About the form

Most small enterprises submit their balance sheet for 2016 in the form approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. Its KND form has code 0710096. It is valid from the report for 2015.

Note that it is not at all necessary to prepare the balance sheet of a small enterprise strictly according to this form. It is only recommended by the Federal Tax Service. If desired or urgently necessary, it can be modified. However, it is better to stick to the general appearance and basic details.

As you can see, this balance sheet form is much easier for a small enterprise to fill out than the standard version of this report, approved by the same order of the Ministry of Finance No. 66n. Therefore, no one thinks for a long time of what balance to hand over to small businesses Of course - simplified.

On our website download the balance sheet of a small enterprise using the following link.

Accountant's calendar for 2021 - reporting deadlines in 2016

Follow the calendar to see when you need to report - then you definitely won’t go wrong.

Explanations for each month:

Rules for filling out balance sheets for small businesses

If a small business representative submits an annual report not for the first time, then the small business balance sheet form for 2016 must include for each line the amount:

- as of the reporting date of the reporting period (i.e. as of 12/31/2016);

- as of December 31, 2015;

- as of December 31, 2014.

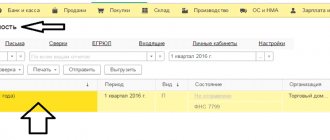

Accordingly, information and amounts for the period of 2015 are taken from last year’s reports. And in order to enter indicators for 2016 a simplified balance sheet for small businesses

- balance sheet for all accounts for 2016;

- statement of interest accrued for 2016 on loans and borrowings received by the company (Account 66 “Short-term loans and borrowings” and account 91 “Other income and expenses”).

Also see “Which accounting forms to use for small businesses in 2017.”

Can there be empty lines with dashes the balance sheet of a small business entity Very much so. This usually happens when the balance sheet does not contain the appropriate information to fill out individual balance sheet lines. And in this case, accounting rules allow the insertion of dashes. Namely, paragraph 11 of PBU 4/99.

If a small enterprise does not use a standard balance sheet form, but its own, then instead of dashes the corresponding numerical values are simply not given.

A separate feature of the balance sheet of a small enterprise is the lines . What code should they be assigned? So: they need to be taken from the table, which is given in Appendix No. 4 of Order No. 66n of the Ministry of Finance.

The following shows all the possible codes that may appear on the balance sheet for small businesses .

Keep in mind that when filling out a balance sheet form for a small enterprise, the following principle must be observed: for aggregated indicators (“Tangible non-current assets”, etc.), you need to enter a code based on the indicator that has the greatest share.

As you finish completing your 2016 small business balance sheet , be sure to check the most important equation throughout this document—assets and liabilities (p. 1600 = p. 1700). If this is not observed, look for an error.

Also see “Balance Sheet 2021: Due Date.”

Read also

20.02.2017

All accounting changes in 2021

Accounting specialists know that there are various reporting options, which are influenced by the status of the company or organization.

Small businesses can submit reports using a simplified scheme if they do not need to undergo an audit.

The procedure will include a report:

- On balance.

- About financial results.

What these documents look like can be found in the Order of the Ministry of Finance under number “66n”.

Other enterprises that are not classified as small businesses, or that need to be audited, will report in full .

It is mandatory to submit a report:

- Balance.

- About the results of financial activities.

- About money movements.

- About changes in capital.

You cannot exclude anything from the documents, but you can supplement them and add explanations.

Let's tell you in more detail what other changes have appeared:

According to personal income tax

Starting from 2016, you will have to get used to submitting every quarter not only certificates in Form 2-NDFL, but also a report in Form 6-NDFL . This document will include information about the amount of withheld funds that will be written off for tax from all employees of the enterprise. The innovation was adopted by the Ministry of Justice under the number “MMV-7-11/450” on October 14 last year.

In accordance with Article 230 of the Tax Code of the Russian Federation, a report on the income of individuals should be submitted:

- The first quarter had to be completed by May 4th.

- For the six months, don’t forget, until August 1st.

- 9 months of work must be completed before October 31st.

These are quarterly reports, and annual reports must be submitted before April 1 . That is, the accountant must report for 2021 by April 1, 2021.

You can submit a report in a strictly established form by printing it on paper. But, please note that if your staff is more than 25 people, you will have to prepare the document electronically.

It is better to submit documentation on time, otherwise:

- The company will be fined one thousand rubles. Moreover, this amount will be charged for each overdue month.

