Who must submit a balance sheet?

The balance sheet is one of the financial reporting forms.

The legislation establishes that all legal entities, regardless of their organizational form and the applicable taxation regime, must prepare and submit reports to tax and statistical authorities. This obligation also applies to non-profit organizations and bar associations. Balance sheets and profit and loss statements do not have to be submitted only to entrepreneurs, as well as branches of foreign companies. But they can do this on their own initiative.

Attention! Previously, some organizations were exempt from preparing a balance sheet, but currently such provisions are no longer in effect. Business entities classified as small businesses are given the right to submit reports in a simplified form. It includes a balance sheet in Form 1 and a statement of financial results in Form 2, so enterprises must send it to regulatory authorities.

Brief summary

The presented sample balance sheet for 2021 is the most simplified form, since it contains information only on the main accounting accounts. In practice, accountants justifiably have a question about how to draw up a balance sheet, since the company carries out a wide variety of operations.

The most important! Competently maintain operational accounting and timely reflect all actions on the appropriate analytical and synthetic accounts so that the data from them is correctly distributed among the lines of the organization’s balance sheet.

Balance due dates

According to the general rules, the balance sheet - Form 1 must be submitted as part of the reporting for the past year no later than March 31 of the following year. This deadline must be observed when submitting balance sheets and other forms to the Federal Tax Service and statistics.

In addition, under certain conditions, an audit report must be sent to Rosstat as an attachment. The deadline is set for ten days, but no later than December 31 of the following year.

Some organizations need to submit financial statements and publish them due to the type of activity they carry out, or according to other criteria defined by law. For example, tour operators must send their reports to Rostrud within three months from the date of their approval.

The legislation provides for separate deadlines for organizations that registered after September 30 of the reporting year. Due to the fact that their calendar year may be determined differently in this case, the due date may be set by such organizations on March 31 of the second year after the current one. For example, Rebus LLC received an extract from the Unified State Register of Legal Entities on October 25, 2017; the accounting report must be submitted for the first time on March 31, 2021.

Attention! Accounting statements are usually submitted based on the total for the year. However, it is possible to present it quarterly. In this case it is called intermediate. Such documentation is very often needed when applying for loans from banks, company owners, etc.

primer_balansa_str_2.png

It should be noted: the structure of the balance sheet is such that the totals of assets and liabilities should always be equal. This is explained by the use of the double entry method in accounting, in which the same transaction is reflected in the debit and credit of accounts simultaneously. If there is no equality between assets and liabilities, then the balance sheet is drawn up incorrectly.

In our example balance sheet, only 2017 is presented, but it must also contain information from at least one previous period. Organizations newly created in 2021 fill out only one balance sheet column - as of December 31, 2017.

Where is it provided?

The provisions of federal laws establish that Form 1 balance sheet and Form 2 profit and loss statement, and in certain cases other forms, must be submitted:

- Federal Tax Service - reporting must be submitted at the place of registration of the company. Therefore, branches and other separate divisions do not submit it, and only the parent company submits consolidated statements. This must be done at the place where it is registered, taking into account these departments.

- Rosstat - currently submitting reports to statistical authorities is mandatory. If this is not done, then, just as in the first case, the company and officials may be held liable.

- For the founders and other owners of the company - this is due to the fact that each annual report of the organization must be approved by its owners.

- To other bodies, if the relevant regulations define such a duty.

Attention! Banks may be asked to provide reporting when applying for various types of loans and borrowings from them. Especially if you take out a loan to open or develop a business.

Currently, when concluding contracts, many large companies ask for Form 1 Balance Sheet, Form 2 Profit and Loss Statement. This should be done at the discretion of the company management.

However, at present, many specialized companies through which you can submit reports have a service that allows you to obtain all the necessary information about a partner according to his TIN or OGRN. This data is provided by the Federal Tax Service itself based on previously submitted reports.

You might be interested in:

Profit and loss statement form 2 balance sheet: how to fill out in 2021, main mistakes

long term duties

Further, the liabilities reflect indicators for long-term liabilities. Let's study how to fill out a balance sheet, taking into account the features of this section. It records information:

- about the organization’s borrowed funds (Loan 67 - if interest on short-term loans - lasting less than 1 year - is taken into account);

— about tax liabilities that are classified as deferred (Credit 77);

- about the estimated liabilities of the enterprise (Loan 96 - if long-term liabilities for a period of more than 1 year are taken into account);

- about other liabilities of the company, which correspond to the company’s long debts to creditors, not reflected in other lines;

— final indicator for the section.

Delivery methods

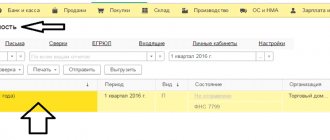

The OKUD form 0710001, which is part of the annual report, can be submitted to the Federal Tax Service and Rosstat in the following ways:

- Personally by a company representative to an inspector or Rosstat specialist.

