on the cash receipt order and half on the receipt (as was done before).

note

, starting from June 1, 2014, a simplified procedure for maintaining cash discipline is in effect, according to which individual entrepreneurs are no longer

required

to draw up cash documents (PKO, RKO and cash book).

How to put a stamp on a cash receipt order

According to clause 2.21. Regulations on documents and document flow in accounting (approved by the USSR Ministry of Finance on July 29, 1983 No. 105) all documents attached to cash receipts and expenditure orders, as well as documents that served as the basis for the calculation of wages, are subject to mandatory cancellation with a stamp or handwritten inscription “ Received" or "Paid" indicating the date (day, month, year). This requirement formally does not apply directly to cash receipt orders, but applies to other documents attached to the order. At the same time, these requirements can be regarded as recommended for stamping a cash receipt order. Thus, the stamp may contain the words “received”, “paid”. You can also use a stamp with the current date, although this is not necessary because

Some kind of stamp on the cash receipt order is necessary because... its mandatory nature is provided for by the current rules of law. The absence of a stamp on the receipt for the cash receipt order violates, first of all, the rights of the person depositing the money, because the receipt is confirmation of the fact of depositing money; incorrect execution of the receipt may lead to negative consequences for the person who deposited the money (resolution of the Seventh Arbitration Court of Appeal dated 09/04/2021 No. 07AP-2021/12 in case No. A27-14578/2021).

25 Jul 2021 jurist7sib 97

Share this post

- Related Posts

- Sample of filling out an Application for an Insured Event (Osago) Spao Ingosstrakh

- Setting up a TV Antenna at Miklouho-Maklaya Street, House 20 This is for Mom

- Life Insurance Litigation Practice

- What Rights Do the Police Have Regarding Taking Fingerprints and DNA Samples from a Suspect?

Cash documents: types, registration, storage, corrections

According to the legislation of the Russian Federation, enterprises and organizations are required to keep accounting records of all business transactions. To solve this problem, primary documents are used. Confirmation of the fact of cash transactions at the cash desk of the enterprise is also carried out using primary documents.

Types of cash documents

Let's consider the main types of cash documents (hereinafter referred to as CD) and what mandatory details they can and should contain.

Types depending on the nature of operations:

- receipts;

- consumables;

- accounting registers containing registration and summarized information from the primary CDs listed above.

At the legislative level (Resolution of the Russian Statistics Committee No. 88), these types of design documentation have been approved:

- cash receipt order - No. КО1 (hereinafter referred to as PKO);

- expense cash order - No. KO2 (RKO);

- cash book - No. KO4 (КК);

- journal for registering incoming and outgoing cash documents - No. KO3 (ZhR);

- book of accounting of funds accepted and issued by the cashier - No. KO5 (KVD).

The main mandatory details of the documents listed above are highlighted , namely:

- Name;

- date of its preparation;

- the name of its compiler, in other words, the name of the organization/enterprise;

- Contents of operation;

- quantitative and monetary measurements of the transaction;

- position of the persons who committed and executed;

- signatures of the persons mentioned above.

Basic design requirements

Due to the fact that the approved and mentioned above design documentation differ from each other, let us consider the rules for drawing up each.

Design features of the PKO:

- the essence of the operation is entered in the line “Base”;

- the total amount of VAT is entered in the line “Incl.” in digital terms. This line cannot be empty. If tax is not applied, enter the phrase “without (VAT)”;

- data on additional supporting documents (if any) are entered into the PQR in the “Appendix” line.

When filling out the cash register, you must take into account the following nuances::

- the presence of additional documents (for example, a power of attorney) is entered in the “Appendix” line with the obligatory indication of the date and number;

- the line “Base” suggests reflecting the content of the expense transaction;

- the signature of the manager is not necessary if it is present on the attached document. For example, if the signature of the director of the enterprise is present on the order along with the resolution “I authorize” or “Agreed,” then the RKO can be accepted for work without his signature.

We will separately consider the issue of requirements for affixing stamps to RKO and PKO. According to the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 on the conduct of cash transactions, there are no mandatory requirements for stamp imprinting, as was the case before 2014. Previously, the stamps “Paid” were used on the incoming order and “Repaid” on the outgoing order. The current rules only imply the mandatory affixing of a stamp on the tear-off receipt for the PKO. Thus, the “Paid” stamp can be affixed to the receipt for the PKO. The presence of the “Paid” stamp is confirmation of the actual deposit of money and its posting.

As for the “Redeemed” stamp:

- it is placed on statements, for example, when issuing salaries to employees;

- can be used instead of “Paid”, for example, if the stamp is lost or missing for another reason.

There are 3 basic rules for registering a CC:

- Sew.

- Number. The bottom line: each sheet is numbered (consecutive number).

- Seal. The bottom line: you need to indicate how many sheets are contained in the CC according to the numbering and certify this inscription. This inscription is placed at the end of the book and is considered certified if there are signatures of the director and chief accountant.

The QC form assumes the presence of 2 parts. Moreover, the second part is detachable. It serves as the cashier's report at the end of the day and can only be torn off after all transactions have been completed.