- All company accounts will be blocked. This is an extreme measure, but according to the law, if you are 10 days late, the Federal Tax Service has the right to block accounts.

It is worth knowing that the company will have to report on unwithheld taxes twice (Article 226 of the Tax Code of the Russian Federation) and submit a tax certificate in form 2-NDFL:

- No later than March 1 of the current year.

- Until April 1st.

The reporting form is also new.

Please note that the annual accounting report can now be submitted without the signature of the company's chief accountant!

Tax withholding period

We set deadlines for employees of organizations to receive income that was taxed.

Here are some examples:

- Upon dismissal. The calculation must be completed before the employee works his last day of work. He must receive income on this very day (Article 223 of the Tax Code of the Russian Federation).

- On sick leave. Payments should be made at the end of the month. For example, an employee went on sick leave from May 1 to May 14. The report is submitted until May 31.

- On vacation. The calculation period for vacation income is the same as for sick leave.

- When on a business trip. The employer must approve the expense report, and then the accountant will calculate the income that the employee should receive for the business trip. But no later than the last day of the month.

Payments for children

The employee has the right to demand compensation from the employer , which will come from child taxes .

Federal Law No. 317, approved on November 23, 2015, states that the amount of payments has increased. Now they amount to 350 thousand rubles - but this is if the child is considered disabled.

In other cases, their personal income tax deduction is different: for adoptive parents or guardians - 6 thousand rubles , for parents - 12 thousand rubles .

Social payments

Starting this year, an employee has the right to demand social deductions from personal income tax . The employee must return 13 percent of the income.

This money will be targeted. You will have to spend it on your education or children/siblings, or on medical care.

Previously, employees could only claim this deduction at the end of the year. Now the situation has changed.

You can request a social benefit at any time once a year.

Number of fixed assets in tax calculations

Income tax can now be written off from property whose value is more than 100 thousand rubles .

If the property of the enterprise is worth less, then it is written off as expenses (Article 256 of the Tax Code of the Russian Federation).

Revenue tax

In the new year, it will be possible not to pay advances on income tax every month. Some enterprises may refuse, provided that their profit, calculated on average for one quarter, is less than 15 million rubles (Article 286 of the Tax Code of the Russian Federation). Previously, the limit was 10 million rubles. To calculate the average profit for the quarter, you should: divide the annual revenue by 4.

Income declarations should be submitted:

- For the first quarter of this year until April 28.

- For the first half of 2016 until July 28.

- For 9 months of this year until October 28.

For companies that make advance payments every month, the declaration is also submitted monthly (Articles 287 and 289 of the Tax Code of the Russian Federation).

You can provide it in paper form if the number of employees of the company is less than 100 people.

Otherwise, only an electronic version of the declaration should be prepared (Article 80 of the Tax Code of the Russian Federation).

Registration of organizations

They will be more strict in checking whether the company is reliable. Inspectors now have the right to inspect the organization's real estate and show up without warning . If the inspector finds out that any of the information is incorrect or missing, he will write a notice that lists what you need to do and what information you need to provide.

- The period for correcting defects is 1 month.

- The deadline for registering an organization is now 3 working days!

Please note that existing organizations must use a new standard charter in their work; its form is still being approved.

New budget classification codes (KBK)

It was planned that pension deductions would be sent to different codes, depending on the income limit limits.

But the document has not yet been accepted.

The current BCCs for insurance premiums look like this:

- The first three digits are the government agency code

- The next one digit is the income code (group of this income)

- The third two digits are the tax or other payment code

- The next 5 digits indicate the item and subitem of income

- Next are 2 numbers by which you can understand the level of the budget (regional, federal, or even the budget of one of the funds - the Pension Fund of Russia, the Social Insurance Fund, etc.)

- Next are 4 key numbers that determine the “reason” for the payment. Here it is important to understand that there can be only three such reasons - 1) payment of the tax itself (fee, contribution), 2) payment of penalties on it, 3) payment of a fine on it.

- And finally, the last three digits of any code are a classifier of the type of income (tax, non-tax, from property, etc.).

Patent tax system

More enterprises will now be able to work under a patent, as the list of activities has expanded. This is evidenced by Federal Law No. 232, approved on July 13, 2015.

The list now includes:

- Catering points that do not serve visitors in the hall.

- Companies producing dairy products.

- Firms for growing vegetables, preparing canned fruits and vegetables.

- Organizations providing services for walking and transporting livestock.

- Enterprises producing flour and bakery products.

- Translation companies.

- Enterprises engaged in waste processing and disposal.