- By sending through the postal service - in this case, the letter is subject to requirements for the content of the inventory, and it must also be valuable.

- Through an electronic document management system - in this case, the company must have an appropriate electronic digital signature (EDS) and enter into an agreement with a special operator. You can also send the aileron file with reporting through the tax website; you will also need an enhanced digital signature.

Attention! The legislation stipulates the submission of the report in electronic form if the number of employees of the organization is more than 100 people.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Current balance (turnover sheet) for synthetic accounts”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Balance sheet form 2021 free download

Balance sheet form 1 form 2021 free download in Word format.

Balance sheet form 1 form 2021 download free in Excel format.

Balance sheet with line codes form download in Excel format.

Download a sample of filling out the balance sheet in Form 1 for 2021 in PDF format.

How to fill out a balance sheet using Form 1

Title part

After the name of the form, it is indicated on what date it is being generated. The actual date of submission of the report must be entered in the table, in the line “Date (day, month, year)”. Next, the full name of the subject is written down, and opposite in the table is its OKPO code.

After this, his TIN is indicated on the next line in the table. Next, you need to indicate the main type of activity - first in words, and then in a table using the OKVED2 code. Then the organizational form and form of ownership are indicated.

On the contrary, the corresponding codes are entered in the table, for example:

- The code for LLC is 65.

- for private property - 16.

On the next line you need to choose in what units the data in the balance sheet is presented - in thousands or millions. The table displays the required OKEI code. The last line contains the address of the subject's location.

Assets

Fixed assets

Line “Intangible assets” 1110 is the balance of account 04 (except for R&D work) minus the balance of account 05.

Line “Research results” 1120 - account balance 04 for sub-accounts that reflect R&D;

Line “Intangible search requests” 1130 - account balance 08, subaccount of intangible costs for search work.

Line “Material search requests” 1140 – account balance 08, subaccount for the costs of material assets for search work.

Line “Fixed assets” 1150 - account balance 01 minus account balance 02.

Line “Income-bearing investments in MC” 1160 - the balance of account 03 minus the balance of account 02 in terms of accrued depreciation on assets related to income-generating investments.

Line “Financial investments” 1170 - account balance 58 minus account balance 59, as well as account balance 73 in terms of interest-bearing loans over 12 months.

Line “Deferred tax assets” 1180 - account balance 09, it is possible to reduce it by account balance 77.

Line “Other non-current assets” 1190 - other indicators that need to be reflected in the section, but they are not included in any line.

The line “Total for section” 1100 is the sum of lines from 1110 to 1190.

Current assets

Line “Inventories” 1210 - the sum of indicators is entered in the line:

- account balance 10 minus account balance 14, or account balances 15, 16

- Balances on production accounts: 20, 21, 23, 29, 44, 46

- Balances of goods on accounts 41 (minus the balance on account 42), 43

- account balance is 45.

Line “Value added tax” 1220 - account balance 19.

Line “Accounts receivable” 1230 - the sum of indicators is entered:

- Debit balances of accounts 62 and 76 minus the credit balance of account 63 in the subaccount “Reserves for long-term debts”;

- The debit balance of the account is 60 for advances made for the supply of products and services.

- Debit balance of account 76, subaccount “Insurance payments”;

- The debit balance of the account is 73, excluding the amounts of loans on which interest is accrued;

- Debit balance of account 58, subaccount “Granted loans for which interest is not accrued.”

- Debit account balance 75;

- Debit account balance 68, 69

- The debit balance of the account is 71.

You might be interested in:

Information on the average number of employees: sample filling, form

Line “Financial investments” 1240 - the sum of indicators is entered:

- account balance 58 minus account balance 59;

- account balance 55, subaccount “Deposits”;

- account balance 73, subaccount “Loan settlements”.

Line “Cash” 1250 - the sum of account balances 50, 51, 52, 55, 57 is entered.

Line “Other current assets” 1260 - indicators that should be shown in the section, but were not included in any previous line.

The line “Total for section” 1200 is the sum for lines from 1210 to 1260.

Line “Balance” 1600 - the sum of lines 1100 and 1200.

Passive

Capital and reserves

Line “Authorized capital of the organization” 1310 - account balance 80.

Line “Own shares” 1320 - account balance 81.

Line “Revaluation of non-current assets” 1340 - account balance 83 in terms of the amounts of revaluation of fixed assets and intangible assets.

Line “Additional capital” 1350 – account balance 83 without the amounts of additional valuation of fixed assets and intangible assets.

Line “Reserve capital” 1360 - the sum of account balances 82, as well as 84 in terms of special funds.