- Firms engaged in repair of equipment and PCs.

- Organizations providing care and care services for the elderly and disabled.

- Other forestry activities.

You can find out more in Article 2 of this law.

Transition to the EGAIS system

This transition affects companies selling alcoholic beverages. By July 2016, all retail outlets must switch to the system.

In addition, management must keep a sales log in a special form approved by the RAR Order No. 164, dated June 19, 2015.

Violators will be fined.

Work on the simplified tax system and UTII system

Income limits have increased for enterprises that operate under simplified rules:

- To switch to these systems starting next year 2017, you will need to confirm your income for 9 months of this year . The amount of income must be at least RUB 59,805,000.

- For those who already use one of the systems, their annual income should be at least 79,740,000 rubles .

Companies with representative offices and a network will now be able to use the special regime.

Rates for simplified tax system and UTII

Regional tax services can now reduce rates under the simplified system to 1% for the “income, profit” object. And with the object “income minus expenses,” the rate reduction remained at the same level – at least 5%.

Administration representatives can reduce the UTII rate to 7.5%, previously it was 15%. The deflator coefficient will not change. This figure is 1.798.

VAT for special regimes

Now, when submitting a VAT invoice, companies can take it into account in profit . Previously this could not be done. This innovation applies only to organizations working under the simplified tax system and the simplified agricultural tax system.

Information on the average number of employees

You should report how many employees you have in your company once a year - before January 20. This applies to new organizations or reorganized ones (Article 80 of the Tax Code of the Russian Federation).

Form RSV-1 PFR

Companies that have at least one employee must report for them quarterly, semi-annually and 9 months. The form for this was approved - RSV-1 (Federal Law number 212, dated July 24, 2009).

Reporting must be done electronically.

Form SZV-M

Information about insured persons working for the company must now also be submitted to the Pension Fund. The SZV-M form is intended for this. It must be submitted completed by the 10th of each month. The first report should have been submitted for April, before May 10.

Property tax

Companies that have property must report by filing the appropriate declaration before:

- May 4 for the 1st quarter.

- August 1 for the half year.

- October 31 for 9 months.

- March 30, 2021 for the previous year.

Again, if there are more than one hundred employees in the company, then the declaration is submitted electronically (Articles 80, 386, 379 of the Tax Code of the Russian Federation).

Transport tax

Organizations that own transport must also report to the tax office (Article 357 of the Tax Code of the Russian Federation) once a year, no later than February 1 (Article 363.1 of the Tax Code of the Russian Federation).

The electronic version is also provided by companies with more than one hundred employees.

Land tax

Applies to those organizations that own land plots that are taxed (Article 388 of the Tax Code of the Russian Federation). The declaration must be submitted before February 1 (Articles 397 and 398 of the Tax Code of the Russian Federation).

Those with fewer than one hundred employees are allowed to submit a document in paper form (Article 80 of the Tax Code of the Russian Federation).

Who submits the balance sheet

All Russian organizations and official representative offices of foreign companies are required to report on their financial and economic situation for the reporting year. This is regulated by the Law “On Accounting” No. 402-FZ.

The law provides “indulgences” for certain categories of economic entities that have the right to keep accounting records in a simplified form. But regardless of the method of accounting, basic or simplified, Form No. 1 is mandatory for all economic entities - legal entities.

How to fill out the balance form

Where to begin

A balance sheet, an example of filling out, which can be given for any organization, is not difficult for a specialist. Filling out the balance sheet begins with the “header”. The Taxpayer Identification Number (TIN) and KPP are indicated at the top, and the balance sheet date is indicated just below. Next, write down the name of the organization, its type of activity according to the OKVED classifier, its individual OKPO code.

The next line is the form of ownership according to OKFS (private - code 16). Below is the code for OKOPF, which represents its legal form (for the balance sheet of an LLC, code 65). The next code is OKEI for numerical records (thousand or million rubles), code 384 or 385 is written. Next, it is indicated how many pages the balance sheet form occupies, and the number of pages of attachments.

At the bottom left, the 2014 balance sheet form has a subsection where the data of the head of the company or an authorized representative, the chief accountant is entered, and the name of the document certifying the rights of the representative is indicated.

Then detailed information about the legal address of the company is entered.

Next, the data is entered line by line.

About non-current assets of the balance sheet:

- 1110 - intangible assets (data 1120 are not taken into account);

- 1120 – information on R&D (results of research and development);

- (1130 – 1140) – reports on the search and exploration of mineral deposits and the equipment used;

- 1150 – fixed assets (their residual value);

- 1160 – the cost of material assets and profitable investments accounted for in account 03.

- 1170 - financial investments of the enterprise for a period of more than 12 months (debit of account 58 and 55 subaccount “deposits”);

- 1180- account balance 09 (related tax assets);

- 1190 – other non-current resources not shown above;

- 1100 – the final amount of all funds on lines 1110-1190.

Definition of small business

To begin with, let’s find out how this privilege provided for by Federal Law No. 402 of December 6, 2011 “On Accounting” is implemented, namely, we will understand who is considered to be representatives of small businesses. The criteria for classifying organizations and individual entrepreneurs into this category are specified in the current version of Federal Law No. 209 of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation.” Thus, in 2020, a small enterprise is considered to be an organization that:

- the average number of employees for 2021 does not exceed 100 people (how to correctly count employees is described in Rosstat order No. 739 of December 30, 2014). A micro-enterprise is not allowed to employ more than 15 people;

- the amount of income from business activities does not exceed 800 million rubles per year for small enterprises and 120 million rubles per year for microenterprises. These values are set by the government. Similar restrictions are provided for the book value of the organization’s assets, which should be understood as the residual value of the organization’s fixed assets and intangible assets. This indicator is calculated only on the basis of accounting data.

- the share of participation in the authorized capital of the Russian Federation, its constituent entities, municipalities, public and religious organizations and charitable foundations, including Russian legal entities does not exceed 25%, and the share of participation of foreign organizations is 49%. But there are exceptions to this rule. Thus, restrictions on participation in the authorized capital do not apply to business companies and partnerships that work on the practical application of the results of intellectual activity, provided that the exclusive rights to these results belong to their founders. In addition, the requirement does not apply to organizations that have received the status of a project participant in accordance with, and other companies included in the List of legal entities providing state support for innovation activities in the forms established by the Federal Law “On Science and State Scientific and Technical Policy”, approved By Order of the Government of the Russian Federation No. 1459-r dated July 25, 2015.

It is important to remember that since August 10, 2016, the Federal Tax Service of Russia has maintained a unified register of SMEs, and in fact, only those organizations and individual entrepreneurs that are included in it are classified as small enterprises.

Now comes the turn of current assets:

- 1210 - reflects the cost of inventory for sets 10, 15, 20, 21, 23, 28, 29, 41 - 45, 97;

- 1220 – the amount of VAT on purchased assets presented by the supplier, but for some reason not accepted for deductions (account balance 19);

- 1230 – accounts receivable from counterparties (out of 60, 62, 68, 69, 70, 71, 73, 75, 76 accounts);

- 1240 – financial investments, the period of which is less than a year;

- 1250 – funds of the company (enterprise, organization) in monetary equivalent in rubles (accounts 50 and 51), in foreign currency (52), in checks and letters of credit (account 55);

- 1260 – the remaining assets of this group, not displayed in the above lines of the enterprise’s balance sheet;

- 1200 - the generalized amount of all assets for this subsection listed in the sample balance sheet.

The balance is the sum of all its total values: 1100+1200.

The new form also reflects the sources of asset formation.

Composition of the BFO

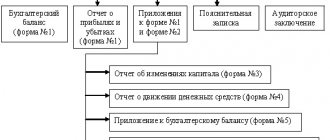

The main question for a confused accountant is information about the composition of the reports being submitted. Law No. 402 clearly defines the list of papers required to be submitted. The composition of the annual financial statements 2021 is as follows:

- balance sheet;

- income statement.

Additionally, attachments to these document forms are used. It is noteworthy that previously the financial results statement had a slightly different name - the profit and loss statement.

As before, an audit report will be required if the company is required to undergo an appropriate audit. But this document does not need to be submitted along with the rest of the reporting. An explanatory note to the 2021 annual financial statements is not required as a separate document. Starting from January 1, 2013, all necessary explanations are included in the relevant reports.

Capital and reserves:

- 1310 – capital of the enterprise (authorized), from the account balance 80;

- 1320 – company shares (own, purchased from shareholders) are reflected in the debit balance of account 81;

- 1340 – the amount of the changed value of fixed assets and intangible assets, if revaluation was carried out (account 83);

- 1350 – the amount of additional capital minus 1340;

- 1360 – reserve capital, data from account 82;

- 1370 – retained earnings (uncovered damage) – from account 84;

- 1300 – total amount 1310-1370.