Line “Retained earnings (uncovered loss)” 1370 - account balance 84 without special funds.

Line “Total for section” 1300 - the sum for lines 1310, as well as from 1340 to 1370 minus line 1320.

long term duties

Line “Borrowed funds” 1410 - account balance 67, including the amount of loans and interest accrued on them.

Line “Deferred tax liabilities” 1420 - account balance 77, it can be reduced by account balance 09.

Line “Estimated liabilities” 1430 - account balance 96 for the subaccount of estimated liabilities for more than 12 months.

Line “Other liabilities” 1450 - credit balances of accounts , , 68, 69, , 76 for which liabilities with a maturity period of more than 12 months are reflected.

Line “Total for section” 1400 - the sum for lines from 1410 to 1450.

Short-term liabilities

Line “Borrowed funds” 1510 - account balance 66, including loan amounts and interest accrued on them.

Line “Accounts payable” 1520 - The amount of indicators is entered in the court:

- Balances of accounts 60 and 76, which show the debt to suppliers and contractors;

- The balance on the credit of account 70, except for the debt on payment of income on shares and shares;

- The balance on the credit of the sub-account “Settlements on deposited amounts” of account 76;

- Credit balances of accounts 68 and 69;

- Account credit balance 71;

- Balances on the subaccounts “Calculations for claims” and “Calculations for property insurance” on account 76;

- Credit balances on accounts 76 and 62 for advances received;

- Credit balance on the subaccounts “Calculations for the payment of income” of account 75 and “Calculations of income for the payment of income on shares” of account 70

Line “Deferred income” 1530 - loan balances for accounts 86 and 98.

Line “Estimated liabilities” 1540 - balance from account 96 in the subaccount of estimated liabilities for less than 12 months;

Line “Other short-term liabilities” 1550 - other short-term liabilities that cannot be included in the previous terms of Section V.

The line “Total for section” 1500 is the sum for lines from 1510 to 1550.

Line “Balance” 1700 - the amount for lines 1300, 1400 and 1500.

Related documents

- Sample. The act of disposal of low-value and high-wear items. Form No. MB-4

- Sample. Act of inventory of precious stones, natural diamonds and products made from them. Form No. inv-9 (Decree of the State Statistics Committee of the USSR dated December 28, 1989 No. 241)

- Sample. Act of inventory of precious metals and products made from them. Form No. inv-8 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Sample. Inventory report of materials and goods in transit (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. The act of inventorying the availability of funds. Form No. inv-15 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Inventory report of unfinished repairs of fixed assets. Form No. inv-10 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Act of inventory of future expenses. Form No. inv-11 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. An act of inventory of settlements with buyers, suppliers and other debtors and creditors. Form No. inv-17 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Inventory report of goods shipped. Form No. inv-4 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Act on the transfer of goods, containers and equipment when changing barmen

- Sample. Act of damage, damage, scrap of goods (material). Form No. 12

- Sample. An act for writing off tools (devices) and exchanging them for suitable ones. Form No. MB-5

- Sample. Act on writing off damaged work record forms

- Sample. Act on write-off of low-value and high-wear items. Form No. MB-8

- Sample. Act on write-off of fixed assets. Form No. os-3 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Sample. Act on mutual settlements (offsets)

- Sample. Act on liquidation of fixed assets. Form No. os-4 (order of the Central Statistical Office of the USSR dated December 14, 1972 No. 816)

- Sample. Certificate of valuation of machinery, equipment and other fixed assets (appendix to the agreement on the procedure for using federal property assigned to a state educational institution with the right of operational management) (pi

- Sample. Certificate of assessment of the cost of unfinished capital construction and uninstalled equipment (appendix to the agreement on the procedure for using federal property assigned to a state educational institution on the right

- Sample. An act of assessing the value of isolated water bodies, forests, perennial plantings, buildings, structures, aircraft and sea vessels, inland navigation vessels, space objects and other property that is subject to special regulations

Common mistakes when filling out a balance

When filling out a balance sheet, novice accountants often make the following mistakes:

- Accounts receivable and payable are shown as a collapsed indicator. This is a mistake - in the balance sheet you need to show separately the debt to debtors or creditors and separately - received or paid advances. Profits and losses should be reflected using the same principle.

- The amount of the advance received should not be reflected in pure form, but together with the VAT received with this payment.

- Fixed and intangible assets are reflected at historical cost. This is not true. These values must be adjusted to the amount of accrued depreciation for each type of property.

- Interest-free loans are shown as part of financial investments. This is incorrect; they should be shown as part of accounts receivable by maturity.

- Negative indicators are written with a minus sign. According to the instructions for filling out the form, negative values must be shown in parentheses without a minus.